- Learn how to buy crypto safely and explore their unique investment potential.

- Secure your crypto assets with the right platform, wallets, and safety measures.

- Understand the benefits, risks, and strategies for starting your crypto investment journey.

TABLE OF CONTENTS

Discover a step-by-step guide to buying crypto, covering benefits, risks, and security tips. Learn to choose a trusted platform, secure your assets, and navigate the volatile market with confidence.

“Buying crypto” has become a buzzword among financial enthusiasts and technology adopters alike. As blockchain technology continues to evolve, cryptocurrencies such as Bitcoin and Ethereum are garnering attention as innovative financial instruments with the potential for high returns.

However, the process of buying crypto can feel intimidating for beginners due to technical complexities, security concerns, and the volatility of the crypto market.

In this comprehensive guide, we’ll cover the basics of buying crypto, discuss the benefits and risks, and provide actionable steps to make your entry into the world of cryptocurrencies as smooth and safe as possible. Whether you’re planning to invest in Bitcoin or explore emerging altcoins, this guide will equip you with the knowledge and tools you need to get started.

WHY PEOPLE ARE BUYING CRYPTO?

Crypto as a new asset class

Cryptocurrencies represent the future of decentralized finance (DeFi), offering opportunities to invest in a new and rapidly growing asset class. Unlike traditional investments such as stocks or bonds, crypto assets operate on blockchain technology, ensuring transparency, immutability, and global accessibility.

(Source:Tradingview)

Their use cases are diverse:

Payments: Cryptocurrencies allow for fast, borderless, and low-cost transactions, making them an ideal option for international payments.

