KEYTAKEAWAYS

- Interest rate hikes negatively impact the crypto market by diverting investments to lower-risk assets and increasing borrowing costs, reducing speculative investments.

- Black Swan events like the LUNA crash and FTX bankruptcy significantly erode investor confidence, causing severe market downturns.

- Stock market performance can influence crypto markets, with positive correlations observed between Bitcoin and the US Dow Jones Index.

CONTENT

In this article, COinRank will help readers solve one of the most asked questions by crypto newbies: Why is crypto market down? Below we will introduce 3 key factors toy should notice: Interest rate trends, Black Swan events, and stock market performance, which can help you strategize investments more effectively.

Most people join the crypto market to earn significant profits. Many investors closely monitor market trends after purchasing cryptos, fearing they might miss the best buying or selling opportunities. However, investors will quickly realize that the fluctuations in the crypto market are much more severe than those seen in traditional financial markets.

So, why is crypto market down? What indicators can investors observe to predict and preemptively strategize? This article will break down the reasons for readers.

WHY IS CRYPTO MARKET DOWN? REASON 1: ECONOMICS

One significant reason why the crypto market is down is the overall economic situation and financial policies of countries.

Among many economic indicators, most people pay the most attention to interest rates. Why is that?

First, we need to understand two main monetary policies about interest rates:

- Interest Rate Hikes:

- When banks raise the interest rates on loans and deposits, it means the central bank of a country or region increases the interest rates, making commercial banks’ borrowing costs higher, which in turn forces an increase in real interest rates.

- The purposes of raising interest rates include reducing money supply, suppressing consumption, curbing inflation, encouraging savings, and slowing down market speculation.

- Interest Rate Cuts:

- Conversely, lowering interest rates means banks decrease the interest rates on loans and deposits, reducing commercial banks’ borrowing costs from the central bank.

- The purposes of lowering interest rates include increasing money supply and liquidity, stimulating consumption, promoting exports, and alleviating deflation.

