KEYTAKEAWAYS

- Multiple factors contributed to Bitcoin's 20% drop, including Mt. Gox repayments, ETF outflows, halving challenges, and government sell-offs, creating market pressure and investor concerns.

- Despite the sell-off, major investors aren't selling; community sentiment remains positive, with expectations of Fed rate cuts and potential crypto-friendly political developments.

- Historical patterns suggest a potential Bitcoin price recovery post-halving; long-term investment outlook remains positive despite short-term volatility in the cryptocurrency market.

CONTENT

Explore the reasons behind Bitcoin’s recent 20% drop, including Mt. Gox repayments, ETF outflows, and mining challenges. Discover potential bullish factors and long-term investment prospects in the crypto market.

Original source: Gargoyle

INTRODUCTION

Why is there a $BTC sell-off? This is the result of a combination of factors, including the Mt. Gox incident, ETFs, halving, Germany, and more. I have prepared a comprehensive analysis of the current situation.

In the past week, Bitcoin fell from $71,000 to $57,000, a drop of about 20%, which we haven’t seen in a long time. Today, let’s understand why this is happening and what the outlook for BTC is.

MT. GOX

This cryptocurrency exchange went bankrupt in 2014 due to a hacking attack. At the end of last month, news emerged that Mt. Gox was about to start repaying its creditors. Exchange representatives plan to distribute 142,000 BTC (0.68% of the total Bitcoin supply) to customers.

Many are concerned that creditors might choose to sell these received bitcoins. Given the amount of BTC they hold, this would certainly impact the market. Moreover, just the worry of this possibility has already led many to start selling their assets.

But that’s not all.

