KEYTAKEAWAYS

- Nigeria launchefirst compliant stablecoin cNGN

- cNGN maintains a 1:1 peg to the Nigerian Naira (NGN)

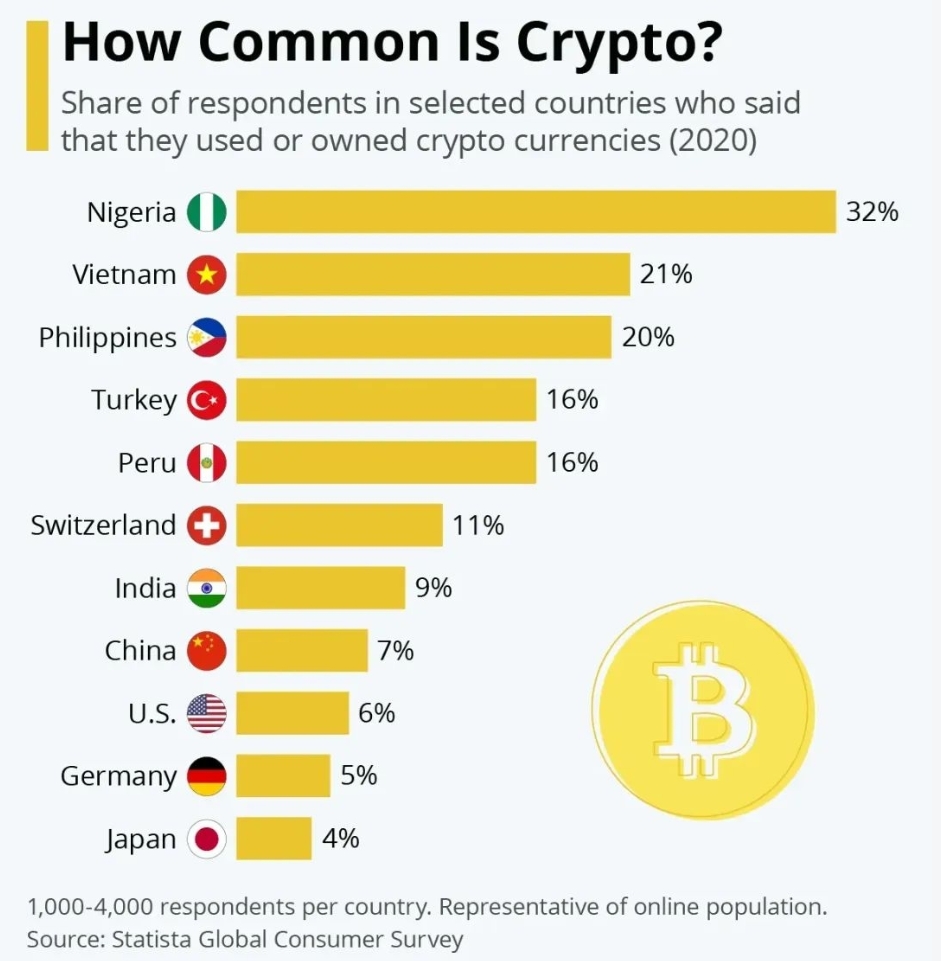

- Nigeria is one of Africa’s largest cryptocurrency markets

- In 2022, Nigeria launched its central bank digital currency (CBDC)

CONTENT

Nigeria launchefirst compliant stablecoin cNGN. cNGN maintains a 1:1 peg to the Nigerian Naira (NGN). Nigeria is one of Africa’s largest cryptocurrency markets. In 2022, Nigeria launched its central bank digital currency (CBDC).

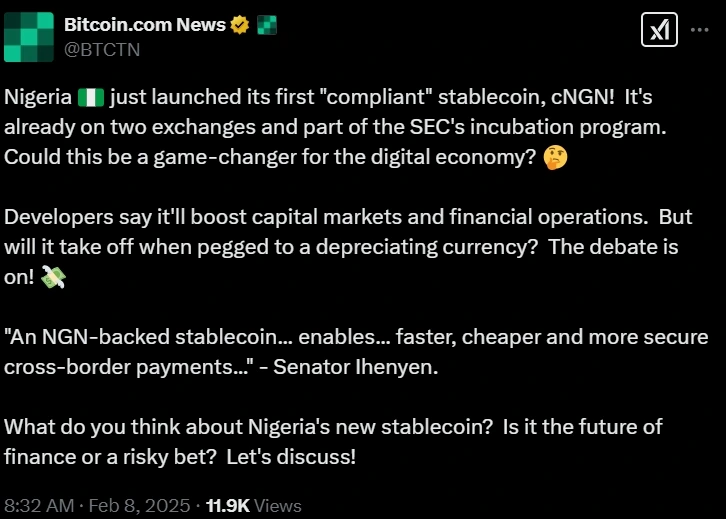

Nigeria has officially launched its first compliant stablecoin, cNGN, which has successfully listed on two exchanges. As part of an incubation project by the Nigerian Securities and Exchange Commission, cNGN aims to enhance financial system efficiency through blockchain technology and facilitate domestic and international fund flows.

Nigerian Senator Ihenyen stated that cNGN is pegged 1:1 to the Nigerian Naira (NGN) and can significantly accelerate cross-border payments, reduce transaction costs, and enhance fund security.

Source: Bitcoin.com

TECHNICAL ADVANTAGES AND COMPLIANCE OF CNGN

cNGN is Nigeria’s first officially recognized stablecoin, with its core advantages lying in compliance and transparency. In recent years, the Nigerian government has strengthened its regulation of digital currencies, and cNGN must comply with regulatory requirements from both the Securities and Exchange Commission (SEC) and the Central Bank to ensure its legal status. cNGN maintains a 1:1 peg to the Nigerian Naira (NGN), ensuring value stability, and utilizes blockchain technology to guarantee transaction transparency and traceability.

PROMOTING CROSS-BORDER PAYMENTS AND FINANCIAL INCLUSION

As a major African economy, Nigeria’s financial system faces numerous challenges in cross-border payments. Traditional cross-border transactions typically take several days and involve high fees. The launch of cNGN is expected to transform this situation:

- Accelerated Payment Processing: Based on blockchain technology, cNGN enables instant settlement, avoiding the complex processes of traditional banking systems.

- Reduced Transaction Costs: Compared to traditional payment methods like SWIFT, cNGN reduces intermediary steps, significantly lowering fees.

- Enhanced Security: The immutable nature of blockchain technology can reduce risks of fraud and money laundering.

Furthermore, Nigeria is one of Africa’s largest remittance-receiving countries, with annual overseas remittances reaching tens of billions of dollars. The introduction of cNGN helps Nigerian citizens abroad send money home more quickly and at lower costs, further enhancing financial inclusion.

CHANGES IN NIGERIA’S CRYPTOCURRENCY POLICY

Nigeria is one of Africa’s largest cryptocurrency markets, driven by currency depreciation, foreign exchange shortages, and financial restrictions. Despite past regulations restricting banks from working with crypto exchanges, peer-to-peer (P2P) trading, USDT stablecoins, and decentralized finance (DeFi) remain active.

Since the Central Bank’s 2021 ban on commercial banks engaging in cryptocurrency transactions, the government has gradually eased restrictions. In 2022, Nigeria launched its central bank digital currency (CBDC), eNaira, but low adoption led to broader digital currency initiatives, including support for fiat-pegged stablecoins. In 2024, Nigeria’s central bank further relaxed crypto regulations, fostering industry compliance and growth.

Local projects like Yellow Card and Bundle continue expanding, while Solana and BSC-based MEME coins, NFTs, and GameFi are gaining traction. Additionally, the government-backed stablecoin cNGN complements eNaira, advancing Nigeria’s financial digitalization and integrating cryptocurrencies into the formal economy.

FUTURE DEVELOPMENT AND CHALLENGES

While the launch of cNGN brings numerous opportunities to Nigeria’s financial system, it still faces certain challenges:

- Market Acceptance: Whether users and businesses will widely adopt cNGN remains to be seen.

- Regulatory Environment: Although cNGN has regulatory support, future policy changes may affect its development.

- International Cooperation: Promoting cross-border payments requires establishing partnerships with more international financial institutions and payment platforms.

The launch of cNGN marks a major breakthrough in Nigeria’s fintech sector, signifying a solid step forward in the country’s digital economy and cryptocurrency space. It not only promises to address the high costs and inefficiencies in cross-border payments but also provides new solutions for financial inclusion.

Moving forward, cNGN’s successful adoption will depend on market acceptance, government policy support, and its ability to expand within international payment networks.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!