KEYTAKEAWAYS

- Institutional investors are favoring established cryptocurrencies, with XLM and ADA showing strong technical patterns and potential for significant market cap advancement.

- THE demonstrates promising growth potential in the DEX sector, targeting 255-678% upside by competing with established players like CAKE and RUNE.

- Altcoin season indicators show strong momentum, with the index rising from 33 to 63, suggesting potential broad market gains across top-100 tokens.

- KEY TAKEAWAYS

- CURRENT MARKET OVERVIEW

- XLM: STELLAR’S PAYMENT NETWORK SURGES WITH INSTITUTIONAL MOMENTUM

- ADA: ACADEMIC BLOCKCHAIN PIONEER SHOWS STRENGTH IN STAKING METRICS

- THE: BSC’S RISING DEX CHALLENGER TARGETS ESTABLISHED PROTOCOLS

- SAND: METAVERSE LEADER FINDS SUPPORT AS GAMING SECTOR REAWAKENS

- COMPARATIVE ANALYSIS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Comprehensive analysis of XLM, ADA, THE, and SAND cryptocurrencies, examining technical patterns, market positioning, and growth potential. Features detailed price predictions, risk assessments, and investor suitability guidance for Q1 2024.

*Ready to explore these opportunities? Trade on Bitget now. Remember: This content is informational only – always trade responsibly.

Welcome to the fifth edition of the potential/popular cryptocurrency research report series jointly launched by CoinRank and Agen. This edition mainly covers four cryptocurrencies: XLM, ADA, THE, and SAND, providing comprehensive analysis from aspects such as token introduction, reasons for optimism, technical analysis, top price predictions, and suitable investor groups.

CURRENT MARKET OVERVIEW

Before we officially begin, let’s talk about the recent market conditions. After a major surge, Bitcoin experienced a nearly 10,000-point pullback and is currently trading sideways in a small range, showing signs of struggle to move higher. So, is it time for altseason? Looking at the current alt season index, it has risen from 33 to 63 in less than a month, indicating that more and more altcoins are outperforming Bitcoin during the same period.

