KEYTAKEAWAYS

- Blockchain lending enables you to earn interest by lending crypto or obtain liquidity by borrowing against your digital assets, bypassing traditional financial institutions.

- Platforms like AAVE, JustLend, and Compound offer innovative features such as flash loans, dynamic interest rates, and token rewards to maximize user benefits.

- Despite risks like market volatility and complex operations, advancements like Layer 2 solutions and multi-chain ecosystems are making decentralized lending more accessible and efficient.

CONTENT

Discover blockchain lending, a decentralized way to earn interest and provide liquidity using crypto assets. Learn top platforms, key benefits, and how to maximize asset efficiency in the evolving DeFi ecosystem.

Have you ever considered that the small amount of interest you earn each month on your bank deposit is nothing compared to how much the bank earns by using your money? My friend Jack recently had a realization about this.

He owns several digital assets like Bitcoin and USDT. Every day, he watches their prices fluctuate but can’t do much besides stare at the charts. “My assets are like lazy bums on the couch—doing nothing but still needing me to take care of them!” he lamented.

Then, Jack discovered blockchain lending. In simple terms, it allows you to lend out your crypto assets and earn interest—just like how banks profit from your deposits. But this time, you become the “bank.” So, he deposited his idle USDT into the AAVE platform, earning a decent interest.

He even borrowed funds to invest in other projects. The core value of blockchain lending lies in making assets move. It lets you earn interest while providing liquidity—without the involvement of traditional financial institutions.

This is the magic of blockchain lending. Today, let’s dive into this innovative tool that “mobilizes” your assets, focusing on six of the most outstanding projects in the market.

WHAT IS BLOCKCHAIN LENDING

In simple terms, blockchain lending refers to the lending market within decentralized finance (DeFi), where you can either be a borrower or a lender.

- Borrowers: Use your crypto assets, such as Bitcoin, as collateral to obtain liquidity, like USDT.

- Lenders: Lend out your funds to earn interest.

Unlike traditional lending, blockchain lending eliminates banks and intermediaries. Everything is executed automatically through smart contracts, making the process transparent and efficient. Your assets no longer lie dormant in your wallet—they become tools for generating wealth.

Reading Pairing:

The 5 Best Cross-Chain Bridges for Breaking Blockchain Barriers

Ethereum TVL Rankings: Exploring the Top 5 Protocols by Value Locked

THE TOP SIX BLOCKCHAIN LENDING PLATFORMS

#1: AAVE

AAVE is the largest cross-chain lending protocol, operating across 13 blockchains. It was the first to introduce flash loans to the DeFi ecosystem, allowing users to borrow without collateral and repay within a single transaction.

AAVE’s interest rate strategy is dual-mode: fixed rates for long-term borrowers and variable rates reflecting real-time market conditions. Its liquidation mechanism features multiple thresholds, providing borrowers more time to top up their collateral.

#2: JustLend

Focused on the TRON ecosystem, JustLend has a comprehensive incentive system built around the JST token. It supports all major TRC-20 tokens, allowing depositors to earn both lending interest and JST rewards by providing liquidity. Built on TRON, JustLend enables low-cost lending and borrowing.

#3: Morpho

Morpho introduces a groundbreaking innovation: a peer-to-peer matching engine that maintains compatibility with AAVE and Compound.

This engine prioritizes matching borrowers and lenders with similar amounts, with any unmatched portion going into a liquidity pool. This mechanism offers higher returns for depositors and lower interest rates for borrowers.

