KEYTAKEAWAYS

- Fake mining pools promise high returns but lock funds. Avoid unknown projects and unrealistic returns advertised on social media.

- Fraudulent bots exploit smart contracts to steal funds. Verify tools and avoid depositing into unverified contracts.

- Fake airdrops lure users into phishing links or malware. Always verify sources and avoid clicking on suspicious links.

CONTENT

Discover the top 6 blockchain scams of 2024, from mining fraud to rug pulls. Learn how to spot these threats and protect your crypto assets effectively.

1. INTRODUCTION

In 2024, the blockchain industry experienced rapid growth, but with it came a surge in security challenges. Scammers and hackers exploited users’ desire for high returns and their lack of familiarity with blockchain technology, devising increasingly sophisticated fraud schemes.

This article delves into the top five scams of 2024, offering insights to help readers recognize these threats and enhance their security awareness.

2. MINING SCAMS: THE TRAP BEHIND HIGH RETURNS

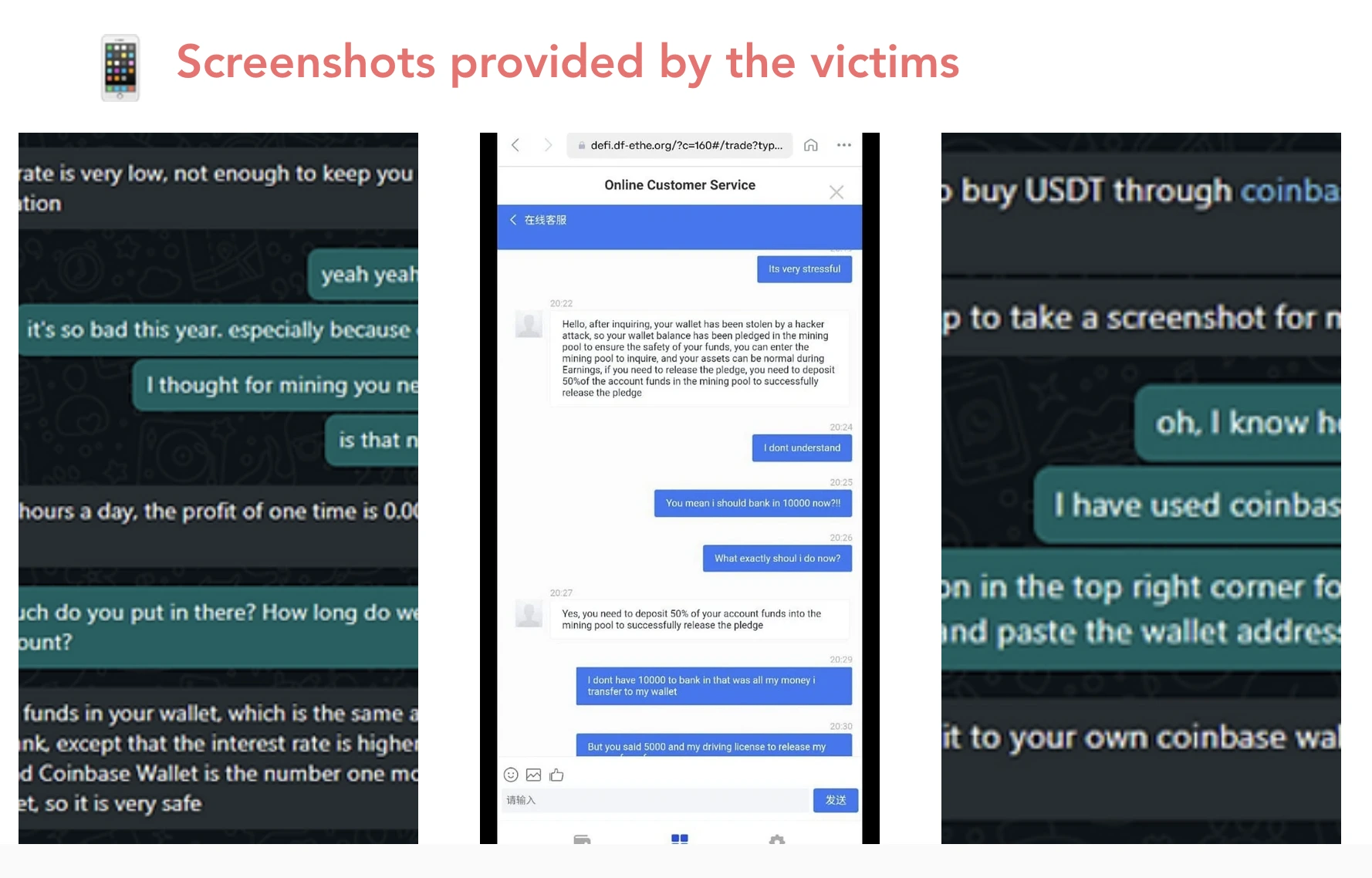

Mining scams were among the most prevalent frauds in the blockchain industry in 2024. Scammers often impersonated well-known exchanges or mining pools on platforms like Telegram and Discord, luring users into fake “mining groups” with promises of exceptionally high returns.

