KEYTAKEAWAYS

- Ondo Finance TVL Breaks Through $1 Billion

- Ondo Finance's Ecosystem Core Events Review

- Maker RWA, Usual, Hashnote USYC, and Ondo Finance—these four RWA projects have TVL exceeding $1 Billion

CONTENT

Recently, star project in the RWA space Ondo Finance (ONDO) announced that its Total Value Locked (TVL) has surpassed $1.002 billion, with a monthly growth rate as high as 59.29%. The rapid development of Ondo Finance further confirms the enormous potential of the RWA track.

ONDO FINANCE TVL BREAKS THROUGH $1 BILLION

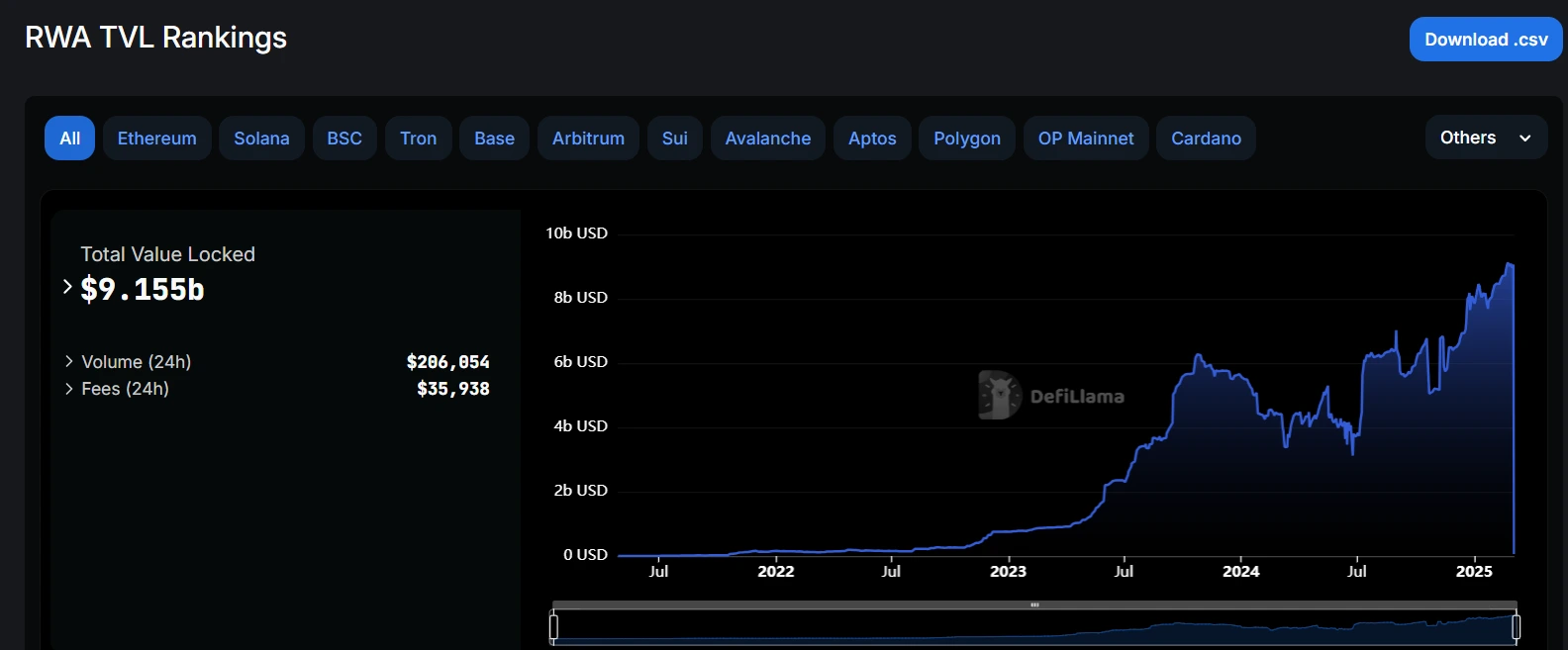

According to DeFiLlama data, Ondo Finance protocol’s TVL has increased by 59.29% monthly, reaching $1.002 billion, becoming the 4th RWA project to break the $1 billion threshold.

Since its establishment, Ondo Finance has stood out in the RWA track with its innovative financial products and strong technical capabilities. Ondo Finance’s core products include high-yield bond funds, real estate tokenization products, and commodity-backed stablecoins, providing investors with more efficient and transparent asset allocation channels through decentralized methods, attracting attention from numerous institutional and individual investors.

