KEYTAKEAWAYS

- From Liquidity Protocol to Developer Platform: Core Innovations of Uniswap v4

- Security and Multi-chain Expansion: The Solid Foundation of Uniswap v4

- User and Developer Guide: How to Participate in Uniswap v4

- Uniswap Protocol has Processed over $2.75 Trillion in Trading Volume

- Raydium and PancakeSwap Have become Strong Sompetitors to Uniswap

- KEY TAKEAWAYS

- FROM LIQUIDITY PROTOCOL TO DEVELOPER PLATFORM: CORE INNOVATIONS OF UNISWAP V4

- SECURITY AND MULTI-CHAIN EXPANSION: THE SOLID FOUNDATION OF UNISWAP V4

- USER AND DEVELOPER GUIDE: HOW TO PARTICIPATE IN UNISWAP V4

- FUTURE OUTLOOK: POTENTIAL AND CHALLENGES OF UNISWAP V4

- DISCLAIMER

- WRITER’S INTRO

CONTENT

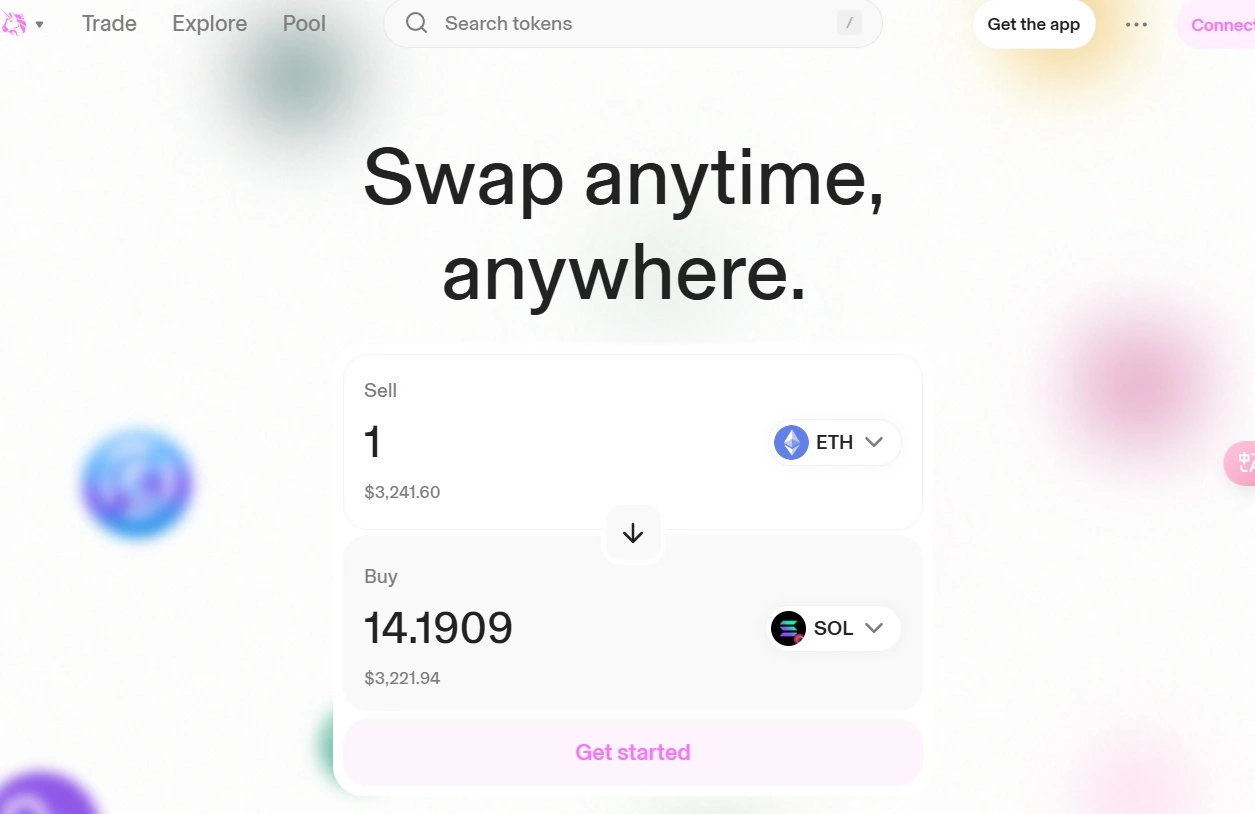

Uniswap v4 has officially launched. Users can now provide liquidity on Uniswap v4 through the Uniswap web application, with swaps becoming available on the network and wallets in the coming days as liquidity migrates to v4.

