KEYTAKEAWAYS

- Cross-chain interoperability protocols enable seamless asset transfers and communication between isolated blockchain networks, with leading projects securing multi-billion dollar valuations and significant venture capital backing.

- These protocols primarily serve DeFi applications by aggregating liquidity, enabling multi-chain yield farming, and facilitating cross-chain lending, while also supporting unified governance systems.

- Despite technological advances, cross-chain protocols face the fundamental blockchain trilemma of balancing security, decentralization, and scalability while connecting multiple networks.

CONTENT

An in-depth analysis of cross-chain interoperability protocols, exploring how Wormhole, LayerZero, and Axelar are revolutionizing blockchain connectivity while addressing the challenges of security, scalability, and decentralization.

THE RISE OF CROSS-CHAIN TECHNOLOGY: FROM BITCOIN TO MULTI-CHAIN INTEGRATION

The emergence of Bitcoin marked the world’s first recognition of blockchain technology, while Ethereum’s smart contracts paved the way for decentralized finance (DeFi), sparking the “DeFi Summer.”

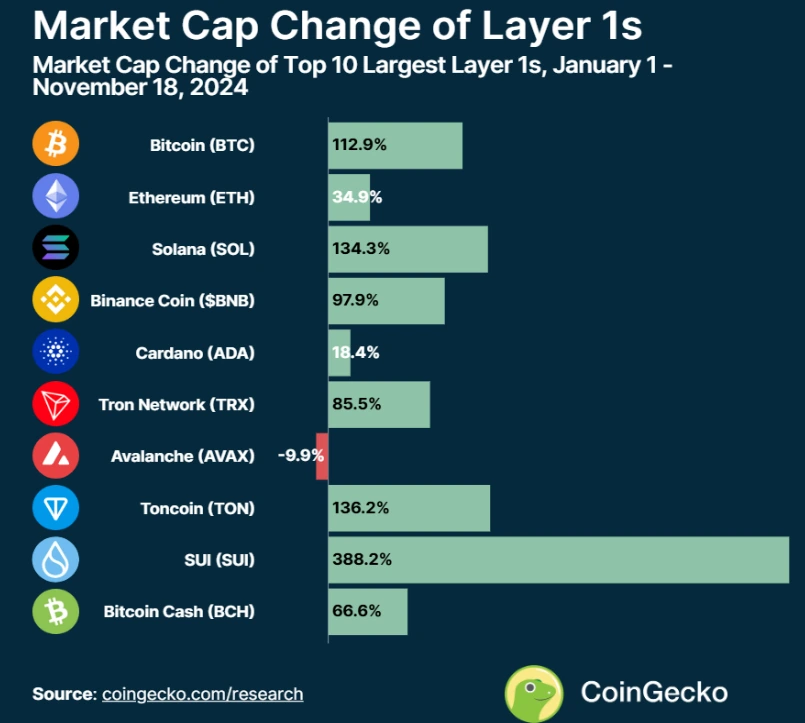

Since then, numerous Layer 1s have entered the competitive landscape. BNB Chain and Solana, known as “Ethereum killers,” have demonstrated outstanding performance.

BNB Chain has leveraged its vast exchange user base to continually expand its applications, while Solana rose from the Shadow of FTX’s Bankruptcy in 2022.

Meanwhile, SUI has become a standout Layer 1s, garnering significant investment and developer interest due to its innovative data model and robust performance.

However, the development of Layer 1s remains uneven.

Each blockchain operates like an island, striving to build its own ecosystem but ultimately existing in isolation. The future of the crypto industry is destined to be multi-chain, necessitating the creation of a secure, efficient, and flexible interoperability platform to connect these isolated Layer 1s.

This pressing need highlights the core significance of cross-chain interoperability protocols.

For more details on layer 1, please refer to our article “Top Public Blockchain Projects to Watch in the 2024 Crypto Bull Market”

WHAT IS CROSS-CHAIN INTEROPERABILITY PROTOCOL?

Cross-chain technology enhances interconnectivity between blockchain networks by enabling the exchange of information and value.

A Cross-Chain Interoperability Protocol, also known as an Arbitrary Message Bridge (AMB), is a technical solution designed to facilitate seamless data and operational interoperability across different blockchain networks.