Ondo Finance CEO Nathan Allman said in an interview: “We’re excited to see TVL break through $1 billion, which is the result of team effort and community support. In the future, we will continue to promote the adoption of RWA and provide more innovative financial products for global investors.”

ONDO FINANCE’S ECOSYSTEM CORE EVENTS REVIEW

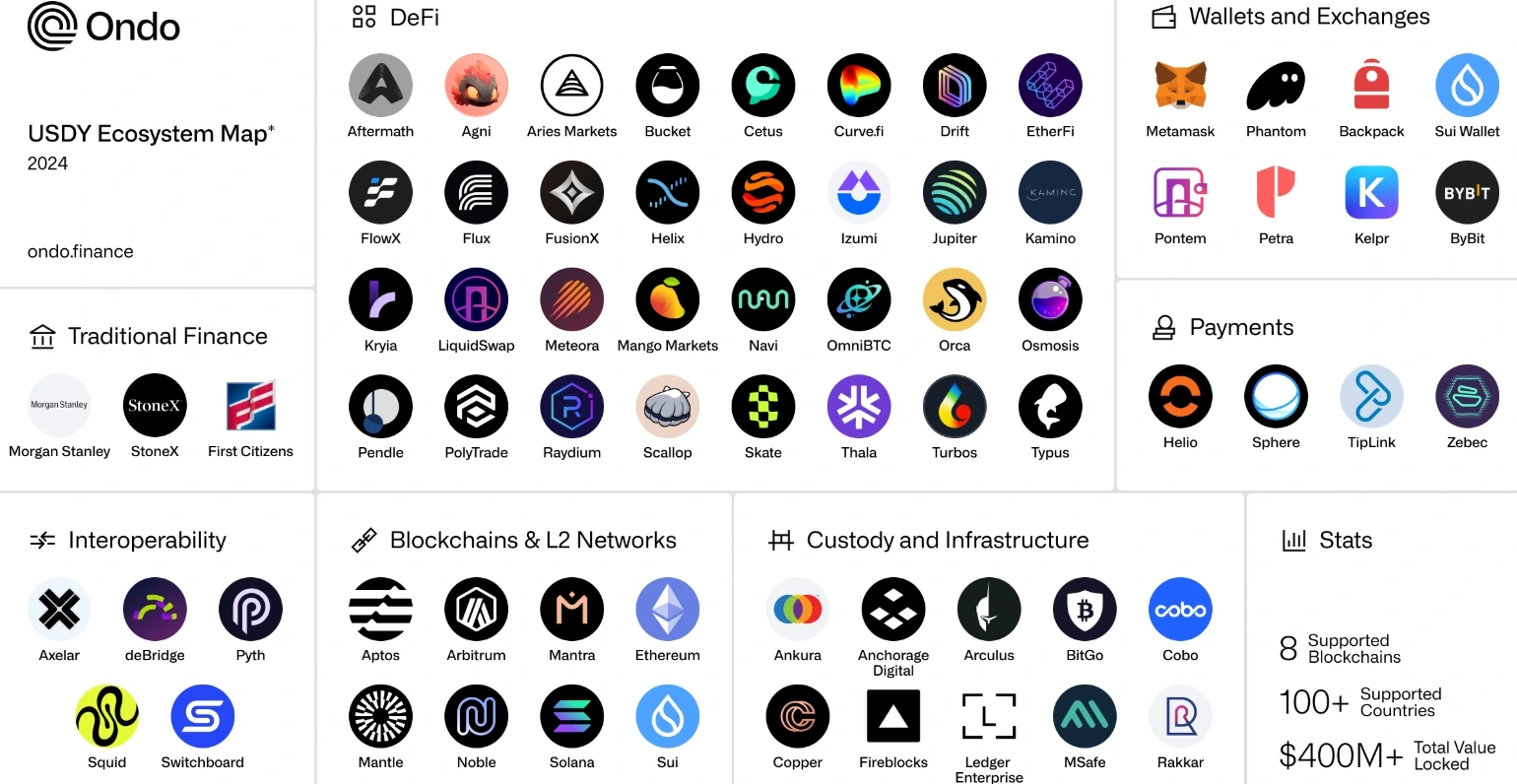

Ondo Finance’s significant achievements in TVL are inseparable from its fast-paced product updates and external ecosystem collaborations.

