KEYTAKEAWAYS

- PYUSD’s Versatile Applications

Built on Ethereum and Solana, PYUSD supports payments, cross-border transactions, and DeFi, offering diverse use cases across blockchain platforms. - Regulatory and Asset-Backed Stability

PYUSD complies with NYDFS regulations and is backed by cash reserves and Treasury bills, ensuring trust and value stability. - Market Expansion and Growth

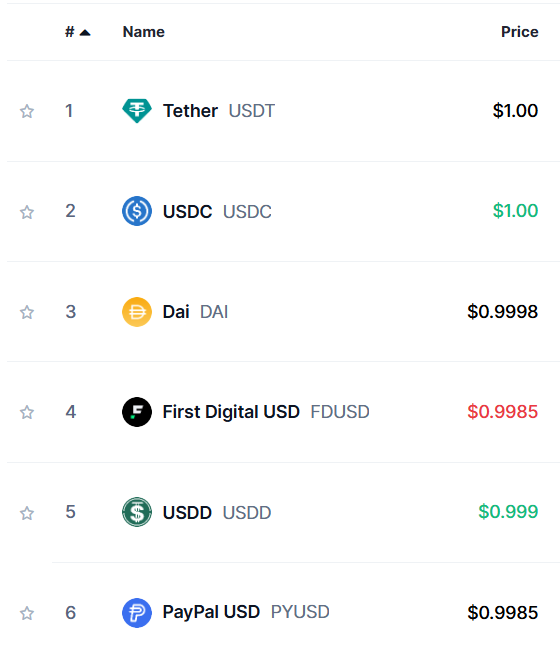

PYUSD’s rapid growth on Solana boosted its market cap by 217.9%, solidifying its position as the sixth-largest stablecoin globally.

CONTENT

PayPal’s PYUSD stablecoin bridges Web2 and Web3 with versatile applications, regulatory strength, and blockchain integration. Positioned for global adoption, PYUSD is reshaping digital payments and commerce.

WHAT IS PYUSD?

PayPal officially launched its stablecoin, PayPal USD (PYUSD), on August 7, 2023.

This stablecoin is pegged to the US dollar and supports functions such as fund transfers, payments, checkouts, and conversion into other cryptocurrencies.

As the first stablecoin introduced by a major global financial institution, PayPal aims to position PYUSD as a crucial bridge between fiat currencies and the Web3 ecosystem.

PYUSD is built on the Ethereum blockchain and issued by Paxos Trust Company, a long-time partner of PayPal.

It maintains a 1:1 parity with the US dollar, backed by cash deposits, short-term US Treasury bonds, and other highly liquid assets to ensure its value stability.

The primary purpose of PayPal USD is to enable cross-border payments on the PayPal platform, offering users a fast, convenient, and low-cost way to transfer money, shop, or donate.

PYUSD can also be used on other cryptocurrency-supported platforms, such as exchanges, digital wallets, and decentralized finance (DeFi) applications.

Whether you’re purchasing international goods, supporting charitable causes, or exploring cryptocurrency investments, PayPal USD provides a versatile solution to enhance the integration of digital currencies into everyday life.

>>> More to read: What Is Stablecoin ? Stable Virtual Assets

PYUSD APPLICATIONS & FUTURE DEVELOPMENT

Since 2020, PayPal’s blockchain division has been actively expanding its cryptocurrency payment services, enabling users to make transactions with cryptocurrencies.

Beyond enhancing crypto payment functions, PayPal is focusing on blockchain-based e-commerce solutions. PYUSD (PayPal USD) has become a key component in their strategy, paving the way for the Web3 era.

-

Versatile Blockchain Applications of PYUSD

PYUSD is an Ethereum-based ERC-20 stablecoin designed to support a wide range of blockchain applications.

It serves as a stable payment solution for the Web3 ecosystem, including third-party exchanges, digital wallets, decentralized applications (dApps), and NFT marketplaces.

For developers, PYUSD offers an easy way to integrate payment systems into their Web3 products and services.

Beyond its use as a payment method, PYUSD can also act as an in-game token in the metaverse or as a settlement tool for NFT trading.

This positions PayPal as an increasingly significant player in the blockchain ecosystem, driving the convergence of traditional finance and the crypto economy.

-

Regulatory Strengths of PayPal Stablecoin

PYUSD is fully compliant with the strict regulatory standards of New York State.

PayPal holds a Virtual Currency Business License from the New York State Department of Financial Services (NYDFS), and the issuance of PYUSD is managed by Paxos Trust Company.

