KEYTAKEAWAYS

- Binance introduces a maximum negative balance feature.

- Top 5 CEXs control 81% of the market share.

- Trump’s inauguration speech has a 32% chance of mentioning crypto.

CONTENT

BINANCE UNIFIED ACCOUNT ADDS MAXIMUM NEGATIVE BALANCE INFORMATION

Binance officially announced that starting from January 22, 2025, unified accounts will introduce a “Maximum Negative Balance” feature.

When a user’s negative balance in a specific asset exceeds the maximum negative balance limit for that asset, the system will automatically initiate a conversion process to repay the negative balance.

Analysis:

This change aims to strengthen risk management for user accounts and prevent excessive losses caused by market volatility or leveraged trading. It could particularly impact users engaging in high-risk trading, especially under extreme market conditions.

Users will need to pay closer attention to negative balances and manage risks prudently to avoid unnecessary losses triggered by automatic conversions. This policy adjustment reflects Binance’s ongoing efforts to enhance its risk control system, providing a safer trading environment for users.

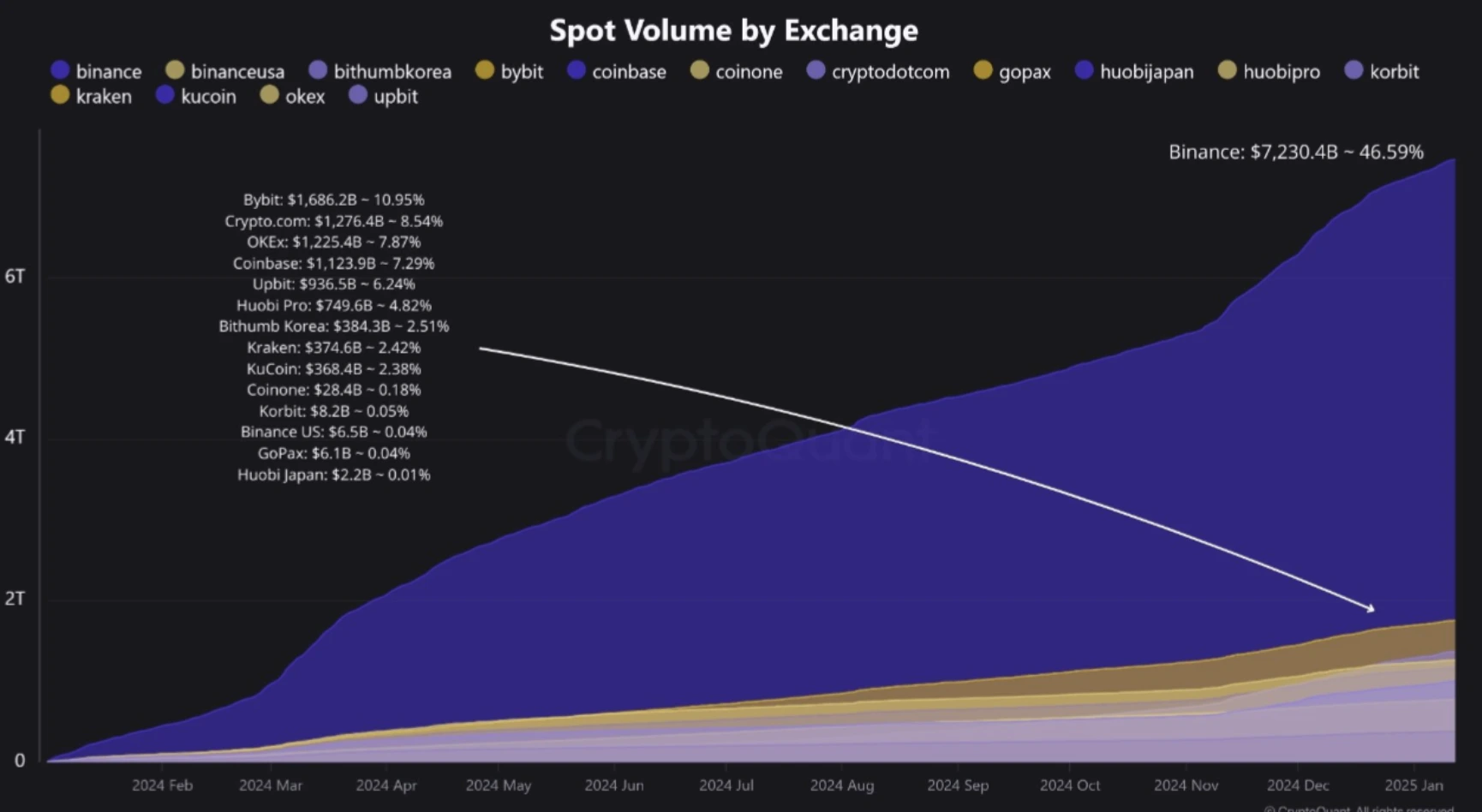

TOP 5 CEXs ACCOUNT FOR 81.24% OF THE MARKET SHARE

In 2024, the cryptocurrency market’s spot trading volume remained highly concentrated. Binance led the market with a trading volume of $7.23 trillion, capturing 46.59% of the market share.

The top 5 exchanges—Binance, Bybit, Crypto.com, OKEx, and Coinbase—collectively accounted for 81.24% of the market share. Medium-sized exchanges such as Upbit, Huobi, and Bithumb Korea contributed significantly but held less than 10% market share individually.

In contrast, smaller exchanges like Coinone, Korbit, and Binance US had market shares of less than 0.2%, exerting minimal influence on the overall market.

