KEYTAKEAWAYS

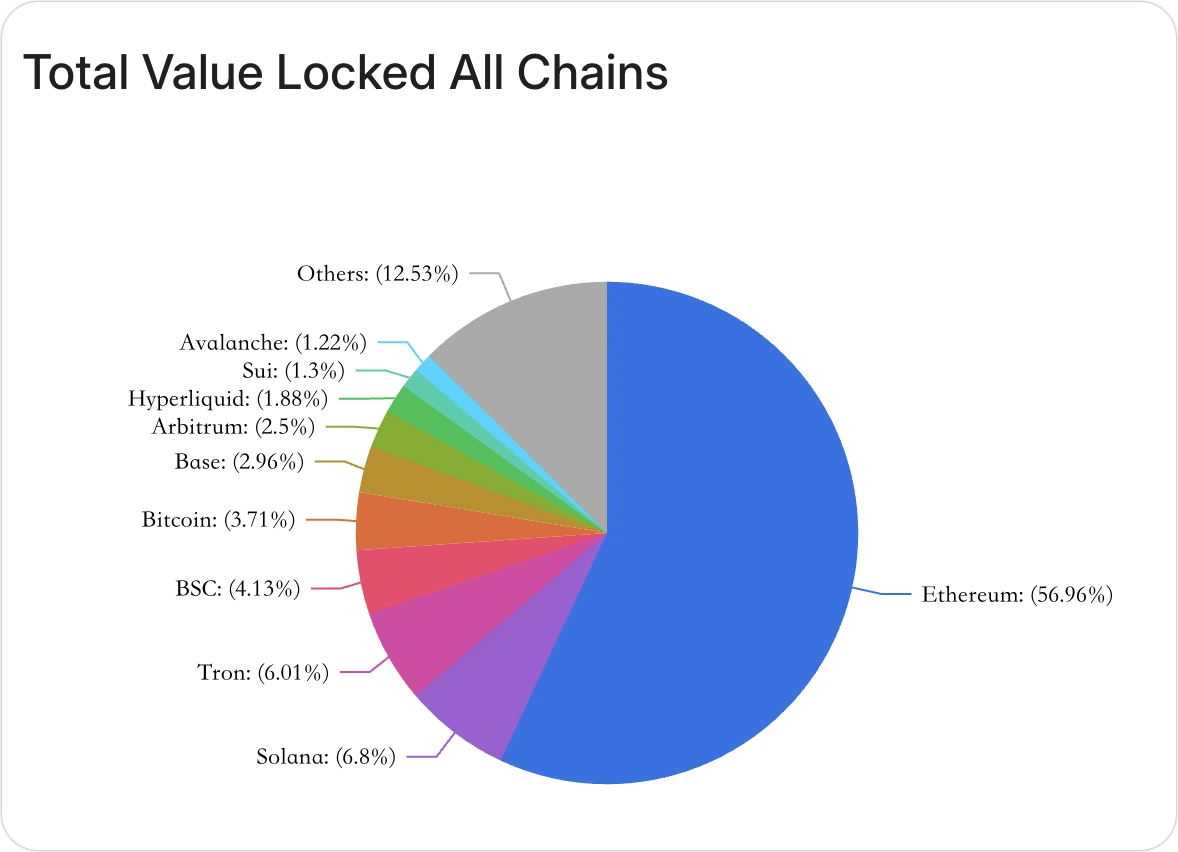

- TVL is a critical metric for assessing blockchain ecosystem activity, reflecting a protocol’s ability to attract user funds and market confidence.

- With approximately $77.8 billion in TVL, Ethereum leads the market, showcasing its strong competitive edge in liquid staking, lending, and DeFi ecosystems.

- Lido, AAVE, EigenLayer, ether.fi, and MakerDAO are Ethereum’s top five protocols by TVL, driving the ecosystem’s rapid growth.