Through this protocol or bridge, users gain broad access to assets and applications across multiple blockchains, allowing them to leverage the unique advantages of each platform.

Key Technical Features:

- Security: The protocol typically incorporates multi-layered security measures, including smart contract audits, transparency and reliability of node operators, and robust governance mechanisms to minimize fraud risk. These measures ensure the integrity, reliability, and tamper-resistance of transitions and data sharing.

- Decentralization: Many protocols prioritize decentralization to eliminate single points of failure and enhance the overall resilience of the system.

- Scalability: The protocol’s design emphasizes scalability, ensuring it can efficiently support increasing transaction volumes and growing user demands.

- Standardization: To enable seamless communication between blockchains, protocols adhere to defined standards that ensure compatibility and interoperability.

- Flexibility: The protocol supports a wide range of use cases, including cross-chain decentralized applications (dApps).

Advantages:

- Breaking “Isolation”: Facilitates synergy and collaboration across blockchain ecosystems.

- Improving Efficiency: Reduces the complexity for developers when building interoperable solutions across different blockchains.

- Lowering Costs: Standardized protocols minimize the need for redundant development and operational investments.

Use cases

Liquidity is the core of financial markets. In the traditional financial world, assets can flow freely between financial institutions, trading platforms, and banks.

However, due to the independence in layer 1s, assets on different chains are not interoperable, which hampers liquidity. This limitation not only severely impacts user experience but also restricts the further development of DeFi.

Cross-chain interoperability protocols address these challenges, enabling users and platforms to overcome isolation between chains and unlock more sophisticated financial services. For example:

- Multi-Chain Yield Farming: Cross-chain interoperability protocols allow yield farmers to seize opportunities across multiple blockchains by deploying assets where returns are highest, thereby maximizing yields. This enhances compatibility among DeFi protocols and enables users to achieve higher returns.

- Liquidity Aggregation: Cross-chain interoperability protocols consolidate liquidity from multiple chains, creating a unified liquidity layer for DeFi applications. This reduces the fragmentation of assets across ecosystems, improves capital efficiency, and minimizes reliance on centralized exchanges(CEX).

- Cross-Chain Lending: Lending platforms can leverage cross-chain interoperability protocols to facilitate collateralization and loan issuance across multi-chains. This provides users with increased flexibility and expands the reach and utility of lending protocols.

- Governance

As multi-chain architectures become mainstream, many blockchain projects are deploying across multiple chains, leading to a growing demand for multi-chain governance.

Cross-chain interoperability protocols play a critical role in multi-chain governance, enabling projects to achieve efficient and transparent decision-making processes.

- Cross-Chain Voting: Cross-chain interoperability protocols enable token holders to participate in governance across multiple chains, recording and aggregating voting results without the need to manually bridge assets. This simplifies the voting process, encourages broader user participation, and enhances governance transparency.

- Unified Identity and Reputation Systems: Cross-chain interoperability protocols facilitate identity and reputation verification across blockchains, which is essential for governance and DAO operations. Seamless identity verification helps users build trust within decentralized governance systems.

LEADING PROJECTS

1. Wormhole

Wormhole is a decentralized cross-chain messaging protocol launched in October 2020.

It enables the transfer of assets and information between different blockchain networks, offering developers and users a suite of powerful products designed to simplify cross-chain interactions while ensuring the highest levels of security and efficiency.

Its core offerings include Messaging, Connect, and Gateway. Wormhole’s key strengths, such as decentralization, modular design, a robust and upgradeable trust network, and seamless user experience, provide an efficient, secure, and cost-effective solution for cross-chain communication.

