KEYTAKEAWAYS

- Solana DeFi TVL Grows 18.15% Weekly

- AI Token Real-time Mindshare Rankings: FARTCOIN, AIXBT, ai16z Lead Top Three

- U.S. BTC Spot ETF Total Net Asset Value Reaches 5.93% of Bitcoin Market Cap

CONTENT

Welcome to CoinRank Daily Data Report. Solana DeFi TVL Grows 18.15% Weekly. AI Token Real-time Mindshare Rankings: FARTCOIN, AIXBT, ai16z Lead Top Three. U.S. BTC Spot ETF Total Net Asset Value Reaches 5.93% of Bitcoin Market Cap.

SOLANA DEFI TVL GROWS 18.15% WEEKLY

Solana chain’s DeFi TVL reached $11.621B, growing 18.15% weekly and 35.67% monthly. Ethereum’s DeFi TVL is $65.896B, declining 5.55% weekly. Tron and Bitcoin maintained ~1% growth. BSC’s DeFi TVL is $5.605B, Base’s is $3.673B, both showing declines.

For Bridged TVL, Solana ($38.098B) ranks below Ethereum ($174.805B) and TRON ($66.217B), but above BSC ($20.44B).

Source: DefiLlama

Analysis:

Solana’s DeFi TVL growth has been impressive over the past week, becoming the leader among major blockchains with an 18.15% weekly growth and 35.67% monthly growth, indicating significant breakthroughs in ecosystem liquidity and user demand. This performance likely benefits from Solana’s recent MEME token popularity and efficient transaction cost advantages. In contrast, the TVL decline of established chains like Ethereum and BSC highlights shifting competitive dynamics, particularly regarding cost and performance optimization pressures.

Additionally, while Solana trails Ethereum and Tron in Bridged TVL, its $38B+ scale solidifies its position among top chains, further validating its potential as a key DeFi ecosystem player. In an increasingly competitive multi-chain environment, Solana’s continued growth trajectory will depend on its ecosystem projects’ innovation capacity and strategies to attract broader developer and user participation.

AI TOKEN REAL-TIME MINDSHARE RANKINGS: FARTCOIN, AIXBT, AI16Z LEAD TOP THREE

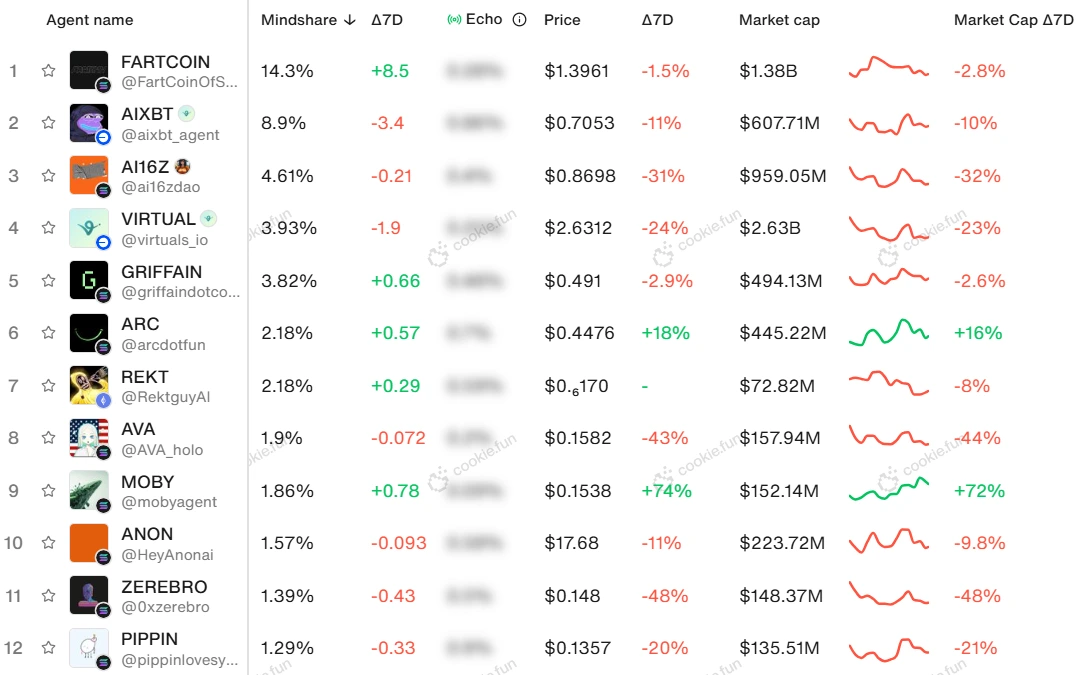

According to AI agent index platform Cookie data, the top five AI tokens by mindshare are currently: FARTCOIN (14.3%), AIXBT (8.9%), ai16z (4.61%), VIRTUAL (3.93%), and GRIFFAIN (3.82%). The mindshare metric measures the percentage of token discussions on X.

Source: Cookie

Analysis:

The AI token mindshare rankings show that AI-themed discussions are becoming a focal point for investors and communities. Data indicates FARTCOIN leads by a significant margin, suggesting extremely high social media engagement and community activity, likely benefiting from topic marketing or unique narrative strategies. AIXBT and ai16z follow closely, demonstrating more stable community support and potential market attention.

