KEYTAKEAWAYS

- RedStone Oracle Deploys to 70 Blockchains

- IOST Announces Token Total Supply Will Double to 42.64 Billion

- Over 1.16 Billion Stablecoins Issued on Tron and Ethereum Mainnet in Past 7 Days

CONTENT

Welcome to CoinRank Daily Data Report. RedStone Oracle Deploys to 70 Blockchains. IOST Announces Token Total Supply Will Double to 42.64 Billion.Over 1.16 Billion Stablecoins Issued on Tron and Ethereum Mainnet in Past 7 Days.

REDSTONE ORACLE DEPLOYS TO 70 BLOCKCHAINS

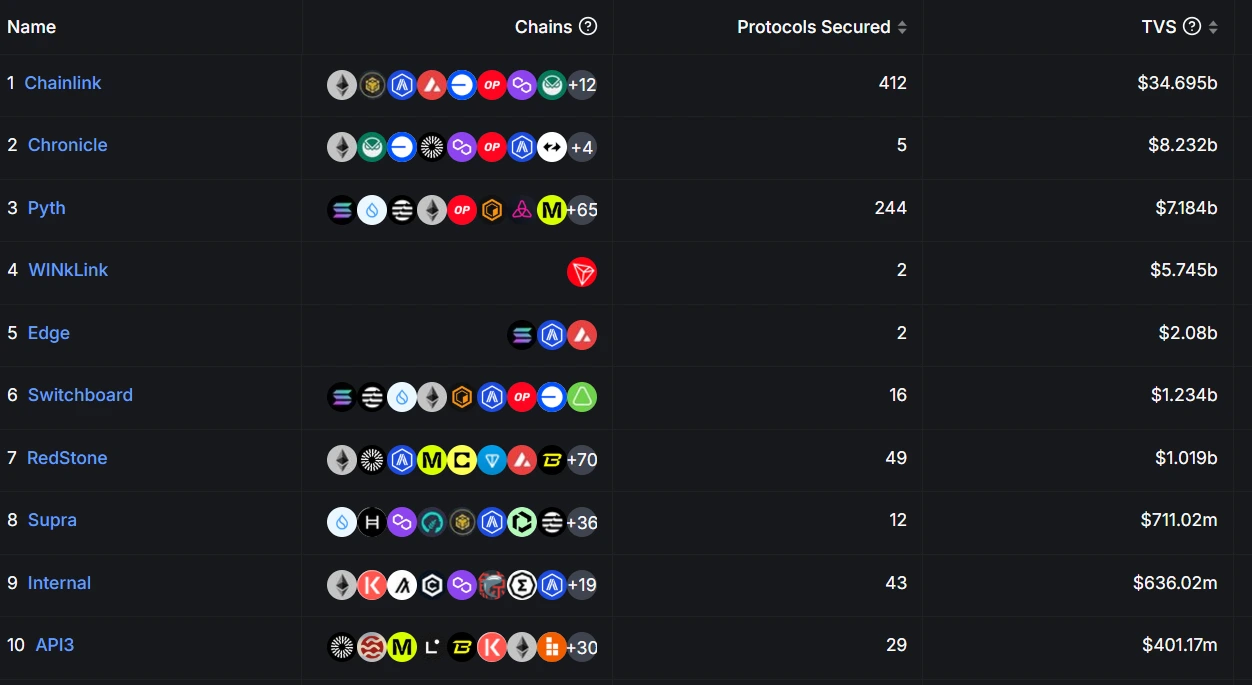

According to DefiLlama data, RedStone Oracle has been deployed to 70 blockchains. Pyth ranks second in terms of blockchain deployments, successfully deploying to 65 chains. Chainlink has deployed to 12 blockchains and supports 412 protocols. Chronicle has deployed to 3 blockchains, but its TVL reaches $8.232b, ranking second in the oracle sector.