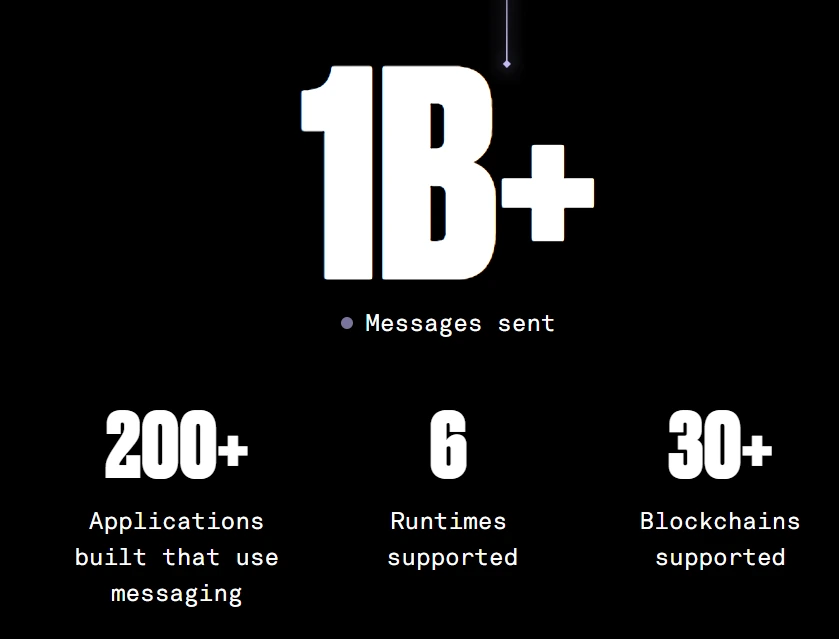

Key Data

(Source: Wormhole’s website)

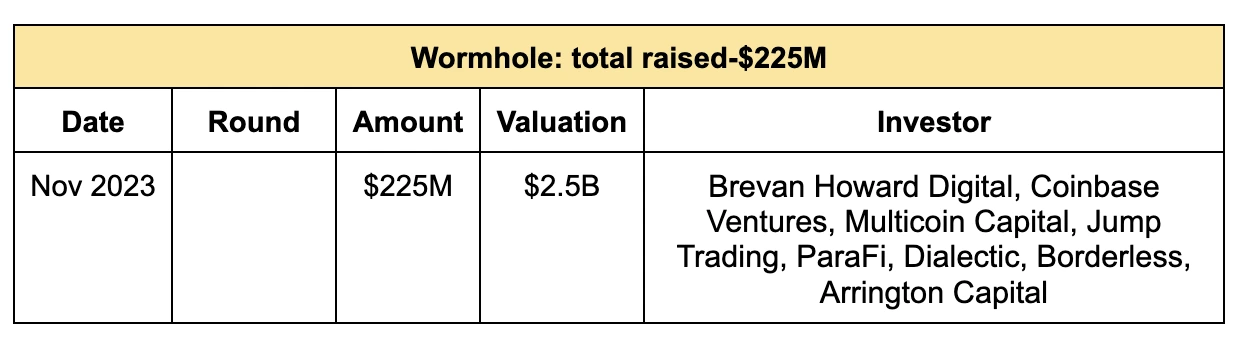

Fundraising

Wormhole has an impressive funding track record, backed by top-tier venture capital firms. In November 2023, Wormhole completed a $225 million funding round, reaching a valuation of $2.5 billion.

Notably, this was the largest fundraising round for a crypto project in 2023.

Ecosystem

Wormhole has established a thriving ecosystem comprising numerous partners, projects, and grant initiatives. To further foster ecosystem growth, Wormhole has launched the following initiatives:

- $50M Cross-Chain Ecosystem Fund: This fund supports the development of next-generation Web3 applications. All builders, founders, and developers innovating cutting-edge apps, infrastructure, and tools that span multiple ecosystems are encouraged to apply.

- Sigma Startup Program: This program guides builders and startups from ideation to becoming fully-funded startups in the crypto space, offering a total prize and seed funding pool of over $1 million.

2. Layerzero

LayerZero, developed by the Canadian team LayerZero Labs in 2021, is a cross-chain interoperability protocol that connects assets, messages, data, and contracts across different blockchains, creating an omnichain.

It consists of three main components: oracles, relayers, and light nodes. Information is conveyed between two on-chain endpoints by running (ultra) light nodes and utilizing relayers and decentralized oracles.

Its three core principles—censorship resistance, immutability, and permissionlessness—empower developers to create applications that seamlessly interact across multiple blockchains, while ensuring security, flexibility, and decentralization.

