KEYTAKEAWAYS

- Usual's USDO stablecoin maintains 1:1 backing with real-world assets like Treasury bonds, generating genuine yield that's distributed back to the community through $USUAL tokens.

- The protocol's innovative flywheel mechanism incentivizes USDO staking with up to 80% APY, driving TVL growth while maintaining sustainable token economics through dynamic issuance.

- Unlike traditional stablecoins, Usual redistributes 90% of protocol revenue to token holders, creating a unique value proposition in the increasingly competitive stablecoin market.

CONTENT

Explore how Usual Protocol transforms the stablecoin landscape by combining RWA-backed USDO with innovative yield distribution through $USUAL governance tokens. Learn about its unique flywheel mechanism, high APY potential, and community-first approach.

USUAL’S UNIQUE POSITIONING

The stablecoin market has long been dominated by traditional players like USDT and USDC. While these centralized stablecoins are widely recognized for their stability and liquidity, users rarely benefit from the significant profits generated by these protocols. Usual aims to disrupt this status quo.

Usual is a stablecoin protocol that introduced USDO, a stablecoin backed 1:1 by Real-World Assets (RWA) such as U.S. Treasury bonds. This design not only enhances the stability of the stablecoin but also ensures transparency in its revenue sources.

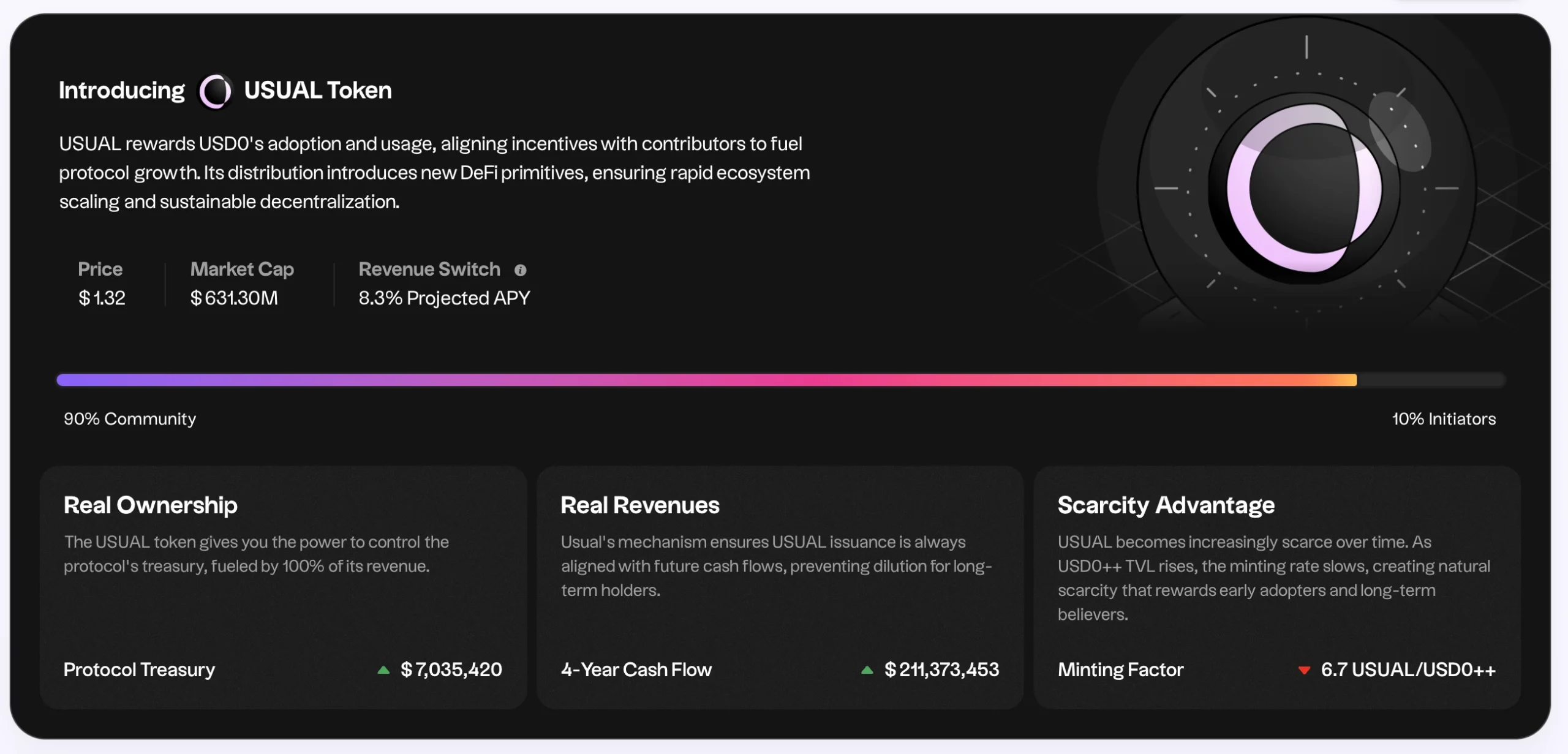

