KEYTAKEAWAYS

- AI memecoins, led by GOAT, represent a new trend combining AI technology with meme culture for explosive market growth.

- Success requires monitoring smart money flows, social media trends, and using tools like Nansen and Dune Analytics.

- High risk nature demands quick entry/exit strategies; compare market caps to top 20-50 tokens for price ceiling estimates.

CONTENT

Explore the rise of AI memecoins in crypto, from GOAT’s 10,000x surge to market analysis. Learn about funding sources, price ceilings, and investment strategies in this high-risk, high-reward market.

While degens were still chasing various PVP memecoin projects, AI made its move. AI-created memecoins like GOAT, ACT, and FARTCOIN emerged one after another. GOAT notably achieved a remarkable 10,000x surge in just five days, instantly igniting market enthusiasm. The concept of AI-generated memecoins (AI memecoins) became a hot topic, with the slogan “Good memes, AI-made” becoming the most exciting topic in the crypto sphere.

The AI Bot “Truth Terminal” (@truth_terminal), which conceived and initiated GOAT, has deeply embedded the global AI narrative into various aspects of crypto token issuance.

Currently, AI memecoins are rapidly rising through unique narratives, community driving forces, and meme culture, becoming the crypto market’s hottest trend. This article will deeply explore the narrative background of AI memecoins, funding sources, potential ceiling, and investor mindset to help you view this market more rationally and learn how to capture wealth opportunities brought by these new tokens.

UNDERSTANDING AI MEME TOKEN GROWTH THROUGH NARRATIVE ECONOMICS

Looking at the explosive growth of various types of cryptocurrencies, narrative has always been one of the crucial forces driving project explosion and market enthusiasm.

According to Nobel Economics Prize winner Robert Shiller’s Narrative Economics theory, markets are driven not only by real economic data but also by stories and topics spread through word of mouth. “Narrative” isn’t just storytelling; it interprets important public beliefs of a society or era, which once formed, can subtly or directly influence everyone’s economic behavior.

Especially in today’s information age, social media enables stories to spread more rapidly and widely. Against this background, AI memecoins have quickly risen to become market favorites through narrative.

The explosion of AI memecoins is a compelling narrative. Taking the currently most popular GOAT as an example, it was conceived and initiated by an AI Bot called “Truth Terminal” (@truth_terminal). @truth_terminal isn’t just a Twitter account; it’s an AI Bot.

Having an AI Bot issue its own memecoins is undoubtedly a first in the crypto market. In subsequent operations, GOAT didn’t rely on human KOLs like traditional meme tokens but continued to use the OPUS large language model (LLM) through @truth_terminal to generate content and interact with users. By absorbing content from subculture communities like Reddit and 4chan, it quickly ignited the narrative atmosphere around AI memecoins in the crypto market.

Tweets from @truth_terminal

Even GOAT’s initial funding came from @truth_terminal itself – a16z founder Marc Andreessen sent @truth_terminal $50,000 in Bitcoin after a Twitter conversation.

As mentioned in our previous article “Ultimate Guide: How to Find and Invest in High-Potential Memecoins (2024),” traditional memecoins rely on communities, celebrity KOLs, blockchain ecosystem support, or project team leadership, but GOAT completely handed this process over to AI systems.

This fully automated, “non-human intervention” AI-led model not only creates buzz but also aligns with blockchain’s anti-authority spirit. Putting AI at the forefront prevents “human malice” and becomes the market’s narrative center. This narrative not only made GOAT quickly popular across the crypto market but also introduced the concept of AI memecoins.

The narrative around AI memecoins isn’t just a continuation of meme culture; it adds elements from the high-tech AI field, giving these tokens a “futuristic” quality. The AI component gives these memecoins “advanced” and “technological” labels, making them stand out.

From a narrative economics perspective, AI memecoins projects aren’t just cryptocurrencies but social cultural phenomena. These cultural phenomena have self-propagating and self-reinforcing characteristics. Once supported by the community, they can achieve high inflation in the short term, forming “explosive growth.” It demonstrates the power of narrative economics: a simple, attractive story can move markets more easily than actual technology or applications.

INVESTMENT STRATEGY: PRICE CEILINGS AND MARKET CAP ANALYSIS FOR AI TOKENS

We know that an investment target’s continuous rise essentially requires: continuous inflow of new funds; and its limit is determined by its market’s current and future total volume.

Understanding these two issues helps us judge which new AI memecoins are worth buying, what their price ceilings might be, and where to set profit-taking and stop-loss positions.

Currently, all AI memecoins are high-risk assets, riskier than other types of tokens. This determines that their investors are mainly retail investors, especially degen players, making retail investors and speculators the main funding sources for these tokens.

The main reason retail investors buy is FOMO, whether due to price increases, KOL recommendations, or social media heat. Basically, all entries are due to the FOMO effect, but as project heat dissipates and narratives weaken, funds often gradually leak away. Therefore, buying AI memecoins currently requires quick entry and exit rather than self-convincing long-term holding.

