KEYTAKEAWAYS

- Popular cryptocurrencies often peak at listing, following an "L-shaped" pattern due to early profit-taking and high initial valuations, as demonstrated by ICP and STRK.

- PI's massive user base from mobile mining could become a liability, with potential selling pressure from millions of zero-cost participants.

- Despite potential, PI faces substantial risks with possible 90% downside; investors should maintain extreme caution and prepare for potential capital loss.

CONTENT

A comprehensive analysis of PI cryptocurrency’s market performance, examining its high-risk nature through historical patterns, market dynamics, and fundamental factors. Essential reading for crypto investors considering PI.

The highly anticipated PI cryptocurrency has finally been listed on major exchanges like Bitget and OKX. The pre-listing period was marked by intense debate within the crypto community – skeptics and critics, many expressing malicious intent, dismissed the project, while others saw tremendous value in its millions-strong user base. These opposing viewpoints and their heated exchanges drove the token’s popularity to unprecedented heights.

Post-listing, PI’s price surged to $3.40 (Bitget data). Given its circulating supply of 6.3 billion tokens, the market capitalization exceeded $20 billion. More strikingly, considering the total supply of 100 billion tokens, the fully diluted valuation (FDV) would reach an astonishing $340 billion! The initial market cap nearly matched TRON’s (TRX), placing PI among the global top 10 cryptocurrencies, while its FDV approached Ethereum’s market value.

However, the price trajectory quickly reversed after listing. At the time of writing, it had plummeted to $0.60 (Bitget data), experiencing two consecutive 50% drops within a single day.

PI Token Price

(Source: Bitget)

This raises crucial questions: Does PI still present a worthwhile investment opportunity? Why do highly anticipated cryptocurrency projects often struggle to maintain their momentum? Let’s conduct a detailed analysis.

HISTORICAL PATTERNS SHOW THAT HYPED TOKENS OFTEN PEAK UPON LISTING

Historical data reveals a consistent pattern: tokens generating significant pre-listing buzz typically struggle to achieve substantial growth afterward. When combined with two critical “debuffs” – a high initial market capitalization and low circulation rate – these tokens usually peak at listing before following an “L-shaped” price pattern. Notable examples include Internet Computer (ICP), Strike (STRK), and others.

This pattern isn’t necessarily due to malicious intent from project teams or exchanges, but rather reflects underlying market dynamics that influence both major traders and retail investors.

From an exchange perspective, premier platforms like Bitget and Binance maintain stringent listing requirements – projects must demonstrate stable technology, active community engagement, strong financial backing, and sound tokenomics. However, by the time projects meet these criteria, they’ve typically already listed on second and third-tier exchanges. Top-tier exchanges, maintaining their reputational standards, can only wait for these supposedly quality projects to prove themselves, by which time significant profit-taking positions have already accumulated.

Moreover, due to the projects’ inherent strength, many early investors have acquired substantial token positions through financing rounds or other means, while active community members often receive extremely low-cost airdrops. These holders have entry prices far below typical market expectations and wait for major exchange listings, where sufficient liquidity enables profit realization.

The most striking example is the once-dominant project Internet Computer (ICP). At launch, ICP simultaneously listed on Binance, OKX, Huobi, and other top-tier exchanges, generating unprecedented excitement that arguably surpassed PI’s current momentum.

ICP Price Chart

(Source: Binance)

ICP debuted with a global top-5 market capitalization and limited circulation. However, aggressive selling by early profit-takers began immediately upon listing, triggering a sustained decline that perfectly exemplified the “L-shaped” pattern. The price collapsed from its opening of $2,831 (Binance data) to a mere $2.80 – a devastating 99.99% decline that effectively wiped out retail investors’ capital.

