KEYTAKEAWAYS

- The Korea Premium Index serves as a vital sentiment indicator for retail activity, with premiums above 16% potentially signaling market peaks or FOMO behavior in the Korean market.

- Miners' Position Index (MPI) tracks miner behavior through outflow patterns; negative values suggest miners are holding Bitcoin, while increasing trends indicate potential selling pressure.

- Exchange Supply Ratio and Whale Ratio work together to monitor market concentration and investor sentiment, with decreasing exchange supplies typically suggesting bullish long-term outlook.

CONTENT

Explore key cryptocurrency market indicators across four major player groups. From Korea Premium Index to Miners Position Index (MPI), learn how to interpret market signals for smarter trading decisions.

MARKET OVERVIEW

The crypto market operates 24/7, with a constant flow of news and updates. Every market fluctuation is accompanied by extreme shifts in investor sentiment, ranging from the euphoria of “the bull market is back” to the panic of “the bear market is here.” These emotional swings have a significant impact on investors’ mindsets. In such an unpredictable market, effective indicators are crucial. This article will explore key indicators tailored for four specific groups, providing deeper insights into the market.

RETAIL INSIGHT: THE KOREA PREMIUM

Retail investors have always been significant participants in the cryptocurrency market, with their sentiment and behavior often serving as a quick reflection of the overall market mood.

