KEYTAKEAWAYS

- Magic Eden's ME token shows strong growth potential in Bitcoin's NFT ecosystem, targeting 485% upside to reach top 50 market cap despite current downward pressure.

- Chainlink's LINK demonstrates sustainable momentum across all timeframes, aiming for top 5 with 500% potential upside as oracle infrastructure leader.

- AAVE's recent surge, backed by Trump family's WLFI investment and V4 launch, positions it for new all-time highs with 353% potential upside.

CONTENT

Comprehensive analysis of four leading crypto projects: ME (Bitcoin’s NFT marketplace), LINK (oracle leader), USUAL (RWA stablecoin), and AAVE (DeFi lending). Deep dive into market positioning, technical analysis, and investment potential across different blockchain sectors.

*Ready to explore these opportunities? Trade on Bitget now. Remember: This content is informational only – always trade responsibly.

Welcome readers to view the potential/hot token research report series jointly launched by CoinRank and Agen. This is the 7th issue, mainly covering 4 tokens: ME, LINK, USUAL, and AAVE. We’ll provide a comprehensive analysis from aspects including token introduction, reasons for bullishness, technical analysis, top price predictions, and suitable investor groups.

The crypto market has experienced extreme volatility in the past week. Led by Bitcoin, there was first a sharp drop that liquidated 570,000 traders, then less than two days later, Bitcoin made a “V-shaped” recovery, breaking $100,000 again and reaching a high of $102,500 (Bitget data), creating both bullish and bearish extremes.

With Bitcoin breaking $100,000 again, some investors are experiencing FOMO, but will this lead to a continuous surge? I believe the probability is low. This isn’t the time for a sustained rally. This significant rebound has likely caused many who missed building positions to chase the rally, and these chase buyers need to be shaken out. From the perspective of this round of sharp decline and consolidation, we’re still in a finishing stage, with up and down volatility wearing down people’s patience and shaking out those who aren’t firm in their positions.

So regardless of what happens next, don’t panic and hold your positions. The crazy bull run hasn’t started yet, and the best days are still ahead!

Please note that all data mentioned below comes from third-party platforms including Tradingview, CoinMarketCap, Feixiaohao, and Bitget.

For more content, you can check out:

- CoinRank’s Market Watch: From Top 10 to Top 200 – Investment Analysis of DOGE, SUI and PIXEL

- CoinRank’s Market Watch: Rising Stars Analysis – PNUT, TIA, XRP, and DOGS

- CoinRank’s Market Watch: From Meme Kings to Tech Giants – Analyzing PEPE, ATOM, ACT and TON

ME: BITCOIN’S PREMIER NFT MARKETPLACE PIONEER

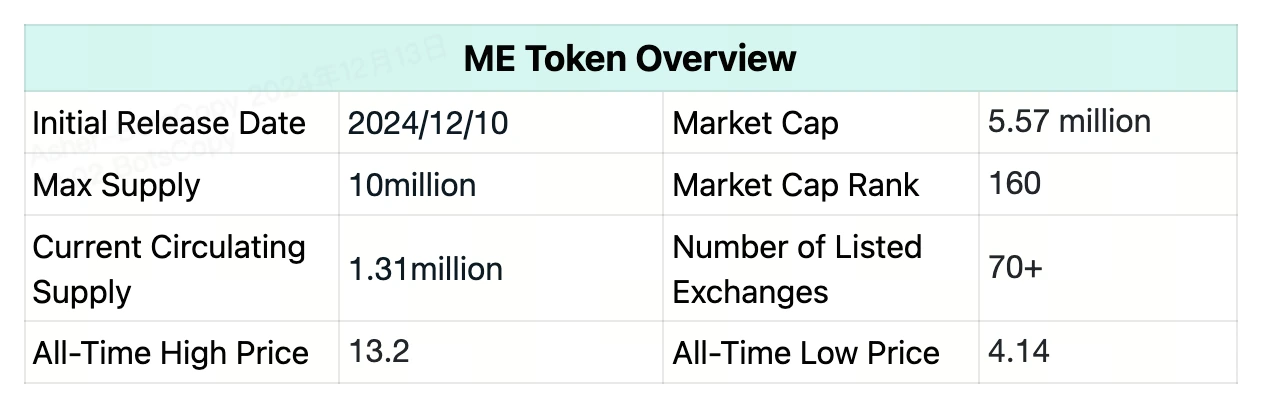

Token Introduction

Magic Eden is a multi-chain NFT marketplace. As Magic Eden’s official token, ME represents the largest on-chain user community, where users earn ME by trading assets across all chains.