According to Uniswap, the V4 upgrade underwent code contributions from hundreds of community members, nine independent audits, the largest security contest in history, and a $15.5 million bug bounty program. As the world’s most renowned decentralized exchange (DEX) protocol, Uniswap v4 not only maintains its security and innovation but also brings unprecedented customization and efficiency improvements to the DeFi ecosystem through modular design and cost optimization. This upgrade marks Uniswap’s transformation from a “liquidity protocol” to a “developer platform,” injecting more innovative momentum into the DeFi ecosystem.

FROM LIQUIDITY PROTOCOL TO DEVELOPER PLATFORM: CORE INNOVATIONS OF UNISWAP V4

Since its launch in 2018, Uniswap has become a cornerstone of the DeFi ecosystem. From v2’s flash swaps and price oracles to v3’s “concentrated liquidity” model, Uniswap has continuously pushed the technical boundaries of decentralized trading. As of v4’s launch, the Uniswap protocol has processed over $2.75 trillion in trading volume without any hacking incidents. This achievement not only demonstrates Uniswap’s technical capabilities but has also earned widespread user trust.

The launch of Uniswap v4 marks its transformation from a “liquidity protocol” to a “developer platform.” At the core of this transformation is “Hooks” – a modular plugin system that allows developers to insert custom logic into the lifecycle of liquidity pools. Hooks can be triggered at key points such as pool creation, trade execution, and fee adjustment, enabling complex functionalities like dynamic fee adjustment, automated liquidity management, and cross-chain interactions.

Currently, the community has developed over 150 hooks, covering various application scenarios from dynamic fees to complex trading strategies. For example, developers can create a hook that automatically adjusts transaction fees based on market volatility or executes automated trading strategies within specific price ranges. This flexibility not only lowers development barriers but also accelerates the innovation cycle of DeFi applications. In the future, as more hooks are developed, Uniswap’s liquidity pools will become more intelligent and diverse, attracting more users and capital into the DeFi ecosystem.

Beyond the hooks system, Uniswap v4 has also achieved significant progress in cost optimization. Compared to previous versions, v4 reduces the cost of creating new pools by 99.99%, while traders can save gas fees through multi-hop swaps. Additionally, v4 introduces native ETH support, further reducing transaction costs for ETH pairs. These optimizations not only improve user experience but also create more opportunities for liquidity providers (LPs) and developers. For instance, the low-cost pool creation feature enables more long-tail assets to enter the Uniswap ecosystem, while reduced gas fees attract more small-volume traders to participate in the DeFi market.

SECURITY AND MULTI-CHAIN EXPANSION: THE SOLID FOUNDATION OF UNISWAP V4

Uniswap has always prioritized security. The v4 codebase underwent nine independent audits and hosted the largest security contest in history, attracting over 500 participants with a total prize pool of $2.35 million. Additionally, Uniswap established a $15.5 million bug bounty program to encourage continuous code review and potential issue reporting from the community. No critical vulnerabilities were found during the security contest and bug bounty program, which not only proves the reliability of the v4 codebase but also further strengthens Uniswap’s security reputation in the DeFi space.

Source:UniSwap

The transparent development process of Uniswap v4 is also one of its key success factors. Since the announcement of v4, Uniswap Labs has made all contract code public and accepted hundreds of code contributions (PRs) from the community. This open approach has not only enhanced community engagement but also ensured high code quality and security.

Beyond security, Uniswap v4 has further expanded its ecosystem influence through multi-chain deployment. V4 is not limited to the Ethereum mainnet but has launched on 10 chains including Polygon, Arbitrum, OP Mainnet, Base, BNB Chain, Blast, World Chain, Avalanche, and Zora Network. This multi-chain layout has not only reduced transaction costs but also expanded Uniswap’s user base and ecosystem influence.