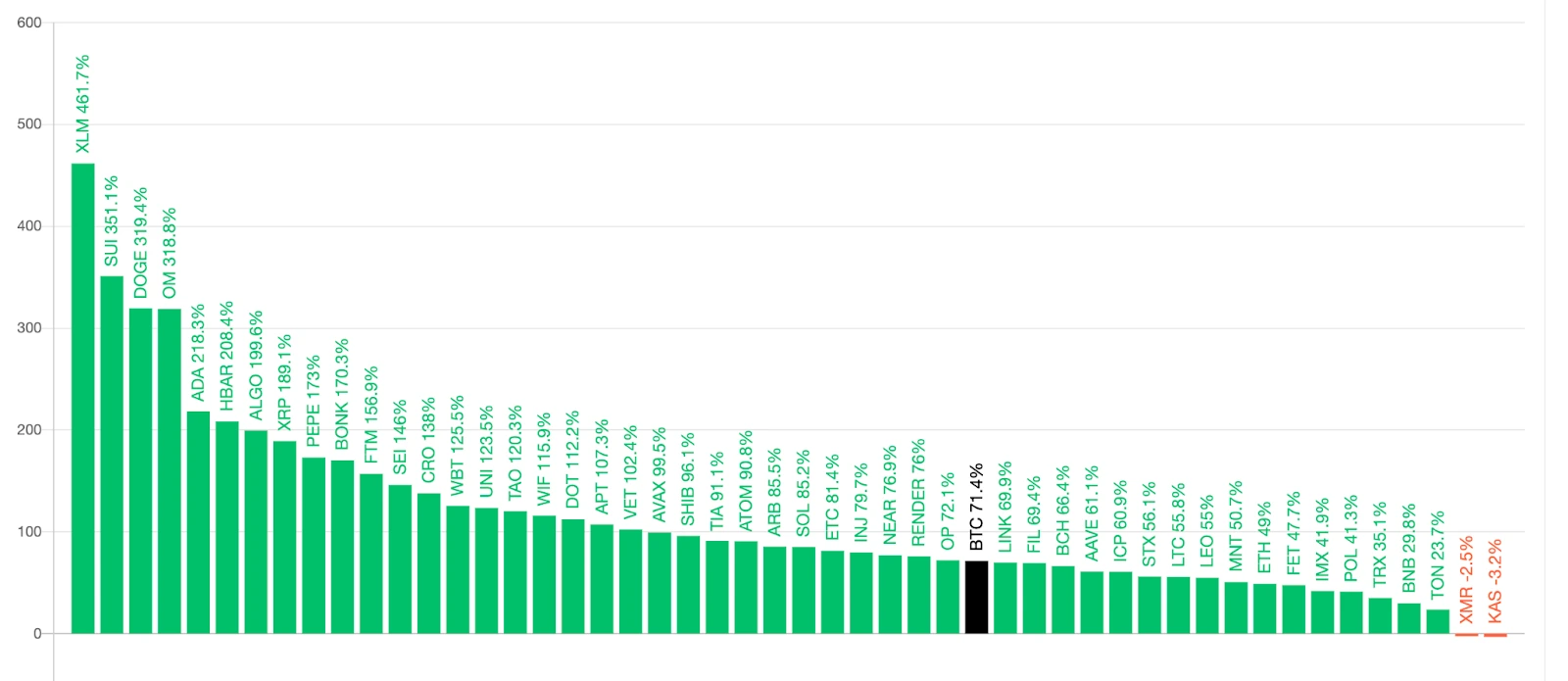

Currently, the main cryptocurrencies in the top 50 by market cap that are outperforming Bitcoin are: XLM, DOGE, OM, ADA, XRP – these established mainstream coins, as shown in the figure below:

Top 50 Cryptos by Market Cap over the Past 90 Days

(Source: Blockchaincenter)

The market appears to be following a pattern where institutional investors prefer established cryptocurrencies. Wall Street investors, in particular, have been heavily accumulating Bitcoin due to the spot ETF developments, with spillover effects benefiting well-established and reputable cryptocurrencies. Following this trend, we anticipate the next wave of growth to focus on strong performers that have emerged in the past two to three years, particularly those ranking within the global top 100 by market capitalization. Investors should exercise caution when considering smaller-cap cryptocurrencies at this stage.

The altcoin season appears to be on the horizon, poised for a potential breakout. Once it begins in earnest, we expect to see significant market activity across alternative cryptocurrencies.

All data mentioned in this report comes from third-party platforms including: TradingView, CoinMarketCap, feixiaohao, and Bitget.

Read More:

- CoinRank’s Market Watch: From Top 10 to Top 200 – Investment Analysis of DOGE, SUI and PIXEL

- CoinRank’s Market Watch: Rising Stars Analysis – PNUT, TIA, XRP, and DOGS

- CoinRank’s Market Watch: From Meme Kings to Tech Giants – Analyzing PEPE, ATOM, ACT and TON

XLM: STELLAR’S PAYMENT NETWORK SURGES WITH INSTITUTIONAL MOMENTUM

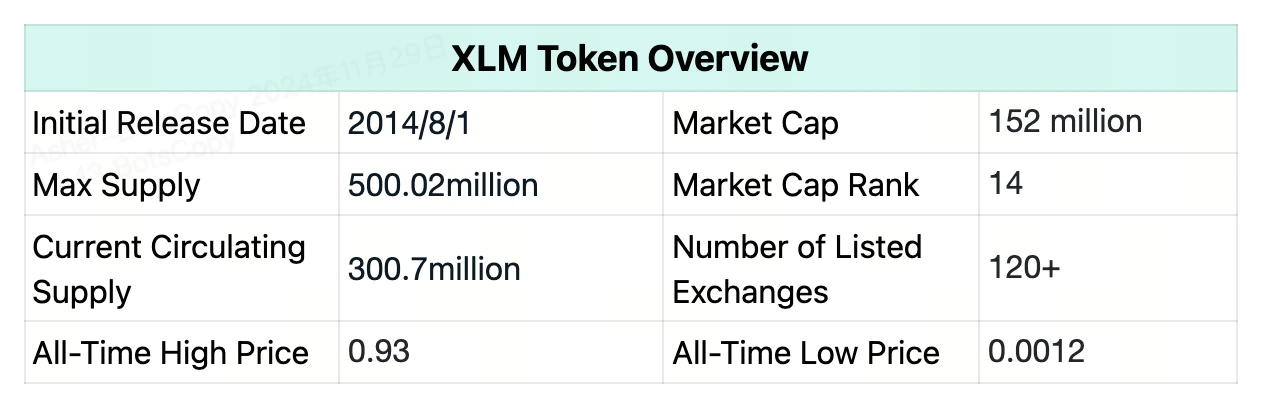

Token Introduction

Stellar is an open-source network aimed at “enabling fair access to the global financial system.” Stellar is maintained by the Stellar Development Foundation, a non-profit organization established in 2014. The native token XLM is used for staking and as a payment method for all services provided by the system.

