KEYTAKEAWAYS

- Ethereum network experiences lowest ETH burn rate of the year, with only 210 ETH burned on Saturday.

- NYSE files application with SEC to list options for three Ether ETFs, aiming to provide investors with more exposure to Ether.

CONTENT

Network activity decline leads to record-low ETH burn, raising inflation concerns. NYSE proposes options trading for Ether ETFs, potentially expanding investor opportunities in the cryptocurrency market.

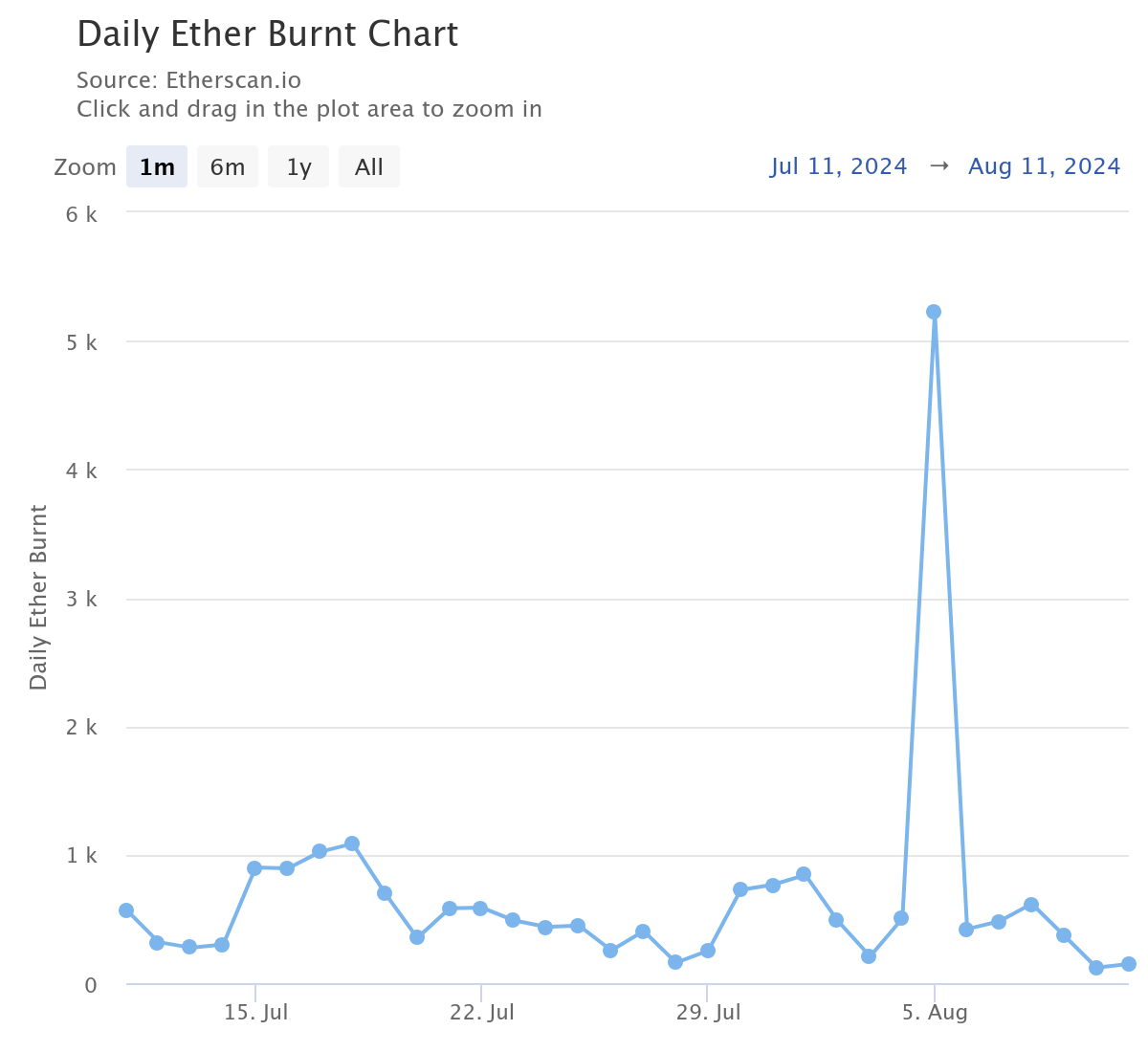

The Ethereum network has recently experienced a significant downturn in its ETH burn rate, reaching the lowest levels recorded this year. This decline is primarily attributed to a substantial decrease in network activity, reflected in the base fees for transactions fluctuating between just 1 and 2 gwei.

On Saturday, a mere 210 ETH were burned, marking a record low for the year. This figure stands in stark contrast to the 5,000 ETH burned on August 5, when gas fees spiked to approximately 100 gwei. The reduced burn rate has led to an increase in the network’s inflation, with a net ETH emission exceeding 2,000 ETH on the same day.

Source: Etherscan

In response to this inflationary trend, Gnosis founder Martin Köppelmann has proposed a temporary increase in the gas limit. He suggests that a base fee of about 23.9 gwei would be necessary to offset staking rewards, indicating that boosting Layer 1 activity could be a viable strategy, even under current low-fee conditions.

The decline in gas fees is largely attributed to two factors: the migration of users to Layer 2 scaling solutions and the implementation of blob transactions introduced in the Dencun upgrade in March. These advancements have effectively reduced costs on Layer 2 networks, consequently decreasing the demand for Layer 1 transactions.

Despite these challenges, ETH is currently trading at $2,540, showing a nearly 10% increase year-to-date, with a market capitalization of $305 billion.

In a related development, the New York Stock Exchange (NYSE) American has proposed a rule change to list and trade options for three Ether ETFs managed by Grayscale and Bitwise. This move aims to include options for the Bitwise Ethereum ETF (ETHW), the Grayscale Ethereum Trust (ETHE), and the Grayscale Ethereum Mini (ETH).

>> Also read: Market Analysis: Ethereum ETF Launch and Trading Strategy for Potential Downside Risk

NYSE American stated that introducing options trading on these Ether ETFs would benefit investors by providing a cost-effective means of gaining additional exposure to Ether. The SEC is expected to receive comments on this proposal within the next 21 days.

If approved, the rule change would specifically apply to the Grayscale and Bitwise Ether ETFs, currently the only spot Ether funds listed on the NYSE American exchange. This development comes in the wake of Bitcoin ETF launches in January, which now hold approximately $50 billion in assets under management.

Options trading is a crucial tool for hedge funds and financial planners, allowing them to mitigate risks associated with market volatility. Additionally, options form the foundation for more complex investment strategies, such as the “covered strangle” strategy promoted by investment research firm 10x Research.

As the cryptocurrency market continues to evolve, these developments in Ethereum’s network activity and potential new investment vehicles highlight the ongoing maturation and integration of digital assets into traditional financial systems.