KEYTAKEAWAYS

- Ethereum L2 TVL Drops to $467.9 Billion

- Lido Has Released the Ethereum SDK

- The Fed is Likely to Skip a Rate Cut in January Next Year

CONTENT

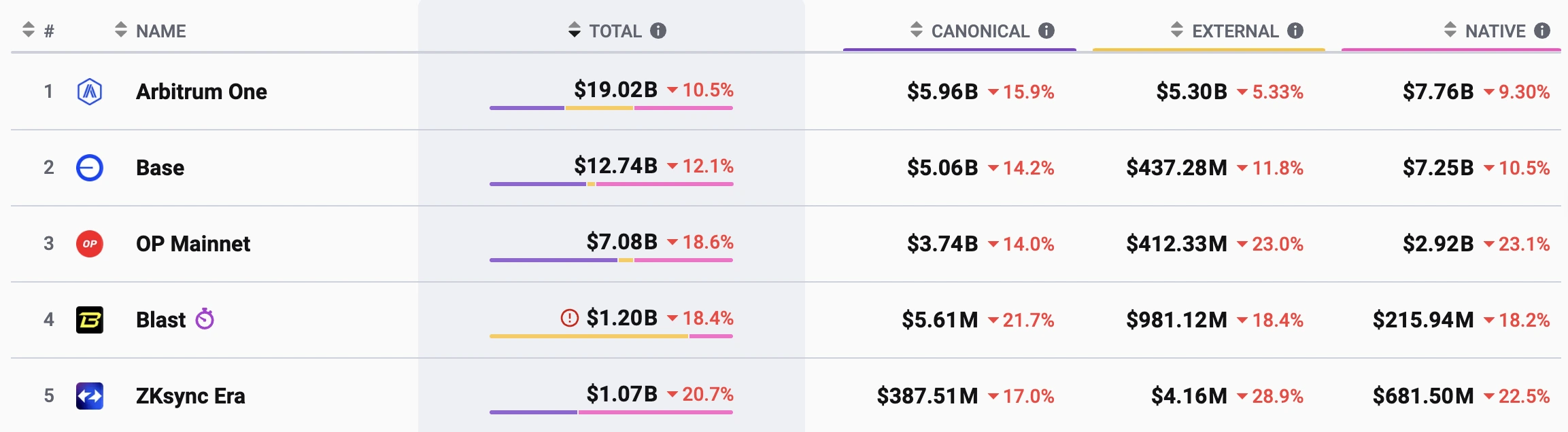

ETHEREUM L2 TVL DROPS TO $46.79 BILLION

According to data from L2BEAT, as of December 23, the total value locked (TVL) in Ethereum Layer 2 has dropped to $46.79 billion, representing a 13.2% decrease over the past seven days.

(Source:L2BEAT)

Among the major Layer 2 networks, Arbitrum One maintains the highest TVL at $19.18 billion, with a 7-day decrease of 9.96%. Following closely is Optimism PBC Mainnet with a TVL of $12.91 billion, showing an 11.4% decline. Smaller networks have experienced even steeper declines, with Blast and ZKSync Era dropping by 17.7% and 19.9%, respectively.

Analysis:

The recent data reveals a significant decline in Ethereum Layer 2 TVL, particularly affecting smaller networks like Blast and ZKSync Era, which have seen drops of nearly 20%.

While leading networks Arbitrum and Optimism maintain substantial TVL figures, their decline suggests broader challenges within the Layer 2 ecosystem. These challenges may stem from decreased transaction volumes, falling token prices, or slower-than-anticipated technical development progress.

LIDO LAUNCHES ETHEREUM SDK

On December 23, Lido introduced its Ethereum SDK, a TypeScript library designed to streamline the integration of Lido’s Ethereum staking functionality into off-chain applications.

The SDK provides developers with production-grade tools, pre-built methods, and comprehensive documentation, simplifying the integration of Lido’s staking capabilities into various Ethereum projects, including widgets and wallets. The SDK serves as a core component of Lido’s staking widget interface, which has already been adopted by thousands of stakers.

Analysis:

The launch of Lido’s Ethereum SDK represents a strategic advancement in simplifying the staking experience. By providing a comprehensive SDK, Lido reduces technical barriers for developers while promoting broader integration between off-chain applications and staking mechanisms.

This development is particularly valuable for developers seeking to incorporate Ethereum staking features into their platforms, as it significantly reduces the complexity of implementation.

