KEYTAKEAWAYS

- DEX On-Chain Daily Trading Volume Rankings: Ethereum Leads, Arbitrum Grows Over 30% Weekly

- Number of Addresses Holding Over 10,000 ETH Reaches 919, with Average Cost Basis of $2,172

- TON Chain Daily Transaction Volume Plummets 87.79%, Account Growth Significantly Slows

- KEY TAKEAWAYS

- DEX ON-CHAIN DAILY TRADING VOLUME RANKINGS: ETHEREUM LEADS, ARBITRUM GROWS OVER 30% WEEKLY

- NUMBER OF ADDRESSES HOLDING OVER 10,000 ETH REACHES 919, WITH AVERAGE COST BASIS OF $2,172

- TON CHAIN DAILY TRANSACTION VOLUME PLUMMETS 87.79%, ACCOUNT GROWTH SIGNIFICANTLY SLOWS

- DISCLAIMER

- WRITER’S INTRO

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

DEX ON-CHAIN DAILY TRADING VOLUME RANKINGS: ETHEREUM LEADS, ARBITRUM GROWS OVER 30% WEEKLY

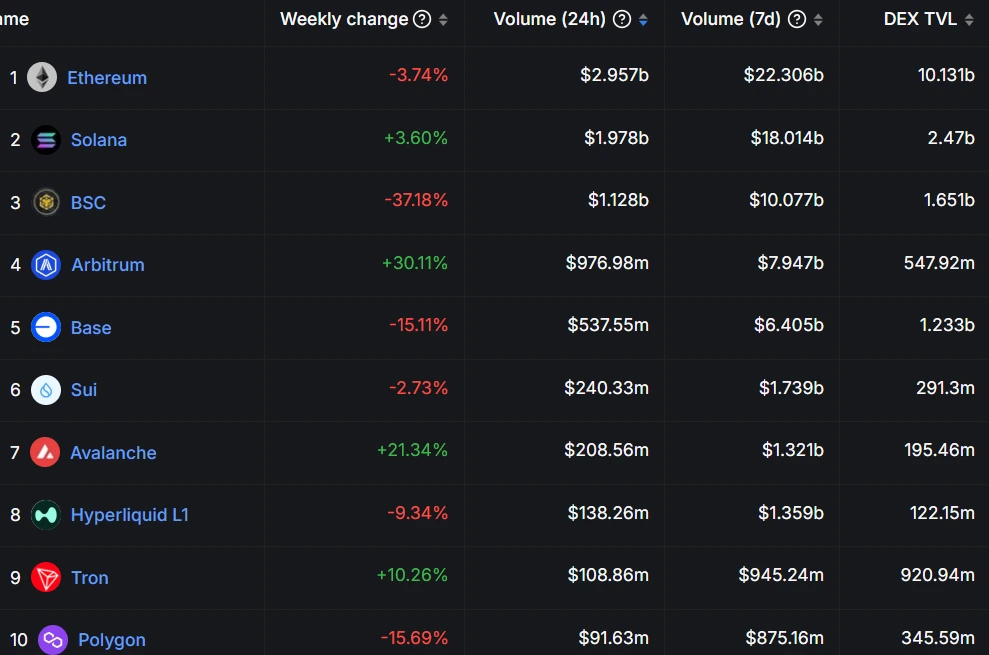

According to DeFiLlama data, the daily trading volume of decentralized exchanges (DEXs) by blockchain shows: Ethereum leads with $2.957 billion, followed closely by Solana with $1.978 billion, and BNB Chain in third place with $1.128 billion.

Additionally, Arbitrum ranks fourth with $976.98 million and demonstrates impressive performance with a weekly growth rate of 30.11%. Base chain currently holds fifth place with a trading volume of $53.755 million.

Analysis:

Ethereum continues to maintain its top position in DEX trading volume thanks to its extensive ecosystem and user base, while Arbitrum’s rapid growth demonstrates the significant advantages of Layer 2 solutions in improving transaction efficiency and reducing costs.