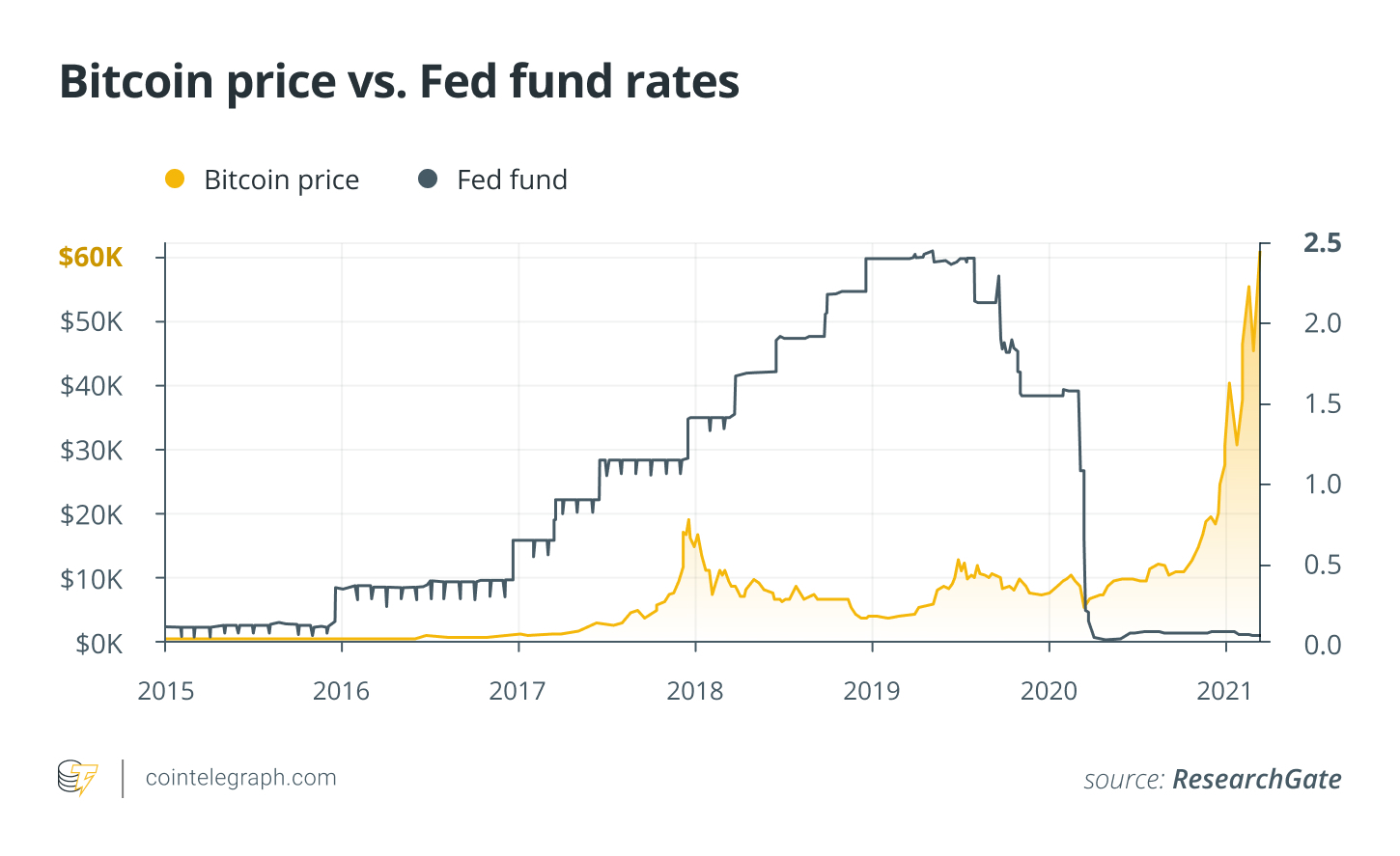

Impacts of Interest Rates on the Crypto Market

Interest Rate Hikes:

- Generally negative for Bitcoin prices, reducing market investment willingness.

- Higher interest rates make fixed-income investments like deposits more attractive, potentially diverting investors from the volatile crypto market to lower-risk investments.

- Increased borrowing costs reduce leveraged and speculative investments in cryptocurrencies.

Interest Rate Cuts:

- Generally positive for Bitcoin prices, encouraging speculative market behavior.

- Lower interest rates make traditional financial markets less attractive, potentially boosting interest in higher-return assets like cryptocurrencies.

- In times of economic downturn, Bitcoin may be seen as a hedge due to its independence from government or central bank control.

When the Federal Reserve mentions terms like “slower rate hikes,” “pausing rate hikes,” or “rate cuts,” it typically benefits Bitcoin prices. Conversely, if the Fed indicates higher likelihoods or certainty of rate hikes, it may cause crypto prices to fall.

Thus, interest rate hikes are a primary reason why the crypto market is down.

WHY IS CRYPTO MARKET DOWN? REASON2: BLACK SWAN EVENTS

Another major factor affecting the crypto market is so-called Black Swan events—rare but impactful occurrences. Recent examples in finance include COVID-19 and the Lehman Brothers collapse.

In the crypto market, notable Black Swan events include the collapse of the LUNA coin and the bankruptcy of the FTX exchange, both of which eroded investor confidence and caused market downturns.

BTC price after the LUNA crash in 2022 May (Source: TradingView)

WHY IS CRYPTO MARKET DOWN? REASON 3: STOCK MARKET PERFORMANCE

Apart from interest rates, investors can also observe stock market performance to gauge the crypto market’s direction.

Although there is no definitive theory proving a direct correlation between crypto market performance and the stock market, recent trends show a positive correlation between Bitcoin and the US Dow Jones Index.

Some believe that if the stock market performs well, investors might shift funds from the crypto market to the stock market, weakening the crypto market.

CONCLUSION

Why is crypto market down? The reasons can be broadly categorized into:

- Interest rate trends

- Unpredictable black swan events

- Stock market performance

For new investors entering the crypto market, it is advisable to first research these factors. Understanding the impact of interest rates, being aware of potential Black Swan events, and observing stock market trends can help avoid buying at high points during market downturns. This approach can prevent significant losses and protect the wealth you have painstakingly accumulated.

FAQS

- Why is crypto market down?

The reasons why the crypto market is down can be broadly categorized into:

- Interest rate trends

- Unpredictable black swan events

- Stock market performance

- Why can interest rate trends be the reason the crypto market is down?

When interest rate hikes happen, it will make fixed-income investments like deposits more attractive, potentially diverting investors from the volatile crypto market to lower-risk investments. Also, increased borrowing costs reduce leveraged and speculative investments in cryptos.

More articles about the crypto market:

- Crypto Bull Market 2024: What It is and When to Buy

- 2024 Crypto Market Predictions Backed by Technical Analysis

- Crypto by Market Cap Ranking 2024 – Top 10 Cryptos You Should Know – CoinRank

- 2024 Top 5 Crypto Market News Websites

- A Review of Crypto Market Trends in the First Half of 2024

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!