KEYTAKEAWAYS

-

Uniswap's Market Share Falls to 21.85% by End of 2024

-

Raydium Captures 24% of DEX Market Share

-

Solana blockchain's high performance and user ecosystem are key to Raydium's success

CONTENT

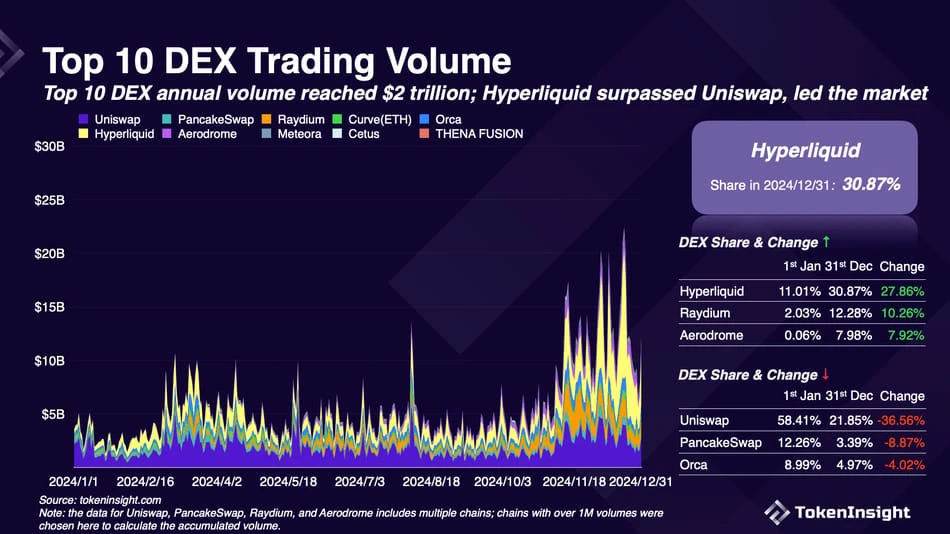

According to TokenInsight’s “Cryptocurrency Exchange Annual Report 2024” released on January 15th, decentralized exchanges (DEX) underwent a reshuffle in 2024, with Hyperliquid and Raydium’s market share surpassing that of Uniswap.

UNISWAP’S MARKET SHARE FALLS TO 21.85% BY END OF 2024

Traditional DEXs like Uniswap and PancakeSwap struggled throughout 2024. Under strong competition from Raydium and Hyperliquid, Uniswap’s market share dropped to 21.85%, losing its long-held market leadership position. PancakeSwap performed equally poorly, with its market share dramatically declining by approximately 8.9% to just 3.39%.

Source: Tokeninsight

In November 2024, Hyperliquid announced the launch of its native token, emerging as a standout among new DEXs during the bull market. Just one month later, Hyperliquid’s daily trading volume surpassed both Raydium and the long-dominant Uniswap, quickly rising to become the best-performing DEX. By year-end, Hyperliquid’s market share reached 30.87%, showing a substantial increase of 27.86% from the beginning of the year, making it the most noteworthy rising star of the year.

This major shift in market dynamics demonstrates that emerging DEXs are challenging traditional leaders’ positions through innovative tokenomics and efficient user experiences. As the Solana ecosystem rapidly develops and more new platforms emerge, competition in the DEX market is expected to become even more intense in the future.

In the fourth quarter, most emerging DEX tokens outperformed traditional ones. RAY and CETUS, the largest DEX tokens in the Solana and Sui ecosystems respectively, showed stronger performance than UNI, CAKE, and CRV. HYPE surged 300% within a month of its launch. AERO and THE achieved even more impressive returns, with THE rising 500% and AERO soaring over 2000%. In contrast, traditional DEX tokens like UNI and CAKE underperformed, failing to match Bitcoin’s growth rate.

