KEYTAKEAWAYS

- Coinbase and HSBC Bank's Collaborative Custody of Crypto ETFs

- New Progress in SOL, ADA, XRP, LTC, and DOGE Crypto ETF Applications

- Cryptocurrency ETF Scale May Become the 3rd Largest Asset Class

CONTENT

Recently, the partnership negotiations between Coinbase and HSBC Bank have attracted widespread market attention, with cryptocurrency ETF scale expected to experience explosive growth.

COINBASE AND HSBC BANK’S COLLABORATIVE CUSTODY OF CRYPTO ETFS

In March 2025, Coinbase Asia-Pacific Managing Director John O’Loghlen revealed that Coinbase is already providing custody services for local ETFs in Hong Kong and is in discussions with HSBC Bank regarding ETF sub-custody plans. This collaboration marks Coinbase’s further penetration into traditional finance while injecting new vitality into Hong Kong’s cryptocurrency market.

Hong Kong already has 6 virtual asset ETFs listed, including Huaxia Bitcoin ETF and Harvest Ethereum ETF. Hong Kong stock data shows that on March 3, the trading volume of all virtual asset ETFs in Hong Kong was approximately 109.7 million Hong Kong dollars. Although the trading volume of these ETFs has not reached the scale of traditional financial products, it demonstrates the potential demand for cryptocurrency ETFs in the Hong Kong market.

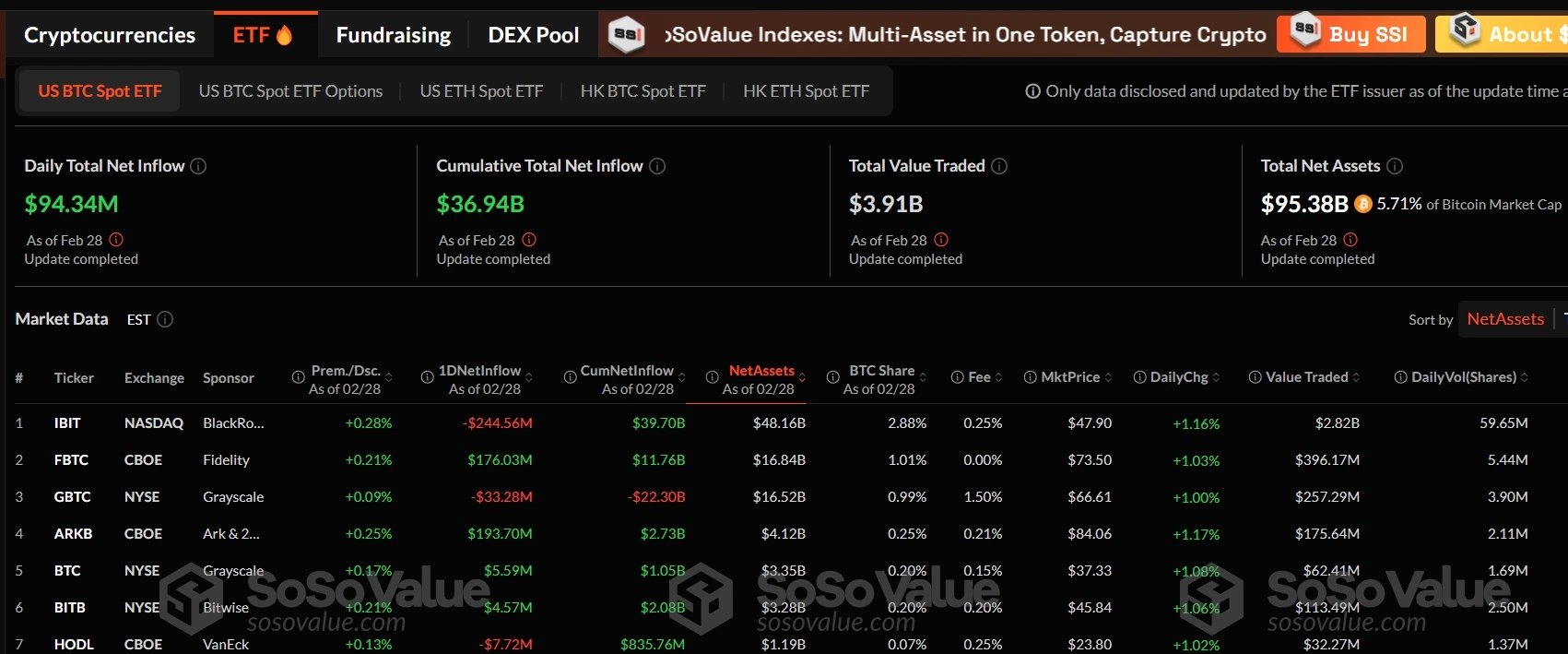

In contrast, the U.S. cryptocurrency ETF market has entered a mature stage. Since the approval of Bitcoin and Ethereum spot ETFs in 2024, the U.S. market has attracted significant capital inflows. As of March 2025, the total asset size of U.S. cryptocurrency ETFs has exceeded $136 billion, becoming the world’s largest cryptocurrency ETF market. State Street Bank even predicts that the asset size of cryptocurrency ETFs will surpass precious metal ETFs within the year, becoming the third-largest asset class after stocks and bonds.