February 11, 2025, Ondo Finance partnered with Trump’s crypto project WLFI to jointly promote the adoption of tokenized real-world assets (RWA). WLFI plans to integrate Ondo’s tokenized assets (such as USDY and OUSG) into its network and provide lending and margin trading services to users. This collaboration not only expanded Ondo’s market coverage but also injected new momentum into RWA adoption.

February 6, 2025, Ondo Finance launched L1 blockchain Ondo Chain aimed at providing on-chain solutions for institutional-grade financial markets. Ondo Chain combines the security and compliance of permissioned blockchains with the openness of public chains, attracting participation from renowned institutions such as Franklin Templeton and Wellington Management. This technological innovation laid the foundation for bringing institutional-grade financial markets on-chain.

February 5, 2025, Ondo Finance launched Ondo Global Markets (Ondo GM) to enable global investors to access U.S. public securities on-chain through blockchain technology. The platform offers tokenized assets paired 1:1 with underlying assets such as stocks, bonds, and ETFs, featuring high liquidity and free trading outside the United States, further enriching Ondo’s product line.

January 28, 2025, Ondo Finance announced plans to deploy its tokenized U.S. Treasury fund OUSG on XRP Ledger (XRPL). This move introduced OUSG to XRPL’s institutional user base, creating new possibilities for institutional DeFi and advanced cash management, further bridging the gap between DeFi and traditional finance.

December 31, 2024, Ondo Finance partnered with Plume Network to expand RWAfi application scenarios by issuing tokenized U.S. Treasury products (such as USDY). Combining their respective strengths, they simplified the RWA access process, providing global users with investment options that combine stablecoins with U.S. Treasury yields.

December 31, 2024, Ondo Finance announced that its yield-bearing stablecoin USDY launched on Plume Network, further expanding USDY’s application scenarios and providing more yield opportunities for non-U.S. users and institutional investors.

October 22, 2024, Ondo Finance partnered with Sui ecosystem’s NAVI Protocol, becoming its official lending partner on the Sui network. After Ondo’s yield-bearing Treasury stablecoin USDY launched on NAVI Protocol, users could earn multiple yields through lending and liquidity provision while improving capital efficiency.

September 25, 2024, BlackRock’s BUIDL Fund transferred 1.102 million USDC to Ondo Finance, further confirming Ondo Finance’s influence among institutional investors.

June 6, 2024, Anchorage Digital supported USDY and OUSG, further enhancing the institutional recognition and market liquidity of its products.

Through a series of ecosystem collaborations and product model innovations, Ondo Finance has provided global investors with more diversified, compliant, and efficient financial products, continuously advancing its influence in the RWA sector.

OTHER MEMBERS OF THE RWA TRACK $1 BILLION TVL CLUB

Besides Ondo Finance, there are several other projects in the RWA track with TVL exceeding $1 billion, collectively driving the rapid development of this field.

Maker RWA

MakerDAO is one of the pioneers in the DeFi space, with its RWA business primarily supporting the issuance of its stablecoin DAI by using real-world assets (such as Treasury bonds, corporate bonds, etc.) as collateral. Currently, Maker RWA’s TVL has reached $1.0749 billion, making it one of the largest projects in the RWA track. MakerDAO’s RWA strategy not only enhances DAI’s stability but also provides traditional financial institutions with an entry point into the crypto market.

Usual

Usual is another star project in the RWA track, with its TVL reaching $1.026 billion. Usual focuses on tokenizing real estate assets and enabling fragmented trading of assets through blockchain technology. This model not only lowers the threshold for real estate investment but also provides investors with higher liquidity.

Hashnote USYC

Hashnote USYC has a TVL of $1.012 billion, and its main product is yield tokens based on U.S. Treasury bonds. By tokenizing Treasury yields, Hashnote provides investors with a low-risk, high-liquidity investment option. This model is particularly popular in the current macroeconomic environment.

RWA TRACK: THE NEXT EXPLOSION POINT IN THE CRYPTO SPACE

The RWA (Real World Assets) track refers to the field of tokenizing assets from the real world through blockchain technology and trading and managing them within the decentralized finance (DeFi) ecosystem. By bringing real assets on-chain, RWA not only injects more quality assets into the crypto market but also provides traditional investors with a bridge to enter the crypto space.

According to industry data, the total market size of the RWA track is expected to reach trillions of dollars in the coming years.

Ondo Finance’s TVL breaking through $1 billion is not only a milestone in its own development but also a microcosm of the rapid rise of the RWA track. With the openness of crypto policies in regions such as the United States and UAE, the RWA track is expected to experience explosive growth in the coming years. For investors, RWA not only provides new investment opportunities but also injects more stability into the crypto market.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!