KEYTAKEAWAYS

- MicroStrategy's inclusion in the Nasdaq 100 marks a historic milestone as the first Bitcoin-focused company, bringing cryptocurrency exposure to mainstream index investors.

- Under Michael Saylor's leadership, MicroStrategy holds 439,000 BTC worth $15.58 billion, representing a 57.51% unrealized gain on their Bitcoin investment.

- Despite criticism from short-sellers like Citron Research, MicroStrategy's stock has surged 432% in 2024, outperforming Bitcoin's price appreciation.

CONTENT

Explore MicroStrategy’s transformation from a business intelligence company to the world’s largest corporate Bitcoin holder, its inclusion in the Nasdaq 100, and the implications for both the company and cryptocurrency markets.

On Monday, December 23, 2024, MicroStrategy (MSTR) was included in the Nasdaq 100 index, making it the first-ever Bitcoin-focused company to achieve this milestone. What does this mean for the company and the broader market? Furthermore, are there other notable companies with significant Bitcoin holdings that investors should pay attention to?

WHAT IS MICROSTRATEGY (MSTR)?

MicroStrategy (MSTR), founded by Michael J. Saylor in 1989, is a leading provider of enterprise business intelligence (BI) software renowned for its integrated platform.

The company’s mission is to make every enterprise a more intelligent enterprise. MicroStrategy provides powerful software solutions and expert services that empower individuals with actionable intelligence.

In recent years, MicroStrategy has expanded its strategy by positioning itself as the world’s first Bitcoin development company. Microstrategy views Bitcoin as not just a new commodity that is becoming increasingly mainstream.

Their business model combines revenue generation from its software operations with a groundbreaking Bitcoin Strategy, where Bitcoin now serves as the company’s primary treasury reserve asset. The Bitcoin Strategy encompasses three key aspects:

- Bitcoin Acquisition Strategy: Acquiring Bitcoin using cash flows from operations and proceeds from equity and debt financings;

- Bitcoin-Related Innovations: Developing product innovations that leverage Bitcoin blockchain technology;

- Bitcoin Advocacy and Education: Periodically engaging in advocacy and educational activities regarding the continued acceptance and value of Bitcoin as an open, secure protocol for an internet-native digital asset and the Lightning Network.

(Source: MicroStrategy 2023 Annual report)

MICROSTRATEGY’S BITCOIN ADOPTION JOURNEY

By aligning its business operations with its Bitcoin strategy, MicroStrategy has established a unique model that blends leadership in enterprise software with a pioneering role in the cryptocurrency industry.

MicroStrategy (MSTR) made headlines in August 2020 when it announced its first Bitcoin purchase, acquiring 21,454 BTC for approximately $250 million.

(Source: saylor tracker)

Since then, MicroStrategy has consistently increased its Bitcoin holdings through multiple purchases, often capitalizing on market downturns. As of today, MicroStrategy holds 439,000 BTC, with an unrealized gain of 57.51%, representing a total value of roughly $15.58 billion.

KEY FIGURE: MICHAEL SAYLOR

At the heart of Bitcoin Strategy is Michael Saylor, the company’s executive chairman and co-founder. Often described as a “Bitcoin Believer”, while some think he is too aggressive, Saylor’s commitment to Bitcoin remains unwavering.

Even as Bitcoin’s price has fallen by 50% from its highs, Michael Saylor has suggested that MicroStrategy will never sell its Bitcoin—a stance the company continues to uphold. This buy-and-hold strategy, particularly during Bitcoin’s price downturns, has drawn significant controversy, with some viewing it as reckless.

Saylor has also explained his bullish outlook on Bitcoin, publicly stating: “We think Bitcoin is the highest form of property, the apex property in the world, and it’s the best investment asset. So the endgame is to acquire more Bitcoin. Whoever gets the most Bitcoin wins. There is no other endgame.”

This unwavering conviction highlights his strategic vision for MicroStrategy’s role in the Bitcoin ecosystem.