Reasons for Bullishness

Carrying the title of Bitcoin’s first DEX, ME has been eagerly listed by mainstream exchanges like Binance, OK, Bitget, etc., which is a recognition of its strength. ME holds a monopolistic position in both the Bitcoin NFT ecosystem and the Runes token business.

From a Bitcoin user’s perspective, calling Magic Eden the most promising project in the Bitcoin ecosystem isn’t an overstatement, suggesting ME should have high value. However, as is widely known, the Bitcoin ecosystem is still relatively basic – among the top 10 NFT projects by market cap, the first nine are on ETH, with only the tenth being on BTC. This might limit ME’s potential.

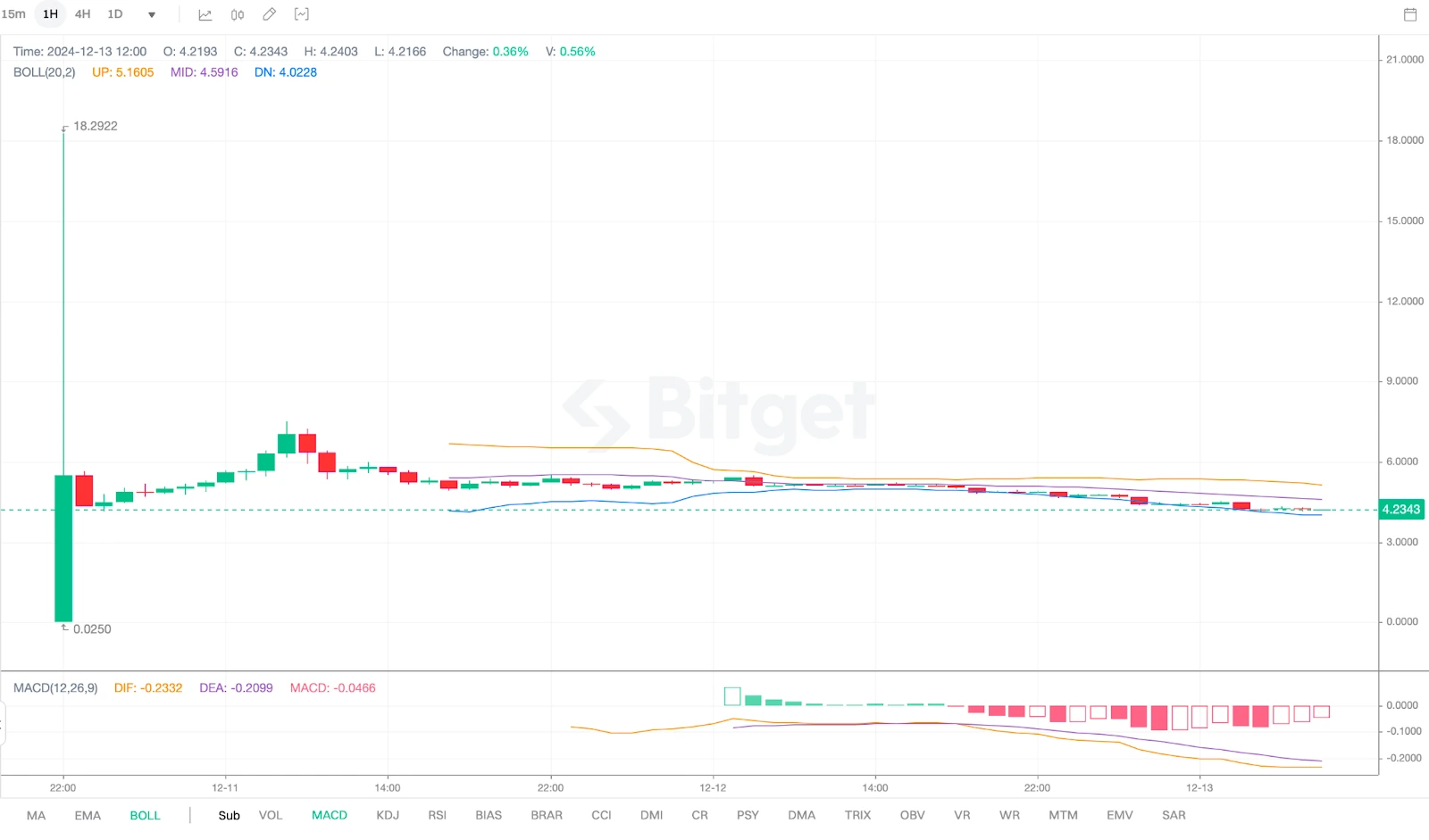

Technical Analysis

Since ME’s listing on mainstream exchanges is relatively recent, technical analysis has limited significance. Overall, ME is still in a downward channel. Despite contracted trading volume, there are no signs of stopping the decline. Going forward, it may need to hold support at $4 for more upside opportunities.

Top Price Prediction

There are two scenarios:

