KEYTAKEAWAYS

- Ethereum ETFs launched with substantial trading, reaching $1.112 billion on the first day, indicating strong investor interest.

- Price performance of ETH post-launch was disappointing, dropping from $3,541 to $3,400, reflecting volatility and market corrections.

- Factors like limited marketing and no staking options in ETFs contributed to the subdued price action and investor caution.

CONTENT

Ethereum ETFs debut on Wall Street with mixed results, experiencing a price drop from $3,541 to $3,400 and nuanced market dynamics despite high trading volumes.

>>> Recent ETH ETF Articles:

-

Spot Ethereum ETFs Debut with Over $1 Billion in First-Day Trading Volume

-

Spot ETH ETFs: The Ultimate Investor’s Guide for the 2024 Launch

The journey toward Ethereum ETF approval gained momentum on May 20 when the SEC requested exchanges to update their 19b-4 filings, raising the approval probability from 25% to 75%. By May 23, the SEC had approved exchange applications to list spot ETH ETFs, clearing the main hurdle for approval.

This progress triggered an immediate increase in ETH futures open interest, jumping from $8.8 billion to $13 billion within a week. Simultaneously, Ether prices surged from $3,065 to $3,959.

ETHEREUM ETF LAUNCH AND MARKET REACTION

Although the launch of ETH ETF sparked initial enthusiasm, its price performance has subsequently failed to meet expectations, dropping from a high of $3,541 to $3,400 the previous day.

This pattern aligns with previous crypto milestones, such as the Bitcoin futures launch in December 2017, Coinbase’s listing in April 2021, and the Bitcoin ETF based on futures listing in October 2021. Each of these events was followed by a market correction.

>>> Read more: 3 Major Implications and Legal Issues Following SEC Approval of Bitcoin ETFs in the U.S.

First-Day Performance of ETH ETFs

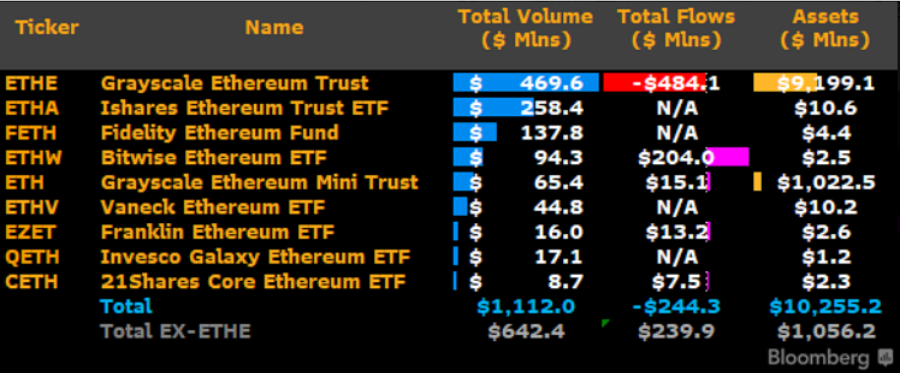

Despite the initial underwhelming price reaction, the first day of Ethereum ETF trading showed significant activity. According to Bloomberg ETF analyst James Seyffart, the total trading volume for Ethereum spot ETFs on their first day reached $1.112 billion, representing 23% of the first-day trading volume seen with Bitcoin spot ETFs. Notably, BlackRock’s ETHA product achieved 25% of the trading volume of its Bitcoin counterpart, IBIT.

(source: Bloomberg)

Excluding the Grayscale ETHE conversion, the total trading volume for new Ethereum ETFs was $642 million. This substantial volume indicates considerable interest from investors, despite the muted price action of ETH itself.

Fund Flows and Market Dynamics

The launch day saw varied performances across different ETF providers:

- Grayscale’s ETHE experienced a net outflow of $484 million, approximately 5% of its assets under management. However, its mini trust ETH product attracted $15.1 million in inflows.

- Bitwise’s BITB product was a standout performer, with net inflows of $204 million. James Seyffart speculates that about $100 million of this may have come from Pantera Capital.

- Franklin’s EZET and 21Shares’ CETH saw net inflows of $13.2 million and $7.5 million respectively.

These mixed flows suggest that while some investors are repositioning their Ethereum exposure, others are entering the market through these new investment vehicles.