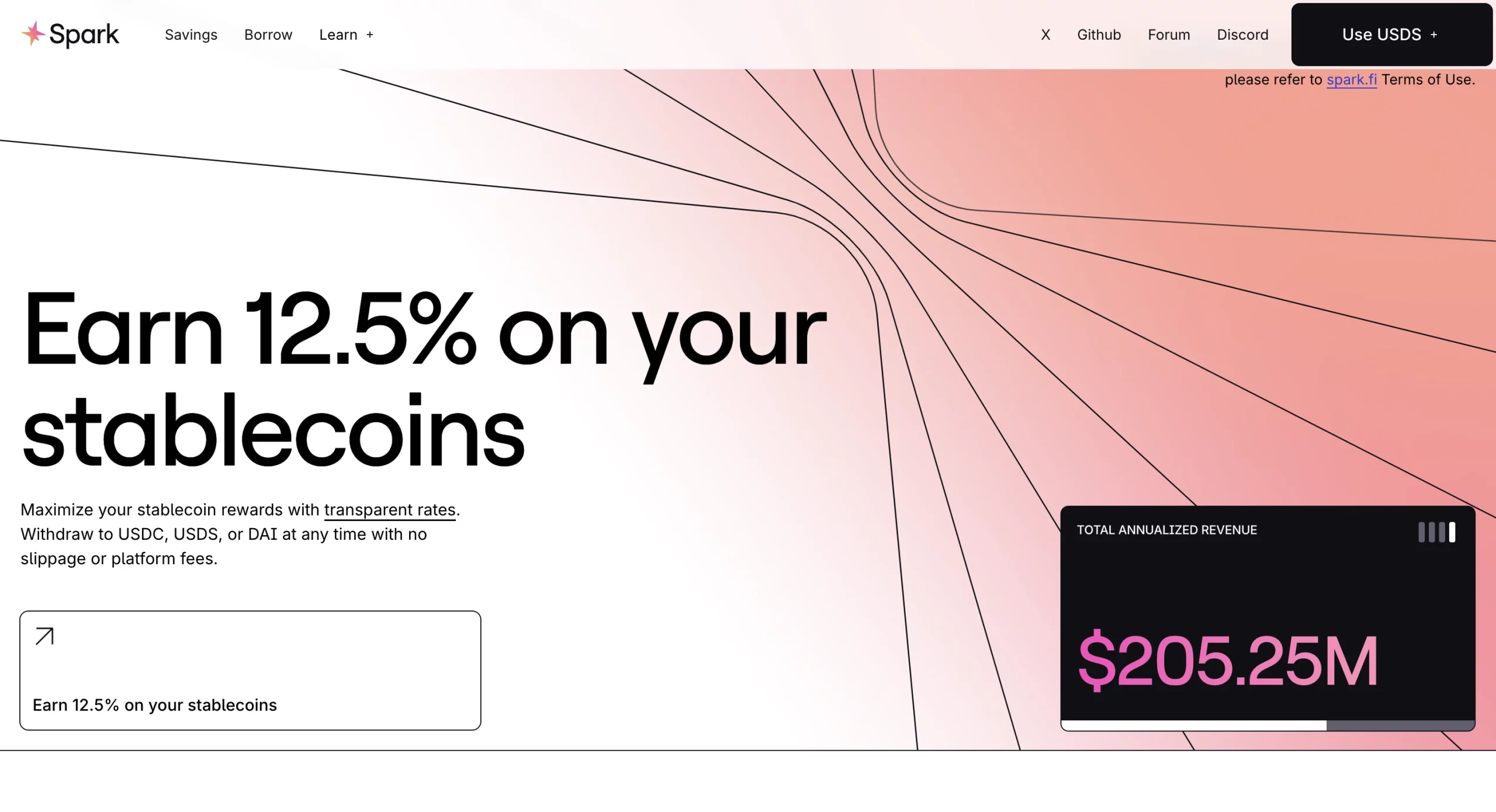

#4: Spark

As a key part of the MakerDAO ecosystem, Spark dynamically adjusts risk parameters based on the stability of DAI. For example, if DAI deviates from its peg, Spark modifies lending conditions to balance supply and demand. Its liquidation mechanism is deeply integrated with DAI’s price oracle.

