KEYTAKEAWAYS

- The convergence of Web3 and AI is revolutionizing decentralized platforms, enabling smarter DeFi risk assessment and creating more immersive metaverse experiences.

- Bitcoin's potential adoption as a strategic reserve by major nations signals a shift toward multipolar monetary systems, accelerating global de-dollarization.

- Cross-chain technology and RWA tokenization are breaking down blockchain silos, democratizing access to high-value assets and fostering global DAO collaboration.

- KEY TAKEAWAYS

- 1. THE SYNERGY BETWEEN WEB3 AND AI

- 2. BITCOIN BECOMES A STRATEGIC ASSET

- 3. THE APPLICATION OF ZERO-KNOWLEDGE PROOF TECHNOLOGY

- 4. THE ARRIVAL OF BITCOIN SPOT ETFS

- 5. CROSS-CHAIN TECHNOLOGY BREAKING BLOCKCHAIN SILOS

- 6. STABLECOINS LEADING GLOBAL PAYMENTS

- 7. THE FUSION OF DEFI AND REAL-WORLD ASSETS

- HOPE AND CHALLENGES: THE JOURNEY AHEAD

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Explore the 7 transformative cryptocurrency trends of 2025, from Web3-AI synergy to real-world asset tokenization. Discover how Bitcoin’s strategic role, zero-knowledge proofs, and cross-chain innovations are reshaping digital finance.

In 2025, the cryptocurrency market is advancing toward a more mature and diversified phase. Whether through technological innovation or changes in the global financial system, these trends are having a profound impact on the industry and creating unprecedented opportunities.

In this outlook, we will delve into the seven major trends that are likely to shape the future, aiming to uncover the deeper implications and insights hidden within them.

1. THE SYNERGY BETWEEN WEB3 AND AI

The fusion of Web3 and Artificial Intelligence (AI) is an inevitable trend in technological development, but its potential extends beyond mere collaboration between the technologies.

AI can bring more intelligent user experiences to Web3, such as optimizing decentralized finance (DeFi) protocol risk assessments through AI or creating more immersive virtual environments in the metaverse. At the same time, Web3 ensures data security and authenticity through blockchain technology, providing AI with trustworthy data sources.

The deeper significance of this trend is that it may disrupt the current internet economy model dominated by centralized companies. In the future, users may be able to achieve more efficient resource allocation and decision-making support through AI-driven personalized services on fully decentralized platforms.

Also Read:

Polymarket Enhances User Experience with Perplexity AI Integration

OpenAI Warns of Potential Emotional Dependence on ChatGPT Voice Mode

2. BITCOIN BECOMES A STRATEGIC ASSET

Whether Bitcoin will be included as a strategic reserve by the G7 or BRICS countries may seem like a mere recognition of its asset properties on the surface, but its deeper significance lies in the reshuffling of the global monetary landscape.

Once sovereign nations begin to hold Bitcoin as a reserve, it will mean that their financial systems are partially stepping away from the dollar-dominated global settlement system, transitioning toward a more multipolar monetary arrangement.

This shift will not only encourage other countries to follow suit but may also lead to the relative depreciation of traditional reserve assets, such as gold.

Furthermore, this process could drive further de-dollarization in regional economies and accelerate the widespread adoption of digital currency payments internationally. This shift may become a major reshaping of the monetary system in the 21st century.

Also Read:

Why Have Nations Been Reluctant to Include Bitcoin in National Reserves?