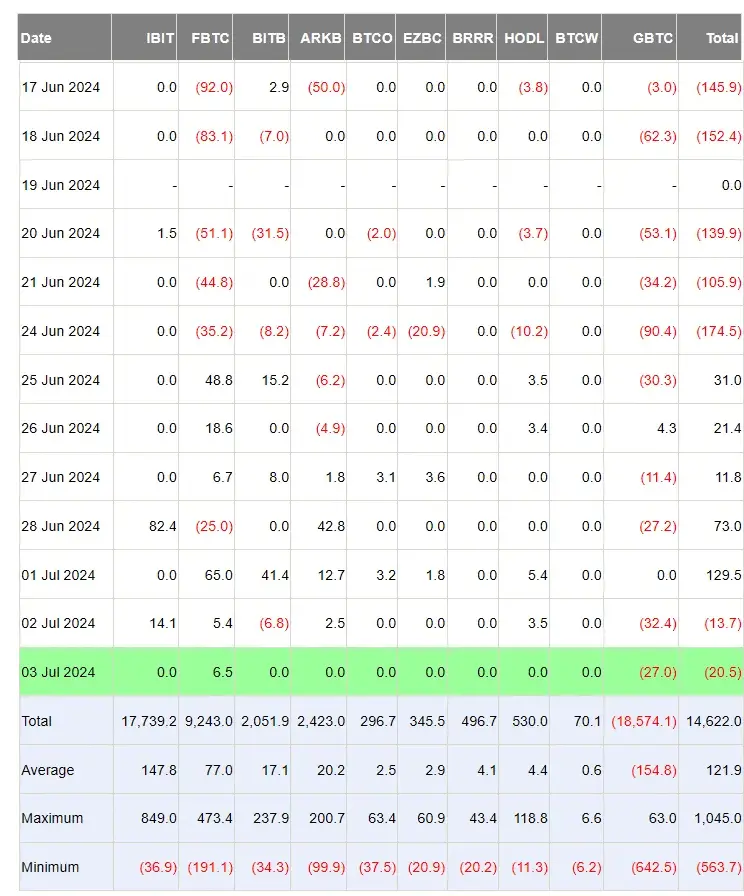

BTC ETF

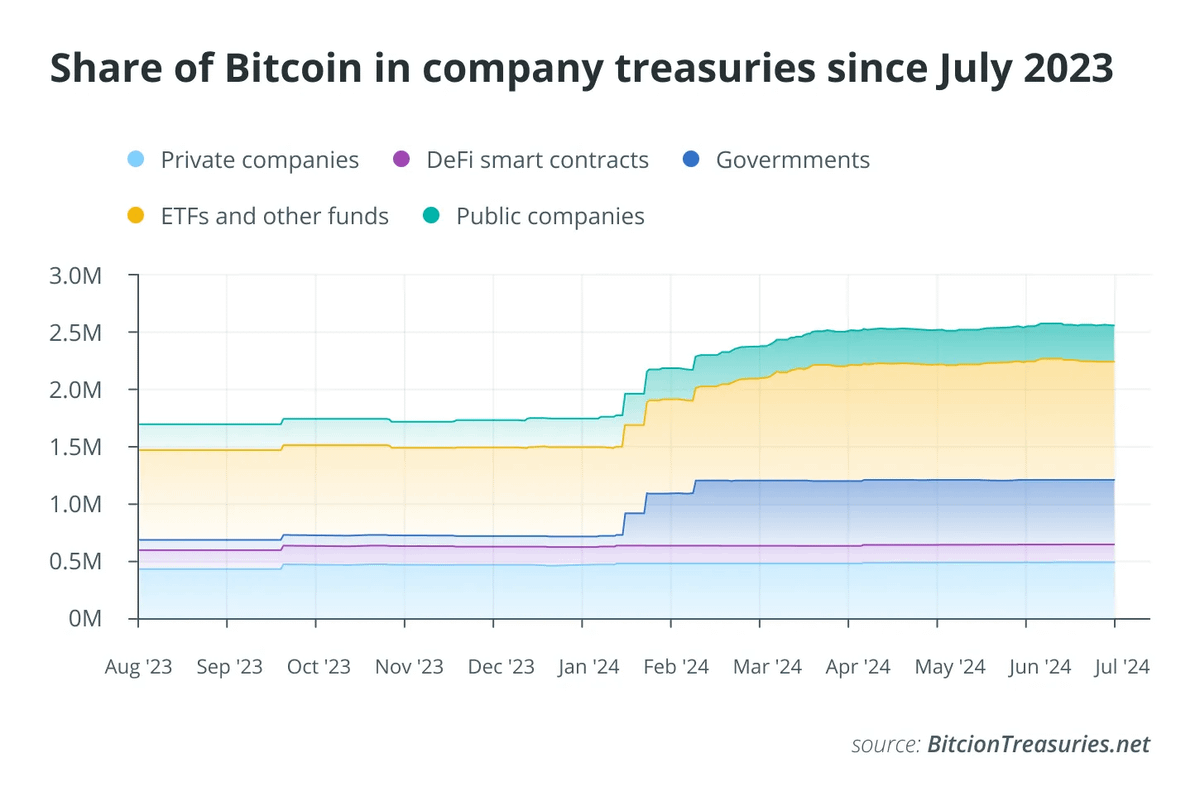

Spot Bitcoin ETFs make the cryptocurrency’s price more dependent on the sentiment of large investors. Currently, BTC ETFs hold 5% of the total Bitcoin supply. At the beginning of this month, ETFs again experienced outflows, and these changes also put pressure on the cryptocurrency’s price.

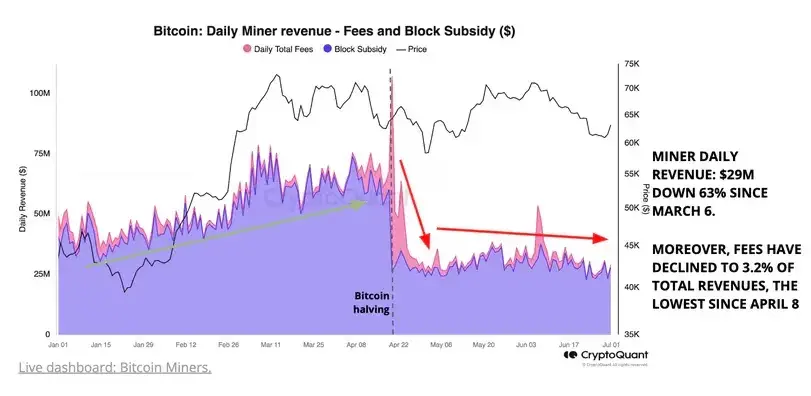

CHALLENGES FACED BY MINERS

On April 20, 2024, Bitcoin underwent a halving event, reducing miners’ rewards from 6.25 BTC to 3.125 BTC per block. For miners to continue mining, a rise in Bitcoin’s price is necessary, and many had expectations for this. However, the price did not rise as expected, and many miners are now forced to sell their BTC.