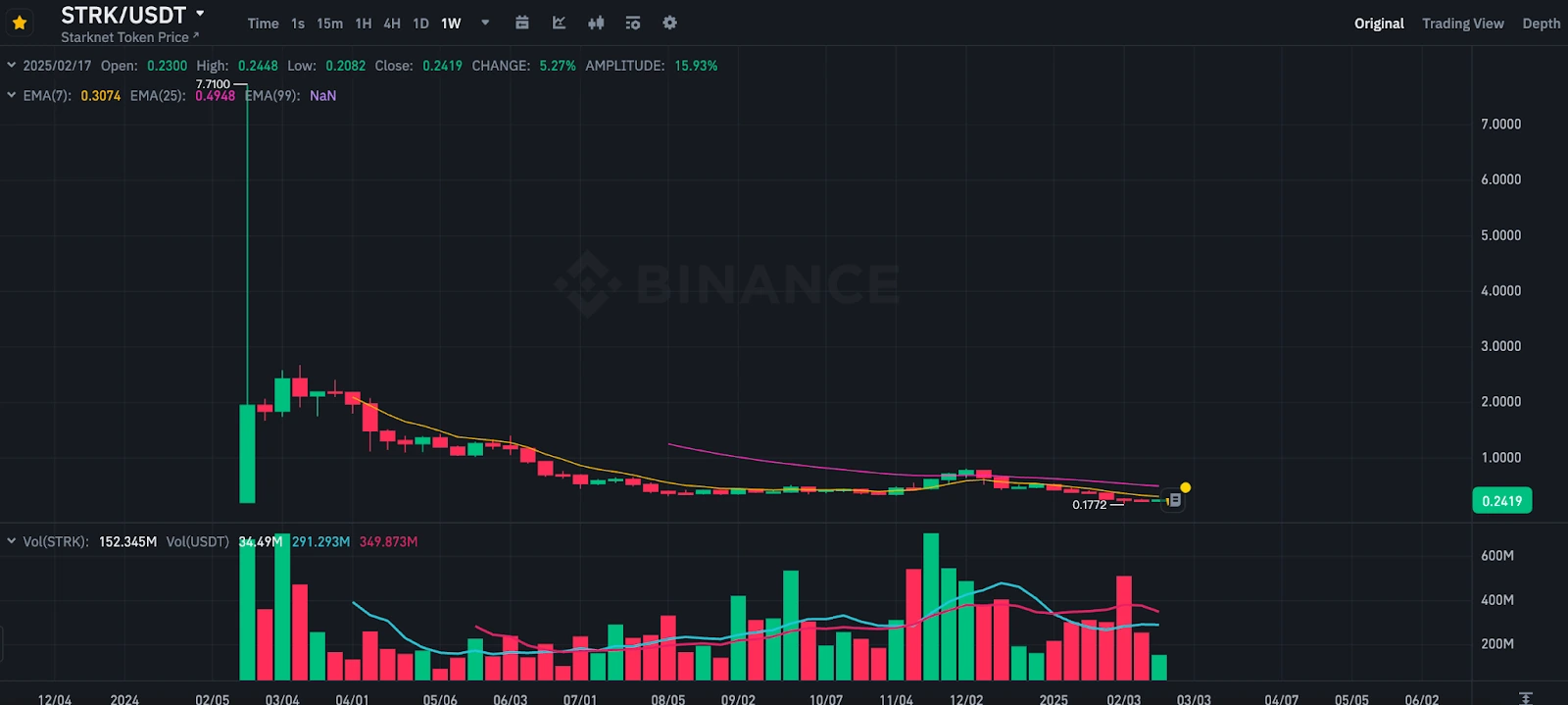

Strike (STRK) provides another cautionary tale. Prior to its major exchange listings, market enthusiasm reached fever pitch, with both media outlets and Key Opinion Leaders (KOLs) expressing strong optimism. Yet it followed the same pattern – peaking at $7.70 (Binance data) before steadily declining to $0.177! Similar trajectories emerged with WIF and PEOPLE tokens.

STRK Price Chart

(Source: Binance)

Detailed analysis reveals multiple factors beyond exchange-related issues that make this “peak at listing” phenomenon almost inevitable for highly anticipated tokens.

From the investor perspective, the cryptocurrency market has a high concentration of “degen” (degenerate) traders who prioritize short-term gains, particularly in newly listed popular projects. These traders chase quick profits while often ignoring fundamental analysis and long-term development potential. During the initial listing period, FOMO-driven (Fear of Missing Out) buying creates price spikes, but once the hype diminishes, these same traders panic-sell, triggering stampede-like crashes followed by prolonged price declines.

From the project team perspective, many engage in what amounts to “retail exploitation” by coordinating with major players to attract retail investors through early positioning and price manipulation, ultimately selling at peak prices. Many popular projects conduct pre-emptive financing rounds, acquiring large token allocations through private sales before listing, which are subsequently dumped on the open market. This results in price crashes while project teams secure quick profits, leaving retail investors holding depreciated assets.

These projects frequently demonstrate delayed ecosystem development and insufficient long-term planning, with teams quickly liquidating their positions after token unlocks, devastating market confidence. A common pattern involves using “referral” mechanisms to attract users, followed by mainnet launches that reveal stagnant ecosystems, effectively turning tokens into “air coins” (tokens with no real utility). Their token release mechanisms often lack transparency, relying entirely on project team discretion, which typically leads to market oversupply and price collapses.