3. THE APPLICATION OF ZERO-KNOWLEDGE PROOF TECHNOLOGY

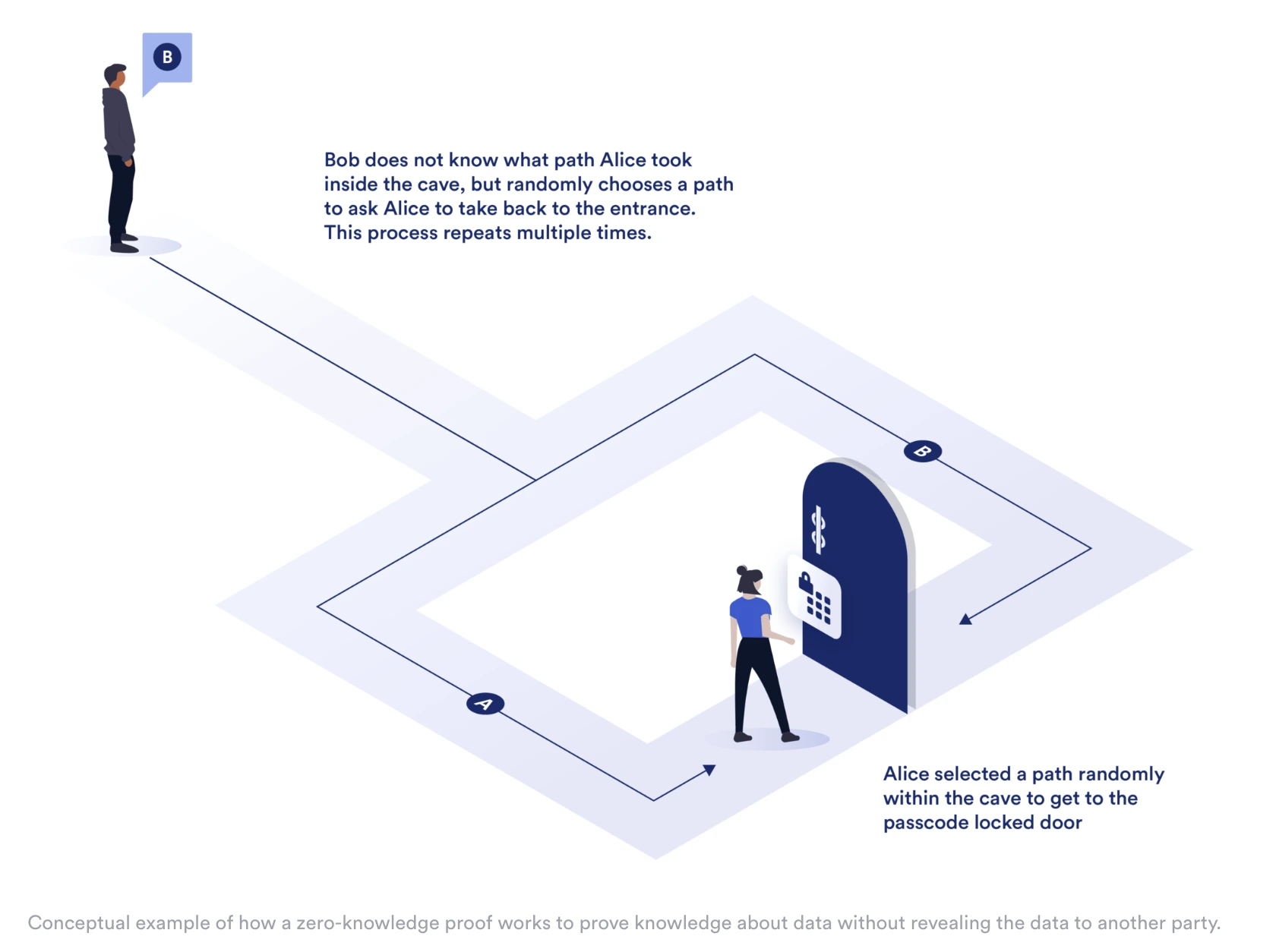

Zero-Knowledge Proof (ZKP) is a cryptographic technique that allows one party (the prover) to prove to another party (the verifier) that a statement is true without revealing any additional information.

In simple terms, ZKP allows you to prove the truth of a secret or information without directly exposing the information itself.

For example, in a typical application scenario, ZKP can be used in financial transactions. Suppose a user wants to prove that they have enough funds for a transaction but does not wish to disclose their account balance or other private information.

Through zero-knowledge proof, the user can demonstrate that they have sufficient funds without revealing the specific amount.

The key advantage of this technology is enhanced privacy protection, allowing sensitive data to remain secure while ensuring privacy. In the cryptocurrency space, ZKP enhances transaction privacy while maintaining transparency and helping the industry meet regulatory compliance requirements without violating privacy.

