KEYTAKEAWAYS

- Bitcoin halving in 2024 reduces mining rewards from 6.25 BTC to 3.125 BTC per block, increasing competition and costs.

- Mining difficulty continues to rise, demanding better hardware and higher operational expenses to stay profitable.

- Home mining remains viable with low electricity costs and participation in mining pools, but challenges like heat and noise persist.

CONTENT

Bitcoin mining profitability is under scrutiny after the 2024 halving reduces rewards. Learn about evolving challenges, costs, and opportunities for miners.

Over the past twelve years, Bitcoin mining has undergone a fascinating evolution.

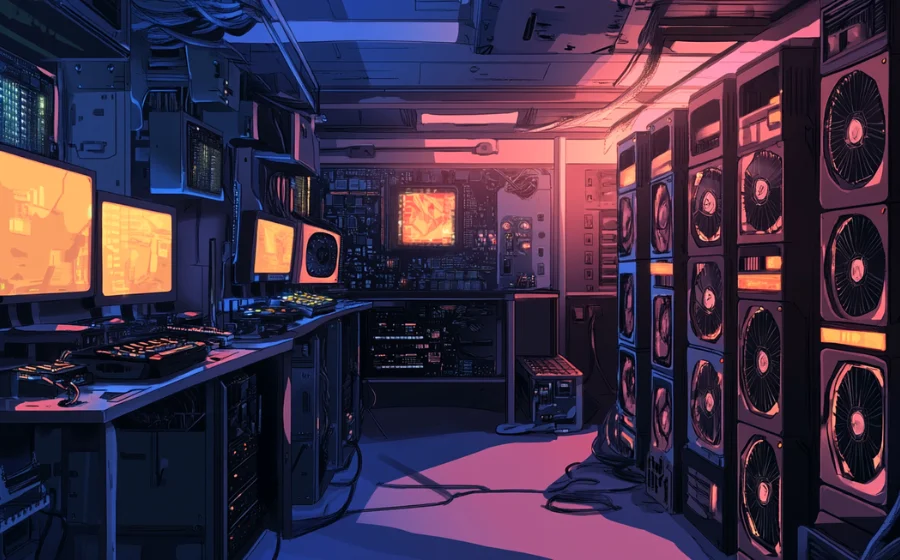

It started with CPU mining on household computers, progressed to basic machines, and eventually led to the construction of large-scale dedicated facilities in places like Iceland and Texas, housing tens of thousands of ASIC mining machines designed exclusively for mining Bitcoin.

But as we move into 2024 and beyond, will Bitcoin mining still be profitable?

WHAT IS BITCOIN MINING?

Bitcoin mining refers to the process where miners support the Bitcoin network by maintaining and validating blockchain operations in exchange for Bitcoin (BTC) rewards.

Miners are individuals or organizations using specialized equipment, known as mining machines, to perform the necessary computations.

These mining machines, such as ASIC devices or high-performance computers, are specifically designed for Bitcoin mining tasks.

※ ASIC, specialized hardware, is at the core of Bitcoin mining.

As a miner, you need to compete for the right to package transaction records into new blocks. Only by successfully adding a block to the blockchain can you earn Bitcoin rewards.

Additionally, every time a block is successfully mined and added to the Bitcoin network, the miner receives a specific amount of Bitcoin as a “block reward.”

This reward is the primary source of profit for miners. However, with the block reward halving every four years, mining has become increasingly competitive and challenging.

-

The Role of Bitcoin Mining in the Bitcoin Network

1. Issuing New Bitcoins

Bitcoin mining is the only way to release newly mined bitcoins into circulation. When a miner successfully mines a block, the Bitcoin reward is added to the network supply, facilitating its availability.

2. Verifying and Confirming Transactions

During the mining process, miners validate Bitcoin transactions on the network and package them into blocks. This ensures the authenticity and immutability of all recorded transactions.

3. Preventing Malicious Behavior and Double-Spending

Bitcoin mining protects the network from malicious activities through its consensus mechanism, such as Proof of Work. Mining ensures that each transaction is unique and valid, preventing issues like double-spending.