CONTENT

TVL is a key metric in blockchain ecosystems, representing the total value of locked funds. Ethereum leads with $77.8 billion in TVL, powered by protocols like Lido, AAVE, and EigenLayer, which fuel its ecosystem’s thriving development.

THE IMPORTANCE OF TVL IN BLOCKCHAIN

Total Value Locked (TVL) is a key indicator of a blockchain ecosystem’s health. It reflects not only the trust users place in a blockchain or protocol but also its user activity, ecosystem attractiveness, and real-world usage.

(Source:DeFiLlama)

A higher TVL indicates greater popularity and indirectly highlights the platform’s market share and influence. As such, TVL has become a vital metric for investors, developers, and industry observers to evaluate blockchain ecosystems.

What is TVL?

TVL represents the total value of assets locked in a blockchain or protocol, typically measured in USD. Its growth signifies increased user trust and activity, as well as a thriving ecosystem.

Factors influencing TVL include:

- Asset Price Fluctuations: Rising cryptocurrency prices directly boost TVL

- User Participation: More users staking assets or joining liquidity pools lead to higher TVL.

- Protocol Innovation: New features or rewards incentives attract more funds to be locked.

WHY DOES ETHEREUM LEAD IN TVL?

As the pioneer of smart contract platforms, Ethereum has long dominated the DeFi market. Currently, Ethereum’s TVL stands at $77.696 billion, making up a significant portion of the crypto ecosystem. This dominance is due to the following factors:

(Source:DeFiLlama)

1.Mature Ecosystem

Ethereum boasts the most active developer and user community, hosting a plethora of DeFi protocols, NFT projects, and Layer 2 solutions.

2.Decentralization and Security

Ethereum’s robust consensus mechanism and vast network of nodes provide unparalleled security, making it the preferred platform for investors.

3.Asset Diversity

From stablecoins and ETH itself to other ERC-20 tokens, Ethereum supports a wide range of assets extensively used in DeFi protocols.

TOP 5 PROJECTS ON ETHEREUM BY TVL

Ethereum’s DeFi ecosystem is incredibly diverse. Below are the top five protocols ranked by TVL and their core functionalities:

