KEYTAKEAWAYS

- Sui's focus on GameFi and DeFi, coupled with its high-performance architecture, positions it as a strong contender in the L1 blockchain sector.

- Sui's ecosystem is rapidly expanding, with its TVL reaching historic highs and daily active users increasing by 300% in under a month.

- If Sui becomes a top-performing L1 chain, its token SUI could potentially reach $180 by the 2025 bull market peak, a 100x increase.

CONTENT

Explore Sui’s potential 100x growth in the 2025 Bitcoin halving bull market. Analysis of Sui’s ecosystem, market position, and value proposition in the competitive L1 blockchain landscape.

The Facebook-affiliated L1 blockchain Sui Network has been performing exceptionally well recently. Not only has its native token SUI’s price risen from last month’s low of $0.74 to this month’s high of $2.16 (Bitget data), a 192% increase, but Sui’s ecosystem Memes have also produced many successful projects. Examples include FUD, which rose up to 5 times, Hippo, which briefly surpassed Ethereum’s moodeng, and the rapidly emerging Blub.

Meanwhile, Sui’s on-chain daily active users have soared by 300% in less than a month, and its TVL has reached a historic high, exceeding $1 billion. The ecosystem is experiencing explosive growth. Voices in the market are calling Sui “the next Solana.”

Sui’s TVL values

In our previous article: “Top Public Blockchain Projects to Watch in the 2024 Crypto Bull Market,” we mentioned that each halving bull market sees one or several L1 blockchain projects explode, rising dozens of times or even becoming 100x coins. So, is it Sui’s turn in this halving bull market?

SUI’S ECOSYSTEM DEVELOPMENT: GAMEFI AND DEFI TAKE CENTER STAGE

As a Layer 1 blockchain, the richness and quality of its ecosystem are the most important foundations for Sui’s value enhancement. The success of Ethereum, the king of L1 blockchains, is due to its unparalleled ecosystem.

Sui, as a L1 blockchain focusing on high performance, primarily has a deep foundation and investment in decentralized finance (DeFi) and gaming (GameFi), gradually covering multiple areas such as NFTs, Dapps, and infrastructure. This is mainly because Sui’s core team members primarily come from Meta (Facebook)’s Novi Research team and were a significant force behind the Libra project.

The Sui L1 blockchain is particularly suitable for GameFi project development, mainly because Sui adopts an object model-based parallel execution mechanism, giving it high scalability and significantly improving transaction speed and efficiency. This is suitable for the high-frequency, low-latency on-chain interactions of games. Moreover, Sui’s architecture provides the advantage of low transaction fees, making it the preferred platform for many GameFi developers. Additionally, Sui’s Move programming language allows GameFi developers to easily create complex asset types, which is crucial for game characters, props, NFTs, and in-game economic systems.

Sui’s advantages in DeFi mainly lie in its efficient transaction processing capabilities and security. The DAG-based consensus mechanism allows for near real-time transaction confirmation, which is crucial for DeFi applications. Sui’s architecture features low latency and low cost, while the Move language greatly lowers the barrier for developers, enabling more innovative DeFi projects to quickly launch.

To date, numerous GameFi and DeFi projects have emerged under the nurture of the Sui ecosystem. Examples include Suia, an NFT platform focused on in-game assets; Souffl3, a cross-chain NFT marketplace; Got Beef, a game-based custody and voting system; as well as Cetus Protocol, a concentrated liquidity DEX project with a TVL of $168 million; Bucket Protocol, a staking debt protocol; and Typus Finance, a DeFi options trading platform suitable for retail investors.

Sui’s ecosystem directory

Currently, Sui’s dual focus on GameFi and DeFi is driving the rapid expansion of its ecosystem. Although the DeFi sector is showing strong growth momentum, the GameFi sector remains the main driver in attracting users.

Besides GameFi and DeFi, the Sui ecosystem is also continuously advancing in multiple infrastructure projects, such as oracles, wallets, and blockchain development tools. These projects provide more convenient tools for Sui’s developers and users, enabling them to build projects and applications more efficiently on the Sui network.

SUI’S POSITIONING AND DEVELOPMENT: WHY IT CAN SUCCEED IN THE COMPETITIVE L1 BLOCKCHAIN SECTOR

As we know, due to the value ceiling and attention level of L1 blockchains, there are already numerous L1 blockchain projects in the market, such as ETH, SOL, TON, TIA, APT, ATOM, DOT, etc. They either stand out with unparalleled ecosystem prosperity or occupy a place in the market with features like high performance and cross-chain capabilities.