Reasons for Optimism

As an L1 blockchain network forked from Ripple (XRP), its main application direction is similar to XRP, both being payment platforms connecting cryptocurrencies with fiat currency (banks). The difference is that XRP mainly helps banks and large financial institutions with rapid transactions, while XLM focuses on helping individuals and small businesses, especially in areas where financial services are inconvenient.

Currently, projects/partners developed on the Stellar network have reached 298, covering 18 areas including exchanges, payments, NFTs, and wallets. Additionally, with the recent entry of old money represented by Wall Street mainly speculating on old mainstream coins, XRP surged first due to positive developments like SEC personnel changes, and XLM has benefited from this positive sentiment.

Technical Analysis

(Source: Bitget)

From a technical perspective, XLM has undergone two and a half years of bottom oscillation and major accumulation. During this period, the price mostly fluctuated in a small range, indicating very thorough market cleaning and strong control by major players. Starting from November 10th, it gradually gained momentum. During the price increase, trading volume also gradually expanded, indicating a relatively healthy uptrend. However, on the 24th, the daily chart showed a pin bar with increased volume, and the current weekly chart shows an evening star pattern. Although this week hasn’t ended yet, it shows significant selling pressure in the short term.

Having already risen more than 6 times, it needs consolidation before continuing upward. There are two ways to consolidate: quick downward movement to clean out positions, or sideways movement to wear out retail investors’ patience, with the latter being more likely currently.

Top Price Predictions

As an established L1 project with ecosystem and applications, XLM has a relatively high ceiling, but after experiencing a major surge, its market cap ranking has reached 14th. The next two targets, which are also XLM’s potential tops in the short term (2-3 months), are:

- Enter top 10 by market cap: Currently, the 10th-ranked token AVAX has a market cap of $17.8 billion, while XLM’s current market cap is $15.2 billion. To achieve this goal, there’s still 17% potential upside.

- Further advance into top 5: Currently, the 5th-ranked token BNB has a market cap of $94.3 billion. To achieve this goal, there’s still 520% potential upside.

Given the current situation, the top 10 goal is more likely to be achieved, followed by a further push upward, while the top 5 goal remains quite challenging. Of course, due to the arrival of a bull market, most coins will rise together, so these top predictions represent minimum potential gains.

Suitable Investors

Suitable for investors with assets in the $100,000-$1,000,000 range, with overall gains already quite high, carrying certain risks.

Rating

3.5 stars ⭐️

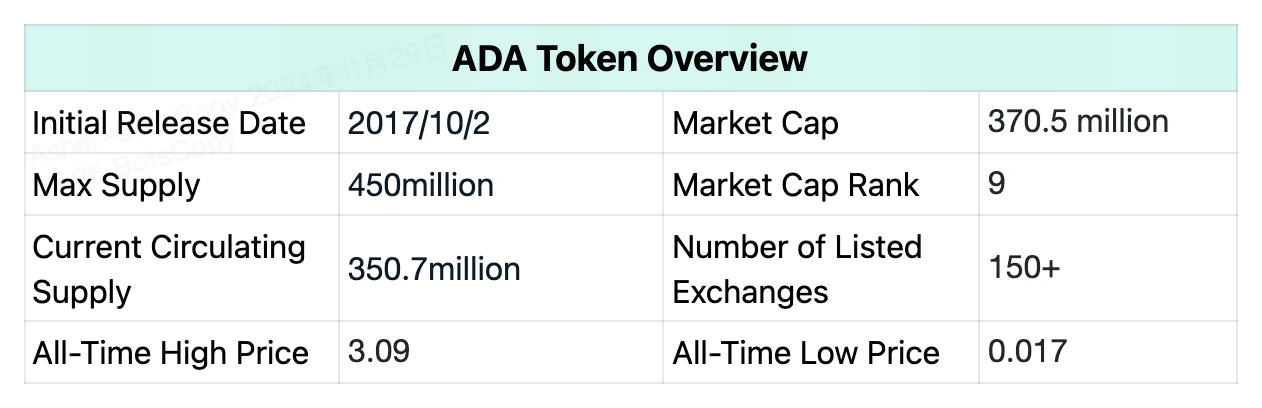

ADA: ACADEMIC BLOCKCHAIN PIONEER SHOWS STRENGTH IN STAKING METRICS

Token Introduction

Cardano (ADA) is an open-source “Proof of Stake (PoS) blockchain network.” As an established public chain, its main characteristic is stability, with development going through academic verification and rigorous technical testing, aiming to build a robust and efficient ecosystem in the long term.

