KEYTAKEAWAYS

- Curve Finance revolutionizes stablecoin trading with its AMM model, offering low slippage and high efficiency.

- The CRV token powers Curve's DAO governance, providing holders with multiple earning opportunities.

- Despite challenges, Curve's multi-chain strategy and unique features cement its position as a key decentralized crypto exchange in the DeFi landscape.

- KEY TAKEAWAYS

- WHAT IS THE DECENTRALIZED CRYPTO EXCHANGE, CURVE FINANCE?

- HOW DOES THE DECENTRALIZED CRYPTO EXCHANGE, CURVE, OPERATE?

- DECENTRALIZED CRYPTO EXCHANGE: CURVE | DAO GOVERNANCE AND CRV TOKEN

- DECENTRALIZED CRYPTO EXCHANGE: CURVE | ADVANTAGES AND CHALLENGES

- CURVE FINANCE UNIQUENESS & FUTURE

- FAQ

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Curve Finance, a leading decentralized crypto exchange for stablecoin trading in DeFi. Explore its innovative AMM model, governance structure, and how CRV tokens shape the future of decentralized finance.

WHAT IS THE DECENTRALIZED CRYPTO EXCHANGE, CURVE FINANCE?

In the flourishing world of Decentralized Finance (DeFi), Curve Finance has distinguished itself with its unique stablecoin trading model. As a liquidity pool-based decentralized crypto exchange (DEX), Curve not only occupies a significant position in the cryptocurrency market but also provides users with a low-slippage, high-efficiency trading platform.

▶ Curve App Website: https://curve.fi/

Curve Finance, or simply Curve, is a decentralized crypto exchange focused on stablecoin trading. The platform was developed by Russian mathematician Michael Egorov, beginning in September 2019, and officially launched on the Ethereum mainnet just three months later. Since then, Curve has rapidly become an indispensable part of the DeFi ecosystem, particularly excelling in the field of stablecoin trading.