As a rising star, why can Sui succeed in the fiercely competitive L1 blockchain sector?

In terms of positioning, Sui mainly focuses on GameFi and NFTs, paying special attention to on-chain games and NFT application scenarios. Its high throughput and low latency characteristics fully meet the needs of this field. Additionally, Sui’s design philosophy particularly emphasizes user experience and developer friendliness, greatly lowering the barrier for developers by providing a series of development tools and SDKs.

In terms of economic model, its native token SUI is mainly used for network security, transaction fee payment, and ecosystem governance. The token model design is more concise and effectively encourages long-term ecosystem development and project construction. This positioning gives it a first-mover advantage in GameFi and NFT ecosystems, which are the most grounded and popular areas in this bull market.

Compared specifically with other established or popular L1 blockchains, it also has some advantages. For example, compared to established chains like ETH and SOL, Sui adopts a brand new object model and parallel processing transaction architecture, avoiding the global consensus bottleneck in traditional blockchains and achieving more stable high throughput than SOL. This design is particularly suitable for GameFi and DeFi applications.

Compared with other rising stars like APT, TON, and TIA, APT and Sui both use the Move language, making them similar in technical foundation, but Sui has made more in-depth optimizations in parallel transactions and throughput. Although TON and TIA have unique advantages in user growth and infrastructure, Sui is more differentiated in technological innovation, especially in future-oriented application scenarios such as GameFi and DeFi.

Compared with other popular L1 blockchains like ATOM and DOT, unlike their focus on cross-chain interoperability, Sui focuses on a high-performance single-chain architecture, making it perform better in focused scenarios like GameFi and DeFi.

Overall, Sui’s strong team background, focus on practical application scenarios like GameFi and DeFi, and innovative parallel transaction processing and low-cost, high-efficiency design in technology ensure its unbeatable position in the fierce L1 blockchain sector. In the future, as more projects and developers join, Sui is expected to further consolidate its competitive advantage.

SUI’S VALUE ENHANCEMENT: IS A 100X INCREASE POSSIBLE?

In our previous article “Top Public Blockchain Projects to Watch in the 2024 Crypto Bull Market,” we already discussed how to evaluate the value of a L1 blockchain. The above text has explained factors such as Sui’s technical architecture, ecosystem, team background, market demand, and governance mechanism.

Here, we will mainly explain why its native token SUI might become a 100x coin in the fourth Bitcoin halving market from the aspects of token economics and market trading circulation. The data mentioned below mainly comes from third-party data platforms such as feixiaohao, CoinMarketCap, and tradingview.

The basic situation of SUI: Since its initial release in May 2023, it has been listed on more than 60 mainstream exchanges including OKX, Bitget, and Binance, ensuring liquidity. The listing on almost all mainstream exchanges also demonstrates the market’s mainstream recognition of SUI.