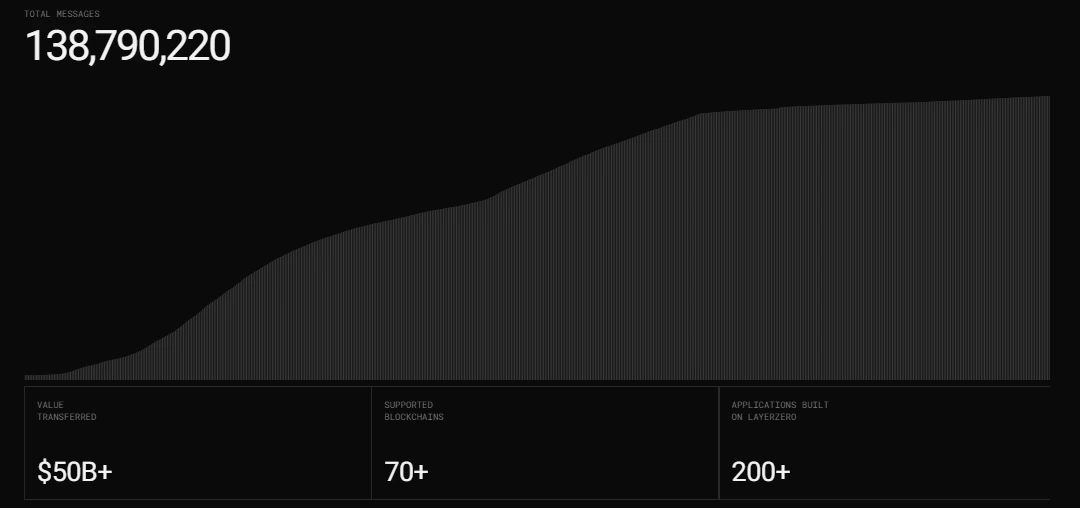

Key Data

(Source: LayerZero’s Website)