- As a hot project in the BTC ecosystem, it should at least enter the top 50 by market cap. Currently, the 50th position is OKB at $3.26 billion, meaning ME still has 485% potential upside.

- Based on ME’s initial circulating supply, token distribution, and profitability, the community optimistically expects it to reach $40. This would put ME’s market cap ranking around 35th, where currently Bitget’s token BGB sits. Undoubtedly, Bitget’s current strength far exceeds Magic Eden’s, so this possibility is relatively small for now. Of course, if the overall bull market raises all boats, ME might reach $40, though this target seems too ambitious in the short term.

Suitable Investor Group

Suited for $10,000-$100,000 tier portfolios, with medium overall risk-reward ratio.

Comprehensive Rating

3.5 stars ⭐️

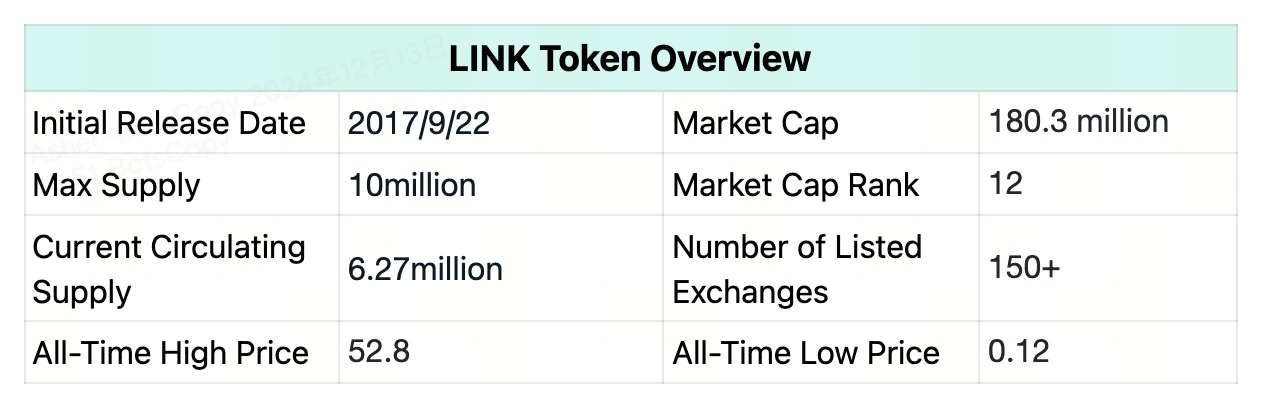

LINK: THE ORACLE INFRASTRUCTURE BACKBONE OF WEB3

Token Introduction

Chainlink was launched in June 2017 by San Francisco fintech company SmartContract. Developers describe it as secure blockchain middleware designed to allow smart contracts to access key off-chain resources such as data feeds (databases), websites (WeChat, Taobao, etc.) APIs, and traditional bank (Alipay, WeChat Pay, etc.) account payments.