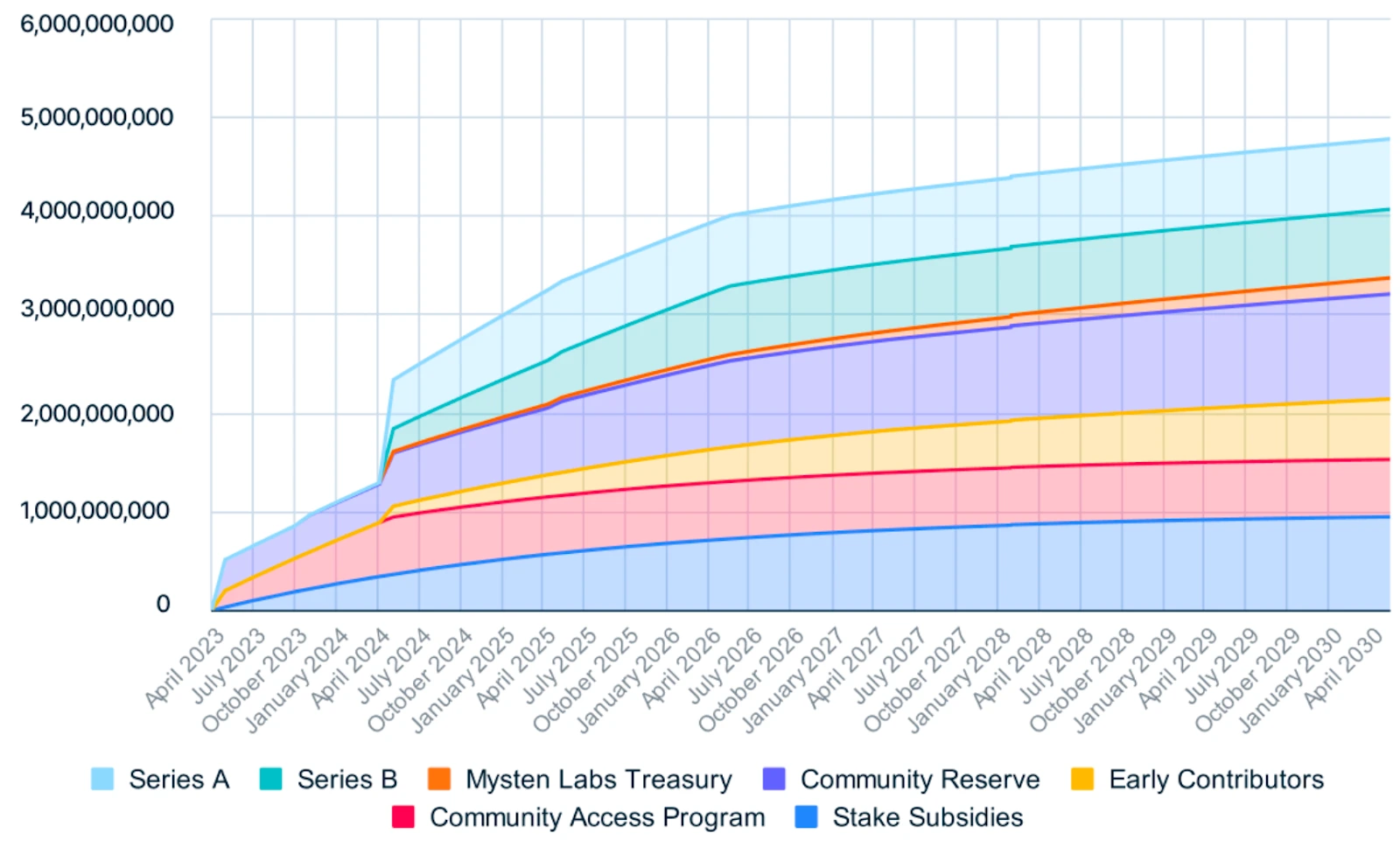

Currently, SUI has a circulation of 2.7 billion tokens, with a total supply of 10 billion. Of these, 5 billion are reserved for the community, mainly managed by the SUI Foundation for authorized project funding and development. Early contributors account for 2 billion, investors 1.4 billion, and the rest are divided between Mysten Labs and other contributors. Currently, the token implements a lock-up and gradual unlock mechanism, with full token unlock expected by April 2030, as shown in the following chart:

SUI token unlock situation

Assuming the SUI project maintains its current unlock speed and increases token circulation according to market demand, by December 2025, when this halving bull market reaches its peak, the circulation ratio of SUI tokens may reach about 50%, i.e., 5 billion SUI.

If, as analyzed above, Sui becomes the best-performing L1 blockchain project in the 2025 halving bull market, successfully entering the top ten global market cap rankings, second only to ETH in market cap, then considering the overall increase in market cap, we can roughly estimate that SUI’s total market cap at that time should be in the reasonable range of $480-640 billion. Based on the total market cap algorithm, the specific calculation process is as follows:

According to the experience of previous halving bull markets, at the peak of the bull market, ETH’s total market cap accounts for about 40% of Bitcoin’s, while the total market cap of the second-ranked L1 blockchain accounts for 30-40% of ETH’s.

According to the estimation in our previous article “Federal Reserve May Accelerate Rate Cuts: When Will Bitcoin Reach $100,000?“, Bitcoin’s peak price in this bull market will be around $200,000, with a total circulation of about 19.9 million bitcoins at that time. Bitcoin’s total market cap will reach about $3.98 trillion, ETH’s total market cap about $1.6 trillion, and the total market cap of the second-ranked L1 blockchain about $480-640 billion.

In the context of the Bitcoin halving bull market, the price of SUI tokens will be driven by growing market demand. In an extremely optimistic scenario, at the peak of the bull market at the end of 2025, it could reach around $180, a 100-fold increase from now.

Of course, this prediction is based on the premise that the SUI ecosystem continues to develop, especially in the continuous expansion of DeFi, NFT, and GameFi sectors. Global cryptocurrency market sentiment, macroeconomic environment, changes in regulatory policies, etc., will also have a significant impact on the price. Therefore, this prediction should only be used as a reference.

As always, for any project and sector, you should deeply understand its underlying logic, fully grasp market information, draw your own conclusions, and reasonably formulate an investment strategy that suits you.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!