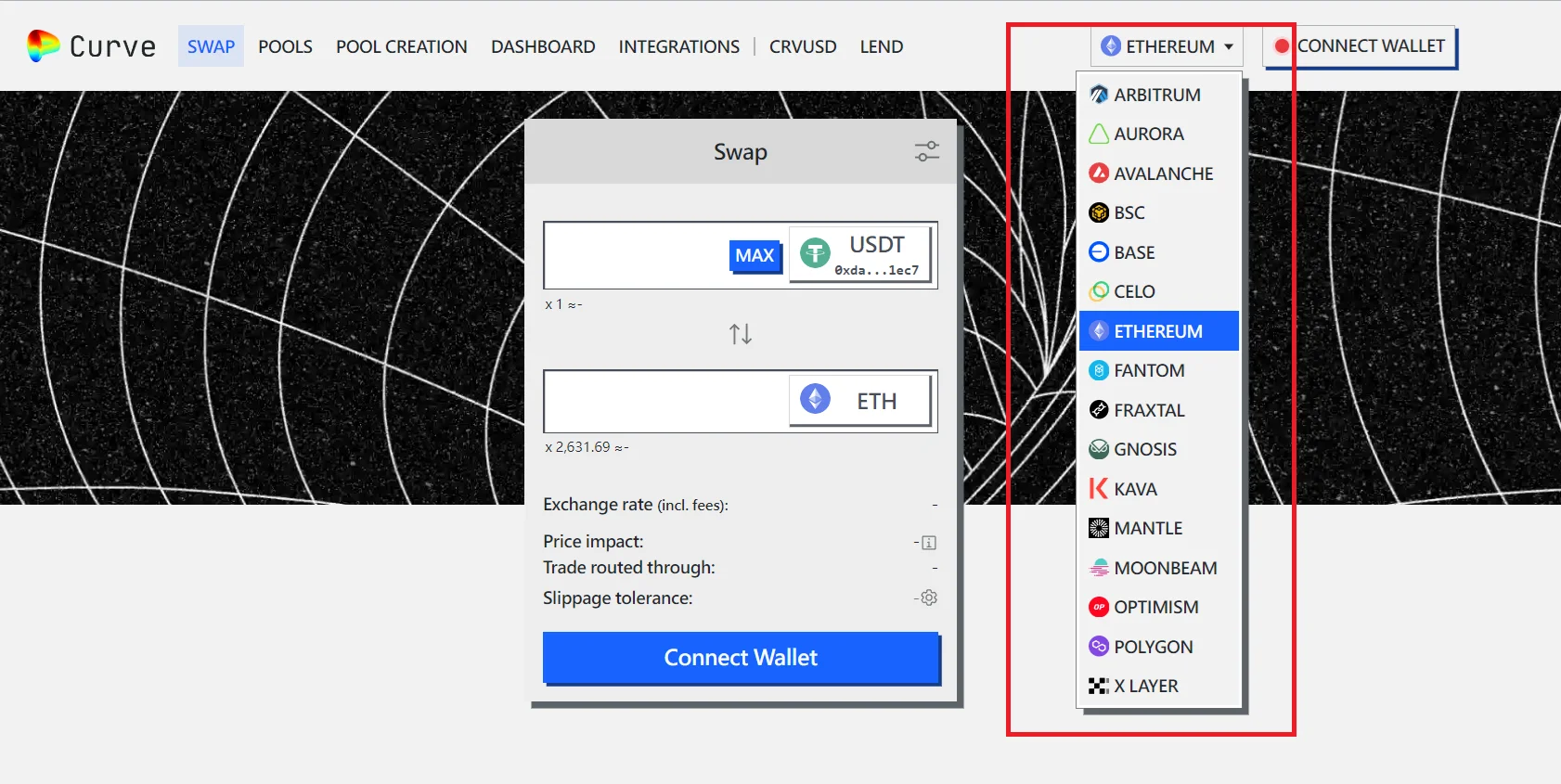

As of August 2024, Curve has been deployed on multiple blockchains, including Ethereum, Avalanche, and Polygon, offering users a wider range of choices and greater flexibility. This multi-chain strategy has not only expanded Curve’s user base but also significantly enhanced the platform’s overall liquidity and trading efficiency.

>>> More to read : 6 Most Popular Decentralized Crypto Exchanges In 2024

HOW DOES THE DECENTRALIZED CRYPTO EXCHANGE, CURVE, OPERATE?

Curve adopts the Automated Market Maker (AMM) model, which is commonly used by many decentralized crypto exchanges (such as Uniswap). AMM allows users to exchange assets without the need for traditional order books, thereby increasing the degree of automation and liquidity in trading.

1. Creation and Expansion of Liquidity Pools

Users can deposit stablecoins (such as USDT, DAI) or other crypto assets of similar value into Curve’s liquidity pools. When the pool has sufficient funds, other users can trade with the pool, achieving automatic asset exchange.

2. Trading Mechanism

On the Curve platform, users trade directly with the liquidity pool, rather than being paired with other users. This design significantly reduces slippage, allowing Curve to offer more favorable prices than other DEXs, especially for large transactions.

3. Reward Distribution

Users pay a small fee (usually 0.04%) for each transaction on Curve. These fees do not go to the decentralized crypto exchange but are distributed proportionally to the liquidity providers. This mechanism incentivizes more users to participate in liquidity provision, enhancing the stability and attractiveness of the platform.

DECENTRALIZED CRYPTO EXCHANGE: CURVE | DAO GOVERNANCE AND CRV TOKEN

To achieve true decentralization, Curve launched its DAO governance model in August 2020 and issued its governance token, CRV. The CRV token not only plays a key role in platform governance but also brings diversified income opportunities for liquidity providers.

-

Main Uses of CRV Tokens

CRV token holders can participate in various activities that not only help enhance platform liquidity but also create actual benefits for holders:

1. Liquidity Mining: CRV holders can participate in mining by providing liquidity, receiving both CRV airdrops and transaction fee rewards.

2. Stake Mining: Users can deposit CRV into the Convex platform to obtain cvxCRV, and then stake cvxCRV to receive additional CVX token rewards.

3. Governance Participation: Holders can lock CRV to obtain veCRV, thereby participating in platform governance voting. In addition to governance rights, this can also bring transaction fee rewards and potential project airdrop opportunities.

4. Collateralized Borrowing: CRV holders can use CRV as collateral on lending platforms like AAVE to borrow other crypto assets, increasing asset utilization efficiency.

DECENTRALIZED CRYPTO EXCHANGE: CURVE | ADVANTAGES AND CHALLENGES

Advantages:

- High Efficiency and Low Cost: Focuses on stablecoin trading, abundant liquidity, fast transaction speed, extremely low slippage and fees.

- Deflationary Mechanism: Controls CRV circulation through staking and buyback-and-burn, beneficial for token value appreciation.

- Liquidity Optimization: Lends idle funds to other DeFi protocols, improving capital efficiency and increasing returns.

- Secure Liquidation Mechanism: crvUSD adopts a continuous liquidation mechanism, reducing bad debt risk and enhancing system stability.

Challenges:

- Protocol Dependency Risk: Closely integrated with other DeFi protocols, potentially subject to chain reactions.

- Governance Centralization: Large amount of governance power concentrated in Convex, posing potential centralization risks.

- Security Concerns: Has experienced multiple security incidents, including contract vulnerabilities and DNS attacks, necessitating continuous enhancement of security measures.

>>> More to read : 4 Most Common Crypto Scams And How To Avoid Them

CURVE FINANCE UNIQUENESS & FUTURE

Curve’s uniqueness lies in its innovative technical architecture and excellent execution capability. As an automated market maker that doesn’t rely on traditional order books, this decentralized crypto exchange is able to provide users with the most optimized trading paths, particularly excelling in the exchange of stablecoins and assets of similar value.

Looking to the future, as the DeFi market continues to expand, Curve is poised to play an increasingly important role in the global cryptocurrency ecosystem. Its focus on stablecoin exchange strategy, innovative liquidity pool design, and unique governance structure allow Curve to maintain strong competitiveness in the fiercely competitive DeFi field.

However, Curve also faces challenges such as security risks and governance issues. Overcoming these challenges will be key to Curve’s future development. As technology continues to advance and the ecosystem gradually improves, Curve has the potential to become an important bridge connecting traditional finance and the crypto world, providing safe and efficient decentralized financial services to a wider user base.

>>> More to read : Choosing the Right Cryptocurrency Exchange: CEX vs DEX

FAQ

- What is Curve Finance?

Curve Finance is a decentralized exchange (DEX) operating on Ethereum, designed specifically for exchanging stablecoins.