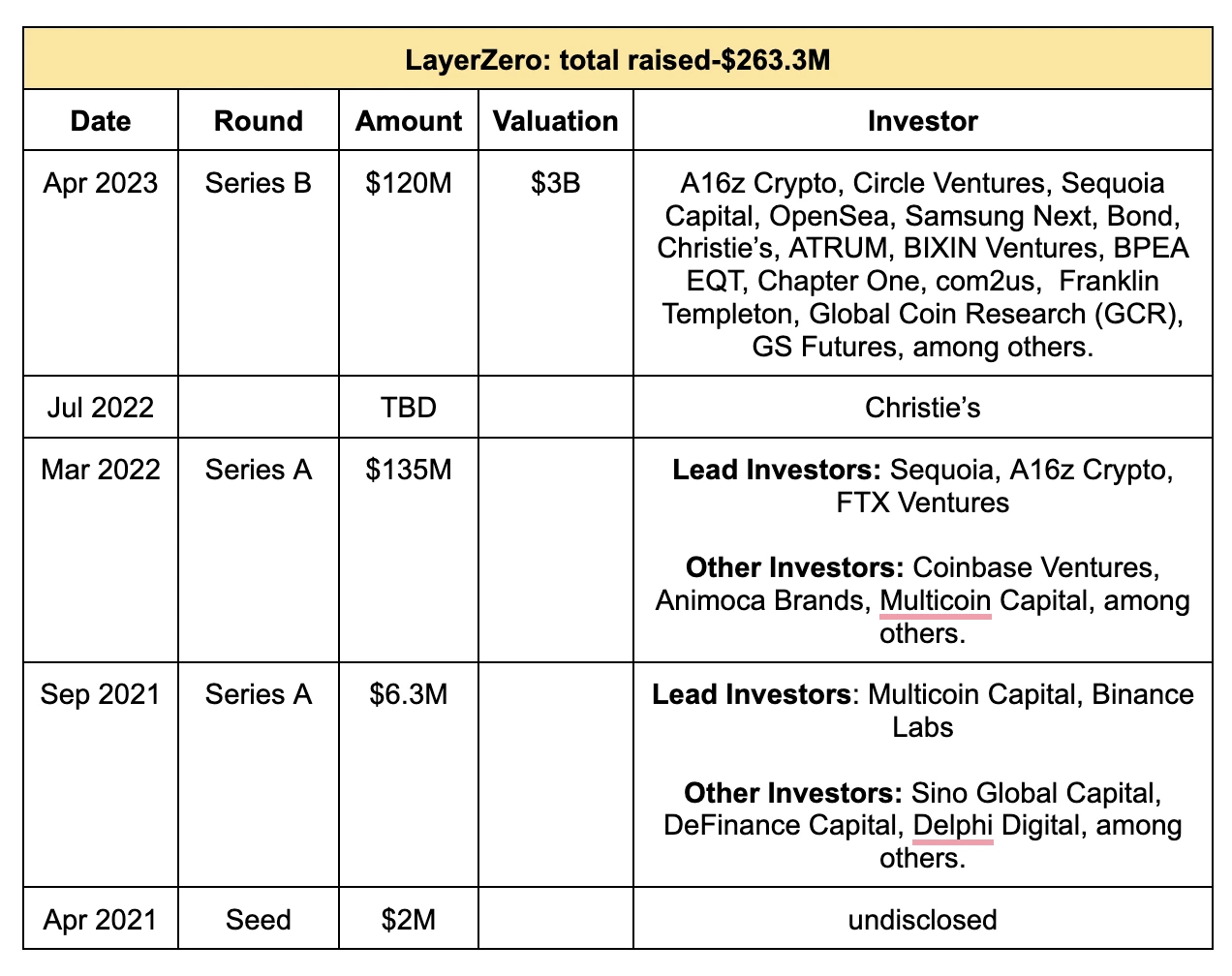

Fundraising

LayerZero has disclosed five funding rounds, amassing a total of $263.3 million in capital. Notably, during its Series B round, the company’s valuation reached $3 billion.