Notably, mindshare doesn’t directly equate to project value or actual development potential, but it serves as an important indicator of market sentiment and project exposure. As AI technology integration deepens, AI token market performance will increasingly depend on practical technology implementation and use case expansion, with excessive speculation potentially leading to short-term volatility. While monitoring market heat, investors should remain vigilant about potential disconnects between project fundamentals and bubble risks.

U.S. BTC SPOT ETF TOTAL NET ASSET VALUE REACHES 5.93% OF BITCOIN MARKET CAP

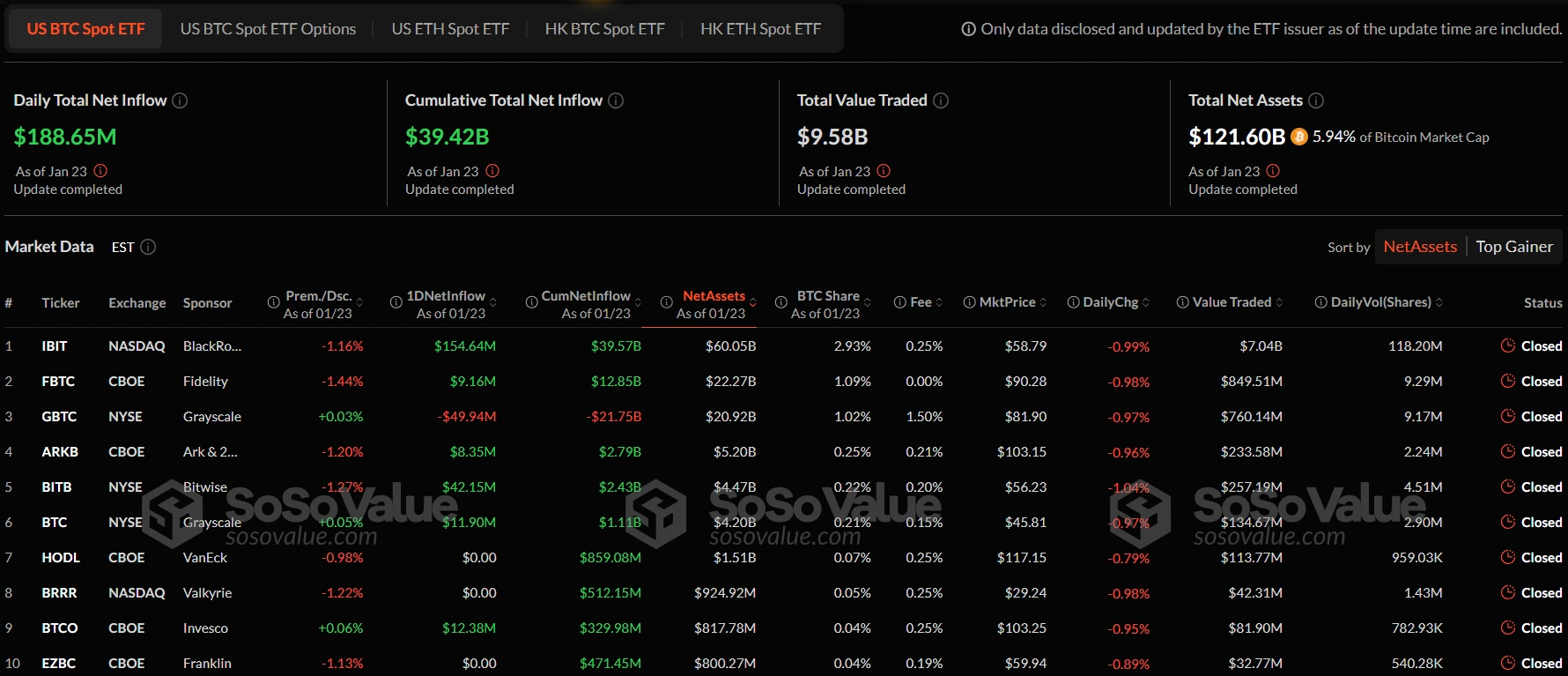

As of January 23rd (EST), U.S. BTC spot ETFs saw net inflows of $188.65M, with total net asset value reaching $121.6B, representing 5.93% of Bitcoin’s market cap, according to SoSoValue. Meanwhile, U.S. BTC spot ETFs experienced net outflows of $14.93M on the same day.

BlackRock’s ETF IBIT led daily net inflows at $155M, bringing its historical total net inflows to $39.573B. Following was Bitwise ETF BITB with daily net inflows of $42.1475M, reaching historical total net inflows of $2.431B.

Source: SoSoValue

Analysis:

U.S. BTC spot ETF’s total net asset value reaching 5.93% of Bitcoin’s market cap indicates growing acceptance and investment enthusiasm from traditional finance. BlackRock’s IBIT maintains market leadership through strong appeal and sustained inflows. This influx reflects institutional recognition of Bitcoin’s core digital asset status and may accelerate its integration with traditional finance. Notable is ETH spot ETF’s outflow after several days of net inflows. As regulatory frameworks clarify globally, spot ETFs could become key indicators of crypto market capital flows.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!