For example, on Layer 2 networks, users can enjoy DeFi services with lower gas fees and faster transaction speeds, while on emerging chains (such as Base and Blast), Uniswap’s presence has injected more liquidity into these ecosystems. This multi-chain strategy has not only improved Uniswap’s market coverage but also provided users with more choices and flexibility.

USER AND DEVELOPER GUIDE: HOW TO PARTICIPATE IN UNISWAP V4

For regular users, participating in Uniswap v4 is very straightforward:

- Traders: In the coming days, Uniswap products will roll out support for v4 swaps. Users won’t need to take any additional steps, as swaps will automatically route through UniswapX, v2, v3, and v4 liquidity pools. This seamless experience ensures users can freely switch between different versions of liquidity pools while enjoying optimal trading prices and minimal gas fees.

- Liquidity Providers: Users can migrate existing positions to v4 or create new positions using hooks. Simply select “v4” on the LP page and enter the hook address. This flexibility allows liquidity providers to choose different strategies based on their needs to maximize returns.

- Developers: Can build their own hooks through Uniswap’s development guide, or integrate hooks with Uniswap Web applications and wallets. Uniswap provides detailed documentation and sample code to help developers quickly get started and implement their ideas.

Source: UniSwap

For developers, Uniswap v4 provides a platform full of possibilities. Through the hooks system, developers can build more complex and intelligent DeFi applications, driving innovation across the entire industry. For example, developers can create dynamic fee hooks that automatically adjust transaction fees based on market volatility, or build automated liquidity management hooks that execute complex trading strategies within specific price ranges. This flexibility not only lowers development barriers but also accelerates the innovation cycle of DeFi applications.

FUTURE OUTLOOK: POTENTIAL AND CHALLENGES OF UNISWAP V4

The launch of Uniswap v4 marks a new development phase for the DeFi ecosystem. Through its hooks system, cost optimization, and multi-chain expansion, Uniswap v4 has created more value for developers, liquidity providers, and regular users. Looking ahead, as the community continues to explore and innovate, Uniswap is poised to lead the DeFi ecosystem toward a more open and efficient future.

However, Uniswap also faces several challenges. First, maintaining consistency across the multi-chain ecosystem is a significant issue. As Uniswap deploys on more chains, ensuring consistency in user experience and liquidity pools across different chains will become a crucial task. Second, Uniswap needs to address increasingly intense market competition. As more DEX protocols launch similar features, maintaining its technical advantage and user stickiness will be a long-term challenge.

Source: DefiLlama

In the competitive landscape of DEX protocols, Raydium and PancakeSwap have emerged as strong competitors to Uniswap, with these three DEXs often ranking in the top three by daily trading volume. Raydium, Orca, and Meteora DLMM are seeing rising transaction volumes thanks to Solana blockchain’s performance advantages and community vitality. PancakeSwap has been competing for market share through innovative tokenomics and community incentive measures. Established DEX protocols like Curve are also continuously upgrading their technical architecture, attempting to attract users through optimized trading algorithms and new liquidity management tools. Additionally, cross-chain DEX protocols such as Fluid DEX and Cetus AMM are expanding their user base by supporting multi-chain asset trading.

Nevertheless, with its strong brand influence, innovative technical architecture, and massive user base, Uniswap is still expected to maintain a dominant position in the future DeFi ecosystem. As v4 becomes widely adopted, Uniswap will not only consolidate its leading position in the DEX sector but also bring more possibilities to the entire blockchain industry.

The launch of Uniswap v4 represents not just a major technical upgrade, but a revolutionary breakthrough for the DeFi ecosystem. Through its hooks system, cost optimization, and multi-chain expansion, Uniswap v4 has created more value for developers, liquidity providers, and regular users. Looking ahead, as the community continues to explore and innovate, Uniswap is poised to lead the DeFi ecosystem toward a more open and efficient future. Whether for developers, liquidity providers, or regular users, Uniswap v4 provides them with a platform full of possibilities, driving the continued prosperity of the DeFi ecosystem.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!