Reasons for Optimism

ADA has strong technical foundations, with Ouroboros recognized as the first academically reviewed and verified blockchain protocol, ensuring security and efficiency. Its only weakness is being too stable, but its strong community and staking mechanism provide confidence for steady development. As one of the world’s largest staking public chains by scale, over 70% of circulating ADA participates in staking, which is undoubtedly positive for price appreciation.

Additionally, its community has over 3 million token holders and thousands of active staking pools distributed globally, supporting the project’s decentralization goals. ADA is also promoting blockchain applications in education, identity verification, and financial services through partnerships with African countries (such as Ethiopia and Rwanda), showing global potential.

Technical Analysis

(Source: Bitget)

ADA also began experiencing a powerful surge in early November, with three consecutive rising weeks on the weekly chart, characterized by both volume and price increases. However, recently it has shown high-level consolidation with shrinking volume, which could indicate two possibilities:

1) After significant previous gains, it needs consolidation, with major players using oscillation to clear positions, followed by continued upward movement;

2) Major players are gradually distributing during the oscillation period and will trigger a sharp decline once complete. Currently, the first scenario is more likely, as the current high-level oscillation range is relatively small with low volume. However, if this situation continues, it’s more likely to be distribution by major players, requiring further observation.

Top Price Predictions

As an established public chain project, ADA has both advantages and disadvantages. The advantages are mainly its well-accumulated community and ecosystem, but the disadvantage is appearing to lag behind trends. Currently, ADA ranks ninth by market cap, and moving up would mean chasing SOL, currently the second-ranked public chain project with a market cap of $114.5 billion. To achieve this goal, ADA still has 208% potential upside.

Suitable Investors

Suitable for investors with assets in the $100,000-$1,000,000 range, with lower risk but limited returns.

Rating

3 stars ⭐️

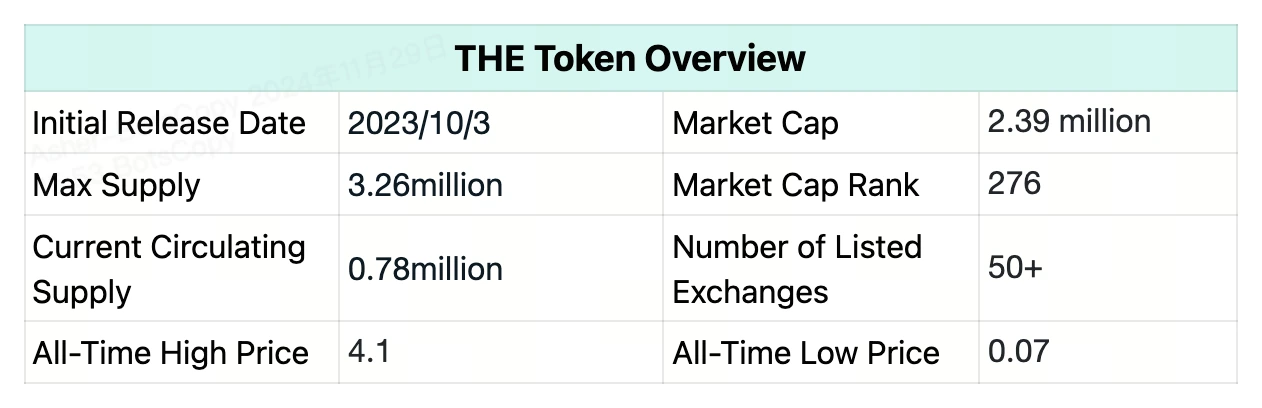

THE: BSC’S RISING DEX CHALLENGER TARGETS ESTABLISHED PROTOCOLS

Token Introduction

Thena is a decentralized exchange (DEX) operating on the BSC chain, providing a comprehensive platform for decentralized finance (DeFi) activities. It aims to facilitate spot and perpetual trading of various assets, meeting the needs of different participants in the DeFi ecosystem.

Reasons for Optimism

The main positive factor is that as a DEX project on the BSC chain, it can receive support from Binance’s massive ecosystem. Binance’s listing of its token is also a form of recognition. Now it’s up to the project to prove itself by leveraging its liquidity market features and demonstrating the effectiveness of its innovative ve(3,3) model. If it can truly integrate these unique features and focus on adaptive liquidity management to become the primary liquidity layer for DeFi protocols, its potential ceiling is quite promising.

Technical Analysis

(Source: Bitget)

As a relatively new token, technical analysis has limited utility. From a short-term perspective, it’s currently oscillating in the range of $2.9-4. Due to significant previous gains, current risks are high. However, due to its small market cap and limited supply, long-term future appreciation remains quite possible.

Top Price Predictions

As a DEX project, the main comparable projects are CAKE and UNI; the former is also a DEX on BSC chain, while the latter is currently the largest DEX project.