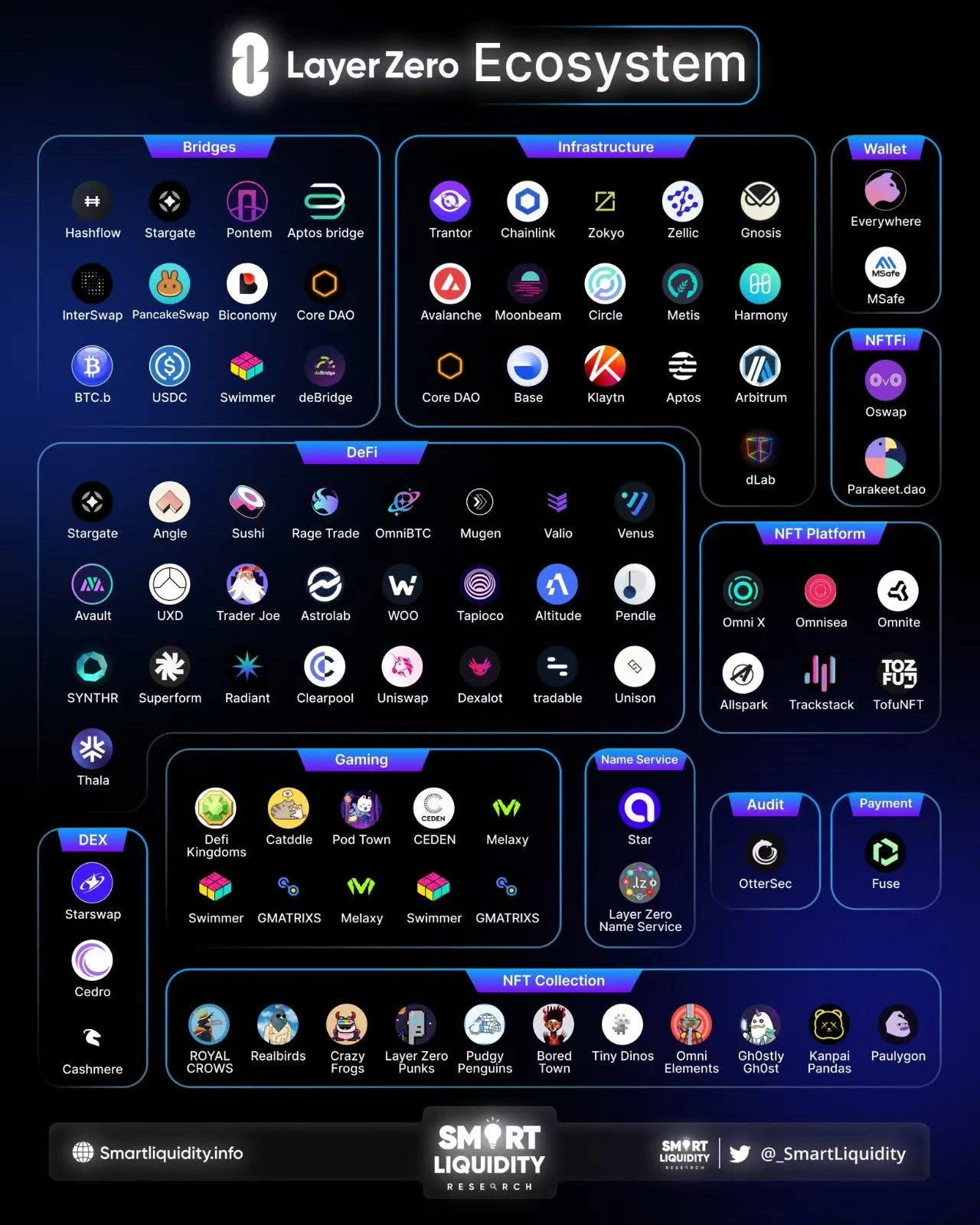

Ecosystem

LayerZero has initiated several strategies to promote the ecosystem.

- IzCatalyst: The program is designed to support developers building on LayerZero by providing grants and funding for projects that leverage the protocol to develop innovative, interoperable applications. The amount is up to $300M which is backed by leading investors.

3. Axelar

Axelar, founded in 2020, is a blockchain that connects blockchains.

Through a unified network protocol, Axelar supports the interoperability of on-chain assets, messages, and application logic, providing infrastructure for developers to build cross-chain dApps.

Axelar has created a programmable cross-chain layer capable of executing smart contract logic. It is built around three key components: a decentralized network, gateway smart contracts, APIs and developer tools.

These elements enable the Axelar network to automate tasks and abstract away complexities for both developers and end users.