Regarding media influence and market dynamics, cryptocurrency media naturally gravitates toward trending tokens, while KOLs frequently “analyze” popular projects to grow their following, sometimes engaging in paid promotion. This practice leads uninformed retail investors to blindly follow trends and make FOMO-driven purchases. However, when market sentiment shifts or investor confidence wanes, the inevitable crash begins.

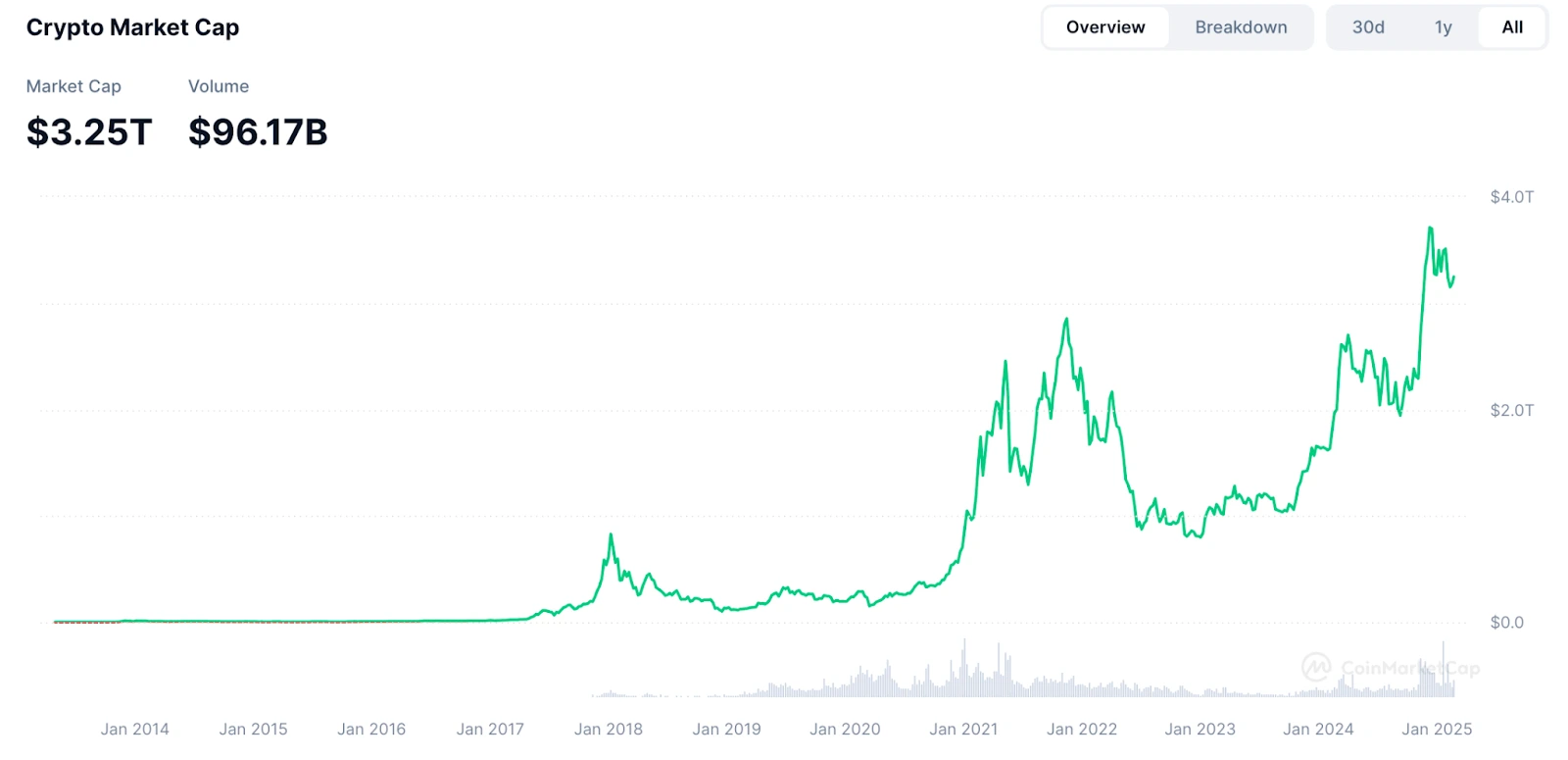

From a fundamental liquidity perspective, the cryptocurrency market remains relatively small, with a total market capitalization of just $3.25 trillion, of which Bitcoin (BTC) alone accounts for $1.95 trillion (60%). Compared to the U.S. stock market’s $50 trillion capitalization, the crypto market represents a mere fraction of traditional financial markets.