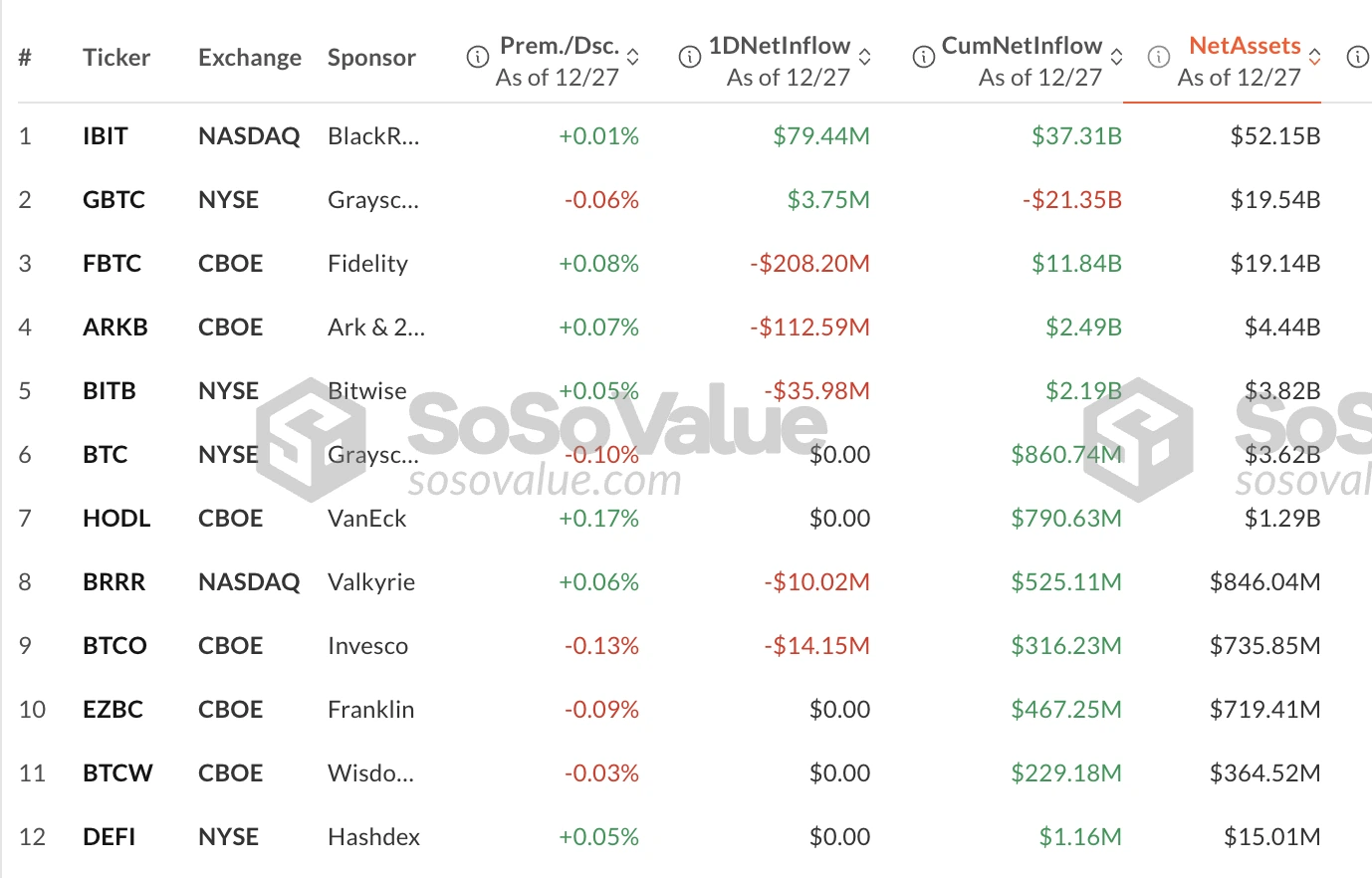

4. THE ARRIVAL OF BITCOIN SPOT ETFS

The approval of Bitcoin spot ETFs is not only an important gateway for institutional funds to enter the cryptocurrency market but also a significant step toward market stability.

The involvement of traditional financial institutions brings higher liquidity and lower market volatility. Additionally, these institutions’ research and operational capabilities may introduce more mature risk management strategies for crypto assets.