-

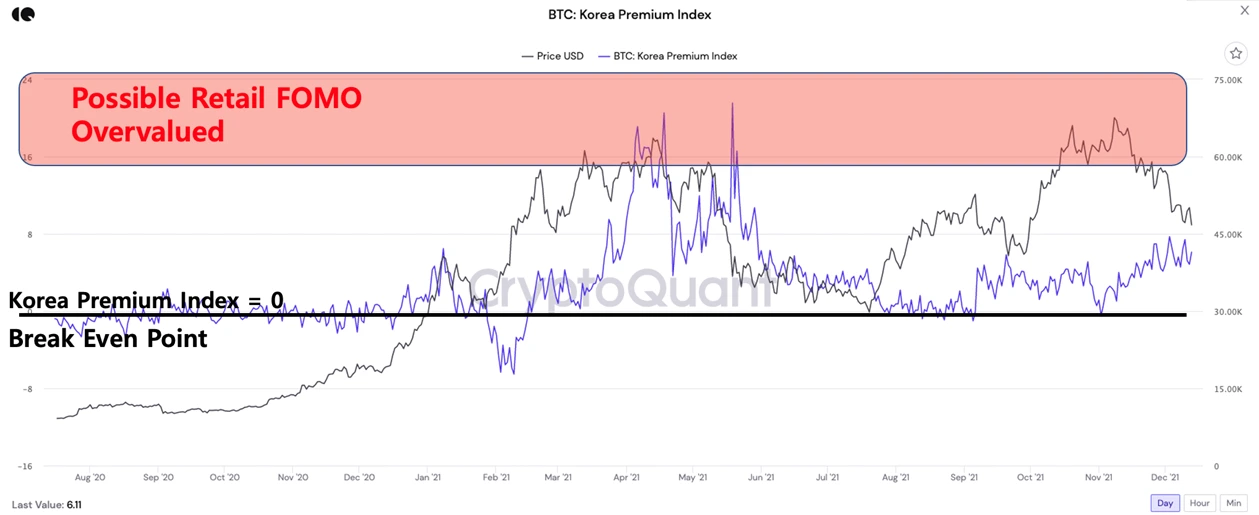

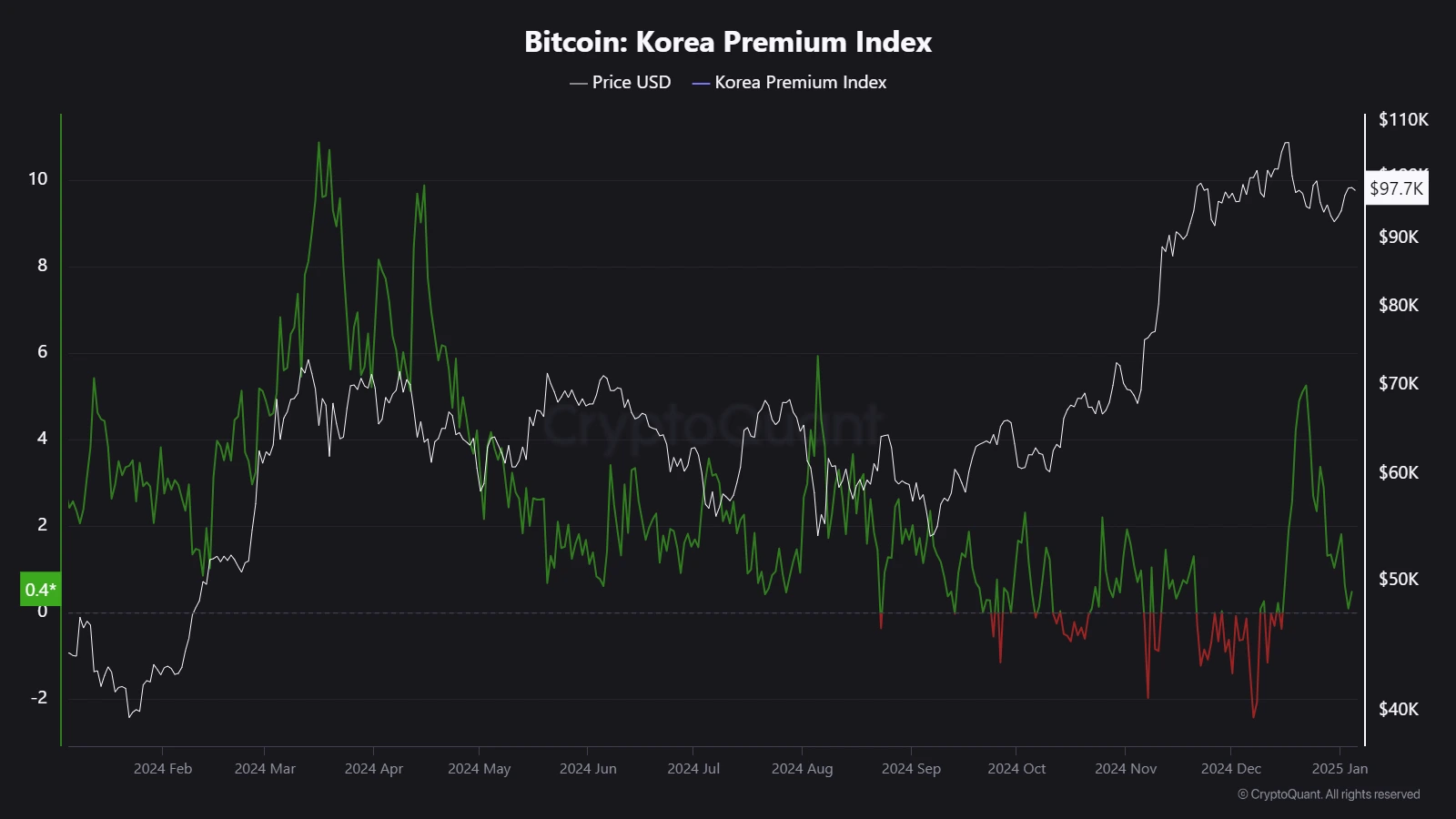

Bitcoin: Korea Premium Index

The Korea Premium Index measures the percentage difference between the market price of Korean exchanges and other exchanges. The Korean cryptocurrency market is primarily driven by retail investors. Utilizing this unique market structure, the Korean Premium Index indicates the closest meaning to the retailers’ sentiment and buying power or particularly Korean market buying power. Historically, a premium exceeding 16% in Korea has signaled either a local price peak or the presence of Fear of Missing Out (FOMO) in the market.

(Source: CryptoQuant)

How to use the Korea Premium Index:

- By Value

– Above 0: Koreans are willing to pay a premium for the purchase.

– Below 0: Koreans are only willing to purchase at a discount.

- By Trend

– Increasing Trend: More retail investors are continuously purchasing at higher prices than the average market price, expanding interest and activity.

– Decreasing Trend: Retail investors are continuously selling at lower prices than the average market price, diminishing interest and activity.

