KEYTAKEAWAYS

- Public blockchains consistently outperform in bull markets, with projects like TIA, ETH, and SOL showing potential for significant growth in 2024.

- Evaluate public blockchains based on technical architecture, ecosystem development, tokenomics, market demand, and ability to address industry challenges like scalability.

- Key trends in public blockchains include Layer 2 solutions, performance improvements, economic model innovations, and integration with emerging technologies like AI and IoT.

CONTENT

Explore top public blockchain projects for the 2024 bull market. Learn evaluation criteria, market trends, and potential breakout chains. Insights on ETH, SOL, TIA, and more for informed crypto investing.

After four consecutive days of decline, Bitcoin reached a low of $59,849 (Bitget data). As we discussed in our previous article, “Has the Fourth Bitcoin Halving Bull Market Begun? Analyzing Market Sentiment After Rate Cuts,” the crypto market is currently in the early stages of a bull market. Therefore, each dip presents an opportunity to enter the market. The question then arises: Which projects are worth watching and investing in? It’s crucial to remember that choosing wisely is far more important than merely working hard.

Today, let’s analyze the sector most likely to produce breakout projects: public blockchains.

If you’ve been in the crypto market long enough, you’ll have noticed that each bull market sees one or several public blockchain projects explode, often increasing in value by tens or even hundreds of times, successfully capturing the entire market’s attention. From the early days of EOS and ADA to DOT and AVAX, which caught fire in the last bull market, or SOL, which has rebounded this year, and the currently popular TON – the pattern is clear.