Source: DefiLlama

Analysis:

Oracle projects are entering into multi-chain competition, significantly improving the security of DeFi protocols. Oracles are data interoperability services that build bridges between blockchains and the external world. Through oracles, off-chain data can be transmitted into blockchain networks for use by smart contracts; similarly, on-chain data can be sent to off-chain clients, allowing them to take actions based on blockchain information. Major market oracles including Chainlink and Pyth have launched multi-chain deployment services, contributing to the security of DeFi services and data objectivity.

IOST ANNOUNCES TOKEN TOTAL SUPPLY WILL DOUBLE TO 42.64 BILLION

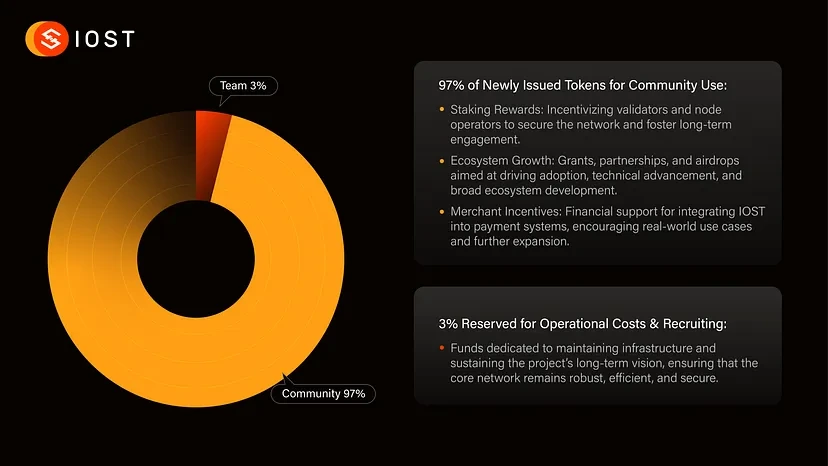

IOST announced that their brand remodeling vote has passed. After implementing this plan, the total supply will increase from the initial 21.32 billion IOST to a final 42.64 billion IOST over 60 months. 97% of the new supply will be allocated to the community. Regarding circulating supply, it will increase by 474,073,888 IOST (2.22%) one month after the brand remodeling is completed.

Meanwhile, to maintain a healthy economic balance and introduce deflationary factors, IOST has implemented four interconnected token burning mechanisms: Transaction Fee Burning, Node MEV Burning, Ecosystem-Based Burning, and DAO-Initiated Burning.

Source: IOST

Analysis:

The adjustment to IOST’s tokenomics lays the foundation for a more flexible, community-centric, and value-driven ecosystem. By prioritizing sustainable incentives and deflationary controls, IOST aims to create an environment where collective innovation thrives, market confidence strengthens, and long-term value accumulates naturally.

IOST officials state that their goal is to establish a lasting foundation ensuring meaningful, sustainable value for all ecosystem participants. IOST is beginning to emphasize building a community-driven and scalable ecosystem supported by sustainable innovation and DeFi principles.

