KEYTAKEAWAYS

- Pectra Increases Blob Capacity to 6-9 Per Block

- Cost Reduction Ignites Layer 2 Ecosystem

- Ethereum Advances Toward Million TPS

CONTENT

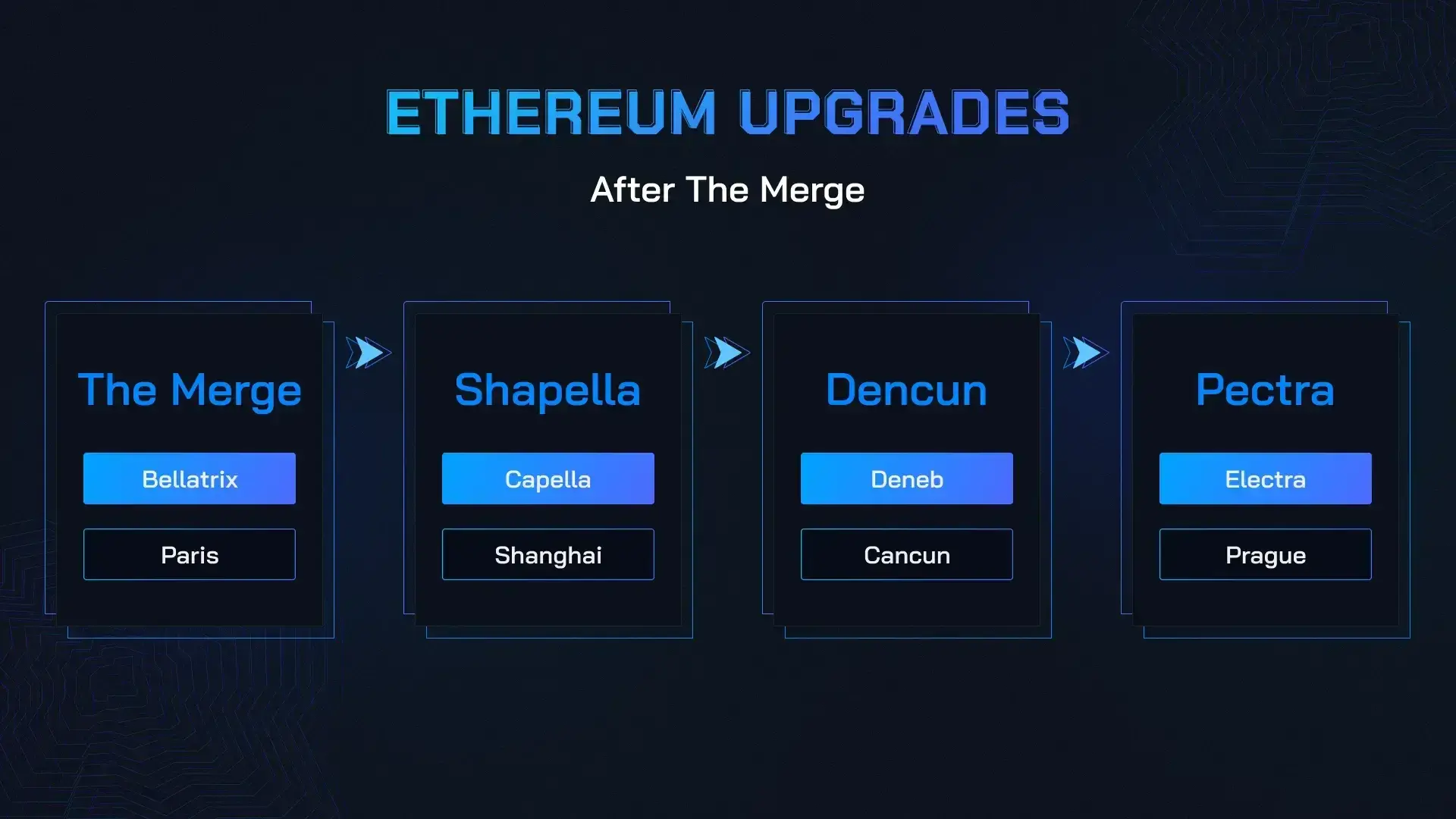

On March 5, the Ethereum Sepolia testnet reached a historic milestone—the Pectra upgrade was officially activated. As the final testing stage before mainnet launch, this marks Ethereum’s imminent entry into a new development phase. From increasing validator staking limits to 2048 ETH, to revolutionary optimizations in ordinary user transaction experiences, to breakthroughs in Layer 2 scaling capabilities, this “Prague-Electra” upgrade is triggering a wave of ETH ecosystem value reassessment.