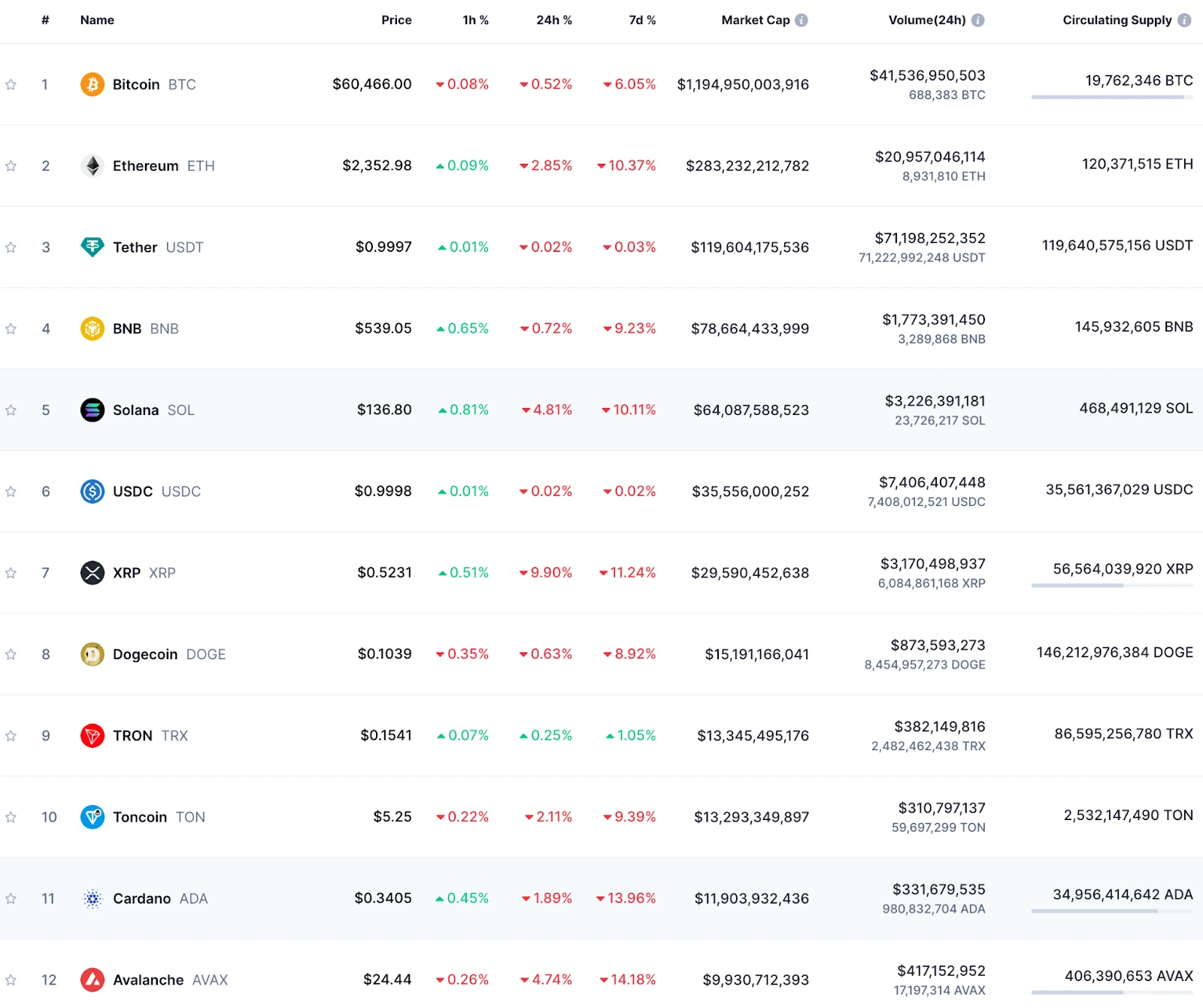

Regardless of whether the market’s hot topic is DeFi, NFTs, AI, GameFi, or BRC20, public blockchain projects consistently shine. They’re the constant amid changing trends. Looking at market capitalization, the most straightforward indicator, 10 of the top 20 global tokens by market cap are public chains, accounting for half of the pie. Among the top 30, there are 14 public chain projects. From a broader perspective, even Bitcoin itself can be considered a public blockchain.

Top 12 Tokens by Global Market Cap

(Source: CoinMarketCap)

WHY DO PUBLIC BLOCKCHAINS HAVE SUCH HIGH MARKET CAP EXPECTATIONS?

The data on public blockchains’ share of global market cap demonstrates that once a public blockchain project gains market recognition, even if briefly, its market cap tends to skyrocket, often propelling it into the global top ten, far surpassing other projects. This high market cap expectation for public blockchains is primarily due to their status as the fundamental infrastructure of the entire crypto industry.

To draw an analogy, a public blockchain is like a highway. Once built, it stimulates services like dining, refueling, charging, and vehicle maintenance. It connects cities and regions, promoting the development of logistics, commerce, tourism, and other industries, while broadly driving economic growth.

As the core infrastructure of the entire blockchain ecosystem, public blockchains support decentralized applications, smart contracts, trustless financial transactions, and other innovations. They’re facilitating the gradual shift from traditional centralized economic models to a decentralized future. The importance of public blockchains is not only reflected in technology but also profoundly influences economic, financial, social, and cultural domains, driving the rapid development of decentralized finance, Web3.0, NFTs, metaverse, and other cutting-edge fields.

Specifically, public blockchains are not only the infrastructure for decentralized economy and trust, providing the technical foundation for blockchain’s core concept of decentralization, but also supporters of smart contracts, allowing users to automatically execute contract terms on the blockchain without intermediaries. Moreover, they serve as pillars of decentralized finance (DeFi), enabling borderless, intermediary-free financial services.

It’s precisely because of the increasing maturity of public blockchain projects that more and more concepts like DeFi, Dapps, and Layer 2 solutions are being developed and promoted based on them. The explosion of these concept projects, in turn, promotes the development and value enhancement of public blockchains.

It can be said that the high market cap expectations for public blockchain projects are unmatched by any other concept projects. Focusing on public blockchain projects means you’ve grasped the largest gold mine in the crypto market.

HOW TO PROFESSIONALLY EVALUATE THE VALUE OF A PUBLIC CHAIN?

Discussing the value of a public blockchain requires in-depth analysis from multiple aspects, including technical architecture, ecosystem, tokenomics, market demand, governance mechanisms, and more. These factors determine a public chain’s potential and competitiveness in the blockchain industry.

1. Technical Architecture and Innovation: This is the core of a public blockchain, determining its performance, scalability, security, and more. It mainly includes consensus mechanisms, scalability solutions, developer tools, and infrastructure. Currently, overall technical capabilities don’t differ much between chains; the key is to see where a public chain focuses its technical efforts – whether on scalability or usability.

2. Decentralization and Security: These are the cornerstones of public blockchains. In the blockchain trilemma, decentralization, security, and scalability cannot be fully achieved simultaneously. It’s important to see which aspect a public blockchain prioritizes. For example, ETH emphasizes decentralization and security at the cost of scalability, which during bull markets gives opportunities to high-performance chains like SOL and AVAX.

