KEYTAKEAWAYS

- TVL reflects user trust and liquidity depth but is highly sensitive to crypto price fluctuations, making it an imperfect measure of a protocol’s long-term stability.

- TVL can be manipulated through temporary capital injections or token-locking mechanisms, meaning high TVL doesn’t always indicate sustainable growth or real user adoption.

- A holistic DeFi evaluation requires additional metrics like transaction volume, user activity, and capital efficiency, rather than relying solely on TVL as an indicator.

CONTENT

Total Value Locked (TVL) is a key metric in DeFi, but does it truly reflect a protocol’s value? Explore its significance, limitations, and why deeper analysis is essential for understanding DeFi success.

If we compare the DeFi ecosystem to a banking system, TVL is like the total deposits of a DeFi “bank.” It represents the total value of digital assets that users have deposited into a specific DeFi protocol or decentralized application (dApp). These assets may include:

- Mainstream Cryptocurrencies: Such as Bitcoin (BTC) and Ethereum (ETH).

- Stablecoins: Such as Tether (USDT) and USD Coin (USDC).

- Liquidity Tokens: For example, Uniswap’s LP tokens.

- Other Assets: Such as ERC-20 tokens, cross-chain assets, and DeFi derivatives.

To make cross-platform comparisons easier, TVL is usually measured in USD. This approach is similar to using the US dollar to compare the economic sizes of different countries in traditional finance, allowing for a macro view of DeFi’s overall development.

THE IMPORTANCE OF TVL: WHY IS IT THE “BAROMETER” OF DEFI?

In the DeFi world, TVL is widely followed because it reflects the health and market position of a protocol from multiple angles. Here are the key reasons why TVL matters:

Indicates User Trust

A higher TVL usually means users have more trust in the protocol. Users are only willing to deposit assets into a platform if they believe it is secure and reliable. For example, lending protocols like Aave and MakerDAO have built high TVL due to their long-term reputation and security.

Trust is the foundation of DeFi, but it takes time to build. It requires solid protocol design, transparent governance, and continuous security audits. Monitoring TVL trends, especially during market volatility, can provide deeper insights into user confidence.

-

Measures Capital Efficiency

The higher the TVL, the more funds a protocol can utilize. For example, in decentralized exchanges (DEXs), a higher TVL means deeper liquidity pools, reducing slippage and improving the trading experience.Uniswap’s success is largely supported by its strong TVL. By attracting large liquidity deposits, it offers users low-cost and efficient trading, securing its market position.

-

A Gauge of Ecosystem Activity

TVL growth often signals the expansion of the DeFi ecosystem. For example, from the “DeFi Summer” of 2020 to the rise of NFTs and blockchain gaming in 2021, the sharp increase in TVL reflected growing user enthusiasm and recognition of blockchain technology.However, a decline in TVL does not always indicate ecosystem failure. Sometimes, it is just a natural adjustment in market liquidity. For instance, TVL drops during bear markets are often due to asset price declines rather than a loss of confidence in DeFi.

-

A Benchmark for Market Share

In the competitive DeFi space, TVL is a key indicator of a protocol’s market position. For example, Curve Finance’s high TVL directly reflects its dominance in the stablecoin exchange sector.

LIMITATIONS OF TVL: IT’S NOT A PERFECT METRIC

Although TVL is the most commonly used metric in DeFi, it has its flaws. When interpreting TVL, we need to be aware of the following issues:

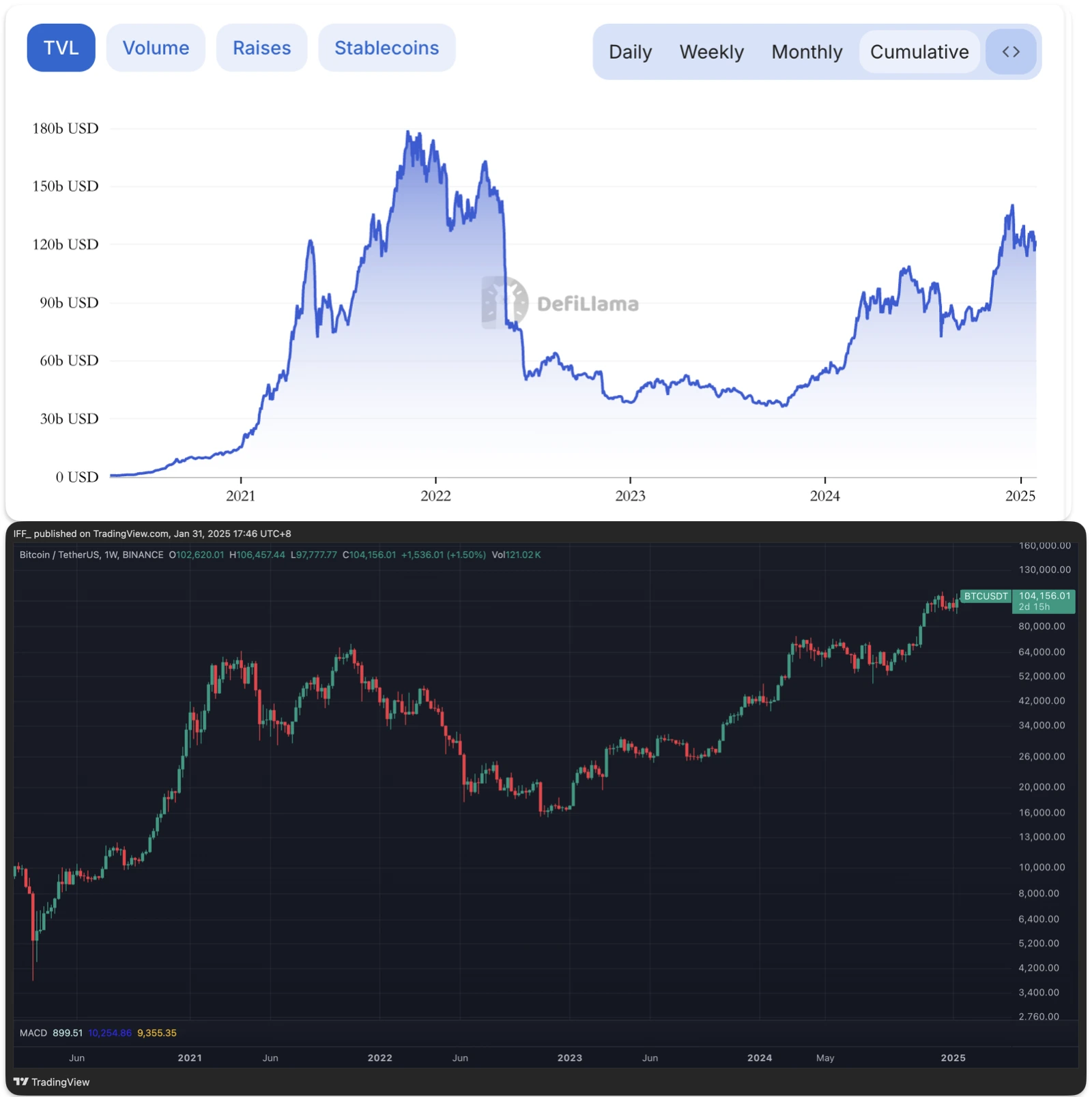

(Source:DefilIama & Tradingview)

Influenced by Price Fluctuations

Since TVL is measured in USD, its value is heavily affected by crypto price movements. For example, if ETH or BTC prices drop, TVL may decrease significantly, even if the actual number of locked assets remains unchanged.

This sensitivity to price makes TVL more of a reflection of market sentiment rather than an accurate measure of a protocol’s intrinsic value. Relying solely on TVL data can be misleading.

Can Be Manipulated

Some projects artificially boost their TVL by temporarily injecting large funds or using token-locking mechanisms. While this can push a protocol up the rankings in the short term, it often lacks sustainable value.

In early 2021, several “high-yield” liquidity mining projects attracted massive deposits, rapidly increasing their TVL. However, many collapsed due to security breaches or liquidity exhaustion, leading to heavy user losses.

Ignores Capital Efficiency

A high TVL does not necessarily mean high efficiency. A protocol with lower TVL but higher capital turnover may be more valuable than one with high TVL but idle funds.

In the future, new DeFi metrics may focus more on “dynamic efficiency,” such as asset utilization rates and returns, rather than just TVL as a static measure.

HOW TO INTERPRET TVL CORRECTLY?

As DeFi participants, we must critically analyze TVL. It is an important reference point but should not be the only factor in evaluating a protocol’s value. Here are some practical tips:

- Focus on Trends, Not Just Absolute Values: TVL trends reveal more about a protocol’s health than static numbers.

- Combine with Other Metrics: Consider user activity, trading volume, and yield rates for a more comprehensive assessment.

- Understand TVL Composition: Especially in multi-chain and cross-chain protocols, look into the asset distribution and risks behind TVL figures.

- Watch for Sudden Spikes: Unusual TVL surges may signal market manipulation, requiring extra caution.

Total Value Locked (TVL) is undoubtedly a key indicator in DeFi, but it does not tell the whole story. As participants, we need to analyze data from multiple perspectives to uncover real value in this complex ecosystem. In the future, as DeFi continues to evolve, new metrics may supplement or even replace TVL. But for now, it remains one of the most useful tools for understanding this emerging space.