Reasons for Bullishness

As the leader in oracles, many believe LINK’s inherent value should be higher than cross-chain projects. LINK has performed well in every bull market, rising 300x since 2017. Currently, LINK is actively promoting Chainlink network smart contracts to cover more markets and use cases, and has launched a community incentive program, which is undoubtedly preparation for this halving cycle.

Technical Analysis

Currently, LINK has completely broken out of its bottom range from both weekly and monthly perspectives, with increasing volume on the upside breakthrough, showing long-term bullishness. However, both daily and weekly charts show clear resistance levels, suggesting higher probability of short-term pullback, though given LINK’s current strength, any pullback shouldn’t last too long.

Top Price Prediction for LINK

Currently ranked 12th by market cap, LINK’s sole target is to enter the top 10, or even top 5. To enter the top 10 at current market caps would require a 38% increase, while reaching the top 5 would need a 500% increase. As the bull market is still ongoing, mainstream coins like LINK will certainly rise with the overall market, so these percentages represent only the minimum expectations.

Suitable Investor Group

Suitable for investors with assets in the $1,000,000-$10,000,000 range, with relatively stable returns and lower risk.

Comprehensive Rating

4 stars ⭐️

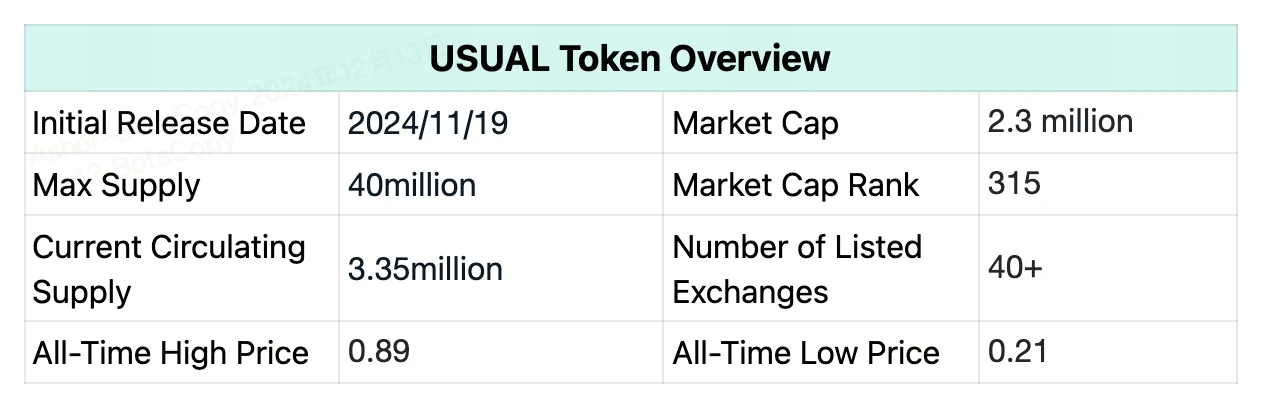

USUAL: EMERGING RWA STABLECOIN INNOVATOR

Token Introduction

USUAL is a decentralized fiat stablecoin issuer that redistributes ownership and governance rights through the $USUAL token.

Reasons for Bullishness

The 61st project launched on Binance Launchpool and one of the hottest RWA (Real World Assets) projects currently. USUAL is well-received by the market, having completed two funding rounds this year totaling $8.5 million. Currently, USUAL platform’s total TVL has reached $350 million, approaching its historical high. According to official statements, 90% of the total token supply will be distributed to the community, with 10% allocated to internal members (team, advisors, investors), representing a relatively fair distribution method that can effectively attract real users to participate in its ecosystem building.

Top Price Prediction

Currently, USUAL’s market cap is quite small, ranked 315th, indicating huge room for growth. In the short term, USUAL could potentially reach the top 100 by market cap riding current market momentum. Currently, the 100th position is held by AXS with a $1.21 billion market cap, meaning USUAL would need a 426% increase to reach this target.