Meanwhile, its governance token, $USUAL, allows participants to share in the protocol’s revenue through an innovative distribution mechanism. This community-focused model is what sets Usual apart.

Also Read:

What Is Stablecoin ? Stable Virtual Assets

What is USD Coin (USDC)? Understanding the Second-Largest Stablecoin

HOW DOES USUAL WORK?

USDO is the core stablecoin of the Usual protocol, backed directly by assets like U.S. Treasury bonds. Simply put, for every 1 USDO held, there is a corresponding asset backing its value. Compared to algorithmic stablecoins (e.g., LUNA, which failed catastrophically), this model is far more reliable.

Revenue Source: Treasury bonds generate interest, which becomes part of the protocol’s income and forms the basis for subsequent revenue distribution.

$USUAL is the governance token of the protocol and the primary tool for revenue distribution.

How to Obtain $USUAL: Users can stake USDO to mint a liquidity token, USDO++, and receive $USUAL as a reward.

How Revenue is Distributed: The protocol allocates 90% of its income to $USUAL and USDO++ holders. For example, if the protocol earns $100, $90 is distributed back to the community.

To attract users in its early stages, the protocol issues $USUAL at a higher rate. As the number of users and Total Value Locked (TVL) grow, the issuance rate decreases over time, effectively controlling inflation.

Burning Mechanism: If users choose to unlock USDO++ early, they must burn a portion of their $USUAL holdings. This balances market supply and enhances $USUAL’s value.

The flywheel effect occurs as:

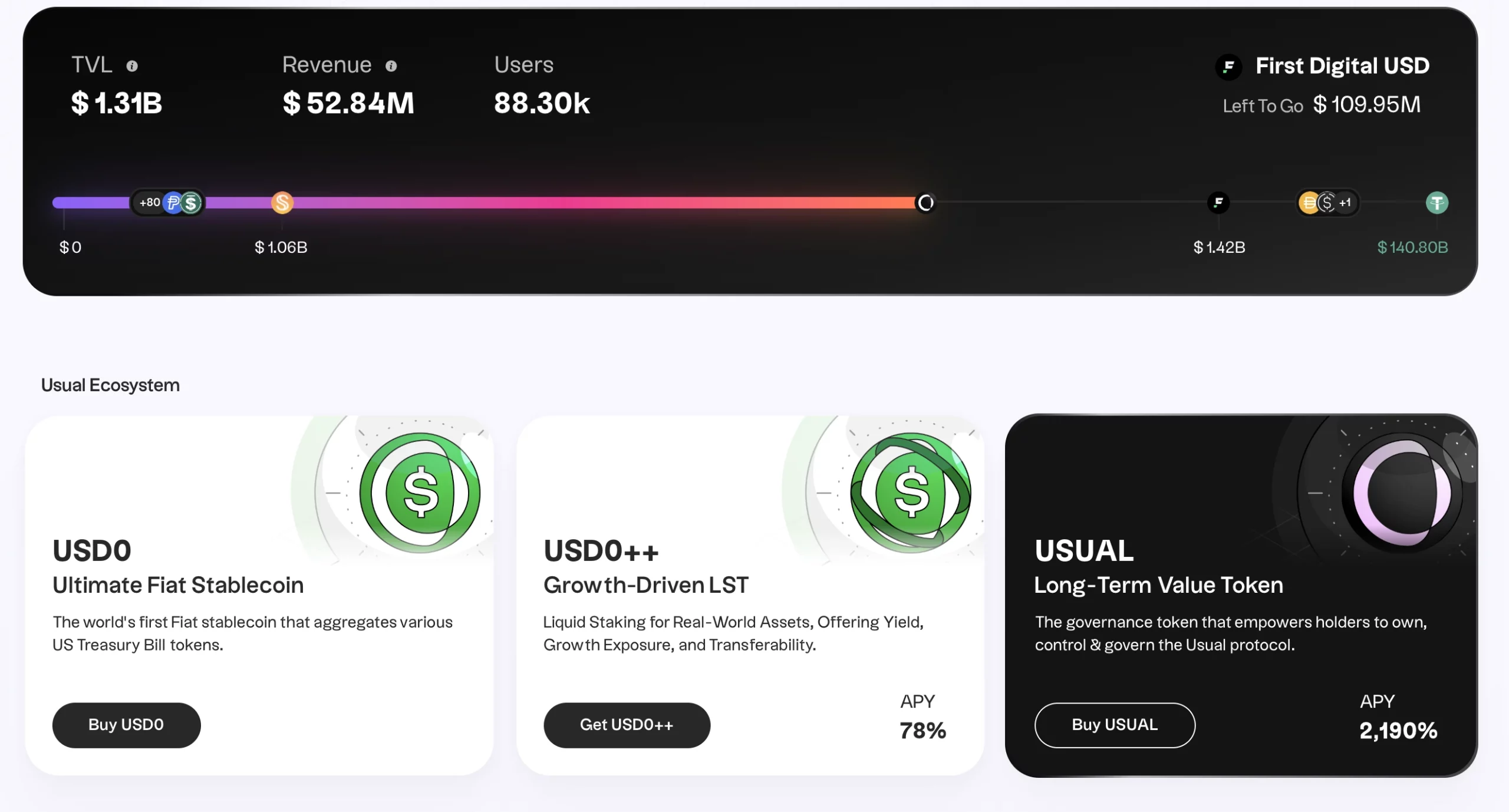

- Users stake USDO to earn USDO++ and $USUAL.

- Increased staking boosts the protocol’s TVL.

- Higher TVL generates more revenue through Treasury bond yields.

- This revenue is distributed back to participants, attracting even more users.

This creates a self-reinforcing flywheel effect, driving the protocol’s growth and sustainability.

Also Read:

Memecoins, RWA, AI, and DePin Lead Crypto Trends in Q2 2024 Despite Market Downturn

WHAT MAKES USUAL ATTRACTIVE?

Real Revenue Sources for Users.

Unlike traditional stablecoin protocols where users only hold assets, Usual allows participants to directly benefit from protocol earnings. This is a significant breakthrough, as it gives users tangible financial incentives.

Competitive Advantages:

- High APY on USDO Staking: Users can earn an annual yield of up to 80% by staking USDO, which is significantly higher than the market average.

- Growing TVL: The protocol’s TVL has already reached $900 million, indicating strong market recognition and adoption.

Innovative Tokenomics:

Usual’s token issuance is closely tied to ecosystem growth. In the early stages, $USUAL’s high issuance rate attracts users, while later, as the protocol matures, the issuance rate decreases to alleviate inflationary pressures. This dynamic adjustment ensures long-term sustainability.

CONCLUSION: IS USUAL WORTH WATCHING?

Usual’s greatest strength lies in its clear revenue distribution model and user participation mechanism. By combining the stability of RWAs with on-chain revenue sharing, Usual creates added value for its users.

However, its long-term success hinges on several critical factors:

- Can the staking mechanism attract long-term users?

- Can $USUAL maintain price stability to support sustainable rewards?

- Can the protocol establish a solid foothold in the broader market?

For investors seeking high returns, Usual’s current high APY is an appealing opportunity. However, as market competition intensifies, the protocol’s ability to maintain its edge will require close monitoring. Whether Usual can become a new benchmark in the stablecoin market is a question that the coming years will answer.

▶ Buy Crypto at Bitget