Analysis:

This market structure indicates that the cryptocurrency industry remains highly concentrated, with leading exchanges like Binance commanding a substantial portion of the market. This dominance highlights their advantages in liquidity, user base, and brand influence, giving them greater leverage during market fluctuations.

While medium-sized exchanges contribute notably, they face intense competition. The negligible market share of smaller exchanges underscores their limited influence in the industry. For investors, choosing platforms with higher market shares may offer more security, but it is also essential to monitor changes in risk management and compliance policies.

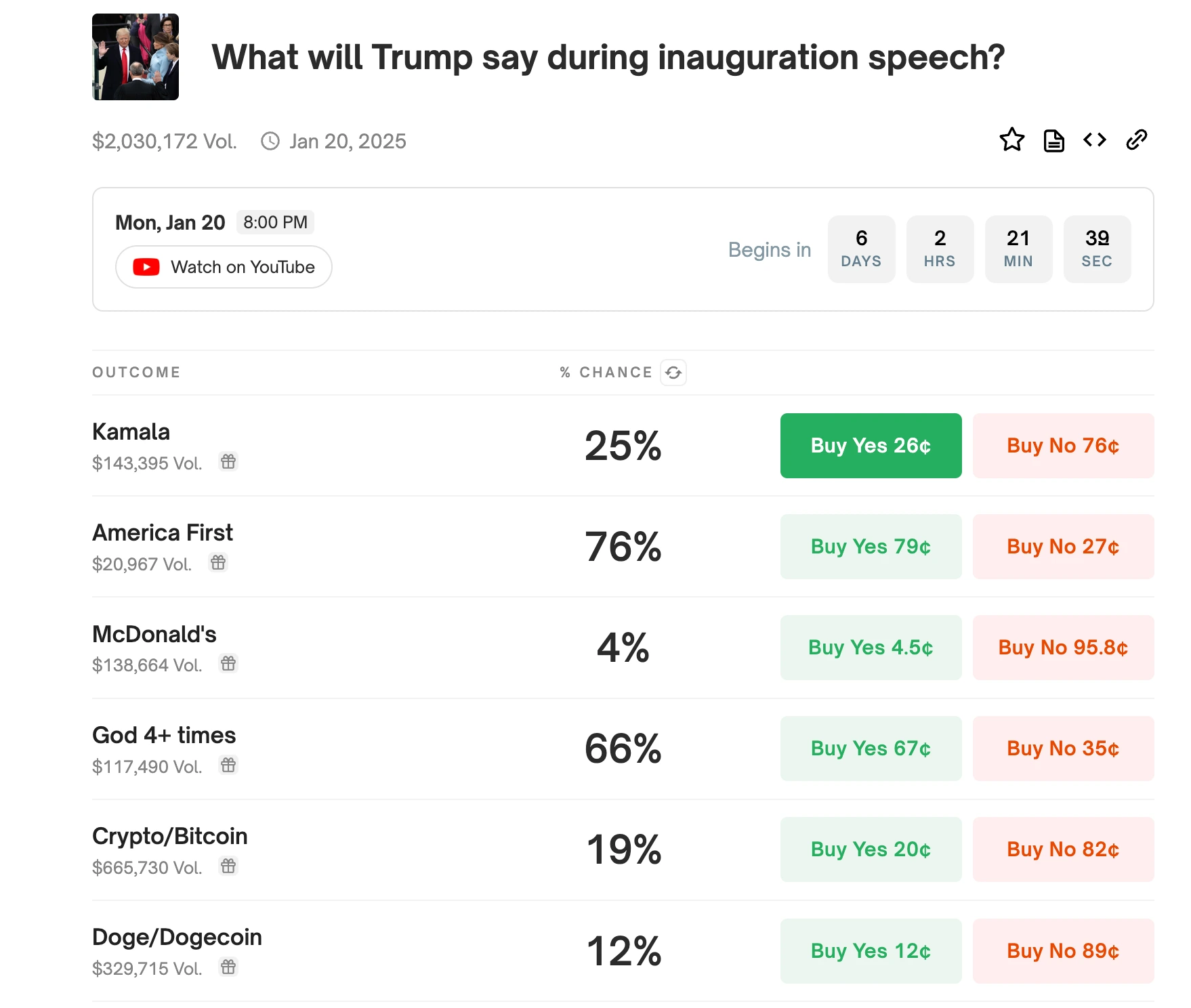

POLYMARKET PREDICTS A 19% PROBABILITY OF TRUMP MENTIONING CRYPTO IN INAUGURATION SPEECH

On the decentralized prediction market platform Polymarket, users have collectively wagered over $930,000 on whether Trump will mention specific cryptocurrency-related keywords during his inauguration speech on January 20.

Of this amount, approximately $610,000 was wagered on Trump mentioning cryptocurrency or Bitcoin, while about $320,000 was wagered on him mentioning Doge/Dogecoin. The probability for mentioning cryptocurrency or Bitcoin stands at 19%, while Doge/Dogecoin has a probability of 12%.

Analysis:

The growing presence of cryptocurrency in mainstream political discourse, particularly in Trump’s speeches, has become a focal point for the market. The bets on whether Trump will mention cryptocurrencies reflect the market’s sensitivity to potential policy changes and its high level of interest in the future direction of the crypto industry.

The focus on Bitcoin and Doge in the wagers further illustrates the prominence of these assets among investors. Although the prediction probabilities are relatively low, the phenomenon itself provides valuable market signals, indicating an increasing level of mainstream acceptance of cryptocurrencies.

Also Read:

CoinRank Crypto Digest: January 13, 2025

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!