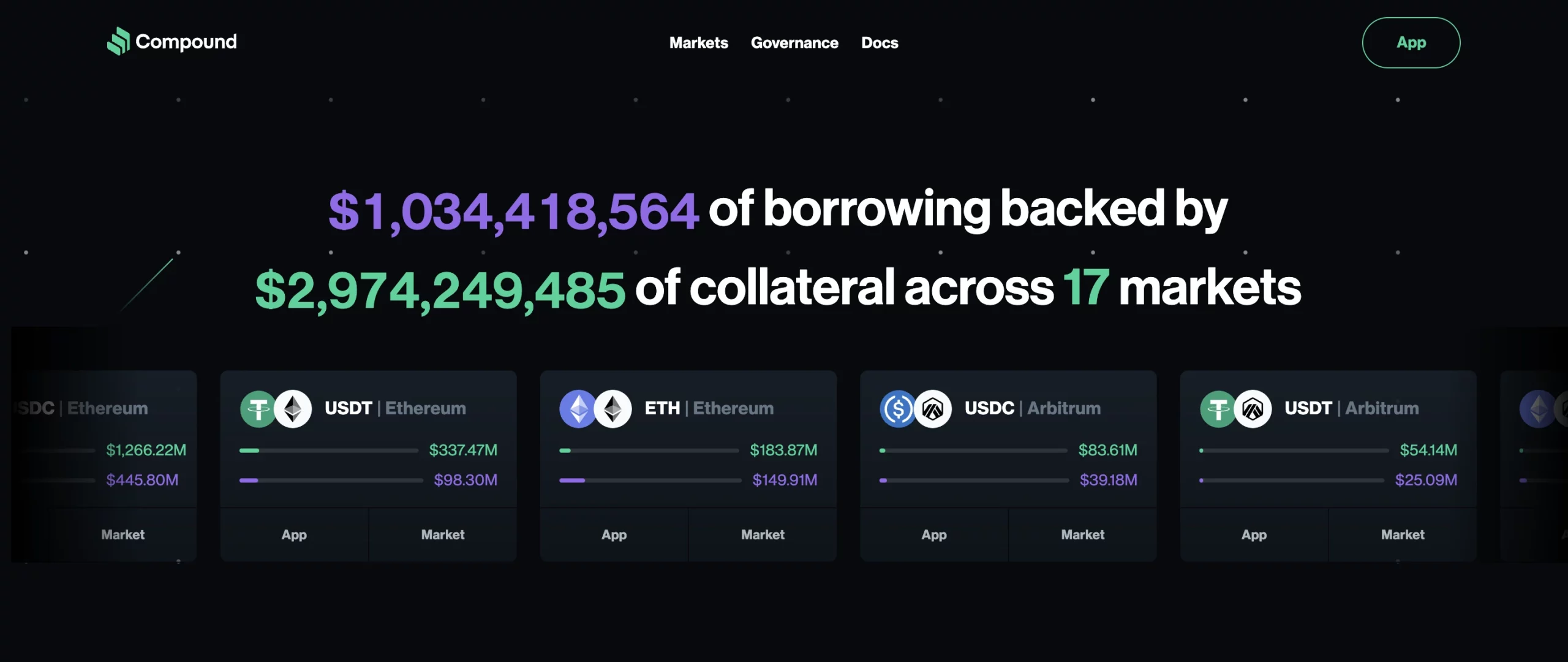

#5: Compound

Compound was the first protocol to introduce interest-bearing tokens (cTokens) to DeFi. Once assets are deposited, users receive cTokens, which automatically grow in value as the protocol earns interest.

Its interest rate model dynamically adjusts based on pool utilization and remains consistent across its seven supported blockchains.