OVER 1.16 BILLION STABLECOINS ISSUED ON TRON AND ETHEREUM MAINNET IN PAST 7 DAYS

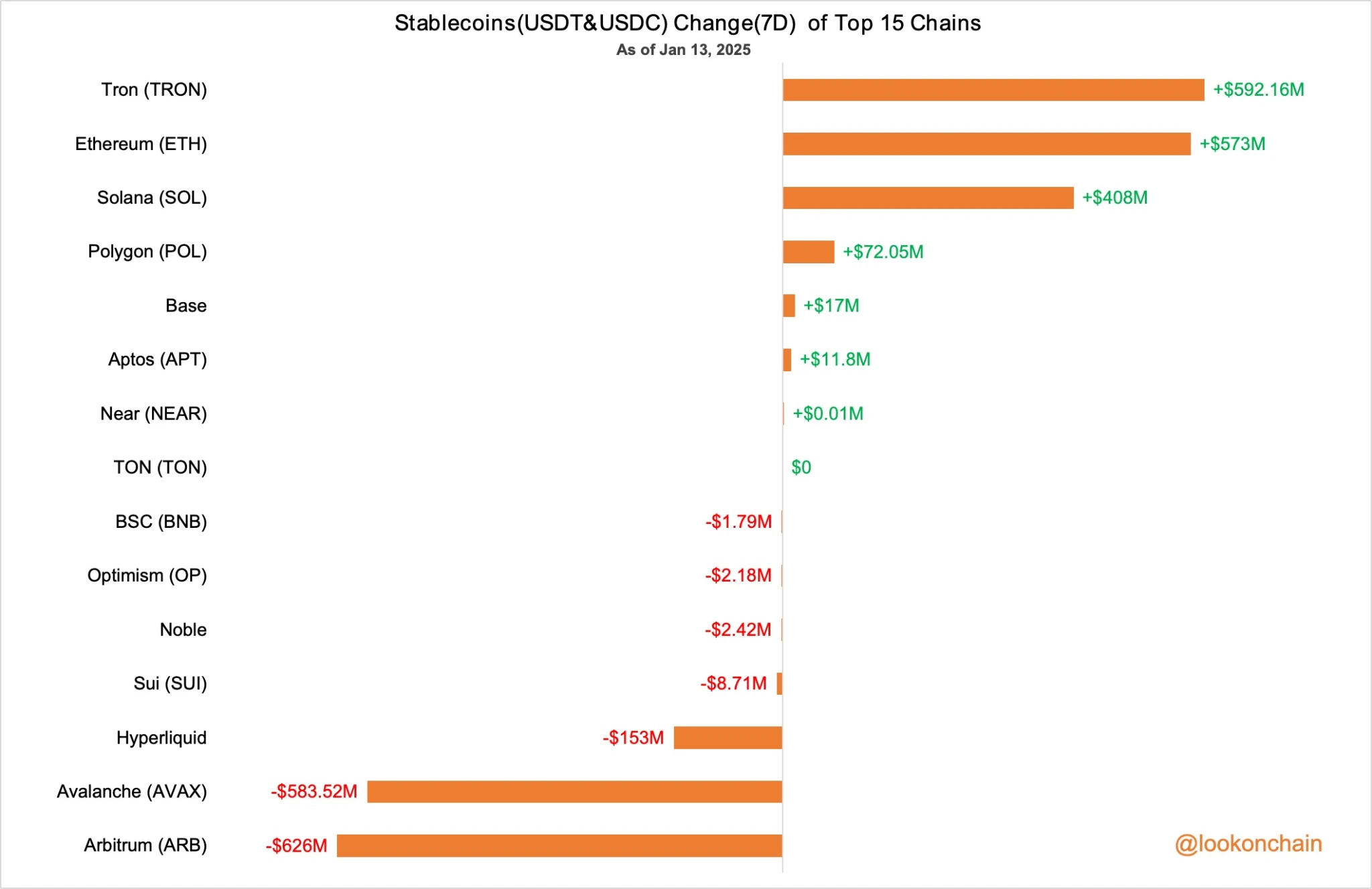

According to Lookonchain monitoring, over the past 7 days, stablecoin (USDT and USDC) issuance increased by 592 million on the Tron Network and 573 million on the Ethereum mainnet. Solana chain ranked third with a stablecoin (USDT and USDC) increase of 508 million. Additionally, various amounts of stablecoins were issued on chains including Near, Base, and Aptos. Meanwhile, significant amounts of stablecoins were burned on the Avalanche (AVAX) and Arbitrum (ARB) chains.

Source: LookChain

Analysis:

The mechanisms for issuing and burning stablecoins on public chains are typically closely tied to their economic models, market demand regulation, and ecosystem development needs. Stablecoin issuance is a means for public chains to provide liquidity to users within their ecosystems, and multi-chain stablecoin issuance to some extent reflects current active Web3 financial behavior.

Stablecoin supply adjustment has become a tool for public chains to maintain economic model balance. The core objectives of public chains issuing and burning stablecoins are to maintain market stability, support ecosystem development, and improve user experience. This mechanism requires careful design and balance to avoid excessive issuance leading to inflation or insufficient burning causing price volatility, ultimately achieving long-term healthy ecosystem development.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!