KEYTAKEAWAYS

- Ethereum Staking Ratio Drops to 27%, First Decline Since Late 2024 Peak

- Tether Holds $5.3B in Precious Metals and $7.8B in Bitcoin

- OpenSea's January Trading Volume at $190M, Significantly Down from Early 2021 Peak

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

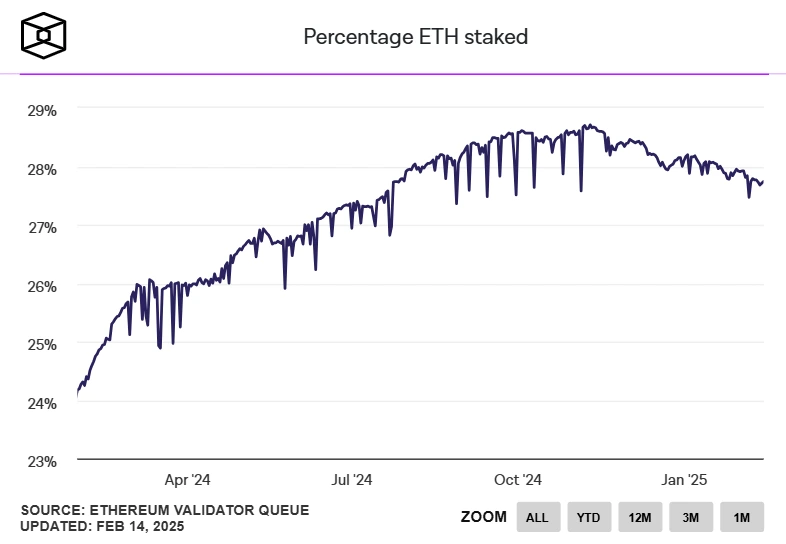

ETHEREUM STAKING RATIO DROPS TO 27%, FIRST DECLINE SINCE LATE 2024 PEAK

Ethereum (ETH) staking ratio has decreased to 27%, returning to levels not seen since July 2024, marking the first decline since its peak of 29% in late 2024. Currently, approximately 33.5 million ETH are staked, continuing to provide security support for the Ethereum network.

Source: TheBlock

Despite the decline in staking ratio, Liquid Staking Derivatives (LSDs) maintain their dominant position in the ecosystem. Among these, Lido leads with about 69% market share, while Binance staked ETH accounts for 15% of the market.

Analysis:

The drop in Ethereum’s staking ratio from 29% to 27% reflects market participants’ reassessment of staking yields or risks in the current environment. Although the ratio has decreased, the 33.5 million staked ETH still indicates a strong security foundation for the Ethereum network.

The dominance of Liquid Staking Derivatives (LSDs), particularly the high market shares of Lido and Binance, demonstrates market demand for flexibility and liquidity. Looking ahead, while Ethereum’s ecosystem staking ratio may fluctuate with market sentiment and yield expectations, the widespread adoption of LSDs is likely to continue driving innovation and diversification in the staking market.