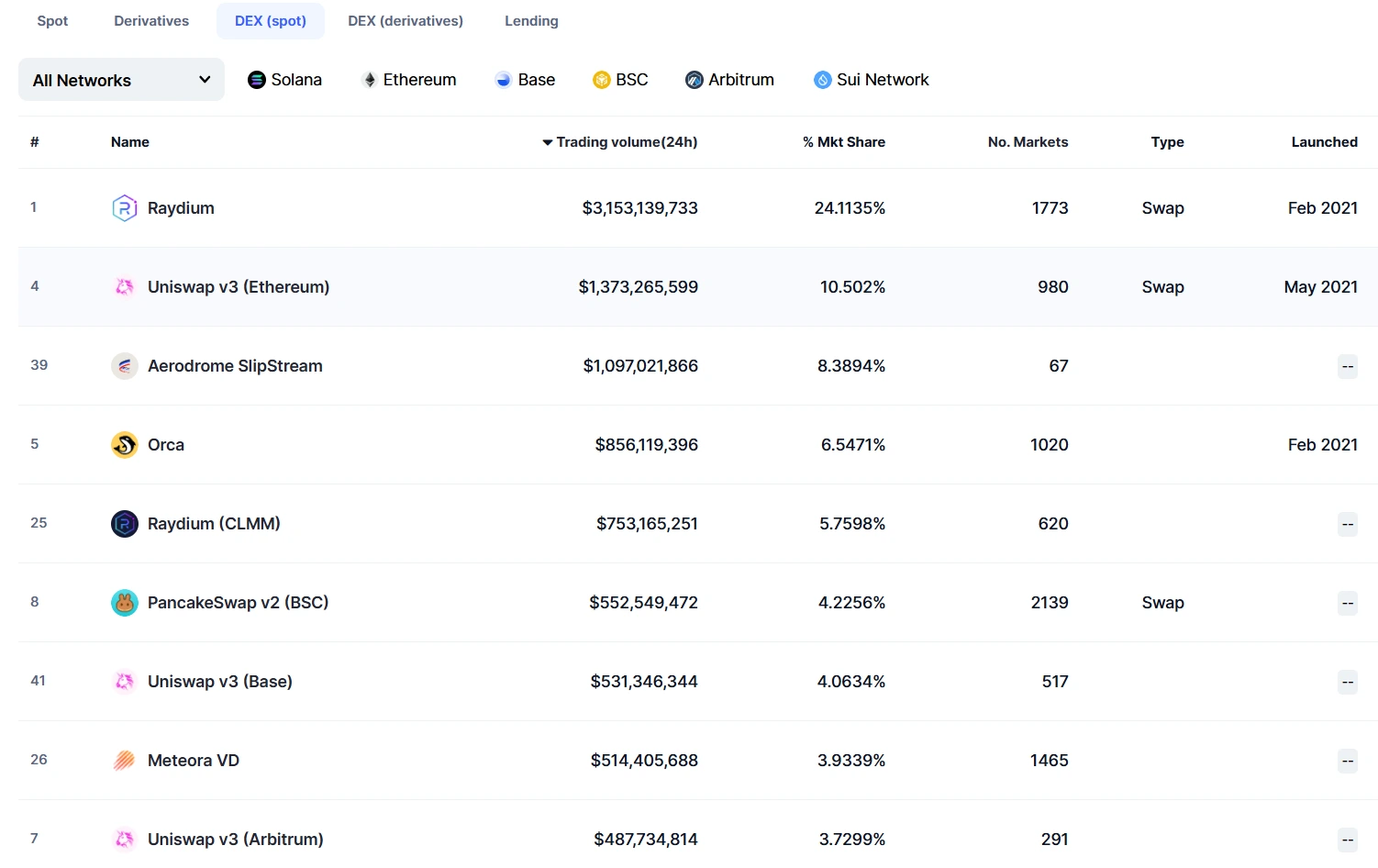

RAYDIUM CAPTURES 24% OF DEX MARKET SHARE

According to Coinmarketcap data platform, on January 16th, Raydium’s daily trading volume reached $3,153,139,733, accounting for 24% of the DEX market share. It significantly leads other DEX platforms in token trading pairs, offering 1,773 pairs.

Source: CoinMarketCap

Raydium is a decentralized exchange and automated market maker built on the Solana blockchain. Launched in 2021 within Solana’s high-performance blockchain ecosystem, Raydium has attracted significant attention from cryptocurrency investors. It combines its own liquidity pools with Solana’s central limit order book. This pioneering hybrid automated market maker model provides a unique trading experience. The model enables more flexible and efficient trading operations. For investors, this unique design is a key reason for choosing Raydium.

Compared to mainstream decentralized exchanges, Raydium holds a significant advantage in efficiency due to its underlying Solana blockchain architecture. For instance, while other platforms are still busy processing slow transactions, Raydium can complete trades rapidly. This represents a crucial competitive advantage in the cryptocurrency market where changes can occur in an instant.

SOLANA’S HIGH CHAIN PERFORMANCE AND ECOSYSTEM USERS EMPOWERED RAYDIUM’S SUCCESS

In the rapidly evolving decentralized exchange (DEX) market, technological innovation is the core driver for maintaining competitiveness. Efficient trading speed and low-cost transactions attract more users, and Raydium’s use of the efficient Solana blockchain network is a key factor in its success. Additionally, DEX support for cross-chain trading can broaden user choices by facilitating liquidity sharing between different blockchain ecosystems.

User experience is equally crucial in determining a DEX’s success or failure. The three main user demands for DEXs are: optimal pricing, fast transactions, and minimal costs. User satisfaction can be improved by optimizing trading processes, reducing transaction fees, and minimizing slippage. Furthermore, simplifying user interfaces and providing intuitive operational processes are important means of enhancing user experience.

Finally, DEXs must focus on community building and ecosystem integration to achieve long-term development. User loyalty and trust can be enhanced through token incentives, decentralized governance, and continuous user interaction. Deep collaboration with Layer 1 or Layer 2 networks, integration of liquidity staking, and data analysis tools can help build a stronger ecosystem, laying the foundation for a DEX’s competitiveness.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!