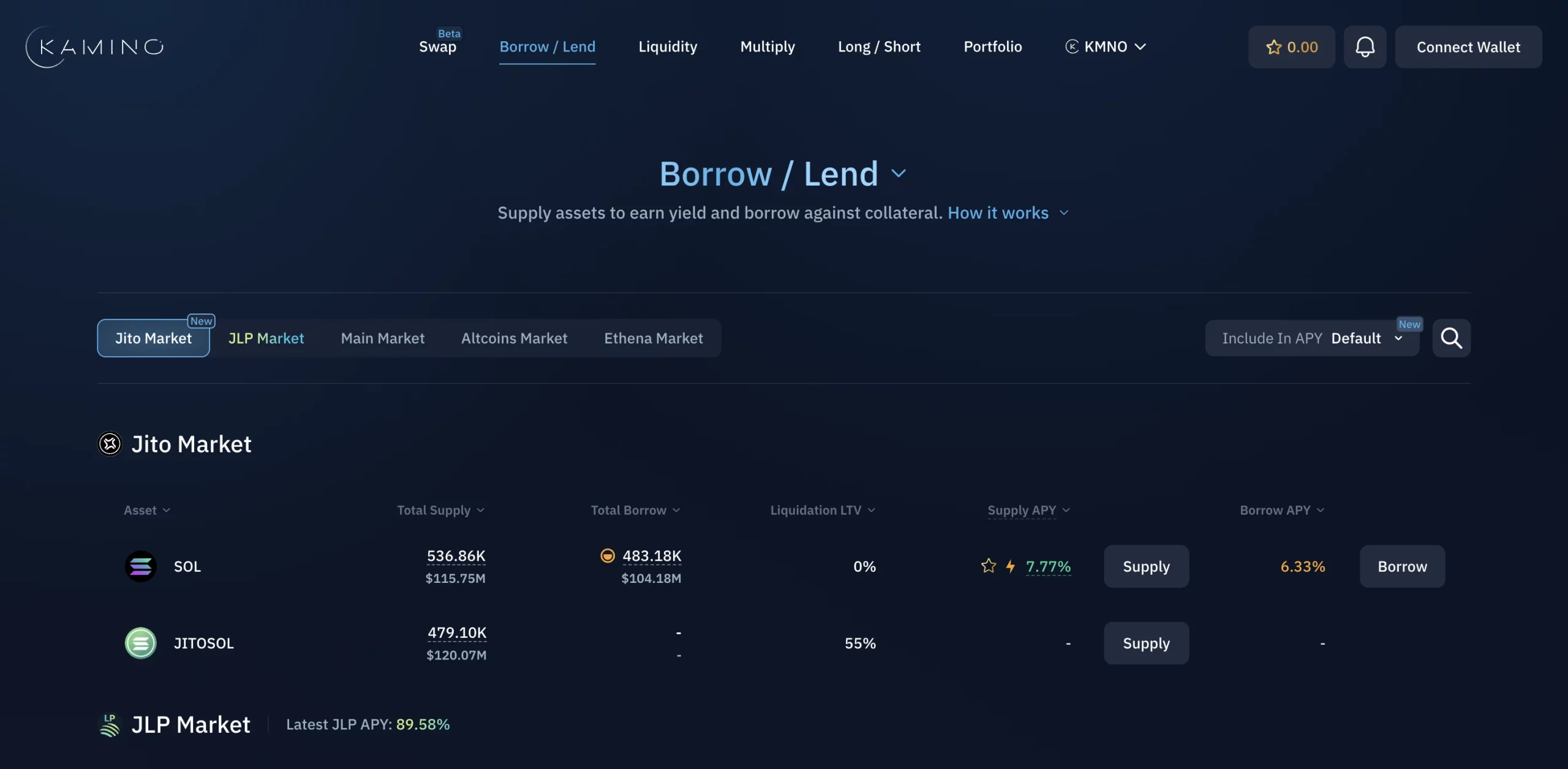

#6:Kamino Lend

Optimized for Solana, Kamino Lend integrates multiple protocols through cross-program invocations, allowing users to complete lending and yield farming in a single transaction. It supports all SPL token features, including metadata and permission control.

Reading Pairing:

The 5 Most Popular DEXs and Their Core Values Explained

Why Have Nations Been Reluctant to Include Bitcoin in National Reserves

THE FUTURE OF DECENTRALIZED LENDING

Blockchain lending isn’t just a new financial tool; it’s a quiet revolution in the financial world. It brings unprecedented opportunities: enabling global users to access financial services equally, improving asset utilization, and even creating innovative features like flash loans.

However, the journey isn’t without challenges. The volatile crypto market poses risks for borrowers, as collateral assets may be liquidated at any time. On the technical side, the security of smart contracts remains an unresolved issue.

Moreover, for beginners, the steep learning curve and complex operations may be a deterrent.

Looking ahead, continuous technological advancements will pave the way for wider adoption. Layer 2 solutions will accelerate transactions and reduce costs, while multi-chain ecosystems will eliminate barriers between blockchains, enabling true asset interoperability.

The integration of traditional finance with DeFi will attract more participants, further promoting the concept of open finance.

Blockchain lending is reshaping the rules of the game. In the future, the financial world will belong to those who understand how to make their assets move.

▶ Buy Crypto at Bitget