Once users deposited funds into these fraudulent “mining pools,” scammers would use various excuses—such as “system maintenance” or “additional funds needed to unlock profits”—to prevent withdrawals, ultimately absconding with the money.

To make the scam appear legitimate, scammers provided detailed tutorials, including steps on how to download wallets and transfer funds. Some even returned fake tokens as “profits” to entice users to invest more, only for users to realize too late that these tokens were worthless.

Case Study: In 2024, several Telegram groups were exposed as mining scams, with tens of thousands of members. However, most were fake accounts controlled by scammers, and genuine users found themselves unable to withdraw their funds.

Prevention Tips: Users should exercise caution when participating in mining projects from unknown sources and avoid falling for promises of unrealistically high returns, especially those advertised on social media.

3. ARBITRAGE SCAMS: AI-POWERED DECEPTION

As AI technology gained popularity, scammers began using tools like ChatGPT to create fake arbitrage bots, tricking users into depositing funds into malicious smart contracts.

These scammers claimed their bots could monitor market arbitrage opportunities and generate profits automatically. Users were required to deposit funds into the provided contracts, with the promise that larger deposits would yield higher returns.

However, once funds were deposited, scammers exploited backdoors in the contracts to transfer the money to their own wallets, leaving users with no way to recover their assets. These scams were widely promoted on social media, attracting numerous victims. While individual losses were often small, the cumulative gains for scammers were substantial.

Case Study: In 2024, many users encountered so-called “AI arbitrage bots” on social media. After depositing ETH, their funds were immediately transferred to scammer-controlled addresses, resulting in losses ranging from hundreds to thousands of dollars.

Prevention Tips: Users should be wary of unverified automated trading tools and avoid depositing funds into unknown contracts, especially those claiming to generate high returns through AI.

4. AIRDROP SCAMS: THE LURE OF FREE TOKENS

Airdrop scams exploited users’ interest in free tokens by fabricating airdrop events to lure them into clicking phishing links or downloading malicious software.

Hackers often hijacked official project accounts on platforms like Twitter and Discord to post fake airdrop announcements, directing users to phishing websites where they were prompted to enter private keys or approve transactions.

Some scammers airdropped worthless tokens to users’ wallets, enticing them to interact with these tokens and thereby stealing assets or gas fees. Others tricked users into downloading malware that harvested sensitive information from their devices.

Case Study: In 2024, several high-profile projects had their official accounts hacked, leading to the dissemination of fake airdrop messages. Many users clicked on phishing links, resulting in significant asset losses.

Prevention Tips: Users should verify airdrop information carefully and avoid clicking on suspicious links or downloading software from untrusted sources, especially when encountering “free token” offers on social media.

5. ACCOUNT HIJACKING SCAMS: EXPLOITING CELEBRITY INFLUENCE

Account hijacking scams involved hackers taking over well-known accounts on platforms like Twitter and Instagram to post fraudulent messages, enticing users to click phishing links or purchase fake tokens. These attacks often targeted influential accounts to lend credibility to the scams.

Case Study:In 2024, the U.S. Securities and Exchange Commission (SEC) Twitter account was hacked, and a fake announcement about the approval of a Bitcoin ETF caused a temporary surge in Bitcoin’s price. Many users suffered losses as a result.

Prevention Tips: Users should approach investment advice on social media with caution, especially when it comes from high-profile accounts. Always verify the source of such information before taking any action.