(Source: CryptoQuant)

MINING METRICS: MINER BEHAVIOR

Miners are one of the largest sellers in the cryptocurrency market. They are highly sensitive to Bitcoin prices, as their profitability is directly impacted by the price. Miners regularly sell a portion of their mining rewards to cover operational costs such as electricity bills and equipment maintenance. Therefore, miner trading behavior can be considered a leading indicator of the market, potentially signaling upcoming price fluctuations.

-

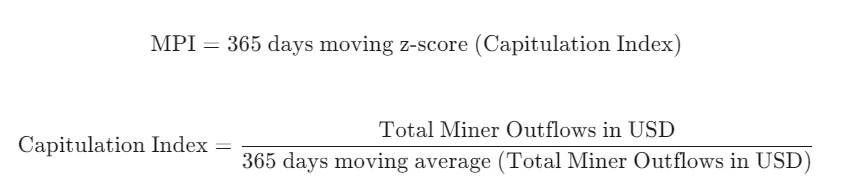

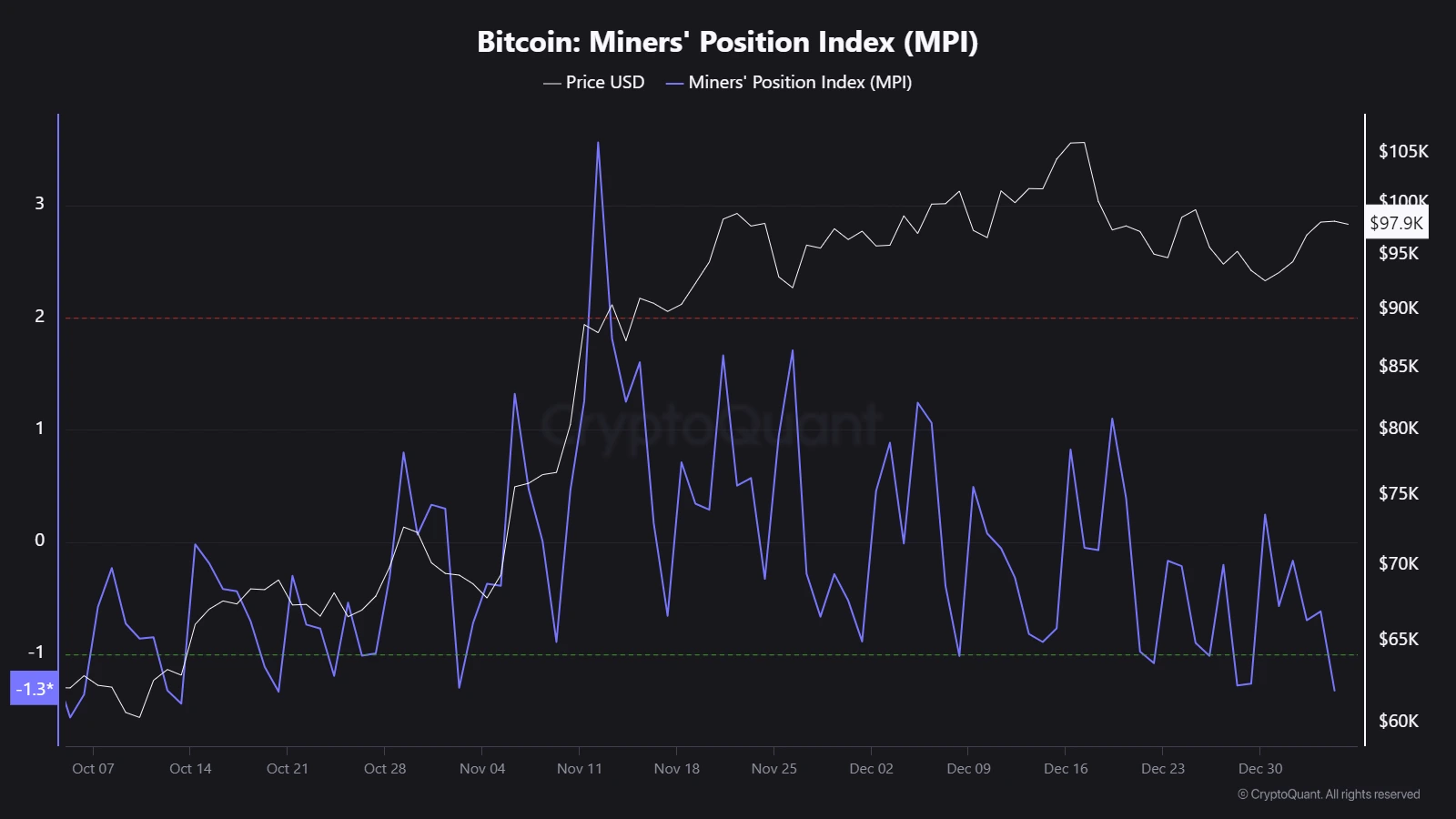

Miners’ Position Index (MPI)

The Miners’ Position Index (MPI) is an indicator used to observe miners’ behavior. It evaluates the relationship between the amount of Bitcoin mined over the past year and its corresponding moving average over the same period. MPI is the ratio of total miner outflow (USD) to the one-year moving average of total miner outflow (USD). Please see the detailed calculation formula in the picture below. MPI helps investors assess the ebb and flow of mined Bitcoin, taking into account market dynamics, transaction costs, and the overall health of the network.

(Source: CryptoQuant)

According to CryptoQuant data, the MPI went from 0.89 around the time of the U.S. presidential election, since then it has increased to 3.56, and has since been on a downward trend, currently standing at -1.32. A negative value indicates that miners are trying to avoid selling their newly mined Bitcoin and are opting to hold instead.

(Source: CryptoQuant)

How to use the MPI:

- Increasing Trend: This indicates that miners are becoming more active in selling Bitcoin, which usually suggests that they are satisfied with the current market price or believe that future prices may not rise further, leading to increased selling pressure. When the MPI continues to rise to higher levels, it may signal that the market is approaching its peak, serving as a bearish signal.

- Decreasing Trend: This suggests that miners are reducing their selling activity, often implying that they are dissatisfied with the current price and expect future prices to rise. This behavior reduces market selling pressure, creating favorable conditions for Bitcoin price increases. When the MPI continues to decline to lower levels, it may signal that the market is approaching its bottom, acting as a bullish signal.

EXCHANGE FLOW: SUPPLY DYNAMICS

Exchanges act as a crucial bridge, connecting users, assets, and markets within the cryptocurrency ecosystem. Exchanges are the initial point of contact for many newcomers to the crypto industry. By offering a trading platform, they inject liquidity into the crypto market.