LATEST PROGRESS ON CRYPTO ETF APPLICATIONS

As of March 2, 2025, the crypto ETF market continues to heat up, especially after the approval of Bitcoin and Ethereum spot ETFs, with more institutions submitting applications for other cryptocurrencies. Here’s the main progress:

SOL (Solana)

- Market Cap: Approximately $80.8 billion

- Category: High-performance public chain using PoH consensus mechanism, featuring high-speed transactions and low costs.

- Latest Progress: VanEck, Grayscale, Bitwise, 21Shares, Canary Capital, and other institutions have submitted SOL spot ETF applications. Grayscale and VanEck applications have entered the 21-day public comment period. Polymarket data shows the probability of SOL ETF approval before July 31, 2025, has increased to 34%.

ADA (Cardano)

- Market Cap: Approximately $33.0 billion

- Category: Third-generation blockchain developed by IOHK, using Ouroboros PoS protocol, emphasizing academic research and scalability.

- Latest Progress: Grayscale submitted the world’s first ADA spot ETF application in February 2025, currently in the SEC’s preliminary review stage. The SEC typically has a 45-day initial response period (until around March 25, 2025), which can be extended to 90 days (until around May 10, 2025).

XRP (Ripple)

- Market Cap: Approximately $149.6 billion

- Category: Blockchain focusing on cross-border payments, driven by Ripple company, using XRP Ledger for fast settlement.

- Latest Progress: Bitwise Asset Management, Grayscale, 21Shares, WisdomTree, Canary Capital, and other institutions have submitted XRP spot ETF applications, but due to SEC lawsuit impacts, the approval probability is 65%. Bitwise formally submitted an XRP spot ETF application through Cboe BZX Exchange in February 2025, and the SEC confirmed receipt on February 18.

LTC (Litecoin)

- Market Cap: Approximately $8.79 billion

- Category: Lightweight version of Bitcoin, using Scrypt algorithm, faster transaction speed, with a supply cap of 84 million coins.

- Latest Progress: Grayscale, Canary Capital, Nasdaq, and other institutions have submitted LTC spot ETF applications, with approval probability as high as 90%. Nasdaq submitted an LTC spot ETF application on January 29, 2025, which the SEC has accepted and entered into a 45-day preliminary review (until around March 15, 2025). Applications from Grayscale and Canary Capital are also progressing simultaneously. Final response and review period: initial response until March 15, 2025, which can be extended to 90 days (until around April 29, 2025).

DOGE (Dogecoin)

- Market Cap: Approximately $32.4 billion

- Category: Meme coin originating from internet culture, using PoW mechanism, active community, repeatedly supported by Musk.

- Latest Progress: Grayscale, NYSE Arca, Grayscale Investments, Bitwise Asset Management, 21Shares, WisdomTree, Canary Capital, and other institutions have submitted DOGE spot ETF applications. Final response and review period: expected 45-day initial response period (until around mid-March 2025), which can be extended to 90 days (until the end of April 2025).

The feasibility of crypto ETFs is affected by regulation, market demand, legal risks, and technological maturity. The SEC’s new leadership (Paul Atkins) is more crypto-friendly, strengthening expectations for policy relaxation in 2025. The success of Bitcoin and Ethereum ETFs has set precedents for other coins.

However, different cryptocurrencies face varying regulatory challenges. For example, SOL and XRP have been embroiled in legal disputes due to SEC questioning whether they are “securities,” and their ETF applications need to first address the clarification of legal status. In comparison, ADA and LTChave higher approval probabilities due to their decentralized characteristics. DOGE, due to its meme attributes, faces greater regulatory uncertainty and relatively higher approval difficulties.

According to Bloomberg analysts’ predictions, the approval probabilities for various cryptocurrency ETFs are as follows: LTC leads with an 85% probability, ADA follows closely at 70%, SOL and XRP at 60% and 50% respectively, while DOGE’s approval probability is only 20%.

CRYPTOCURRENCY ETF SCALE MAY BECOME THE 3RD LARGEST ASSET CLASS

The rise of cryptocurrency ETFs has attracted not only native cryptocurrency institutions but also the participation of traditional financial giants. For example, the Depository Trust & Clearing Corporation (DTCC) has listed the first batch of Solana futures ETFs (with ticker symbols SOLZ and SOLT) on its official website, demonstrating traditional financial institutions’ strong interest in cryptocurrency ETFs.

In addition, the Trump administration recently announced plans to advance strategic cryptocurrency reserves including XRP, SOL, and ADA, further enhancing market expectations for cryptocurrency ETFs. Trump’s “endorsement” effect was immediate, with related token prices surging significantly in a short period of time. ADA’s increase even exceeded 70% at one point today

Institutional investor participation is a key factor driving the growth of cryptocurrency ETF scale. Taking Hong Kong’s Avenir Group as an example, the institution held Bitcoin ETFs worth approximately $599 million in the fourth quarter of 2024, becoming Asia’s largest Bitcoin ETF holder. The influx of institutional investors has not only enhanced market liquidity but also accelerated the mainstreaming process of cryptocurrency ETFs.

According to State Street Bank’s forecast, the asset scale of cryptocurrency ETFs will surpass precious metal ETFs within 2025, becoming the third-largest asset class after stocks and bonds in the rapidly growing $15 trillion ETF industry. With the SEC’s approval of more digital asset ETFs, the market scale of cryptocurrency ETFs is expected to further expand.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!