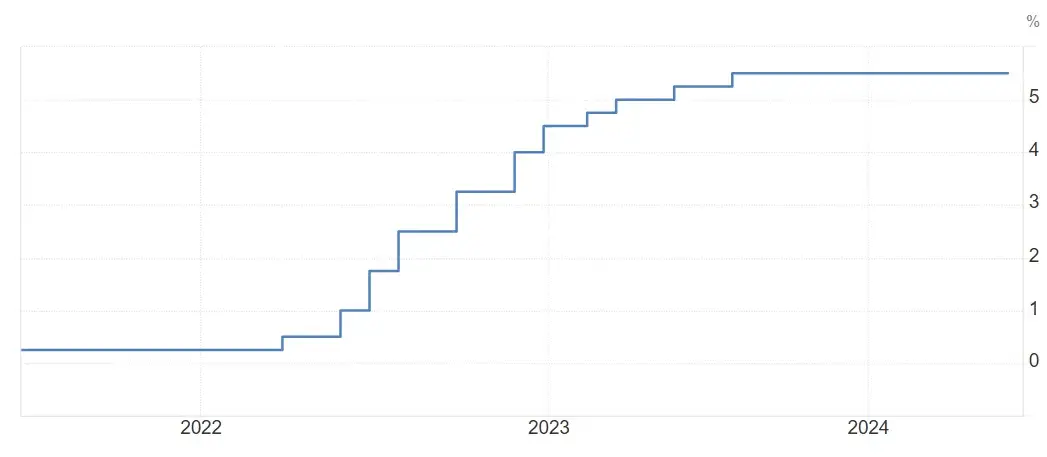

U.S. INTEREST RATES

The lower the interest rates, the more attractive high-risk investments (like cryptocurrencies) become. The FRS (Federal Reserve System) meeting minutes show that policymakers are unwilling to lower interest rates unless more data indicates inflation is moving towards the 2% target rate.