>>> More to read: What is Crypto Mining?

BITCOIN MINING HISTORY

In the early days of Bitcoin, when its value was only a few dollars or even cents, most mining was done at home using regular computers.

This simple and low-key approach was viable and went largely unnoticed. However, this landscape changed with the advent of ASIC miners.

Due to their vastly superior mining efficiency, ASICs revolutionized the Bitcoin mining process and raised the competitive bar.

For many, the rise of ASIC miners disrupted the simplicity and accessibility of home mining.

Operating an ASIC miner came with its own set of challenges, including loud noise, excessive heat generation, and significant power consumption.

These factors significantly altered the parameters and considerations involved in Bitcoin mining.

Stories from home miners often highlight the humorous and sometimes extreme situations they faced.

For example, miners complained about the deafening noise driving them crazy, neighbors lodging noise complaints, and homes overheating to the point of feeling like saunas.

In some cases, miners resorted to opening all their windows in the middle of winter to cool their homes.

Then there were the shocking electricity bills that arrived, leaving miners with nightmare tales to share.

Clearly, this lifestyle wasn’t ideal for most people, especially for those with families or limited living space.

As Bitcoin mining became increasingly profitable, miners were incentivized to set up dedicated mining facilities in remote locations.

These facilities were designed to mine Bitcoin on a large scale in temperature-controlled environments, far from residential areas, eliminating the challenges of noise and heat.

This shift led to the emergence of professional mining farms and hosted mining solutions, further driving the specialization and industrialization of Bitcoin mining.

>>> More to read: What is Proof of Work (PoW)?

BITCOIN MINING AT HOME

Many assume home Bitcoin mining is futile, given the competition from massive mining farms. However, mining pools create a fairer environment, enabling thousands globally to run single mining devices and earn Bitcoin rewards.

Don’t let large-scale facilities discourage you—smaller miners can still participate in the same mining pools. Beyond profits, many home miners do it to contribute decentralized computing power and strengthen the Bitcoin network’s stability.

-

Home Bitcoin Mining: What to Consider

While earning Bitcoin rewards through home mining may sound appealing, there are important factors to consider before starting.

As mentioned earlier, noise and heat are significant issues. If you live in a one-bedroom apartment, running ASIC equipment could drive you crazy.

For those in hot climates, the risk of overheating and dealing with high temperatures adds another layer of difficulty.

Understanding your local electricity costs is crucial. If you live in a place with free or subsidized electricity, it can be a significant advantage.

However, many home miners find that their electricity bills often exceed the value of the Bitcoin rewards they earn.

To determine if Bitcoin mining is profitable for you, tools like the Coinwarz.com Bitcoin Mining Calculator can be helpful.

By entering your electricity rates, you can quickly estimate potential earnings and make a well-informed decision.

>>> More to read: What is Proof of Stake (PoS)?

WILL BITCOIN MINING MAKE MONEY AFTER 2024?

For individuals running Bitcoin mining equipment, the answer is yes, as long as your electricity costs and mining expenses are lower than your rewards.

However, with Bitcoin’s halving events occurring approximately every four years, mining rewards gradually decrease.

When Bitcoin was first mined in 2009, miners earned an impressive 50 BTC per block. By 2020, after three halving events, the reward dropped to 6.25 BTC per block.

In 2024, the reward was halved again to 3.125 BTC per block.

As the Bitcoin network evolves, mining difficulty continues to reach new highs. This means the computing power required to mine a Bitcoin block reward is increasing.

Meeting these requirements demands more significant investments in hardware upgrades and operational costs, making it challenging for individual miners and small-to-medium mining farms or pools to maintain a cost advantage.

As a result, in 2024 and beyond, it’s unlikely that Bitcoin mining alone will make you a millionaire.

As mentioned earlier, Bitcoin mining is no longer a get-rich-quick scheme but rather an activity that requires careful planning and long-term commitment.

>>> More to read: How to Get Crypto Passive Income Easily?