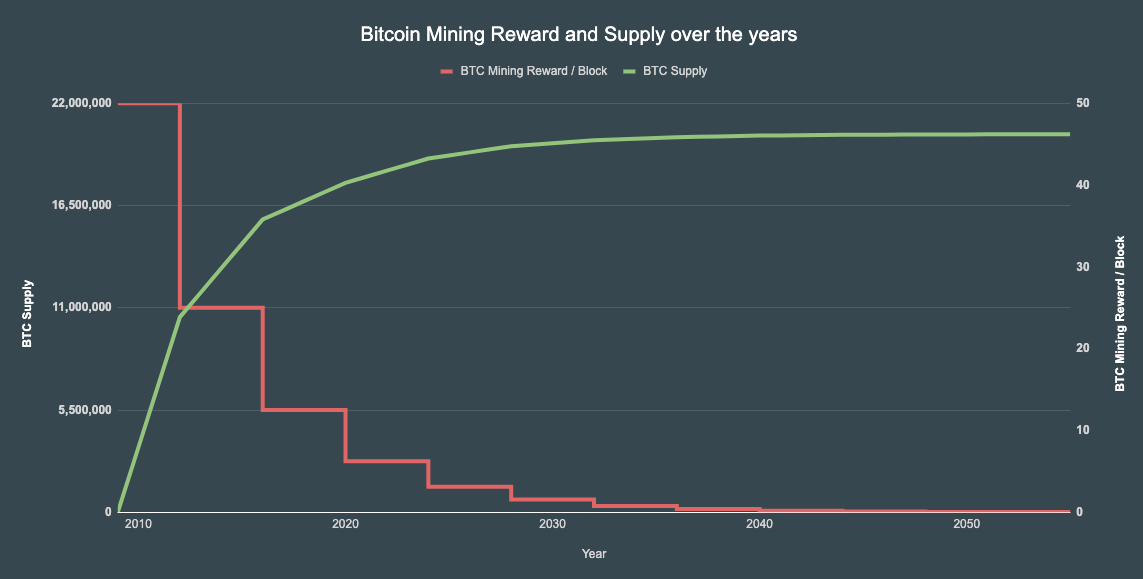

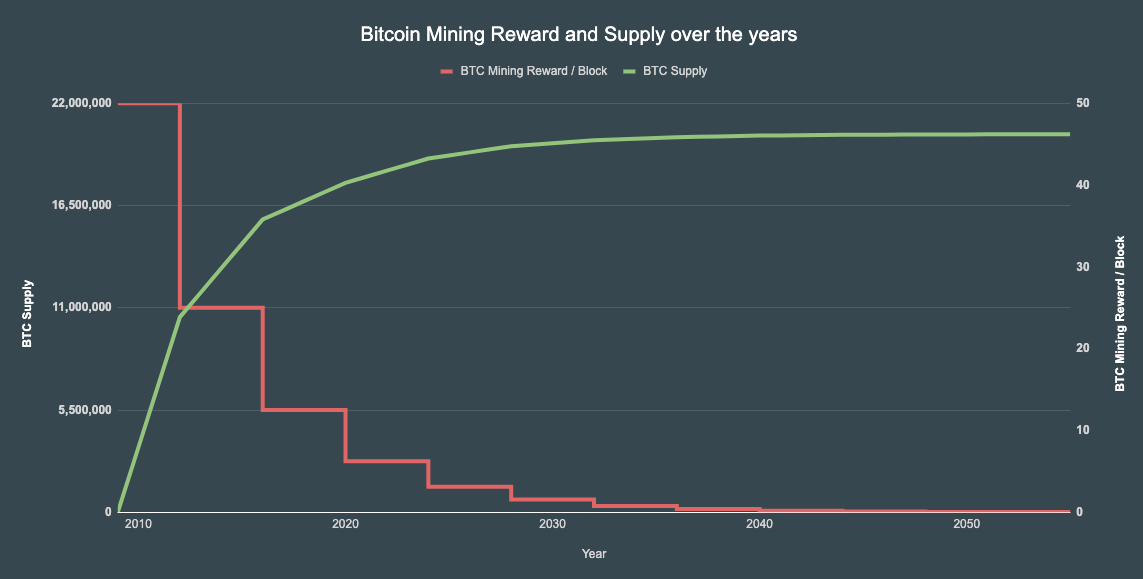

Store of value: Bitcoin, often referred to as “digital gold,” is seen as a hedge against inflation due to its fixed supply of 21 million coins.

Decentralized applications: Ethereum and similar platforms enable smart contracts and decentralized applications (dApps), revolutionizing industries from finance to gaming.

Cryptocurrencies offer unique advantages that traditional asset classes lack, making them an attractive option for forward-thinking investors.

Benefits of buying crypto

There are several reasons why people choose to buy crypto:

Inflation hedge: Unlike fiat currencies that central banks can print at will, cryptocurrencies like Bitcoin have a capped supply, protecting them from inflationary pressures.

Global accessibility: With just an internet connection, anyone from any corner of the world can buy, store, and transfer cryptocurrencies without relying on traditional banking systems.

Portfolio diversification: Cryptocurrencies have low correlations with traditional assets, providing a way to diversify risk in investment portfolios.

By understanding these benefits, investors can align their financial goals with the unique opportunities cryptocurrencies offer.

Also Read:

Crypto Trading Strategies for Beginners: Your First Step to Earning Millions

A Deep Dive into Bitcoin’s Journey: From Fringe Concept to Global Crypto Currency Dominance

HOW TO SAFELY START BUYING CRYPTO?

Choosing a secure crypto exchange

Selecting the right crypto exchange is crucial for safe and smooth transactions. With hundreds of platforms available, it’s important to evaluate them based on these criteria:

