KEYTAKEAWAYS

- Leverage and Flexibility: Crypto futures trading allows investors to amplify profits through leverage and profit from both rising and falling markets.

- Types of Futures Contracts: Futures contracts include Delivery, Perpetual, USDT-Margined, and Coin-Margined, each catering to different investor needs.

- Risk Management is Essential: Using strategies like stop-loss orders, take-profit targets, and continuous learning is critical for long-term success.

CONTENT

Learn about crypto futures trading, its types, pros and cons, and essential tips. Discover how leverage, hedging, and strategies can amplify profits or risks in this complex market.

WHAT IS CRYPTO FUTURES TRADING?

Crypto futures trading is a derivative trading method in the crypto market that allows investors to profit by going long, short, or using leverage.

It helps investors amplify gains during price increases and earn returns even during price declines.

By leveraging, traders can control larger market positions with relatively smaller capital.

Due to the nature of crypto futures trading, futures prices often differ from spot prices.

This is normal; however, during extreme market volatility, price discrepancies can widen significantly.

Therefore, it’s essential to carefully evaluate risks when engaging in crypto futures trading.

>>> More to read: How to Get Crypto Passive Income Easily?

HOW DOES CRYPTO FUTURES TRADING WORK?

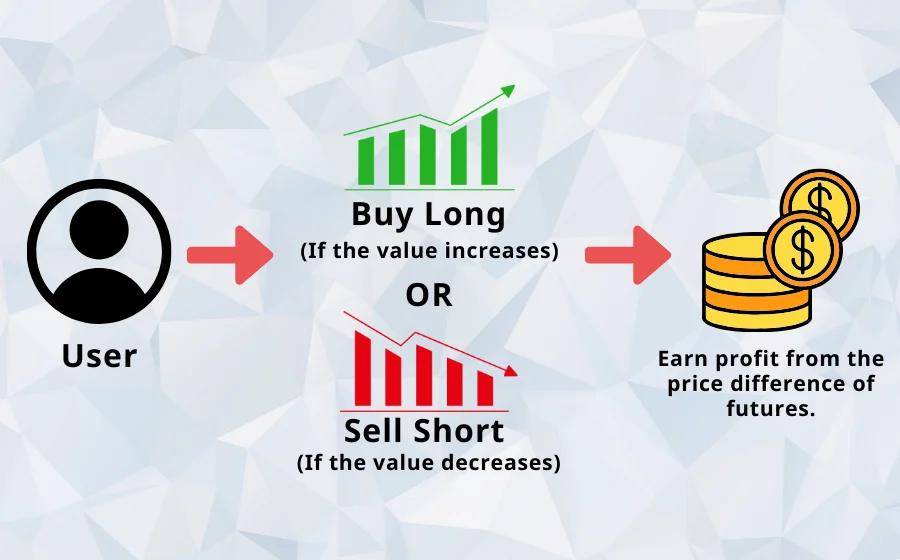

There are two main ways to profit from crypto futures trading:

- Going Long: When you go long, you are essentially betting that the price of the underlying asset will go up.

- Going Short: When you go short, you are essentially betting that the price of the underlying asset will go down.

Or, multiply your investment by using leverage.

✎ Leverage Explained with Examples

Leverage allows you to control a larger position in the market than what your initial capital would permit.

It’s like borrowing money to increase your investment size, aiming for higher returns.

However, leverage also increases the risk of higher losses, which makes it one of the more advanced crypto futures trading strategies.

Profit Scenario:

- Susan has $10.

- She wants to invest in a cryptocurrency.

- She uses 10x leverage, so her $10 controls a $100 position.

- The market moves up by 10%.

Calculations for Profit:

- Market increase: 10% of $100 = $10 profit.

- Susan’s initial $10 investment is now worth $20 ($10 initial + $10 profit).

Loss Scenario:

- Susan starts again with $10.

- She uses 10x leverage, so her $10 controls a $100 position.

- The market drops by 10%.

Calculations for Loss:

- Market decrease: 10% of $100 = $10 loss.

- Susan’s initial $10 investment is now worth $0 ($10 initial – $10 loss).

- Susan has $0 left from her leveraged investment.