Suitable Investor Group

Suited for $1,000-$100,000 tier portfolios, with high returns and high risk.

Comprehensive Rating

3.5 stars ⭐️

AAVE: DEFI’S LENDING PROTOCOL POWERHOUSE

Token Introduction

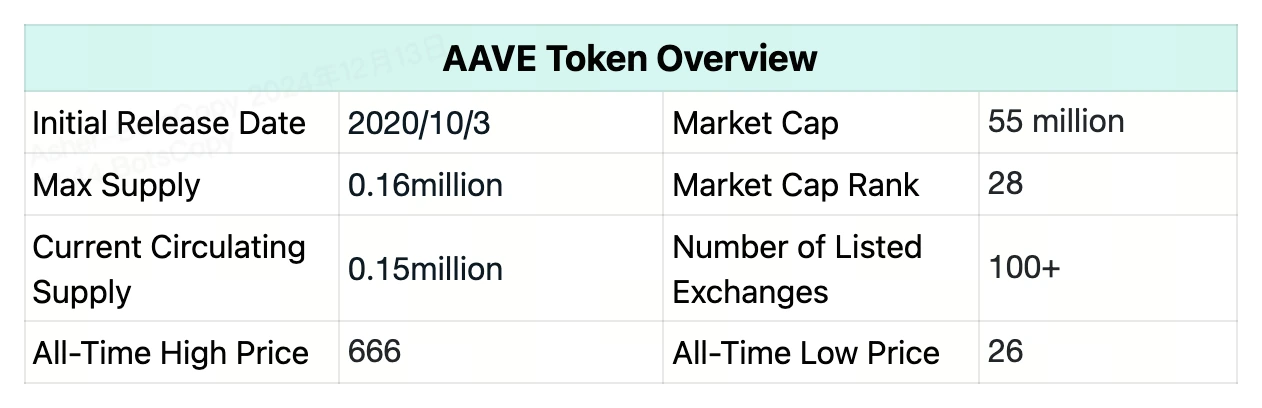

Aave is an open-source decentralized lending protocol providing deposit and lending services. Interest rates for both lenders and borrowers are calculated algorithmically based on platform borrowing and deposit volumes, and the platform uses Chainlink’s oracle to ensure collateral price fairness.

Reasons for Bullishness

As a leader in decentralized lending protocols, it naturally receives more attention during bull markets due to increased borrowing demand. Recently, the WLFI (World Liberty Fi) project, associated with newly elected U.S. President Trump’s family, has continuously increased its AAVE holdings, significantly stimulating its price rise.

From a data perspective, Aave’s TVL and protocol revenue have reached new all-time highs. From a project development standpoint, Aave developer Avara’s engineering VP Emilo has released the Aave V4 version preview after a 7-month gap. Aave is experiencing new growth explosion in terms of product, data, and token price.

Technical Analysis

AAVE is currently showing strong upward momentum, reaching its second-highest historical point, with strength exceeding not only Bitcoin during this period but also most mainstream coins. From a Bollinger Bands perspective, daily, weekly, and monthly charts all show price moving along the upper band, indicating strength but also suggesting pullback risk. The only resistance level before breaking its all-time high is around $450, which could be its short-term top.

Top Price Prediction

AAVE’s current strength suggests it’s heading for new highs. It needs to first break through the $450 resistance level, then challenge the all-time high of $666, requiring increases of 22.9% and 81.9% respectively from current prices. Additionally, as a DeFi lending leader, targeting top 10 market cap during a bull market is reasonable. Currently, 10th-ranked TRX has a market cap of $24.9 billion, requiring a 353% increase.

Suitable Investor Group

Suitable for investors with assets in $100,000-$10,000,000 range, with relatively stable returns and lower risk.

Comprehensive Rating

4 stars ⭐️

COMPARATIVE ANALYSIS

In terms of return stability: LINK > AAVE > ME > USUAL

In terms of potential returns multiplier: USUAL > ME > AAVE > LINK

In terms of current market popularity: ME > AAVE > USUAL > LINK

▶ Buy Crypto at Bitget