-

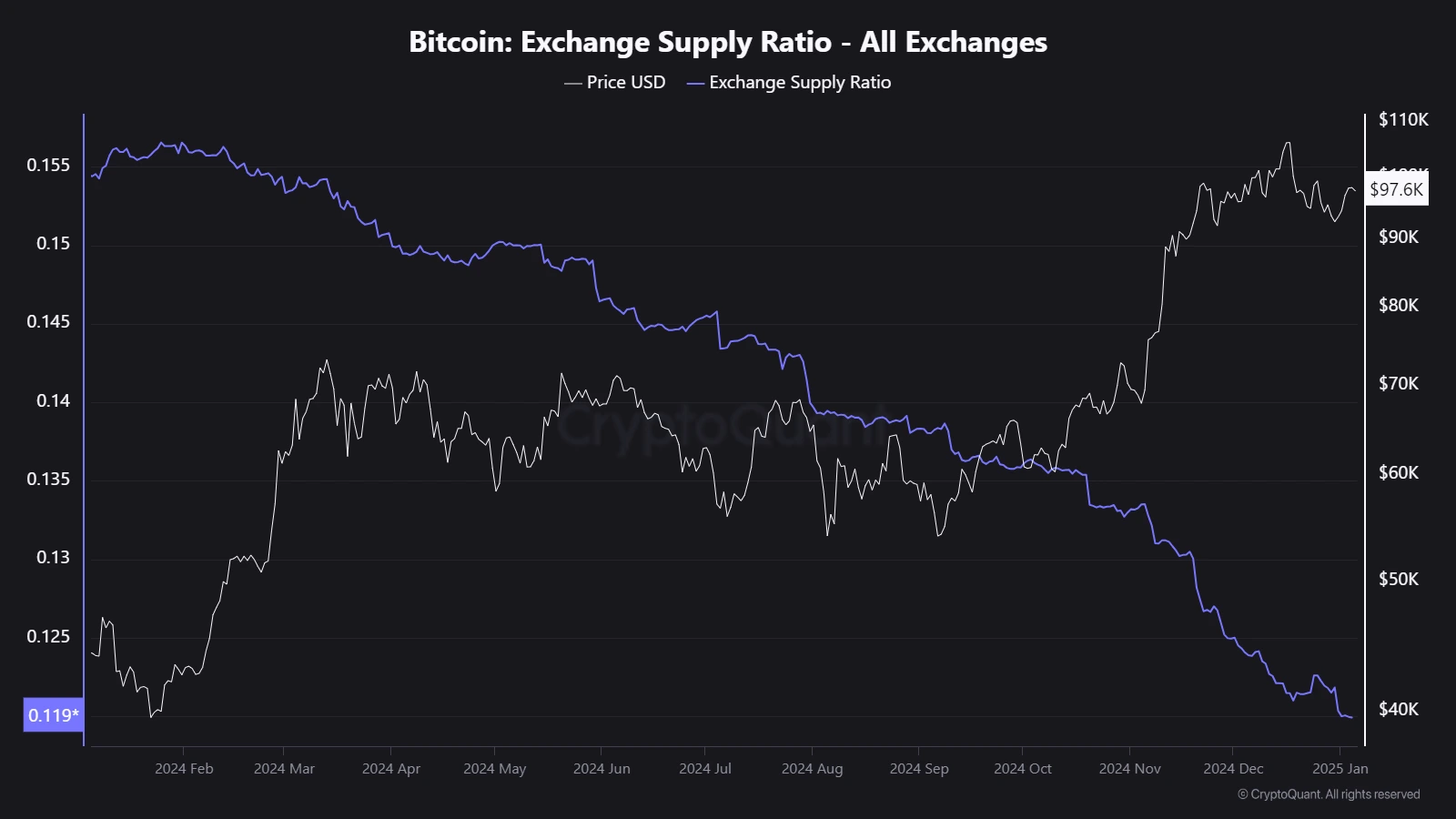

Bitcoin: Exchange Supply Ratio

The Exchange Supply Ratio is calculated as the exchange reserve divided by the total supply. It is an indicator that measures the relationship between the proportion of Bitcoin reserved in exchange wallets and the total circulating supply. This ratio can provide investors with insights into market sentiment.

(Source: CryptoQuant)

How to use the Exchange Supply Ratio:

- Increasing Trend: This Indicates that investors are depositing Bitcoin into exchanges in preparation for trading or selling, which could signal a bearish market sentiment.

- Decreasing Trend: This indicates that more Bitcoin is being transferred from exchanges to personal wallets or cold storage. This typically suggests that investors are inclined to hold Bitcoin for the long term, with market sentiment leaning toward a bullish outlook.

WHALE SIGNALS: MARKET MOVERS

Whales refer to individuals or entities that hold a substantial amount of cryptocurrency. They play a complex role in the crypto market, providing liquidity and stability while also introducing risks related to market manipulation and concentration.