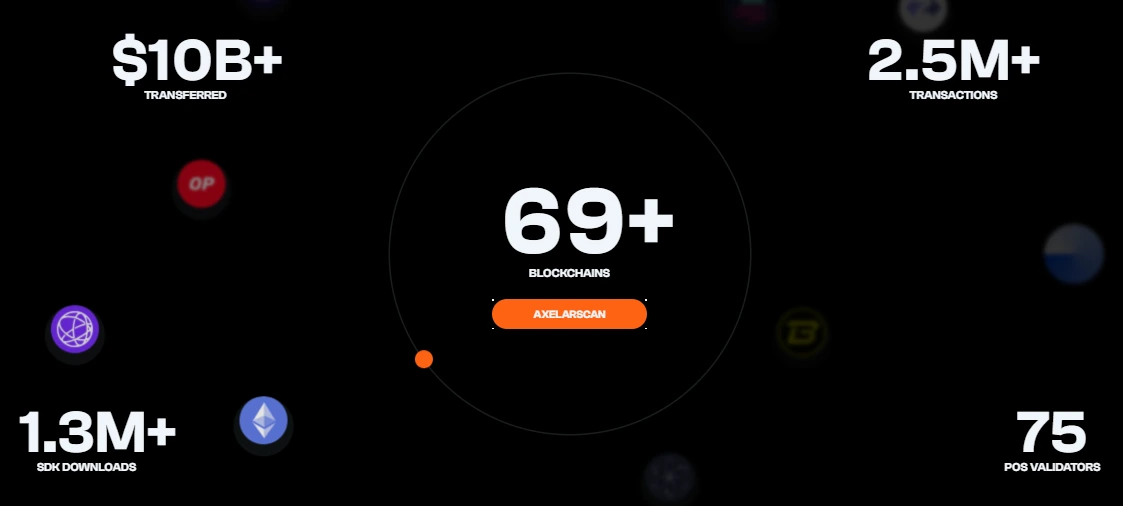

Key Data

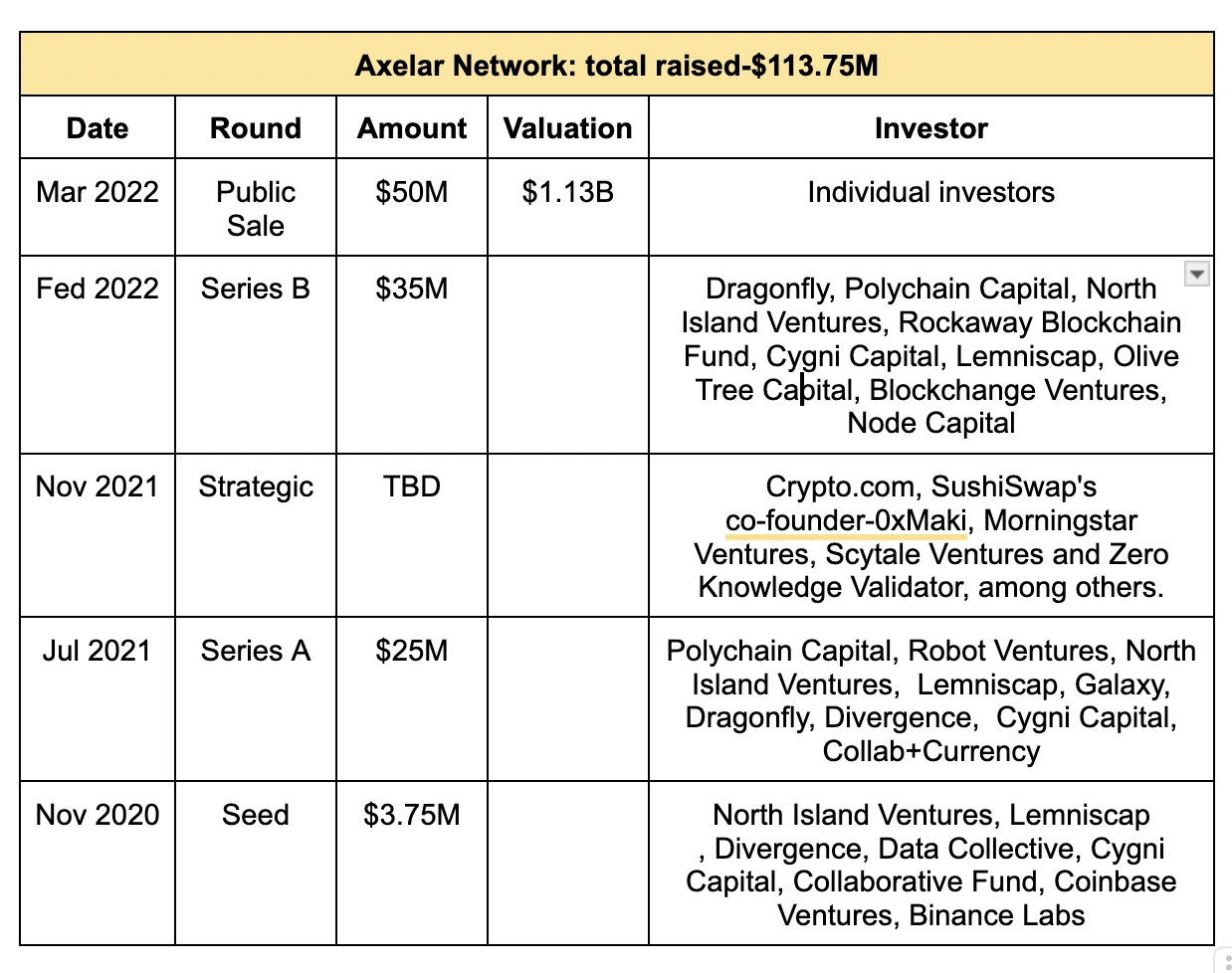

Fundraising

Axelar has disclosed five funding rounds, amassing a total of $113.8 million in capital. Notably, during its Series B round, the company’s valuation reached $1.13 billion.

