KEYTAKEAWAYS

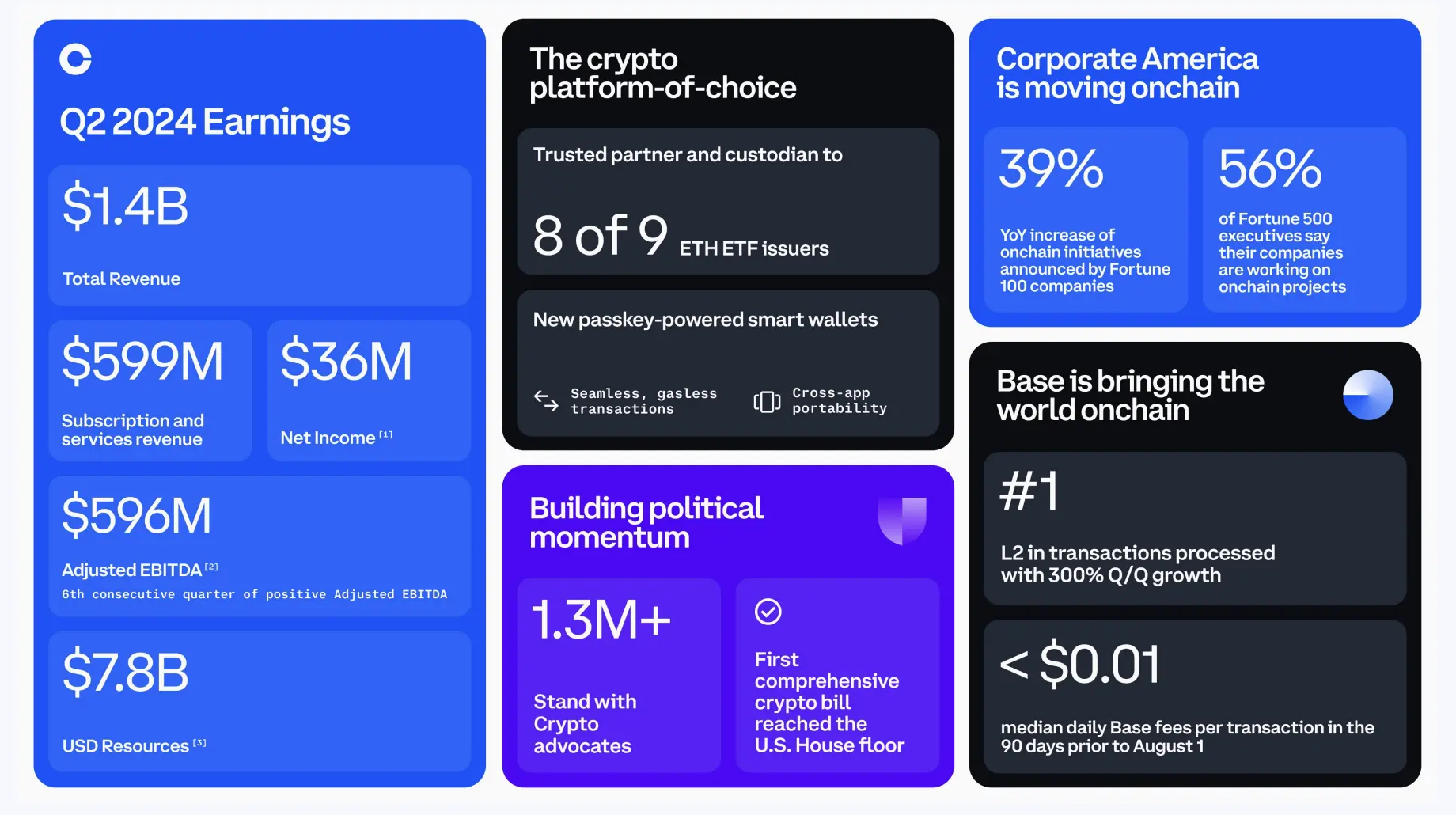

- Coinbase beats analyst estimates with $1.4B Q2 revenue, down from Q1 but exceeding expectations.

- Company highlights regulatory progress and growing political support for crypto legislation.

CONTENT

Crypto exchange reports strong performance despite market challenges, with transaction revenue at $781M and subscription services at $600M. Base transactions surge 300% quarter-over-quarter as regulatory clarity improves.

Coinbase, a leading cryptocurrency exchange, reported its second-quarter earnings on Thursday, surpassing analyst expectations with $1.4 billion in total revenue. This performance, while lower than the previous quarter’s $1.6 billion, exceeded the $1.36 billion forecast by Oppenheimer analysts Owen Lau and Guru Sidaarth.

Source: Coinbase – Second Quarter 2024 – Shareholder letter

The company’s financial breakdown reveals $781 million in transaction revenue, marking a 27% quarter-over-quarter decrease. However, subscriptions and services revenue showed strength at $600 million. Notably, Coinbase reported a remarkable 300% quarter-over-quarter growth in transactions on its Base network.

In a shareholder letter, Coinbase emphasized significant progress in achieving regulatory clarity, describing it as a “vital unlock” for both the company and the broader crypto economy. The company highlighted the mainstreaming of crypto legislation, with over 1.3 million crypto advocates joining the Stand With Crypto movement, many in swing states. This growing support has caught the attention of politicians on both sides, spurring energy in the House and Senate to pass relevant legislation.

>> Also read: 2024 U.S. Crypto Regulation and Market Impact Analysis

Looking forward, Coinbase projects third-quarter subscription and services revenue between $530 to $600 million. The company expects Q3 transaction expenses to be in the mid-teens as a percentage of net revenue, with technology & development and general & administrative expenses increasing to $700-$750 million, largely due to stock-based compensation.

Oppenheimer analysts, maintaining an outperform rating with a $280 price target, believe Coinbase’s long-term potential is underappreciated amid current volume and regulatory concerns. They view recent selling pressures as creating an attractive entry point for investors.

At the time of publication, Coinbase’s stock has shown impressive performance, up 133% over the past year, reflecting growing investor confidence in the company’s strategy and the broader crypto market’s potential.