KEYTAKEAWAYS

- Tracks Market Sentiment: The Crypto Fear & Greed Index helps investors identify whether the market is driven by fear or greed, influencing trading strategies.

- Assists in Risk Management: Extreme fear may signal buying opportunities, while extreme greed can indicate an overheated market prone to corrections.

- Optimizes Trading Decisions: Investors can use the index to time market entry and exit points, reducing emotional trading and improving investment efficiency.

CONTENT

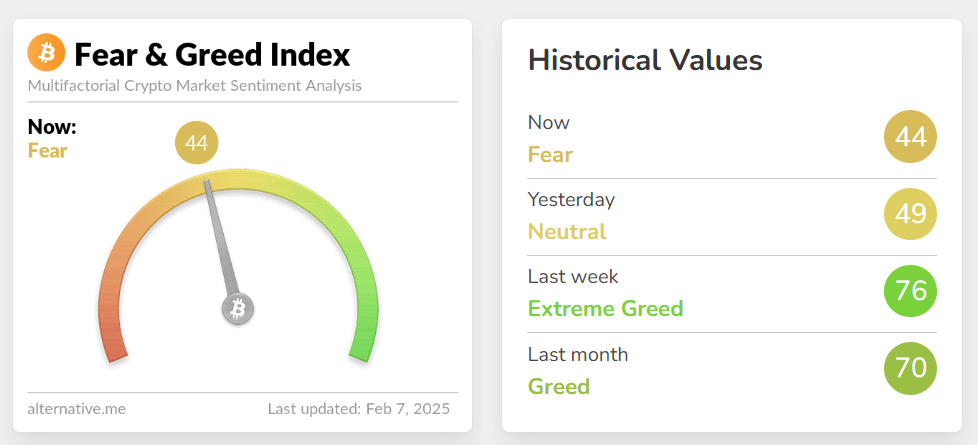

Crypto Fear & Greed Index tracks market sentiment from extreme fear to extreme greed, helping investors make informed decisions, avoid emotional trading, and optimize entry and exit points.

WHAT IS CRYPTO FEAR & GREED INDEX?

In the crypto market, investor sentiment often dictates price movements.

The Crypto Fear & Greed Index is a crucial tool designed to measure this sentiment, ranging from 0 to 100. A lower score indicates extreme fear, while a higher score represents extreme greed.

Market emotions are primarily driven by fear and greed. When fear dominates, investors may panic-sell, causing prices to drop further.

On the other hand, greed fuels FOMO (Fear of Missing Out), leading to aggressive buying and price surges.

By understanding these emotional shifts, investors can make more rational trading decisions and avoid getting caught up in market hysteria.

➤ The Origin and Evolution of Crypto Fear & Greed Index

The original Fear & Greed Index was introduced by CNN Business in 2012 to assess sentiment in the traditional stock market. It considers seven key factors, including:

- Market momentum

- Stock price strength

- Stock price breadth

- Put and call options

- Junk bond demand

- Market volatility

- Safe-haven demand

However, since CNN’s index primarily focuses on traditional markets, it doesn’t fully capture the volatility and unique characteristics of cryptocurrencies.

To bridge this gap, Alternative.me developed the Crypto Fear & Greed Index, specifically tailored to reflect Bitcoin’s market sentiment, which often influences the broader crypto market.

➤ How Can Crypto Fear & Greed Index Help Investors?

This index helps investors gauge market sentiment and refine their strategies:

- 0–22: Extreme Fear (The market is highly pessimistic; potential buying opportunities may arise.)

- 23–49: Fear (Caution prevails; further market downturns are possible.)

- 50–74: Greed (The market is gaining confidence, and investors are taking on more risk.)

- 75–100: Extreme Greed (The market may be overheating; investors should be cautious of potential bubbles.)

(Source: alternative.me)

Ultimately, the Crypto Fear & Greed Index serves as more than just a sentiment tracker—it’s a vital tool that helps investors avoid emotional trading mistakes and make more informed decisions.

Whether you’re a short-term trader or a long-term holder, leveraging this index can help optimize market entry and exit points, improving overall investment efficiency.

>>> More to read: 4 Strategies to Avoid FOMO & Stay Focused in a Bull Market

HOW IS THE CRYPTO FEAR & GREED INDEX CALCULATED?

The Crypto Fear & Greed Index is not based on a single fixed formula but rather a combination of various market indicators.

Developed by Alternative.me, the index aggregates 5 key metrics with different weightings to generate a score ranging from 0 to 100, representing the overall market sentiment.

➤ 5 Key Indicators and Their Weightings

✎ Volatility (25%)

-

- Measures recent price fluctuations and drawdowns. Higher volatility is typically seen as a sign of market fear.

✎ Market Momentum / Trading Volume (25%)

-

- Compares current market momentum and trading volume to historical averages. If buying volume is significantly higher than usual, it indicates increased greed.

✎ Social Media Sentiment (15%)

-

- Analyzes market discussions on X (formerly Twitter) using sentiment analysis tools. A surge in engagement, particularly positive discussions about Bitcoin, often signals heightened greed.

✎ Bitcoin Dominance (10%)

-

- Increasing Bitcoin dominance: Investors shift toward Bitcoin as a safer asset, indicating rising fear.

- Decreasing Bitcoin dominance: Investors favor riskier altcoins, reflecting increased greed.

✎ Google Trends (10%)

-

-

Uses Google Trends to track searches related to Bitcoin.

- ✔ Increase in searches for “Bitcoin price manipulation” → Signals market fear.

- ✔ Increase in searches for “Bitcoin price prediction” → Indicates a more optimistic sentiment.

-

Uses Google Trends to track searches related to Bitcoin.

(Previously, the index also included market surveys, but this data source has been discontinued.)

The Crypto Fear & Greed Index consolidates multiple market factors into a single, easy-to-read metric that helps investors assess sentiment quickly.

By monitoring changes in this index, traders can make more informed decisions, avoid emotional trading, and better time their market entries and exits.

>>> More to read: Why Do Bull Markets Cause Losses? Tips to Avoid Them

WHY IS THE CRYPTO FEAR & GREED INDEX IMPORTANT?

The Crypto Fear & Greed Index is a valuable tool for investors, helping track market sentiment, identify fear- or greed-driven behaviors, and anticipate market trends.

Understanding these emotional patterns and their impact on investment decisions is essential for navigating the highly volatile crypto market.

1. The Impact of Fear on Crypto Markets

When the Crypto Fear & Greed Index falls below 22, it indicates extreme fear in the market.

During such periods, investor confidence weakens, leading to risk-averse behavior, such as prematurely selling off fundamentally strong assets or panic-selling cryptocurrencies, causing further price declines.

Common market behaviors during extreme fear include:

- Declining investor confidence, increasing selling pressure.

- An increase in short selling, as traders attempt to profit from further price drops.

- Potential undervaluation of assets, presenting buying opportunities.

However, extreme fear often signals a potentially oversold market, where prices are lower than usual. This can create opportunities for long-term investors to accumulate assets at a discount.

While the index is typically used for short-term analysis, extended periods of fear can also provide insights for long-term positioning and strategic asset accumulation.

2. The Impact of Greed on Crypto Markets

When the index exceeds 75, the market enters an extreme greed phase, signaling that investors may be overly optimistic and ignoring risks.

Common market behaviors during extreme greed include:

- FOMO (Fear of Missing Out) intensifies, driving more people to buy at high prices.

- Increased risk appetite, leading investors to shift from Bitcoin to riskier altcoins.

- A potential market bubble, where excessive optimism drives prices higher.

In such scenarios, investors often chase surging prices without proper risk assessment, ignoring warning signs like overbought technical indicators and parabolic price movements.

While extreme greed can push prices higher in the short term, it often serves as a cautionary signal for potential market corrections.

Investors should consider risk management strategies, take profits when necessary, or adopt short-term trading approaches to navigate potential volatility.

✎ Conclusion

By tracking market sentiment, the Crypto Fear & Greed Index helps investors avoid panic selling during extreme fear and prevent impulsive buying during excessive greed.

Whether the market is in fear or greed, this index serves as a powerful tool for making informed decisions, developing sound investment strategies, and improving overall trading efficiency.

>>> More to read: Crypto Beginner’s Guide | What, Why, Where, When, Who