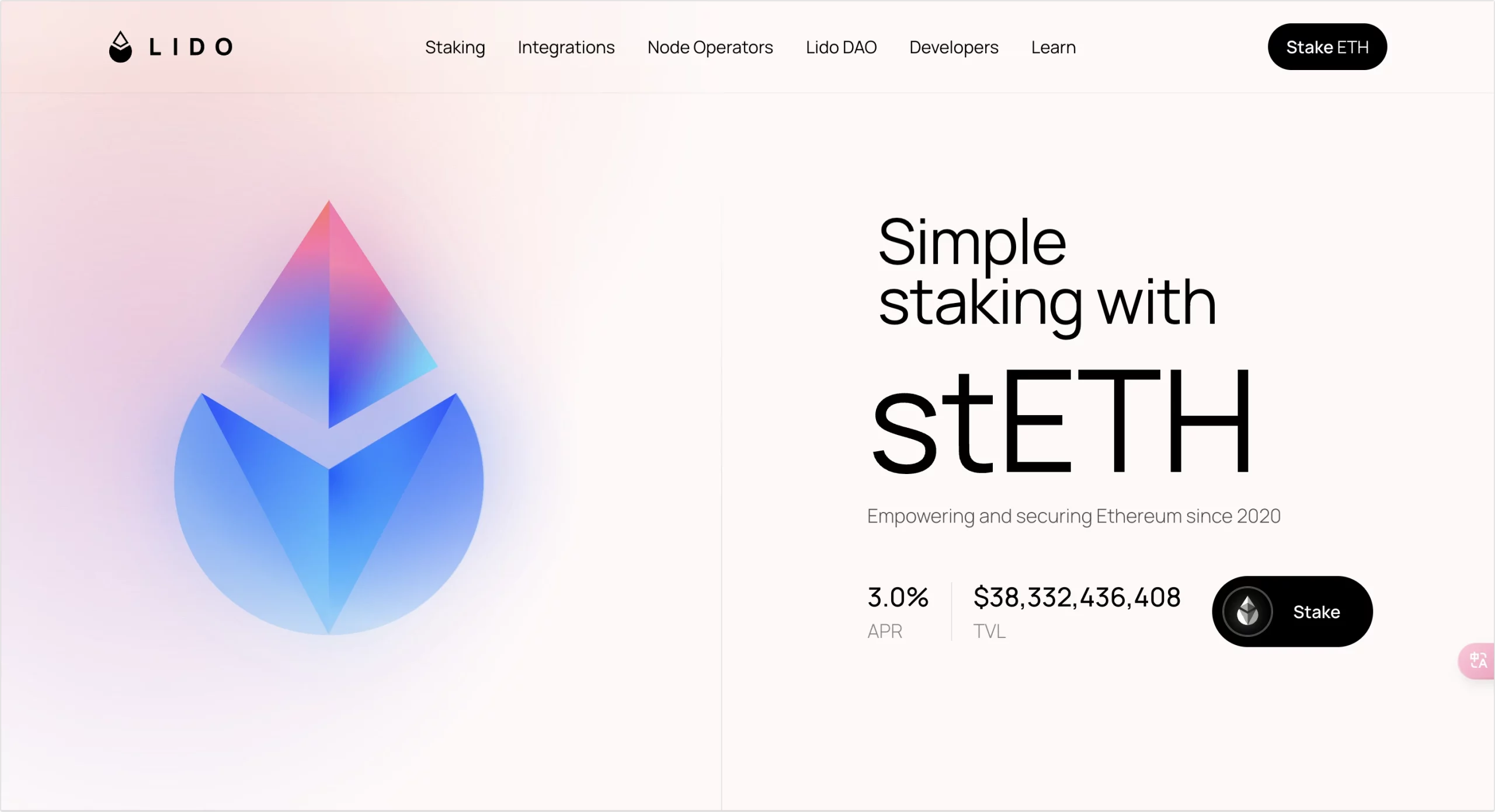

1.Lido

TVL: $38.552 billion

Category: Liquid Staking

Core Functionality: Lido offers liquid staking services, allowing users to stake ETH without losing liquidity. Users receive stETH tokens, which can be used in other DeFi applications. Lido is the largest liquid staking platform in Ethereum’s ecosystem.

2.Aave

TVL: $19.142 billion

Category: Decentralized Lending

Core Functionality: Aave is a decentralized lending protocol supporting a variety of assets for lending and staking. Its unique “flash loan” feature attracts significant user participation.

3.EigenLayer

TVL: $18.072 billion

Category: Restaking

Core Functionality: EigenLayer is an innovative restaking protocol that allows users to use staked ETH as security for other blockchains, increasing capital efficiency.