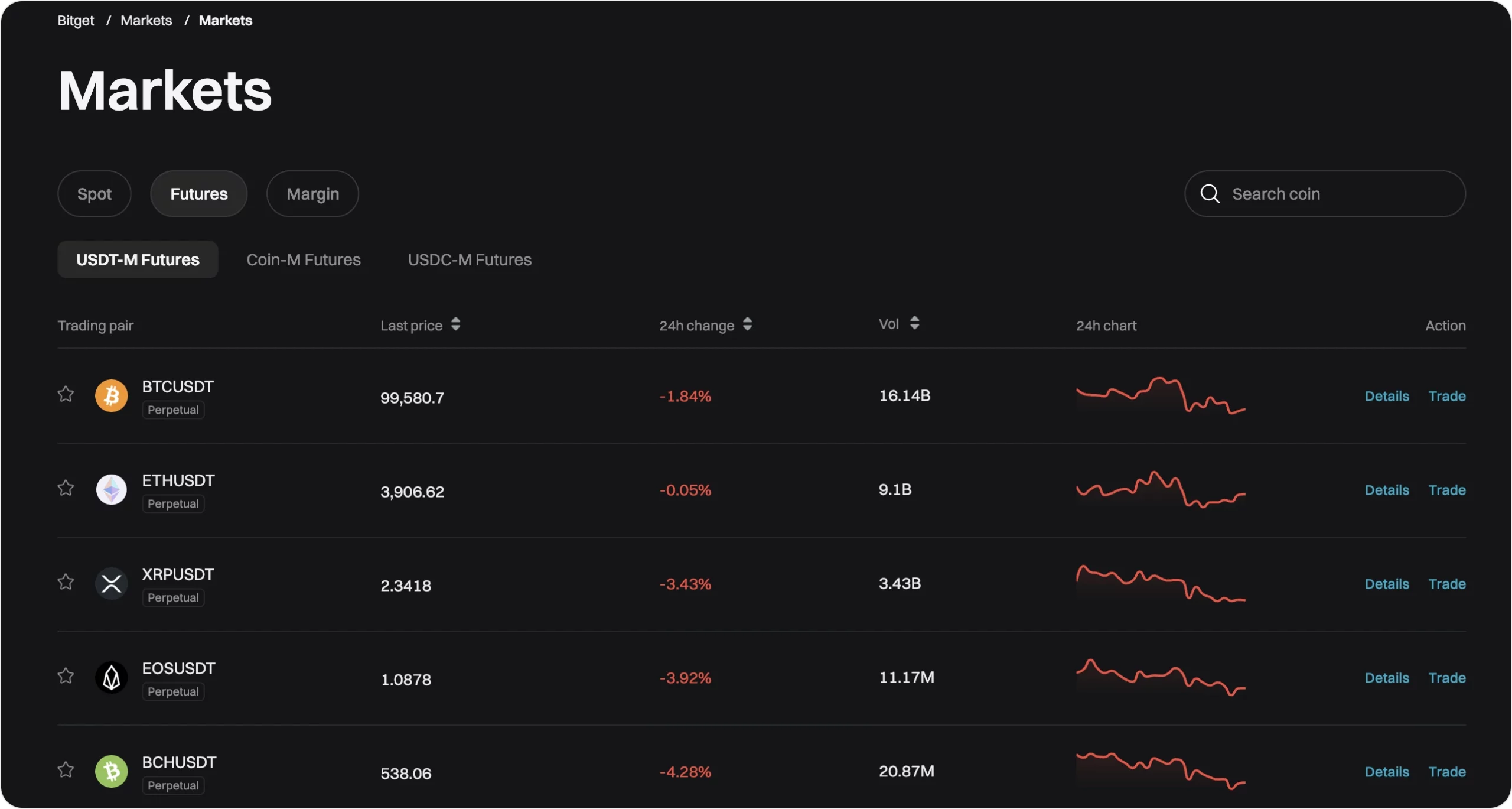

Reputation and security: Opt for well-established exchanges like Bitget,Binance, or Coinbase,which employ robust security measures such as cold storage and multi-signature wallets.

Supported cryptocurrencies: Ensure the exchange supports the coins you’re interested in, as not all platforms offer a wide variety of cryptocurrencies.

(Source:Bitget)

Setting up your account

Once you’ve chosen an exchange, follow these steps to get started:

1. Register: Visit the exchange’s website or app, provide your email address, and set up a strong password.

2. Verify your identity (KYC): Most exchanges require you to complete a Know Your Customer (KYC) process by submitting identification documents like your passport or driver’s license.

3. Link payment methods: Add a credit/debit card or bank account to deposit funds for purchasing cryptocurrencies.

4. Enable security features: Activate two-factor authentication (2FA) to enhance the security of your account.

By following these steps, you’ll be ready to make your first crypto purchase.

Storing your crypto securely

After buying crypto, storing it securely is vital to avoid losses due to hacking or theft. Here are two primary storage options:

Hot wallets: These are connected to the internet and are suitable for frequent transactions. Examples include software wallets like Trust Wallet and MetaMask.

Cold wallets: These are offline wallets, such as hardware wallets like Ledger or Trezor, offering maximum security against online threats.

A good strategy is to use hot wallets for daily transactions and cold wallets for long-term holdings, ensuring both convenience and security.

COMMON RISKS OF BUYING CRYPTO

Volatility in the crypto market

Cryptocurrencies are known for their high volatility, which can result in significant price swings within short periods. For instance, Bitcoin’s value has fluctuated between $16,000 and $69,000 over the past two years.

• Tip: To manage volatility, only invest what you can afford to lose and avoid panic-selling during market downturns. Adopting a long-term perspective can help weather the ups and downs.

Scams and frauds in crypto

The crypto space is rife with scams, including phishing websites, fraudulent coins, and Ponzi schemes.

How to protect yourself:

Always verify the legitimacy of a project before investing. For example, check the team’s credentials, the whitepaper, and community feedback.

Avoid clicking on unsolicited links or emails. Scammers often use fake websites to steal login credentials.

Use exchanges and wallets with a proven track record of security and reliability.

Awareness and vigilance are key to navigating the crypto market safely.

Also Read:

Finance Dictionary : Personal Property Security Register (PPSR)

The Singapore Government Warns of Cryptocurrency Theft Risks: How to Protect Your Crypto Assets?

START BUYING CRYPTO WISELY TODAY

Buying crypto is a step into the future of finance, offering a unique opportunity to participate in a decentralized economy. However, “Buying crypto” requires careful planning, reliable resources, and a clear understanding of the associated risks.

By choosing secure platforms, safeguarding your assets, and adopting a disciplined investment approach, you can confidently navigate this dynamic market and unlock the potential of digital currencies.

The journey may seem daunting at first, but with the right knowledge and tools, you can take advantage of this exciting financial revolution. Start your crypto journey today, and become a part of the rapidly evolving digital economy!

ꚰ CoinRank x Bitget – Sign up & Trade to get $20!