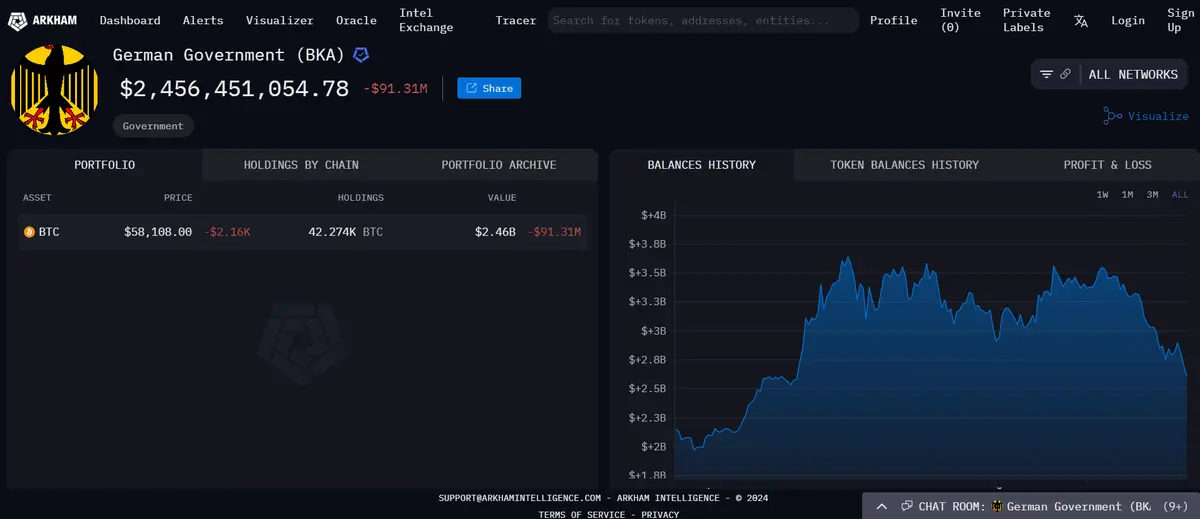

GERMANY

The German government holds a large amount of Bitcoin and has begun selling its assets. According to Arkham data, the German government recently transferred 400 BTC to Bitstamp, Coinbase, and Kraken exchanges. In the past two weeks, a total of 2,700 BTC has been transferred from government wallets to exchanges.

BULLISH FACTORS: THE SILVER LINING IN BITCOIN’S CURRENT MARKET

All these factors together have led to the market conditions we’re currently seeing. However, there’s always another side to things, and there are now factors supporting Bitcoin’s rise. Let’s discuss them in detail.

1. Major Investors Are Not Selling BTC

Despite the fall in Bitcoin’s price, companies are not selling their assets. Instead, many companies started buying BTC during the price drop. Despite needing to release capital, the largest miner, Marathon Digital Holdings, has not disposed of its assets. It’s worth noting that miners’ capitulation may signal an impending trend reversal. Statistics show that Bitcoin typically starts rising about four months after a halving event. If history repeats itself, bulls might drive out bears before the end of summer.

2. Community

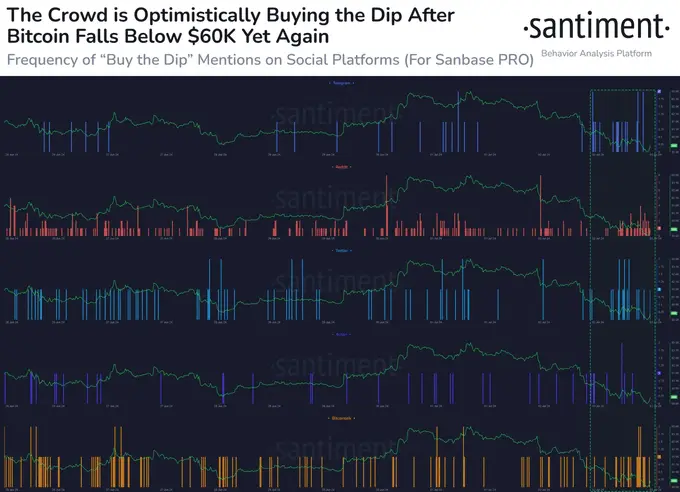

According to Santiment data, more and more people on social media are calling for “buying the dip”. When Bitcoin’s price is below $60,000, people find it particularly attractive. The graph below shows statistics of calls to buy Bitcoin on various social networks.

3. Expectations of Fed Rate Cuts

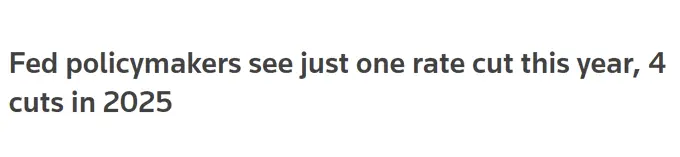

Although most market participants are convinced the Fed won’t cut rates at the next meeting at the end of July, representatives have hinted that investors might see rate cuts later this year.

4. U.S. Elections

The crypto community in the U.S. is growing rapidly, and presidential candidates haven’t ignored this topic. After recent debates, there’s a belief that Donald Trump, who has openly pledged to support the development of the crypto market, will become president. If he wins, the SEC’s head might be someone favorable to cryptocurrencies.

CONCLUSION

I’ve analyzed the positive and negative factors in the current market. I don’t want to impose any views on you; you just need to do your own analysis and develop your own strategy. Personally, I think Bitcoin is a very good long-term investment (at least 4 years). I’m not worried about the future of cryptocurrencies, and I believe the market conditions are good.