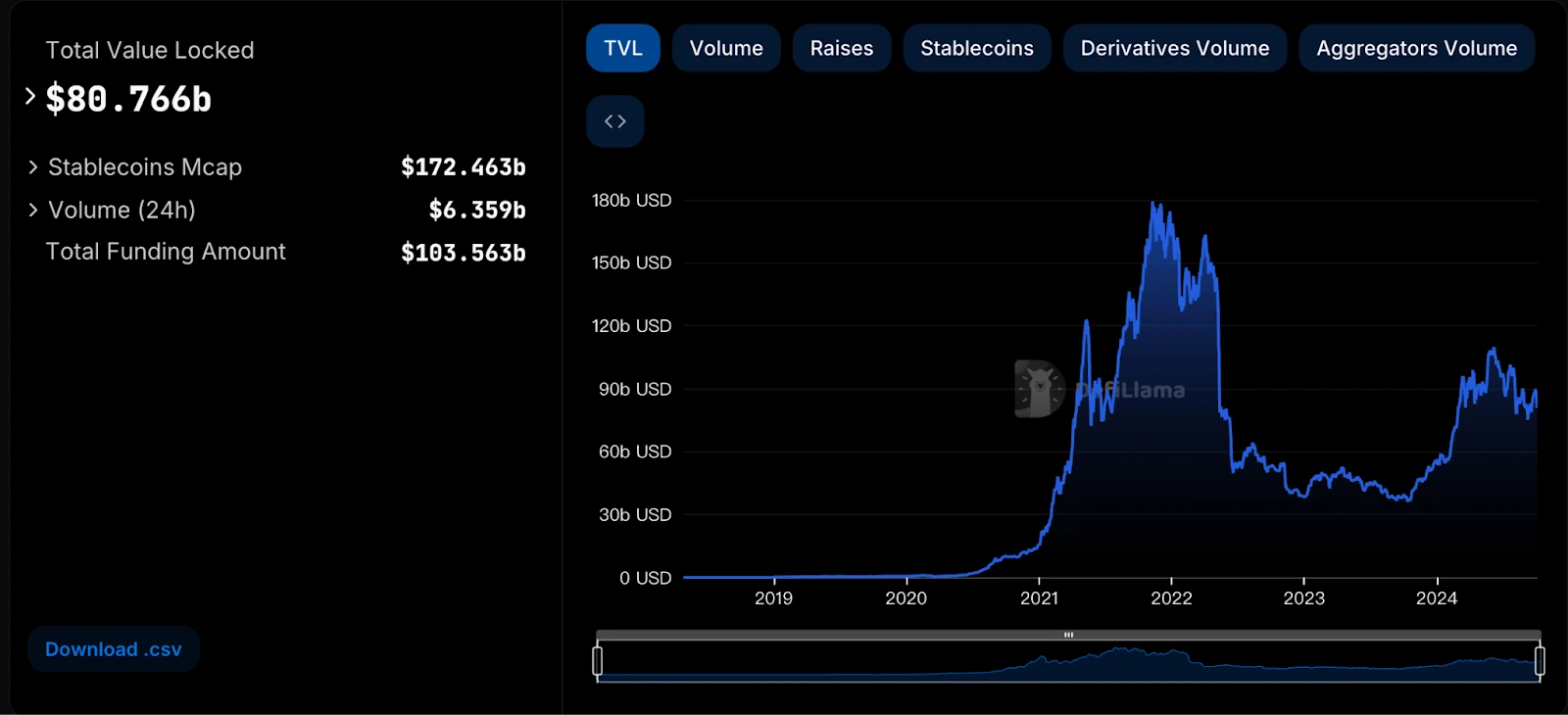

3. Ecosystem Development and Use Cases: These determine its practical applications and long-term value. This includes dApp development and usage, user growth and engagement, developer community support, and cross-chain interoperability. Total Value Locked (TVL) is a clear indicator of a public blockchain’s ecosystem prosperity, which can be viewed on third-party data platforms.

4. Tokenomics: This determines a public blockchain’s value capture ability and long-term sustainability. It includes inflation/deflation models, token distribution and incentive mechanisms, and use cases and demand drivers. The economic model is particularly important for new public blockchain projects, as it clearly shows whether these projects intend to develop long-term or are just here to “harvest” the market. However, some older public blockchain projects with poor economic models still thrive if they occupy a niche or were first movers, such as ETH with its flawed economic model.