-

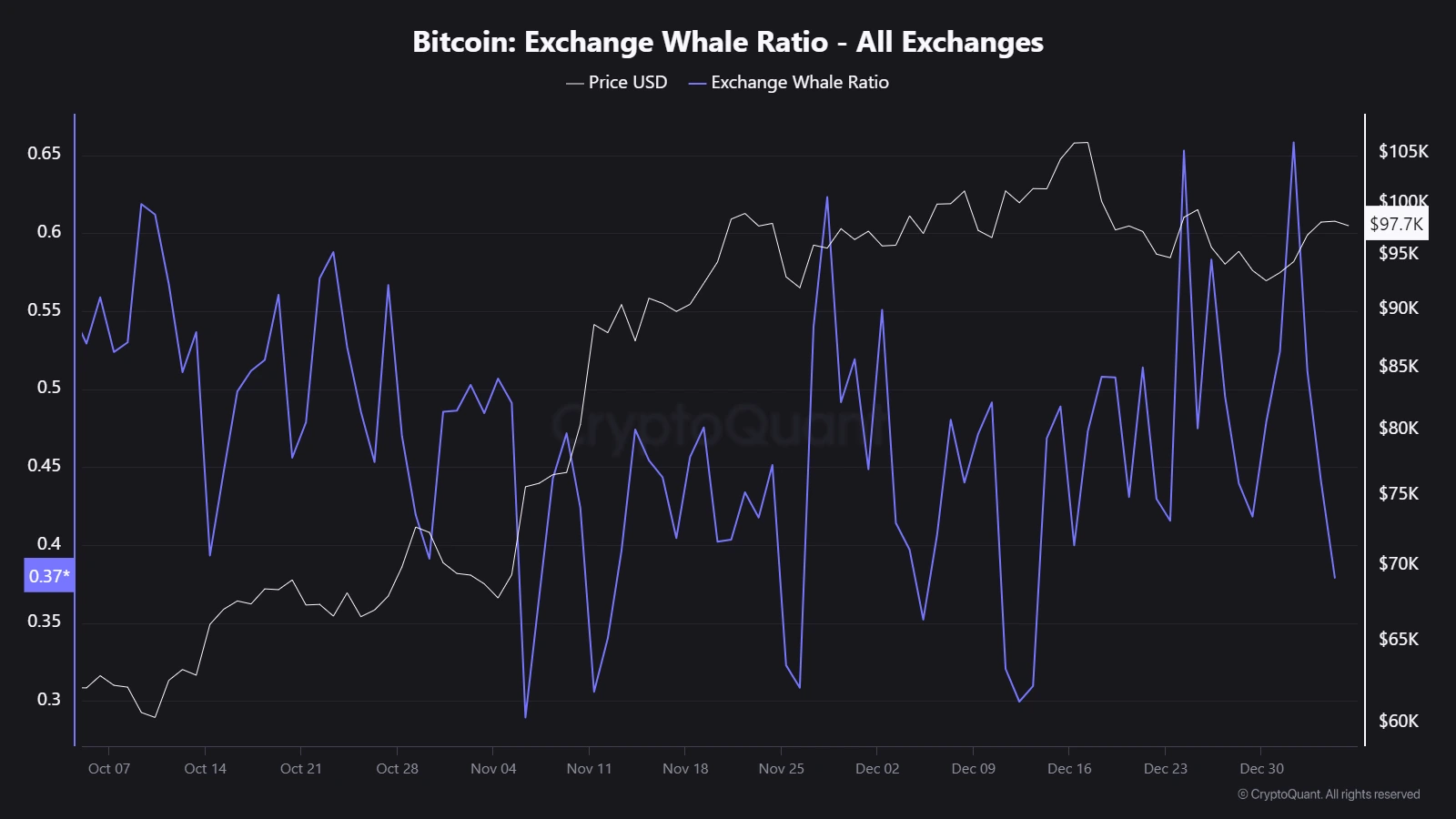

Bitcoin: Exchange Whale Ratio (72h MA)

The Bitcoin Exchange Whale Ratio is calculated as the total Bitcoin amount of the top 10 transactions (in terms of total Bitcoin sent) divided by the total Bitcoin amount flowing into exchanges. This metric measures the flow of funds by whales on exchanges.

(Source: CryptoQuant)

How to use the Exchange Whale Ratio:

- When the value is high, it indicates that a significant portion of the funds flowing into exchanges comes from whales. This could suggest a higher market concentration, where whale activity has a greater impact on market prices.

- When the value is low, it indicates that the flow of funds is more dispersed, with lower market concentration. In this case, price fluctuations are likely to be more stable.

KEY TAKEAWAYS: MARKET SUMMARY

By carefully monitoring these indicators, investors can gain a better understanding of market sentiment. However, no single indicator can accurately predict the future direction of the market. Indicators merely help us gain deeper insights into market conditions, and investment decisions should always be made with caution. DYOR.

Read More:

- 3 Market Indicators Providing Crypto Trading Signals

- 5 Indicators for Crypto Market Analysis and Where to Find Them

- These 2 Indicators Show Bitcoin is at a Bull-Bear Turning Point

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!