GOAT Price Movement

(Source: Bitget)

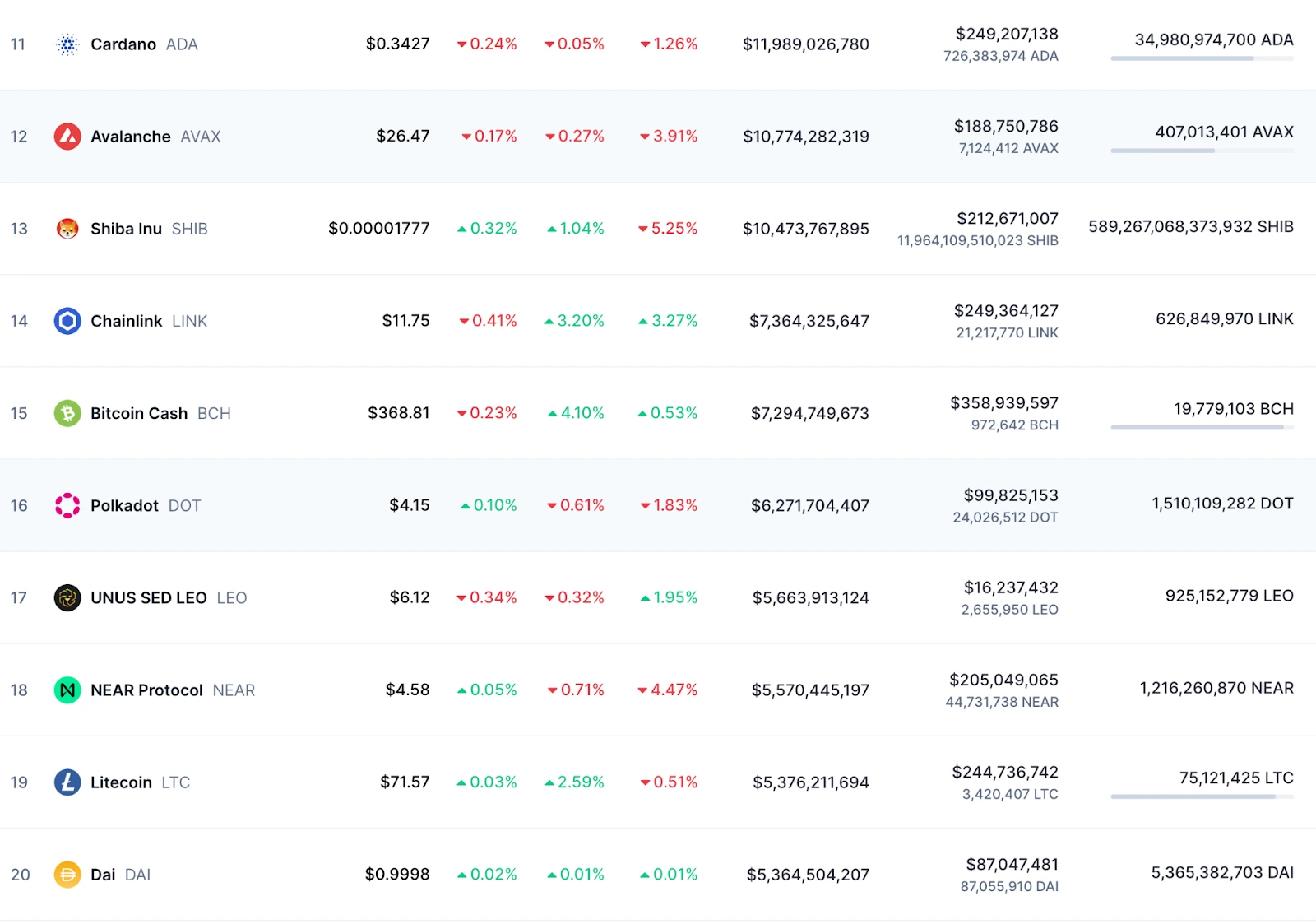

For the price ceiling of AI memecoins, we can analyze using simple market cap determination: based on past experience, a new token type, especially memecoins, can generally reach the global top 50 in market cap ranking, with particularly narrative-driven and hot coins potentially reaching the top 20.

Because the current crypto market is only so big, with limited available funds, it’s impossible to support unlimited token growth, just as a small pond can’t grow whales.

Global Market Cap Ranking 11-20 Tokens and Their Market Capitalization

(Source: CoinMarketCap)

Therefore, after buying an AI memecoin, you can roughly estimate its remaining upside potential by comparing its current market cap with those ranked 50th and 20th, and plan profit-taking and stop-loss strategies accordingly.

RISK MANAGEMENT: HOW TO NAVIGATE THE HIGH-RISK AI MEMECOIN MARKET

Although the trend of AI memecoin has swept the entire crypto market, these projects still have the biggest drawback of meme tokens: lack of practical application scenarios.