5. Market Demand and Macro Environment: Industry trends and demands are perhaps the most critical factors determining whether a public blockchain project can succeed. For instance, during bull markets with thriving ecosystems and frequent transactions, high-performance chains like SOL stand out. As the industry develops, connections between different chains become crucial, leading to the explosion of cross-chain projects like DOT and ATOM.

Other points to consider include governance mechanisms, team and investment background, which can be found in project whitepapers or official websites. Investors need to collect and review materials to draw their own conclusions. Different public blockchains have their strengths and weaknesses in these aspects, but the core lies in whether they can meet market demands, drive technological innovation, and establish strong ecosystems and sustainable economic models.

Total TVL of Public Blockchain Projects

(Source: DefiLlama)

WHICH PUBLIC BLOCKCHAIN PROJECTS ARE CURRENTLY WORTH WATCHING?

Before discussing specific public blockchain projects to watch, it’s necessary to look at the current development directions of the public blockchain sector. This allows for a more macro-level understanding and selection of specific public blockchain projects. After three rounds of bull and bear markets over more than a decade, the crypto market ecosystem has become prosperous and comprehensive, and the development directions of public blockchains have largely manifested:

1. Scalability and Layer 2 Solutions: This is currently the most important direction for public blockchains. For example, Ethereum’s congestion and high fees require Layer 2 projects like Rollups, Optimism, and Arbitrum to solve scalability issues. Polkadot (DOT) uses sharding technology to enhance transaction processing capacity. Additionally, cross-chain and interoperability solutions are needed to address the future multi-chain coexistence, with Cosmos (ATOM) and Polkadot (DOT) being prime examples that have gained market recognition.

2. Performance Improvement: Particularly in transaction processing speed, cost control, and usability. With the onset of the fourth bull market, high-performance chains like Solana (SOL) and Avalanche (AVAX) will again attract market attention and potentially explode. Additionally, the “modular blockchain” concept proposed by Celestia (TIA) represents another development direction for high-performance public blockchains.

3. Economic Model Innovation: This mainly includes deflationary economic models (e.g., Ethereum’s token burning mechanism introduced through EIP-1559), liquidity incentives (primarily liquidity mining and DeFi incentives to encourage user participation), and diversified incentive mechanisms to mobilize users, developers, node operators, and others. Public blockchains that successfully innovate their economic models are likely to secure a strong market position.

ETH Historical Price Trend

(Source: TradingView)

4. Further Development of Web3.0 and Decentralized Applications (dApps): Notably, the growing demand for decentralized social and content platforms is posing new requirements for public blockchains. Those that meet these needs can stand out in the competition. Additionally, public blockchain projects that offer more targeted support in already booming application scenarios like DeFi, NFTs, and the metaverse will also gain market share.

5. Other Development Directions: These include balancing decentralization and security, as well as combining public blockchains with emerging technologies to create new development opportunities. Privacy computing and zero-knowledge proofs, decentralized identity (DID) and data ownership, integration with AI and IoT are all future opportunities for public blockchains. Excelling in any of these directions could lead to a public blockchain becoming the next breakout project, potentially entering the global top ten by market cap.

After analyzing the broader directions, let’s discuss some specific public blockchain projects currently attracting attention in the market. Please note that the following content is purely personal opinion and does not constitute investment advice:

- TIA (Celestia): Representing the modular blockchain concept. Each bull market sees explosive growth in public blockchain projects – EOS with high TPS in 2018, DOT with its cross-chain concept in 2021, SOL rebounding this year with high performance. This bull market could be the turn of the modular concept, as the industry ecosystem has developed to this point. Note that on October 30, 175 million TIA (16.3% of total supply) will be unlocked.

- ETH (Ethereum): Currently performing weakly, but its position as the king of public chains remains stable. Opportunities will arise with the bull market, but it’s more suitable for large capital A7-A9 users.

- ATOM (Cosmos): A representative of strong technology but weak operations, currently undervalued and worth accumulating.

- SUI and APT: Public blockchain projects with relatively high cost-effectiveness in terms of narrative and price position, worth watching.

- DOT, AVAX, ADA: These three established strong public blockchains still have good potential to be tapped, mainly depending on investors’ belief in these projects.

- SOL (Solana): Its story has been told, and it has risen significantly. It needs time to digest gains; currently, just keep an eye on it.

- TON: Benefiting from Telegram’s user base and influence, it has risen rapidly. However, its current market cap is very high, and from a price perspective, future space may be limited. It needs an overall market explosion to drive further growth.