FACTORS INFLUENCING ETHEUREUM’S PRICE PERFORMANCE

Several factors contribute to ETH’s lackluster performance post-ETF launch:

- Limited Marketing: The promotion of Ethereum ETFs has been relatively muted. Even BlackRock’s CEO, Larry Fink, focused on Bitcoin rather than Ethereum in recent public appearances.

- Lower Projected Inflows: Crypto market maker Wintermute predicts that Ethereum spot ETFs might attract up to $4 billion in inflows, significantly lower than most analysts’ projections of $4.5 to $6.5 billion, and far below the $17 billion that Bitcoin spot ETFs have attracted since their launch.

- Lack of Staking in ETFs: The SEC prohibits Ethereum ETFs from offering staking services, putting them at a disadvantage compared to direct ETH holdings, which can participate in staking and earn yields.

- Increased Volatility: Crypto research firm Kaiko reported a significant increase in Ethereum’s implied volatility, with contracts nearing the July 26 expiry date jumping from 59% to 67%. This suggests weakening confidence in ETH.

- Tepid Futures Demand: Greg Magadini from Amberdata notes that demand for Ethereum futures was lukewarm leading up to the ETF launch, contrasting with the excitement preceding the Bitcoin spot ETF launch.

- Yield Comparison: Ethereum’s staking yield, currently at 3.12% (2.91% on Coinbase), is less attractive in the current high-interest-rate environment compared to its appeal during the low-rate era of 2020/2021.

ETHEREUM TRADING ANALYSIS

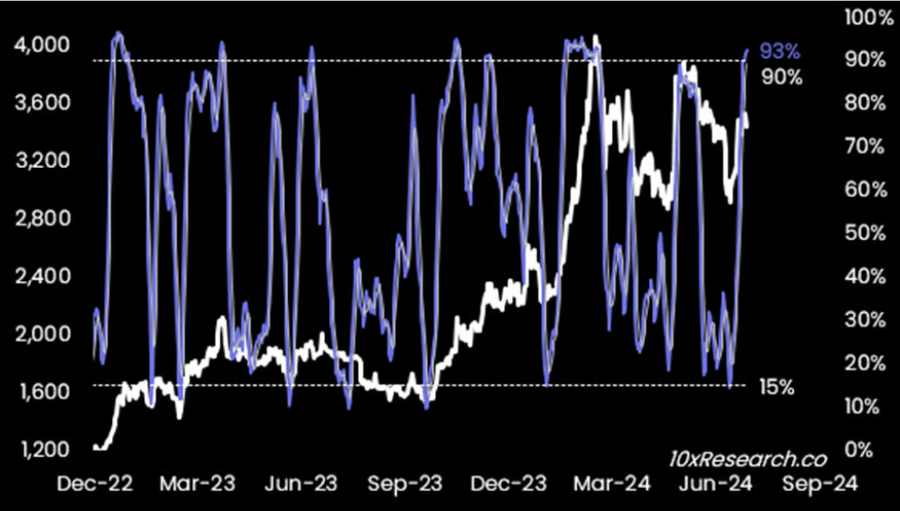

Ethereum’s market dominance has declined from a peak of 18.4% a month ago to 17.0%.

(source: 10x Research)

The stochastics indicator suggests a potential short opportunity, with the recent high of $3,560 serving as a stop-loss point for short positions.

Traders may consider strategies such as long Bitcoin versus short Ether positions or using ETH calls to fund Bitcoin calls. However, options are relatively expensive, with implied volatility for September 27 expiry at 65%, significantly higher than the 30-day realized volatility of 50%.

A SILVER LINING AMONG BEARISH OUTLOOK

Despite the generally bearish outlook, some experts offer a different perspective. Billy Luedtke, CEO of Ethereum attestation protocol Intuition, suggests that Grayscale’s mini Ethereum trust ETF could potentially drive up ETH prices. This product offers investors a tax-free ETF trading option with a more attractive fee structure, which could attract more capital inflows.

In conclusion, while the launch of Ethereum ETFs marks a significant milestone for the cryptocurrency, its immediate impact on ETH’s price has been muted. The substantial first-day trading volume suggests strong investor interest, but mixed fund flows indicate a complex market dynamic.

>>> Read more:

▶ Buy Ethereum at BingX

Sign up to claim 5,000+ USDT in rewards & 20% off trading fees!