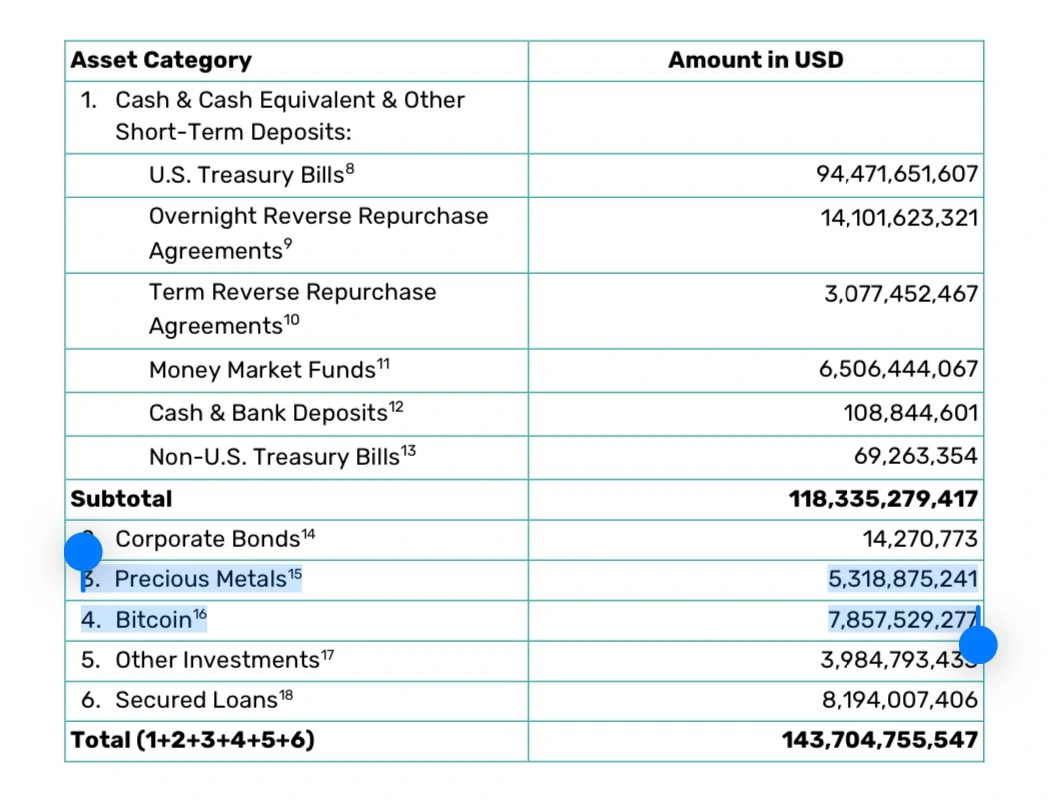

TETHER HOLDS $5.3B IN PRECIOUS METALS AND $7.8B IN BITCOIN

According to Tether‘s strategy and VanEck advisor Gabor Gurbacs on X platform, Tether’s latest attestation report shows its portfolio includes approximately $5.3 billion in precious metals and $7.8 billion in Bitcoin. Gurbacs suggests this could be one of the most successful commodity hedge trades in history, not only enhancing Tether’s asset diversity but also providing strong support for its over-collateralization strategy.

Source: X

Analysis:

Tether’s holdings in precious metals and Bitcoin demonstrate its diversified asset allocation strategy. The combination of precious metals as traditional safe-haven assets with Bitcoin as an emerging digital asset not only spreads risk but potentially enhances overall asset stability through commodity hedging. This strategy further strengthens Tether’s over-collateralization model and boosts market confidence in its stablecoin USDT.

Moreover, Tether’s portfolio composition reflects its recognition of the long-term value in the cryptocurrency market and may serve as a reference for other stablecoin issuers. However, the market should continue monitoring the impact of asset liquidity and external environment changes on the portfolio’s value.

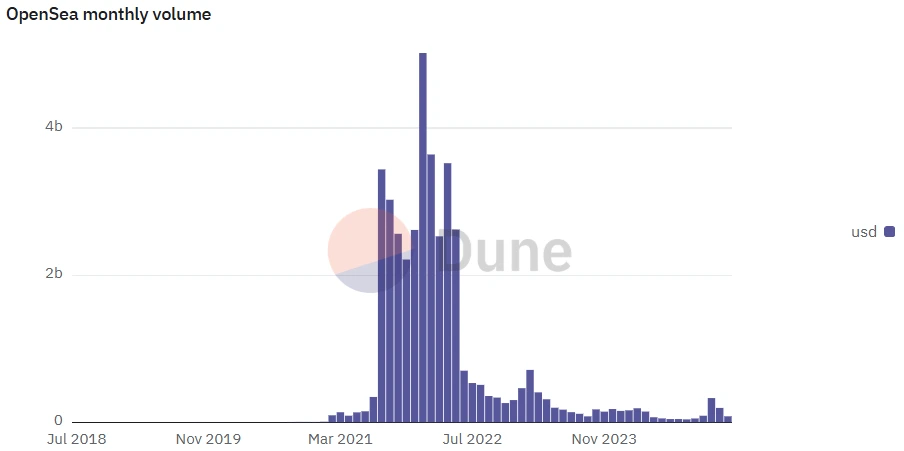

OPENSEA’S JANUARY TRADING VOLUME AT $190M, SIGNIFICANTLY DOWN FROM EARLY 2021 PEAK

According to Dune Analytics data, OpenSea’s NFT trading volume in January was approximately $190 million, marking a significant decline from its peak of $5 billion in early 2021. The platform’s annual revenue stands at around $33 million. Meanwhile, the OpenSea Foundation announced plans to launch the SEA token, though specific details about the airdrop and timing remain undisclosed.

Source: DUNE

Analysis:

OpenSea’s January trading volume shows a substantial decrease from its early 2021 peak, reflecting the overall cooling trend in the NFT market. Despite the decline in trading volume, OpenSea’s annual revenue of $33 million demonstrates its resilience as a leading platform.

With the launch of the SEA token, OpenSea is transitioning from a pure NFT marketplace to a comprehensive digital asset trading platform. Co-founder Devin Finzer emphasized the importance of integrating tokens with NFTs, indicating the platform’s future exploration of broader asset classes and user experiences. This strategy could help OpenSea strengthen its position in an increasingly competitive market and attract a wider user base.

However, the market remains cautious about the specific utility of the SEA token and airdrop details, and its success in driving platform growth will need time to validate.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!