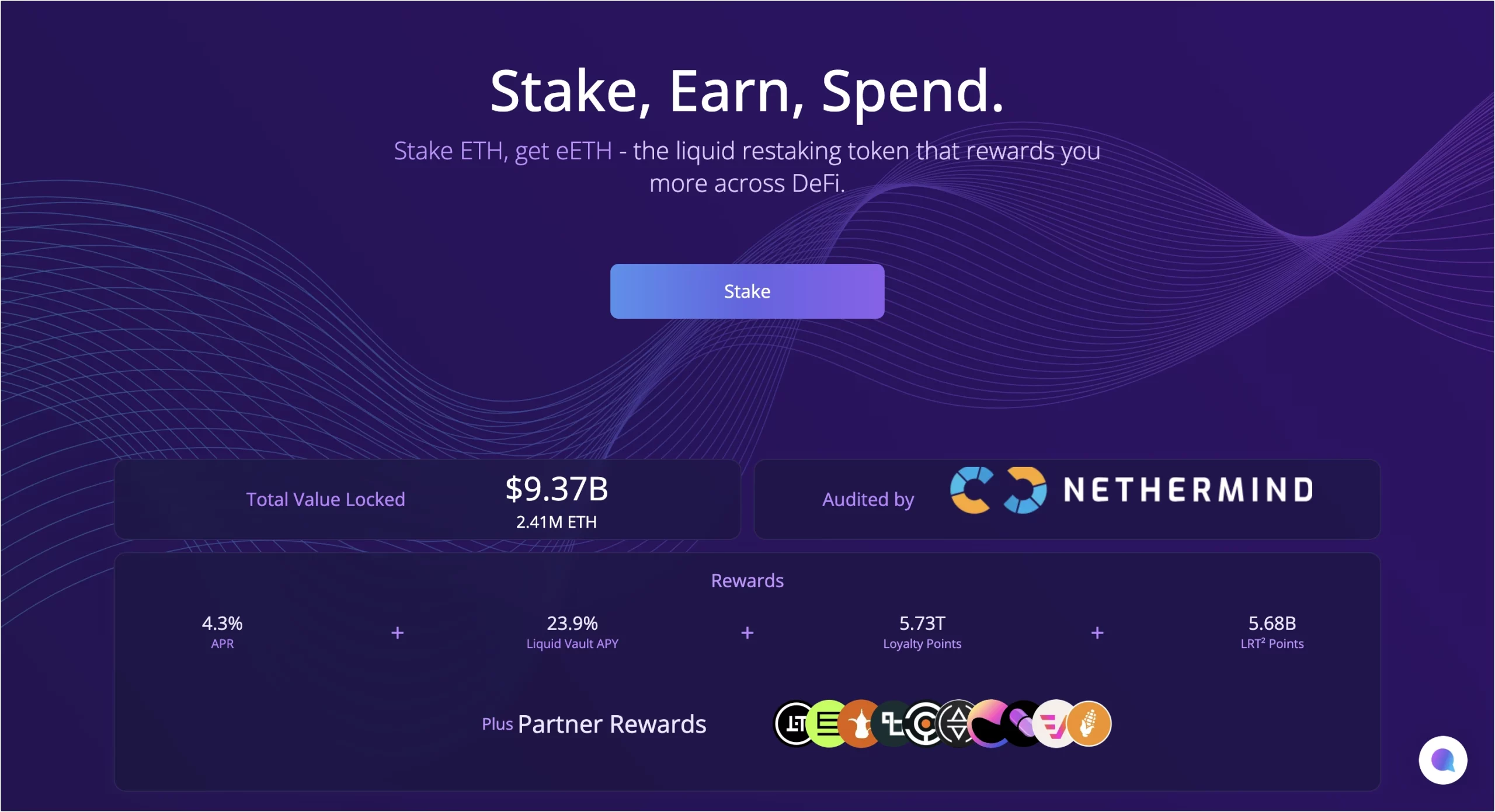

4.ether.fi

TVL: $9.426 billion

Category: Liquid Staking

Core Functionality: ether.fi provides decentralized liquid staking services, focusing on enhancing users’ control over their staked assets.

5.MakerDAO

TVL: $6.246 billion

Category: Stablecoin Protocol

Core Functionality: MakerDAO is Ethereum’s first decentralized stablecoin protocol, enabling users to generate Dai stablecoins by collateralizing ETH or other assets for payments or investments.

CONCLUSION

The level of TVL not only serves as an important metric for assessing blockchain and DeFi protocols but also reflects users’ trust in the ecosystem. As the leader in DeFi, Ethereum’s diverse and innovative ecosystem drives the blockchain industry’s advancement.

With the expansion of Layer 2 solutions and the addition of new projects, Ethereum’s TVL is expected to continue growing, solidifying its position as a cornerstone in the blockchain world.

Also Read:

What is DeFi? A Comprehensive Guide to Decentralized Finance

What Is Ethereum & How Does It Work?

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade!