KEYTAKEAWAYS

- Ethereum Short Positions Increase 40% in One Week, Up 500% Since November

- Central African Republic President's Meme Coin CAR Reaches $280M Market Cap

- CEX Net Inflow of 48,378.31 Bitcoin Over Past 7 Days

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

ETHEREUM SHORT POSITIONS INCREASE 40% IN ONE WEEK, UP 500% SINCE NOVEMBER

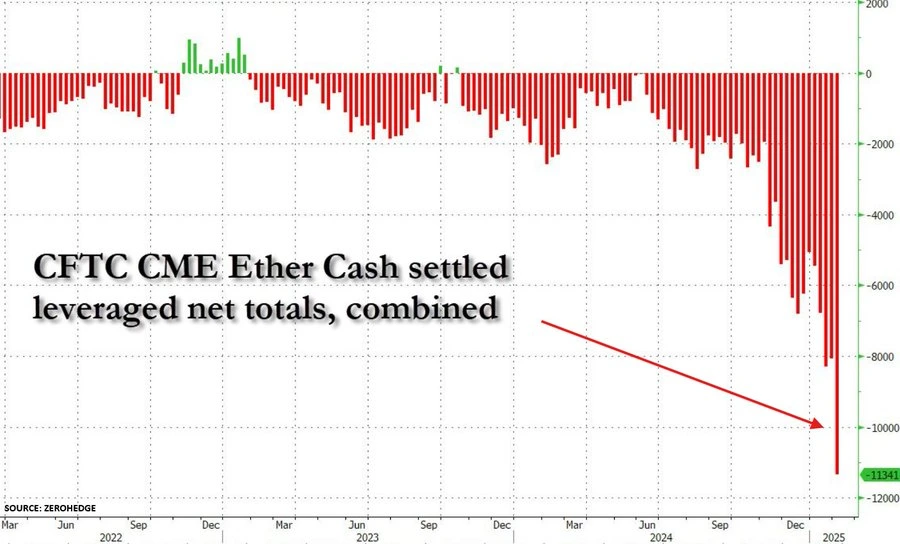

New charts from ZeroHedge show that Ethereum is facing record shorting from hedge funds, with CME futures contracts reaching a new high of 11,341 contracts. Ethereum short positions increased by 40% in one week and have grown 500% since November 2024.

Source: The Kobeissi Letter

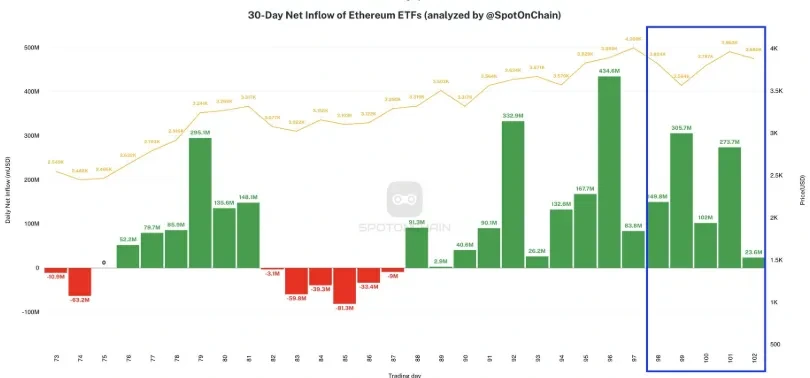

Interestingly, despite the continuous increase in short exposure in December 2024, Ethereum’s capital inflows remained high. In just 3 weeks, ETH attracted over $2 billion in inflows, setting a record of more than $854 million in weekly inflows.

Source: The Kobeissi Letter

Analysis:

Ethereum currently faces record shorting pressure from hedge funds, with CME futures short positions surging, indicating market pessimism about its short-term trajectory. However, despite the significant increase in short positions, Ethereum’s capital inflows continue to rise, suggesting investors remain optimistic about its long-term potential. This contradictory phenomenon may reflect market divergence regarding Ethereum’s future development. While short-term pressure might lead to price volatility, long-term capital inflows could provide support. Investors should closely monitor changes in market sentiment and technical performance.

Additionally, Ethereum’s history shows a clear correlation between large short positions and subsequent price crashes. On February 2nd, ETH fell sharply, dropping 37% within 60 hours following President Trump’s tariff policy announcement.

CENTRAL AFRICAN REPUBLIC PRESIDENT’S MEME COIN CAR REACHES $280M MARKET CAP

On-chain data shows CAR is currently trading at $0.28 with a total market cap of approximately $280 million and daily trading volume of $762.78M. CAR has fluctuated between $0.24 and $0.65.

Source: CoinMarketCap

According to a message posted on X platform by Central African Republic President Faustin-Archange Touadera, he announced the launch of meme coin CAR, describing it as an “experiment aimed at uniting people, supporting national development, and putting the Central African Republic on the world stage.” He emphasized his position as the world’s second president to adopt Bitcoin as legal tender, acknowledging cryptocurrency’s global potential.

Analysis:

While the meme coin CAR launched by the Central African Republic president shows impressive market cap and trading volume, its volatile price movements indicate strong speculative behavior in the market towards this emerging cryptocurrency.

The president’s support has brought attention and credibility to CAR, but its fundamental nature as a meme coin means its value relies more on market sentiment than practical applications. Despite the president’s emphasis on CAR’s “experimental” nature and support for national development, its long-term sustainability remains questionable. Investors should be cautious of high volatility risks and carefully evaluate the gap between its actual value and market speculation.

CEX NET INFLOW OF 48,378.31 BITCOIN OVER PAST 7 DAYS

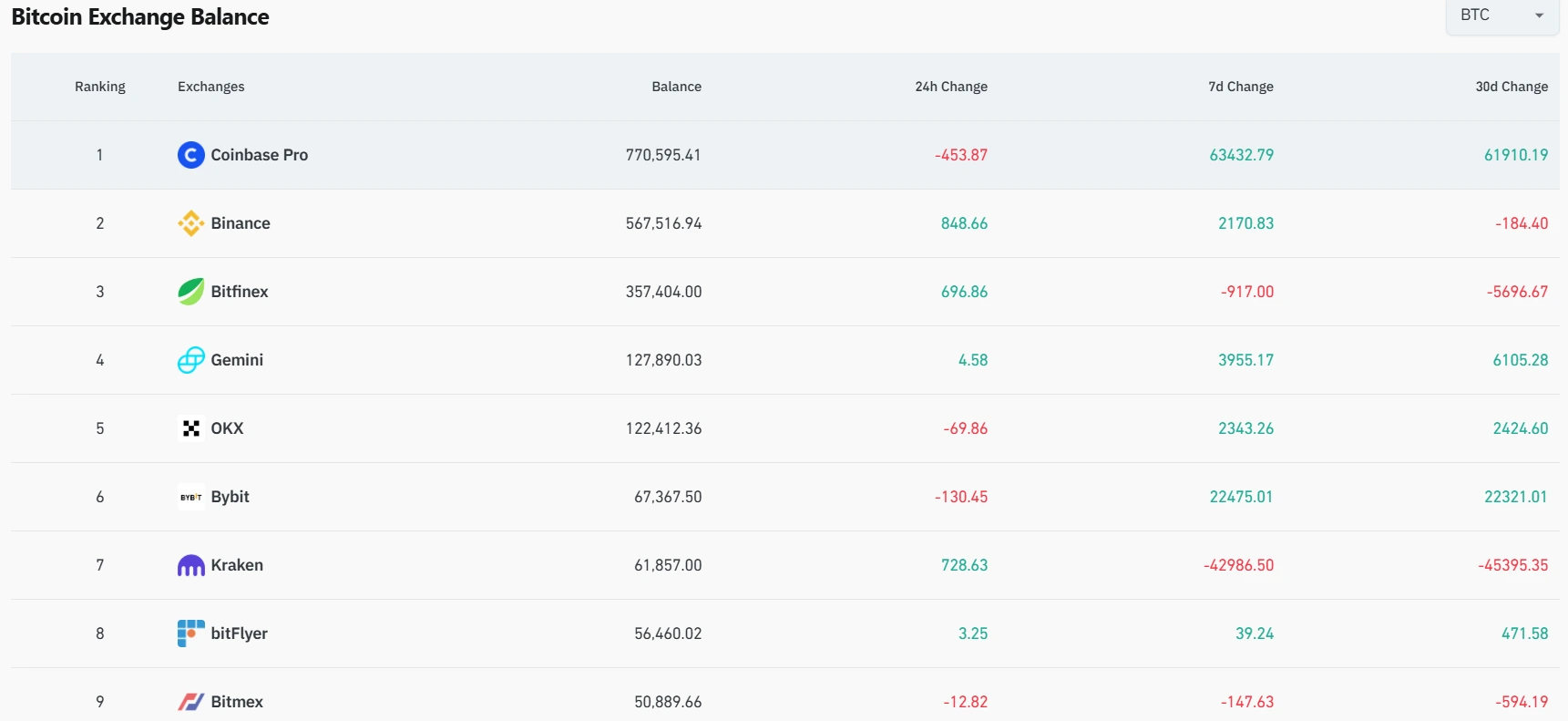

According to Coinglass data, centralized exchanges (CEX) recorded a cumulative net inflow of 48,378.31 Bitcoin (BTC) over the past 7 days. Coinbase Pro led with an inflow of 63,432.79 BTC, followed by Bybit and Gemini with 22,475.01 and 3,955.17 BTC respectively. Additionally, CEX net inflows reached 29,213.87 Bitcoin over the past 30 days, indicating a shift in recent market fund flows.

Source: Coinglass

Analysis:

The cumulative net inflow of 48,378.31 Bitcoin to CEX over the past 7 days indicates that market funds are accelerating their movement toward centralized exchanges. Large inflows to platforms like Coinbase Pro, Bybit, and Gemini suggest investors may be preparing for potential trading activity or market volatility. This trend might be related to recent increased Bitcoin price fluctuations, with some investors choosing to transfer assets to exchanges to capture short-term opportunities.

However, the large fund inflows could lead to changes in market liquidity, and there’s a need to be cautious about short-term selling pressure risks. In the long term, changes in fund flows may provide new directional signals for the market.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!