(Source: Sosovalue)

However, it is important to note that this trend could bring excessive influence from traditional financial thinking into the crypto market. For example, highly quantitative trading strategies may further compress market volatility, weakening the speculative nature of crypto assets.

While this change may be more user-friendly for ordinary investors, it may leave some market participants feeling uncomfortable.

Also Read:

ETFs Continue to Attract Capital

5. CROSS-CHAIN TECHNOLOGY BREAKING BLOCKCHAIN SILOS

Cross-chain interoperability is key to enabling true collaborative development within the blockchain ecosystem. By 2025, the maturity of this technology will not only allow seamless asset transfers between different blockchains but could also enable smart contracts to work together across multiple chains.

For example, a user could initiate a loan on Ethereum and simultaneously make a payment on Solana, all without complex intermediary operations.

The far-reaching impact of this technology is that it may further promote global collaboration within decentralized autonomous organizations (DAOs). Through cross-chain interoperability, DAOs will be able to integrate resources from multiple chains to form cross-regional, cross-industry collaboration networks.

This not only enhances the practical value of blockchain but also provides more possibilities for the transformation of traditional industries.

Also Read:

The 5 Best Cross-Chain Bridges for Breaking Blockchain Barriers

6. STABLECOINS LEADING GLOBAL PAYMENTS

Stablecoins are cryptocurrencies pegged to a stable asset, such as a fiat currency, gold, or another commodity, with their value fluctuations typically being much smaller.

This stands in contrast to the high volatility of cryptocurrencies like Bitcoin, and the main goal of stablecoins is to avoid significant price fluctuations, offering users a more stable store of value and means of exchange.

The significance and value of stablecoins lie in the following aspects:

Reducing Transaction Volatility

The value of stablecoins is typically tied to the US dollar or another fiat currency, making them less susceptible to market volatility. For cryptocurrency market users, stablecoins offer a hedge against volatility, especially during periods of significant market fluctuations, and allow them to avoid trading assets with large value swings.

Cross-Border Payments

Stablecoins can serve as a tool for cross-border payments, solving problems of high costs and low efficiency in traditional payment methods. By using stablecoins for payments, there is no need for intermediary banks, allowing for fast and low-cost international transfers.

Bridging the Cryptocurrency Market

Stablecoins play a crucial role in the cryptocurrency market, acting as intermediary currencies for transactions between various digital assets. For instance, trades between Bitcoin and Ethereum often involve stablecoins, which serve as a “bridge” in the market.

Financial Inclusion

Through blockchain technology, stablecoins provide more efficient and low-cost financial services to global users, especially to those who do not have access to traditional banking systems.

In areas without bank accounts, stablecoins offer a convenient financial tool for users to conduct digital payments, deposits, and even loans.

In summary, stablecoins not only provide a more stable trading medium for the cryptocurrency market but could also become a significant part of the global payment system, profoundly impacting the international financial landscape.

Also read:

The Rise of Stablecoins: A Game Changer in the World of Cryptocurrency

7. THE FUSION OF DEFI AND REAL-WORLD ASSETS

The tokenization of Real-World Assets (RWAs) may fundamentally alter the liquidity structure of traditional assets. For example, a high-value real estate property could be tokenized into thousands of smaller investment products, allowing ordinary investors to share in the profits of large assets.

This not only lowers investment barriers but also introduces new asset classes to DeFi, further expanding its scale and influence.

However, this trend also faces real-world challenges, such as the lack of legal frameworks and security concerns with technology. If these issues are effectively addressed in 2025, RWA tokenization could not only drive financial inclusion but also become a significant force in the digital transformation of the global economy.

Also Read:

Real-world Assets (RWA): Bridging Traditional And Defi Markets

HOPE AND CHALLENGES: THE JOURNEY AHEAD

2025 marks a critical turning point in the cryptocurrency market. While these trends present exciting prospects, uncertainties in the market remain. From regulatory pressures to technological risks, every step is filled with challenges.

However, it is precisely these challenges that strengthen the industry and pave the way for future development.

Perhaps, when we look back at this year, we will see it not only as a year of technological and market change but also as the beginning of a global economic and social transformation.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!