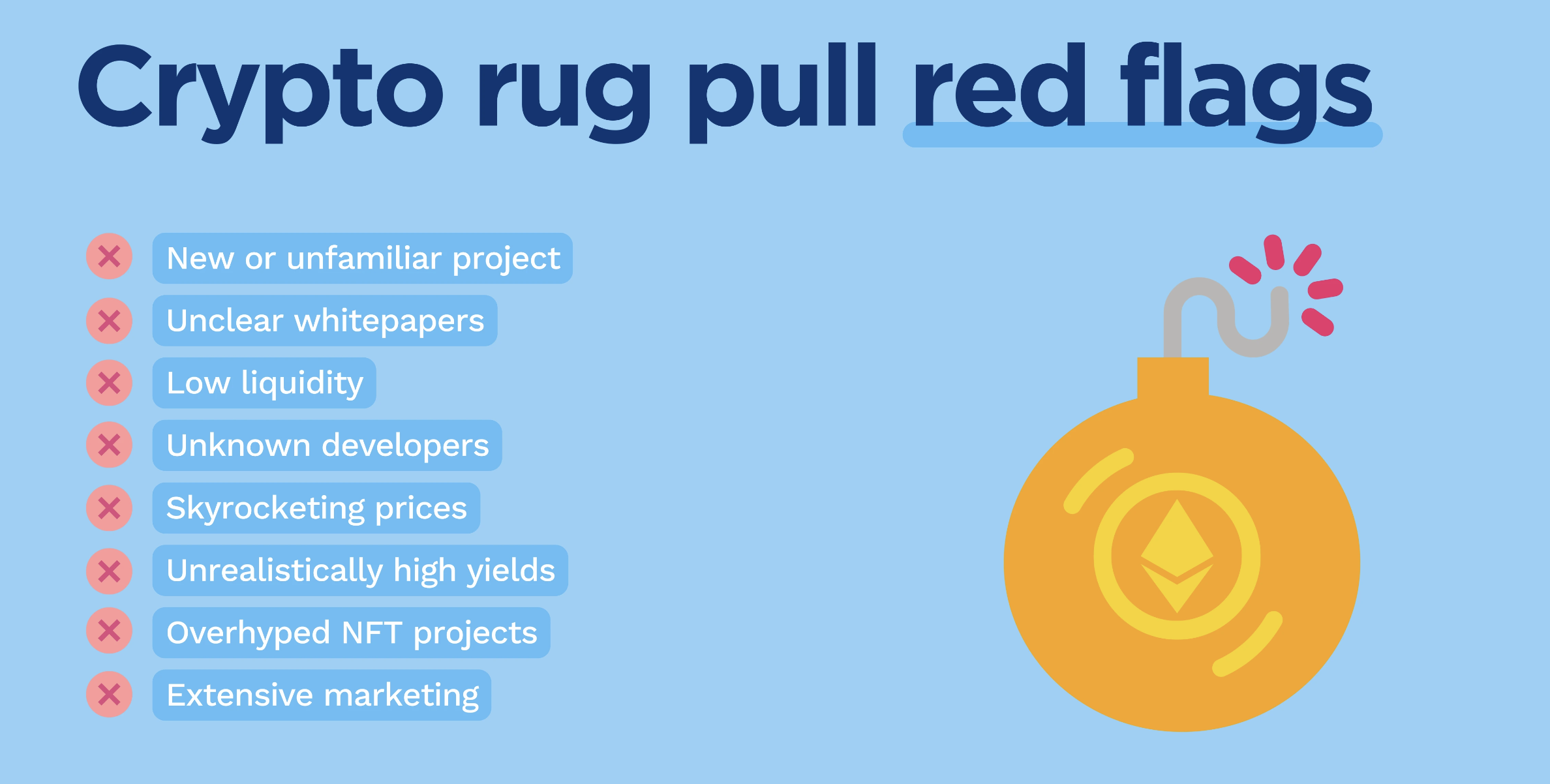

6. RUG PULLS: THE TRAP OF FAKE TOKENS

Rug pulls involved scammers creating fake tokens, promoting them as high-potential investments, and then locking users out of selling their holdings. These scammers would artificially inflate the token’s price, encouraging users to buy more, only to implement mechanisms—such as blacklisting addresses or imposing strict selling restrictions—that prevented users from cashing out.

Case Study: In 2024, several copycat projects gained traction on social media, attracting many users. However, when users attempted to sell their tokens, they found them locked, rendering their investments worthless.

Prevention Tips: Users should thoroughly check token contract addresses and avoid participating in projects from unknown sources, particularly those heavily promoted on social media as “high-potential” investments.

7. CONCLUSION

In 2024, the blockchain industry saw a proliferation of scams, including mining fraud, arbitrage scams, airdrop scams, account hijacking, and rug pulls. These schemes preyed on users’ desire for high returns and their lack of familiarity with blockchain technology, leading to significant financial losses.

Users must remain vigilant, avoid clicking on suspicious links, and refrain from downloading software from untrusted sources. As regulatory frameworks and technological advancements continue to evolve, the blockchain industry is moving toward a safer, more transparent, and compliant future.

With the gradual improvement of regulations and the continuous advancement of technology, we can expect the blockchain ecosystem to become more secure and trustworthy, better safeguarding user assets.

Also Read:

Top 5 Blockchain Security Incidents of 2024

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!