In this context, when tokens launch with high market capitalizations, subsequent price increases require substantial capital inflow – the higher the market cap, the more capital needed to drive price appreciation. However, with insufficient market liquidity, price increases become unsustainable, inevitably leading to crashes.

Regarding the token-specific characteristics, these projects often launch with limited circulation, creating severe supply-demand imbalances. Combined with insufficient market depth (limited buy/sell orders), large holder selloffs can easily trigger price collapses.

Crypto Market Capitalization

(Source: CoinMarketCap)

In summary, these highly anticipated tokens share a common trajectory: while short-term high market capitalizations and speculative activity can drive initial price surges, without concrete use cases, transparent project development, sustainable market demand, or credible team backgrounds, prices rarely maintain elevated levels. Once market enthusiasm dissipates and investor sentiment cools, these token prices typically experience rapid declines, manifesting the characteristic “L-shaped” pattern.

AFTER ITS LISTING, IS PI STILL WORTH BUYING?

Through our previous analysis of why many popular tokens “peak at listing,” we can now evaluate whether PI tokens present a worthwhile investment opportunity.

As a currently trending project, PI exhibits the same two “debuffs” – “high market cap at launch” and “low circulation rate.” For potential investors still considering entry, four critical factors warrant careful consideration:

First, examine the circulating market capitalization. PI’s market cap momentarily entered the global top 10 during launch, an clearly excessive valuation. Even after significant declines, it maintains a position around 30th rank, still relatively high. These elevated market caps require enormous capital inflow for price appreciation, which the market cannot readily provide in short timeframes – as the saying goes, the size of the pool determines the size of the fish that can swim in it.

Second, analyze profit-taking positions. Early profit-takers currently represent the primary downward price pressure, including early investors, community airdrop/mining participants, and gains from initial listings on second/third-tier exchanges. PI cryptocurrency attracted hundreds of millions of users through its mobile mining approach, and while its zero-cost participation mechanism significantly lowered cryptocurrency entry barriers, it simultaneously created an enormous pool of potential profit-takers. Although these holders currently face selling restrictions, such as KYC requirements and minimum 14-day token transfer periods to exchanges, combined with OKX’s regional restrictions blocking Chinese users (PI’s largest user base) from trading, a substantial dam of selling pressure remains poised overhead, potentially intensifying future price volatility.

Third, evaluate the project’s fundamental aspects, particularly its technology, community engagement, capital structure, token value model, and tokenomics (including acquisition methods, distribution mechanisms, release schedules, and lock-up conditions). While Pi Network’s mainnet officially launched on February 20th, its position as a Layer 1 blockchain differs from Ethereum’s approach. Rather than competing through technological innovation or ecosystem richness, PI’s core value proposition centers on its massive user base. As of February 19th, the Pi application had achieved 110 million downloads on Google Play Store, successfully attracting traditional internet users through its zero-barrier mining approach and creating a substantial “external traffic pool.”

However, this user acquisition strategy presents a double-edged sword. Most users joined primarily seeking quick profits through eventual token sales. If prices continue declining or if liquidation proves challenging, this extensive user base could paradoxically fuel continuous price depression. Long-term, PI’s price trajectory will largely depend on its ecosystem development and practical applications. Without effectively converting its massive user base into genuine value creation, the project risks devolving into a “first to exit” scenario.

Fourth, monitor exchange-related developments. Major cryptocurrency exchanges currently display divergent attitudes toward PI. While Bitget and Gate.io have listed the token, OKX temporarily cannot support mainland Chinese users due to regulatory restrictions. Additionally, although Binance has announced a community vote regarding potential PI listing, it hasn’t yet listed the token. Given PI’s enormous user base and current market attention, a future Binance listing could trigger another short-term price surge. However, such news-driven rallies typically carry significant selling risks, with prices often reverting to pre-announcement levels.

$PI COMPREHENSIVE ASSESSMENT

Based on thorough analysis, PI cryptocurrency shows potential but carries extreme risk, with possible downside exceeding 90% from current levels!

The project’s controversial nature stems from its unique growth model and technological implementation uncertainties. While it offers advantages through low entry barriers and strong community engagement, several concerning factors cannot be ignored:

- Potential multilevel marketing (MLM) characteristics

- Long-term inflationary tokenomics

- Significant regulatory risks

- Uncertain value capture mechanisms

For retail investors, maintaining cautious observation represents the most rational approach. Those choosing to participate should implement strict position size limits and prepare for potential complete capital loss. Ultimately, PI’s success depends on its ability to transform from a perceived “air coin” (token without substantial backing) into a utility-driven digital asset – a transformation requiring exceptional team execution and market validation.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!