Currently, CAKE’s market cap is $849 million, while THE’s market cap is $239 million. If it catches up to CAKE, there’s still 255% potential upside. Currently, UNI’s market cap is $7.447 billion. If it catches up to UNI, there’s still 3,015% potential upside.

Given the current situation, it’s unlikely to catch up to UNI‘s market cap in the short term. Catching up to CAKE’s market cap is most likely, though it might potentially advance further to catch up with the second-ranked DEX project, namely RUNE, the DEX project of the Cosmos (ATOM) chain, which currently has a market cap of $1.86 billion. If so, THE still has 678% potential upside.

Suitable Investors

Suitable for investors with assets in the $10,000-$100,000 range, high risk, high return.

Rating

3.5 stars ⭐️

SAND: METAVERSE LEADER FINDS SUPPORT AS GAMING SECTOR REAWAKENS

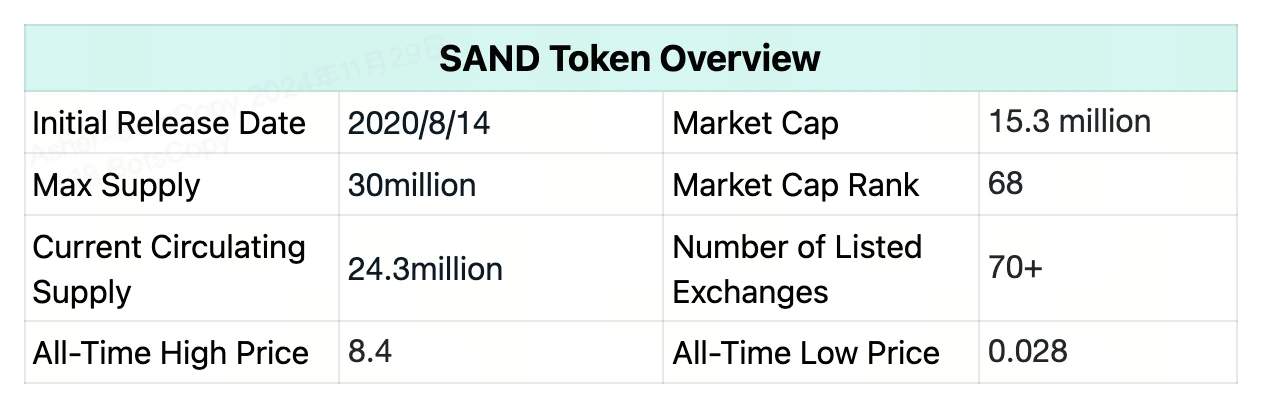

Token Introduction

The Sandbox is a virtual world gaming platform on Ethereum where users can construct, own, and sell in-game models and props. SAND is the ERC-20 utility token within The Sandbox platform, used for transfers, staking, and governance.

Reasons for Optimism

The current rise is mainly benefiting from continued market attention and enthusiasm for the metaverse concept. For example, recently, Qualcomm announced a $100 million metaverse fund, which boosted market interest in metaverse projects. SAND, as a leading project in this field, naturally benefits significantly. Chain gaming, as one of the most grounded areas of blockchain technology, might perform well in this bull market.

Technical Analysis

(Source: Bitget)

SAND is currently just emerging from its bottom range. From the daily chart, it’s oscillating between $0.6-0.72, which is normal consolidation and position clearing after a major surge. Its gains are relatively high among gaming concepts, but the weekly chart shows a high-volume decline after reaching a peak. Although there are still two days before the weekly close, the current bearish body is too long, and if it doesn’t recover by the weekend, the outlook will become concerning.

Top Price Predictions

SAND is currently a leading gaming project, and its pursuit can only be moving up in global market cap rankings. Based on past experience, entering the top 50 and top 30 by market cap are relatively reasonable goals.

Enter top 50: Currently, the 50th-ranked token XMR has a market cap of $2.88 billion, while SAND’s current market cap is $1.53 billion. To achieve this goal, there’s still 88.3% potential upside.

Further advance into top 30: Currently, the 30th-ranked token TAO has a market cap of $4.53 billion. To achieve this goal, there’s still 196% potential upside.

Suitable Investors

Suitable for investors with assets in the $10,000-$100,000 range, average risk-return ratio.

Rating

3 stars ⭐️

COMPARATIVE ANALYSIS

In terms of return stability: ADA > XLM > SAND > THE

In terms of return multiplier: THE > SAND > XLM > ADA

In terms of current market popularity: XLM > THE > ADA > SAND

▶ Buy Crypto at Bitget