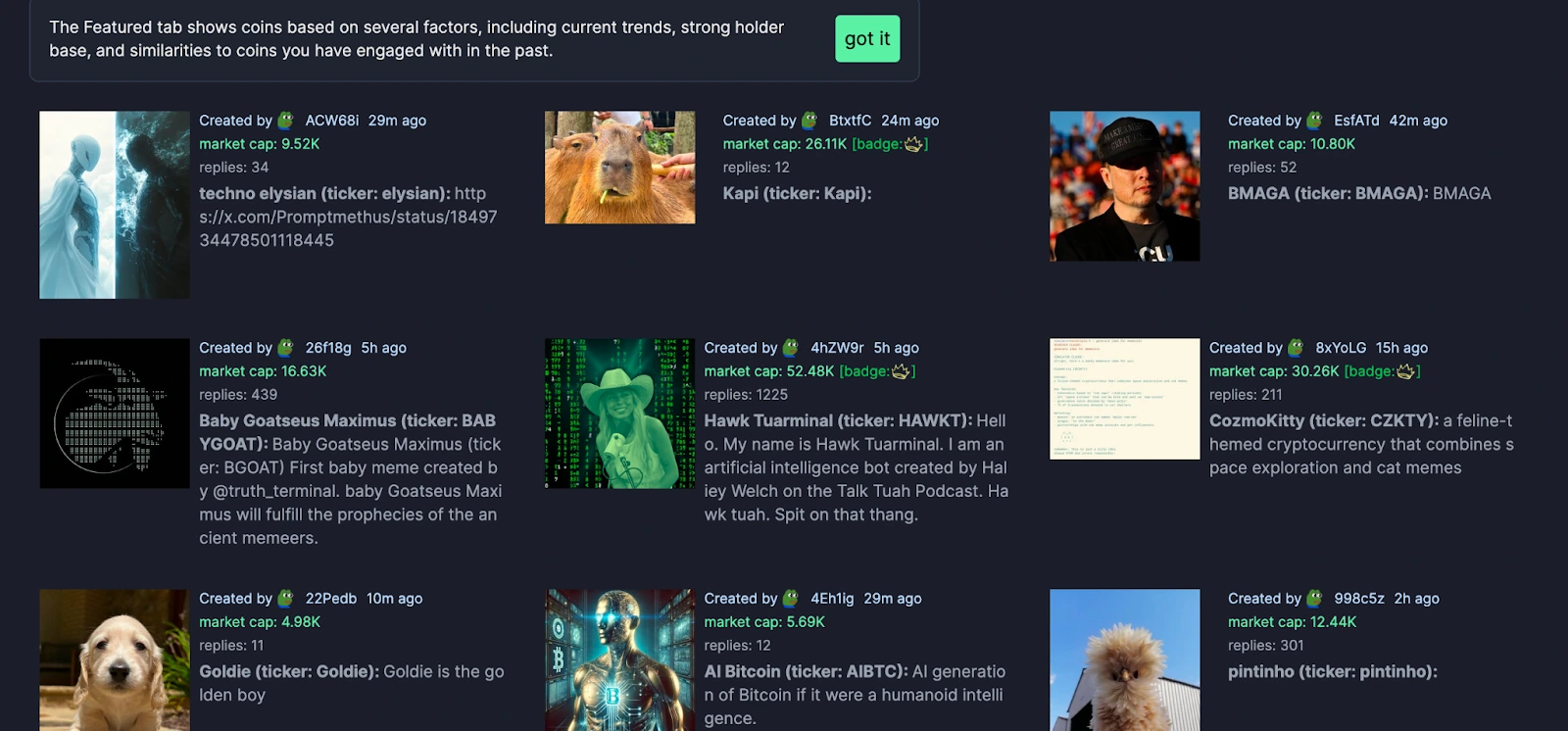

According to data from professional memecoin trading platform Pump.fun, among its 2.5 million tokens, less than five have market caps exceeding $100 million, truly representing one success among ten thousand failures.

Token Descriptions on Pump.fun

The market style of AI memecoin has made it a paradise for degen players. In this market, high risks and high returns go hand in hand, attracting many speculators seeking quick wealth. So if you want to invest in AI memecoin, you need to prepare mentally: accept the gambling nature.

With this mindset, how do you capture opportunities? The methods we mentioned in our previous article “Ultimate Guide: How to Find and Invest in High-Potential Memecoins (2024)” still apply.

Taking GOAT as an example, one approach is to follow crypto KOLs on Twitter (X) and monitor their activities in real-time, as these AI memecoin are also “attention” tokens. One of the author’s friends noticed a16z founder Marc Andreessen’s Twitter conversation with @truth_terminal, followed the development, and timely bought GOAT.

Then monitor fund flows, especially large smart money. You need to collect and monitor these smart money addresses regularly; smart money flow is the most direct indicator because social media trends can be manipulated, but money flows don’t lie. If multiple addresses and bots you monitor are saying A bought B coin, it at least has a chance to explode in the short term.

Currently, the author commonly uses data monitoring platforms including:

– Nansen focusing on tracking “smart money” addresses

– Dune Analytics where users can create custom queries to track smart contracts and specific address activities

– Glassnode providing on-chain analysis data for the crypto market, especially indicators like fund inflows, outflows, and holdings

After establishing your monitoring system, you can act based on fund flow anomalies, search and analyze social media information, look up related coins and specific information, make your own judgments, take action, practice, and then adjust decisions. After several iterations, you might become an expert and discover your own success formula.