MICROSTRATEGY (MSTR) STOCK PERFORMANCE

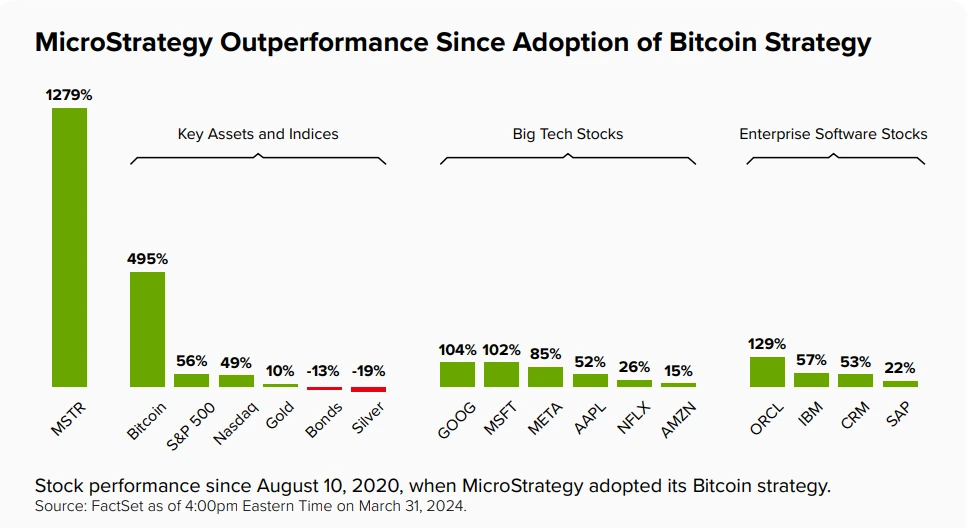

As the world’s largest corporate holder of Bitcoin, MicroStrategy’s stock has surged by approximately 432% since the beginning of the year, significantly outperforming Bitcoin’s own price increase during the same period. This impressive performance is largely attributed to the success of its Bitcoin Strategy.

Factors such as the approval of Bitcoin ETFs, increased institutional participation, cuts to the federal funds rate, and Trump’s election victory have all contributed to Bitcoin’s price rebound, attracting considerable attention from investors.

As a “Bitcoin-leveraged” company, MicroStrategy’s stock has become more attractive to investors due to its direct exposure to Bitcoin’s price fluctuations. As the value of Bitcoin rises, so does the value of MicroStrategy’s holdings, further driving the rapid increase in its stock price.

(Source: Google Finance)

The dramatic rise in MicroStrategy’s stock price has attracted criticism, with prominent short-seller firm Citron Research announcing on Thursday, November 21, via the social media platform X that it intended to short MicroStrategy (MSTR), a major Bitcoin holder.

Citron argued that MicroStrategy’s stock had effectively become a proxy for Bitcoin, with its price reflecting an unjustified premium compared to the Bitcoin underlying its value.

They claimed the stock was significantly overvalued and that trading in $MSTR had become excessively speculative, prompting them to take a short position on the company.

In response, MicroStrategy’s stock price fell sharply that evening, dropping over 21% from its daily high.

The following day, Michael Saylor appeared on CNBC to address the concerns, explaining that while the company profits from Bitcoin’s price volatility, it also uses “at-the-market” (ATM) offerings to leverage its position.

As long as Bitcoin continues to rise, Saylor emphasized, the company will continue to generate profits.

(Source: X)

IMPLICATIONS OF MICROSTRATEGY’S NASDAQ 100 INCLUSION

For a “Bitcoin treasury company” that once faced existential risk, MicroStrategy’s inclusion in the Nasdaq 100 (NDX) is a stunning achievement. This milestone means that MicroStrategy will now benefit from a continuous flow of investment from passive investors tracking the Nasdaq 100 index.

Popular ETFs that track the index, such as Invesco QQQ Trust Series ETF with $300 billion in assets under management (AUM), will need to rebalance their holdings to include a weighted allocation of MicroStrategy.

However, MicroStrategy’s balance sheet is now almost entirely composed of Bitcoin. As Jeff Park, Head of Alpha Strategies at Bitwise Investment, said, “All of you own Bitcoin now, whether you know it or not, planned to or not, like it or not.”

Moreover, some analysts speculate that MicroStrategy may be included in the S&P 500 by 2025, further cementing its position within the broader financial system.

This would significantly enhance its visibility and influence in global markets, and time will tell if this prediction materializes. It would also increase institutional participation in Bitcoin.

(Source: just ETF)

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!