>>> More to read: What Are Crypto Spot & Futures Trading? Key Differences Explained

PROS AND CONS OF FUTURES TRADING

✎ Advantages of Futures Trading

1. Amplified Profits:

Futures trading allows investors to use leverage, enabling control of larger positions with smaller capital.

When the market moves as expected, investors can achieve significantly higher profits. Leverage enhances capital efficiency and growth potential.

2. Profit from Price Declines:

Futures trading is not limited to going long (buying); it also allows short selling.

Investors can profit during market downturns by selling futures contracts at a higher price and buying them back at a lower price.

3. Supports Hedging and Advanced Strategies:

Experienced traders or institutions often hedge risks by opening low-leverage short positions while holding large amounts of spot crypto.

If prices rise, spot profits offset short position losses; if prices fall, short position gains compensate for spot losses.

✎ Disadvantages of Futures Trading

-

Liquidation Risk:

The high leverage in futures trading increases potential losses. If the market moves against an investor’s prediction, they may face significant losses or even liquidation of their positions.

-

Requires Market Knowledge:

Successful futures trading demands strong market knowledge and analytical skills. For investors lacking experience or understanding, futures trading can carry substantial risks.

>>> More to read: What is Margin Trading: A Comprehensive Introduction

TYPES OF CRYPTO FUTURES TRADING

1. Delivery Contracts

- Definition: Delivery contracts, also known as futures contracts, have a clear expiration date. Investors agree to deliver a specified quantity of assets at a future date.

- Settlement: On the settlement date, the system automatically closes and settles all positions, regardless of profit or loss.

- Key Point: Investors must fulfill the delivery obligation as per the contract terms.

2. Perpetual Contracts

- Definition: Perpetual contracts, also called perpetual futures, have no expiration date. Investors can hold positions indefinitely and decide when to close them.

- Funding Rate: To stabilize prices, perpetual contracts use a funding rate, which is like an interest fee paid for borrowing funds to open positions.

- Market Popularity: Perpetual contracts dominate Crypto futures trading. For example, Binance’s Bitcoin perpetual contract volume is over 200 times that of quarterly delivery contracts.

3. USDT-Margined Contracts

- Definition: These contracts are denominated in fiat-backed stablecoins, typically USDT. The contract value is calculated in USD terms, and each contract represents a specific dollar value.

-

Benefits:

- Easy to evaluate contract value and risk.

- Allows trading with USDT directly without buying crypto, avoiding exposure to potential price declines.

- Best For: Beginners, as it simplifies participation in the crypto futures market.

4. Coin-Margined Contracts

- Definition: Coin-margined contracts are denominated in cryptocurrency, such as Bitcoin or other crypto assets. The contract value is based on the value of the underlying crypto.

-

Benefits:

- Allows investors to participate using crypto directly.

- Investors can benefit from potential price increases of the underlying asset without converting to stablecoins.

- Alternate Name: Often referred to as Inverse Contracts on some exchanges.

>>> More to read: What is Margin Trading: A Comprehensive Introduction

CRYPTO FUTURES TRADING TIPS

1. Develop a Trading Strategy

It’s crucial to establish a clear plan outlining your entry and exit points and how you’ll handle risk.

Here are a few common crypto futures trading strategies to consider:

- Trend Trading: Identify market trends using indicators like moving averages and trend lines, and trade in the direction of the trend.

- Reversal Trading: Spot reversal opportunities when the price reaches key support or resistance levels.

- Range Trading: Capitalize on price volatility by buying at lows and selling at highs within a defined range.

2. Risk Management

Proper risk management is key to long-term success:

- Diversify Investments: Spread your capital across multiple trading accounts to reduce exposure to a single position.

- Stop-Loss Orders: Automatically close losing trades when the price reaches a specific level to limit losses.

- Take-Profit Orders: Lock in profits by automatically closing trades when the price hits your target.

3. Continuous Learning

Crypto futures trading is complex, requiring continuous improvement and education:

- Stay updated with trading books and market articles.

- Take online courses designed to enhance trading knowledge and skills.

- Learn from market trends and past experiences to refine your strategies over time.

>>> More to read: Crypto Risks 101 | Beginner’s Guide