Paxos, a government-chartered trust company, specializes in blockchain technology and cryptocurrency services, with its products regulated by NYDFS.

The stability of PYUSD is backed by reserves consisting of U.S. dollar deposits, U.S. Treasury bills, and cash equivalents, ensuring user funds are secure and trustworthy.

The partnership between PayPal and Paxos provides a strong foundation for PYUSD’s operations, guaranteeing compliance and reliability.

-

Integration of PayPal Wallet and Web2 Applications

PYUSD supports transactions with other self-custodial wallets and is versatile in its commercial use cases, including payroll, cross-border settlements, business expenses, and B2B (business-to-business) transactions.

Unlike USDC and USDT, which are widely used in the DeFi ecosystem, PYUSD focuses on commercial payment solutions.

It facilitates seamless business transactions between regions such as the United States, the United Kingdom, and the European Union.

Additionally, PYUSD’s blockchain integration enables cross-chain transfers, such as to Ethereum or Solana addresses, enhancing its flexibility and practicality.

PYUSD, PayPal’s stablecoin, bridges the gap between Web2 and Web3 with its diverse applications, strong asset backing, and robust regulatory compliance.

As blockchain technology and digital payment demands continue to grow, PYUSD is poised to play an increasingly pivotal role in global commercial payments and the digital economy.

>>> More to read: Understanding Tether USDT

PYUSD POTENTIAL ISSUES & CHALLENGES

Some observers have raised concerns about potential risks associated with PayPal’s longstanding “Buyer Protection Policy” when applied to PYUSD transactions.

This policy allows buyers to request a full refund if goods are not delivered or do not meet expectations, with sellers bearing the loss. However, applying this policy to blockchain-based PYUSD transactions could introduce new challenges.

-

Fraud Risks

In a blockchain environment, malicious buyers could exploit this policy by falsely claiming they did not receive the goods after delivery and demanding a refund. Such fraudulent activities could result in financial losses for sellers.

Since blockchain transactions are irreversible, once funds are transferred out of PayPal’s ecosystem, it becomes significantly more difficult to freeze or recover those funds, further complicating the resolution of disputes.

-

Challenges in Resolving Disputes

The decentralized nature of blockchain transactions limits the effectiveness of traditional dispute resolution mechanisms. For instance, PayPal can freeze accounts or funds within its centralized platform to resolve issues.

However, in blockchain-based transactions, control is distributed across the network, greatly reducing PayPal’s ability to intervene.

-

Proposed Solutions and Recommendations

To mitigate these potential risks, sellers are advised to adopt preventive measures, such as:

1. Maintaining detailed shipping and delivery evidence: Including logistics records and signed delivery confirmations.

2. Opting for secure transaction methods: Utilizing smart contracts with identity verification or multi-signature requirements.

3. Leveraging professional services: Employing decentralized dispute resolution tools enabled by blockchain technology.

PayPal could also develop new dispute resolution frameworks tailored to PYUSD’s unique features to ensure secure and fair transactions within the blockchain environment, preventing exploitation of policy loopholes.

As an innovative stablecoin, PYUSD offers vast potential for application but also faces challenges in integrating traditional policies with blockchain technology.

By implementing robust regulations and risk management strategies, PYUSD can maximize its value while safeguarding the interests of all parties involved in transactions.

>>> More to read: What is USD Coin (USDC)?

PYUSD LATEST DEVELOPMENTS

PYUSD (PayPal USD) has risen to become the sixth-largest stablecoin, driven by its rapid growth and strategic expansion.

Following its deployment on the Solana blockchain this year, PYUSD has seen a significant surge in market cap and trading volume, showcasing its potential in the stablecoin market.

(source:coinmarketcap)

-

Solana Expansion Fuels Growth

While stablecoins like USDT and USDC operate on multiple blockchains, PYUSD currently focuses on Ethereum and Solana. Its expansion to Solana in May marked a pivotal step in its adoption.

Initially planned to launch on Solana in partnership with FTX in 2022, the collapse of FTX delayed the launch, leading PYUSD to debut on Ethereum instead.

-

Market Cap and Adoption Surge

On Ethereum, PYUSD reached under $300 million in market cap after 10 months. However, within three months of launching on Solana, its market cap surged by 217.9%.

Adoption on Solana has grown rapidly, making PYUSD a significant player in Solana’s stablecoin market.

PYUSD’s rise to the sixth-largest stablecoin reflects its focused strategy and rapid adoption.

Its expansion to Solana has bolstered its market position, paving the way for further growth and increased competition with other leading stablecoins.

>>> More to read: How to Get Crypto Passive Income Easily?