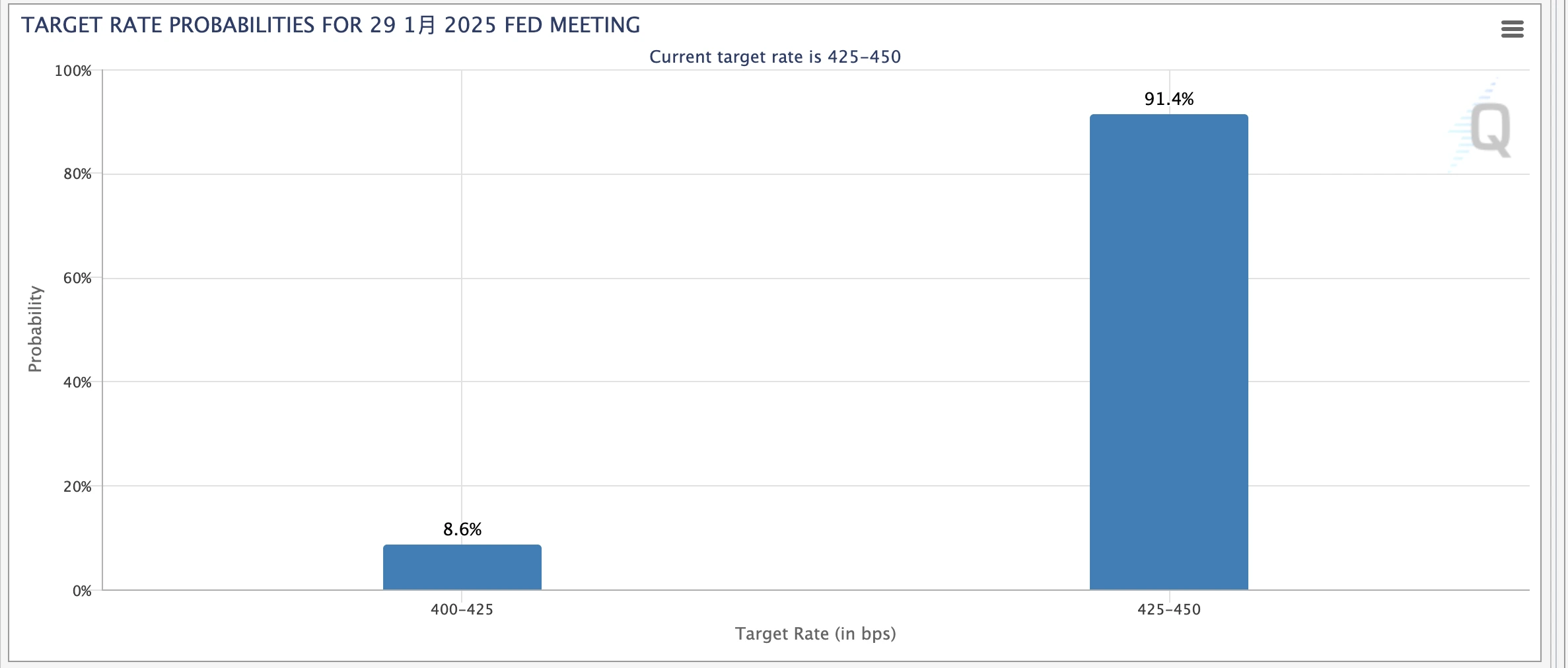

FEDERAL RESERVE EXPECTED TO HOLD OFF ON JANUARY RATE CUT

On December 23, the U.S. dollar strengthened as markets anticipate a cautious approach to rate cuts from the Federal Reserve. According to London Stock Exchange Group data, markets project Fed rate reductions totaling 38 basis points through December 2025.

(Source:FedWatch)

Despite implementing a 25 basis point rate cut recently, the Fed has indicated a more measured approach to future cuts. Deutsche Bank analysts anticipate the Fed will likely maintain current rates in January 2024, potentially extending the pause in policy easing into 2025.

Analysis:

The dollar’s appreciation reflects market response to the Fed’s deliberate policy approach. While the Fed has recently cut rates, expectations point to a more gradual adjustment path ahead.

The Fed appears to be pursuing a balanced monetary policy to prevent economic overheating, particularly given persistent inflation concerns and market uncertainties. The strengthening dollar typically creates headwinds for Bitcoin and other cryptocurrencies, as investors often shift capital from digital assets to traditional markets during periods of dollar strength.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!