NUMBER OF ADDRESSES HOLDING OVER 10,000 ETH REACHES 919, WITH AVERAGE COST BASIS OF $2,172

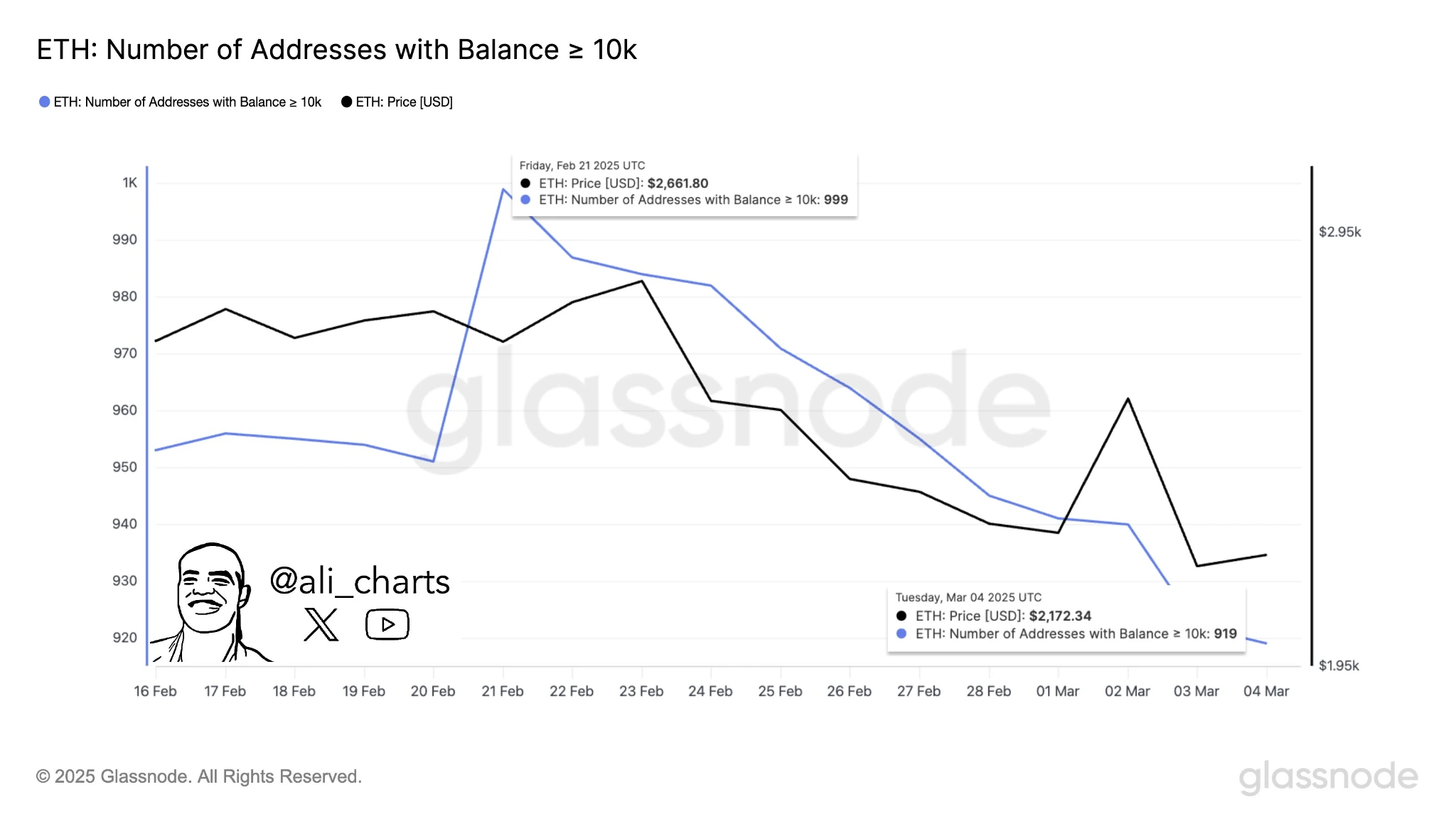

According to the latest on-chain data, the number of addresses holding more than 10,000 Ethereum (ETH) has reached 919. These “whales” have an average cost basis of $2,172 per ETH.

Analysis:

The increase in Ethereum whale numbers indicates that despite frequent market volatility, large investors remain optimistic about Ethereum’s future. Whale holding behavior is often viewed as a barometer of market sentiment. Increasing holdings may inject more confidence into the market, but caution should be exercised regarding the risk of concentrated selling by large holders.

TON CHAIN DAILY TRANSACTION VOLUME PLUMMETS 87.79%, ACCOUNT GROWTH SIGNIFICANTLY SLOWS

According to TonStat data, TON chain’s daily transaction volume has fallen to 2,215,607 transactions, a sharp 87.79% decrease from 18,146,948 transactions in September 2024. Meanwhile, the number of accounts on the TON chain stands at 145,227,677, showing growth from 70,983,316 in September 2024, but with notably slowing momentum.

It’s worth noting that “accounts” on the TON chain include not only wallet addresses but also NFTs, staking contracts, and other smart contract entities.

Analysis:

The dramatic decline in TON chain’s daily transaction volume may reflect a significant drop in ecosystem activity, potentially due to shifting Telegram user interests, network performance issues, or intensified external competition.

Despite continued growth in account numbers, the slowing pace suggests insufficient momentum in new user acquisition or contract deployment. This trend could pose challenges for TON chain’s long-term development, indicating that the social+finance model needs to find new growth drivers.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!