The roster of investors includes prominent names such as Polychain Capital, Coinbase Ventures, and Dragonfly Capital, among others.

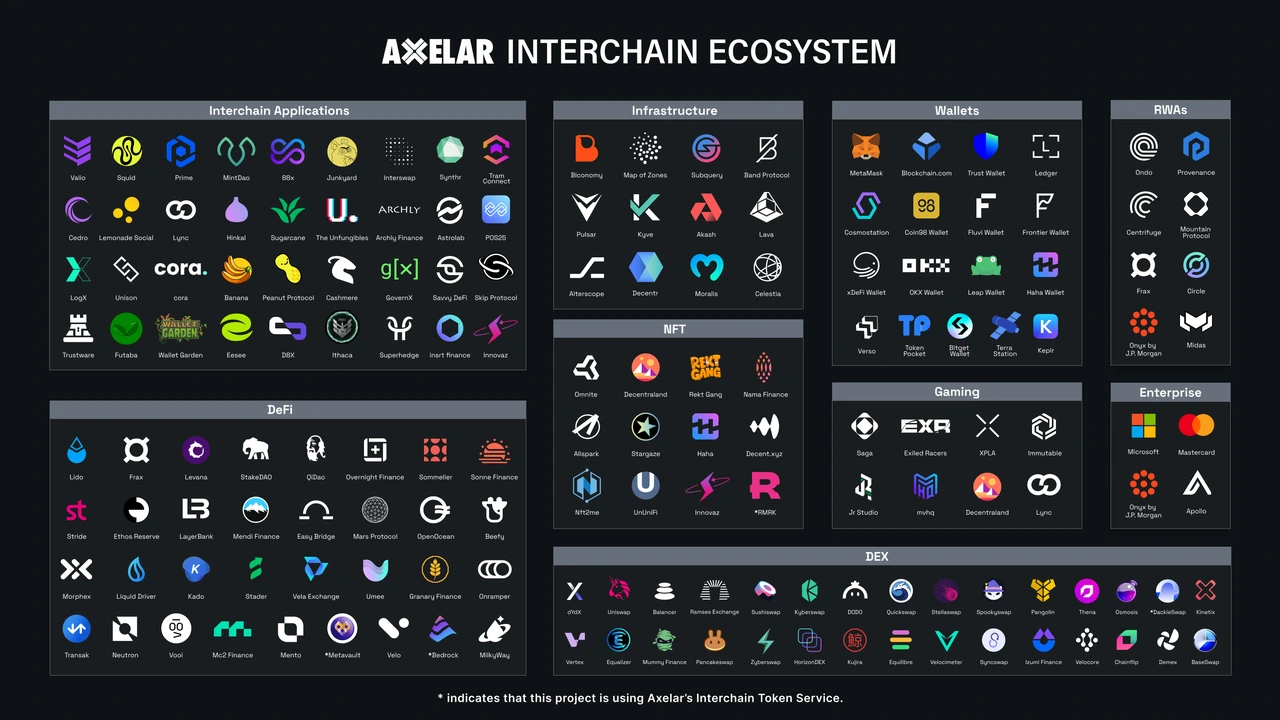

Ecosystem

Axelar Ecosystem Startup Funding Program is a $60 million fund designed to support developers building decentralized applications and protocols in Web3.

This program is an initiative led by top-tier, crypto-native investment firms: Blockchange, Chorus One, and Collab+Currency among others.

LOOKING AHEAD

The future of blockchain lies in a multi-chain ecosystem where cross-chain interoperability becomes a key enabler. Currently, the field of cross-chain interoperability protocols is flourishing, yet it faces numerous challenges.

Reflecting on the well-known “Impossible Triangle” in blockchain, Decentralization, Security, and Scalability—we observe that while cross-chain protocols bring scalability to a multi-chain ecosystem, they inevitably introduce security risks and centralization concerns during asset transfers.

As various solutions continue to develop, there is a strong expectation for the emergence of a cross-chain protocol that can seamlessly integrate “Impossible Triangle”.

▶ Buy Crypto at Bitget