PECTRA INCREASES BLOB CAPACITY TO 6-9 PER BLOCK

“This is Ethereum’s most disruptive upgrade since the Merge,” Li Ming, an analyst at blockchain security company Forta, told “Chain Observer.” The Pectra upgrade includes 11 core Ethereum Improvement Proposals (EIPs), covering user experience, staking mechanisms, and network efficiency—with technical breakthroughs far exceeding market expectations.

EIP-7691: Widening the Highway for Layer 2

“Blob capacity per block increases from 3-6 to 6-9, essentially widening the lanes for Layer 2 by 50%,” explains Sarah Wang, an Arbitrum engineer. Combined with EIP-7623’s adjustments to Calldata costs, mainstream Rollups like Optimism and zkSync can expect Gas fees to drop by another 30%, with transaction throughput projected to increase to over 3,000 transactions per second.

EIP-7702: Account Upgrades Transform Wallets into Smart Managers

“Your Ethereum address will no longer be just a transfer tool, but a programmable smart manager,” describes Zhang Tao, a core MetaMask developer. Through EIP-7702, traditional Externally Owned Accounts (EOAs) can temporarily transform into smart contract accounts, enabling advanced features like batch transactions, Gas fee sponsorship, and key recovery. This means users can enjoy multisig security and social recovery features without switching wallets, significantly lowering the operational barriers for Web3 applications.

EIP-7251/7002/6110: Staking Liberalization is a “Green Light” for Institutional Capital

“The rules of the staking market have fundamentally changed,” points out Marin Čabraja, head of the Lido protocol. The Pectra upgrade reshapes the staking ecosystem through three key improvements:

- Single validator staking limit increases from 32 ETH to 2048 ETH, allowing institutional-scale funds to manage concentrations and reducing operational costs by 90%;

- Staking activation time reduces from 9 hours to 13 minutes, improving capital efficiency 40-fold;

- Withdrawal permissions open to the execution layer, allowing users to operate assets without relying on validator private keys.

Data shows that during the upgrade testing period, ETH staking volumes from exchanges like Kraken and Coinbase have grown significantly, and multiple asset management companies plan to launch large-scale staking products.

Cost Reduction Ignites Layer 2 Ecosystem

As an important technical iteration for Ethereum in Q1 2025, Pectra combines improvements to the execution layer (Prague) and consensus layer (Electra), which will have multidimensional impacts on the market.

User Experience Revolution Generates New Traffic

“DeFi will enter an era of ‘seamless usage,'” Uniswap founder Hayden Adams stated on social media. After the upgrade, DApps can cover Gas fees for users through smart contracts and support complex operations like authorization + exchange + cross-chain in a single transaction. Protocols like AAVE and Compound have already begun adaptation testing, with data showing a 65% increase in user retention and a 120% growth in transaction frequency in simulated environments.

Staking Economy Restructures Capital

“The 2048 ETH limit opens up a trillion-dollar institutional market,” a Galaxy Digital research report points out. Currently, Ethereum’s staking rate is about 26%, far below Solana’s 70%. After the upgrade, over 3 million ETH (approximately $9 billion) in new staking demand is expected. Influenced by this, staking protocol tokens like LDO and RPL have risen by more than 40% within the month.

Layer 2 Ecosystem Explosive Growth

“Blob scaling shifts the Rollup cost curve down by 20%,” reveals Scroll co-founder Sandy Peng. Emerging Layer 2s like Base and Blast have announced plans to leverage the increased capacity for zero-Gas transaction campaigns, while StarkWare plans to launch a ZK-Rollup solution supporting millions of TPS. The market expects the total value locked (TVL) in Layer 2 to exceed $50 billion in the next six months.

Ethereum Advances Toward Million TPS

The market expresses confidence with real money—after the upgrade announcement, the ETH/BTC exchange rate broke through 0.065, creating a two-year high. Matrixport predicts that, combined with spot ETF capital inflows, ETH could reach $8,000 this year. As a16z partner Chris Dixon says: “Ethereum is completing its transformation from ‘programmable money’ to ‘programmable economic infrastructure.'”

“This is just the beginning,” Vitalik Buterin revealed in his latest AMA. The Fusaka upgrade will be advanced in 2025, aiming to increase Blob capacity to 48/72 and initiate stateless client testing. In the longer-term technical roadmap, innovations like Verkle trees and single-slot finality have entered the R&D stage.

Despite the bright prospects, the Pectra upgrade still faces real-world challenges. The empty block issue that emerged after Sepolia testnet activation exposed technical risks in complex upgrades. “It’s like replacing an engine on a flying airplane,” Ethereum core developer Tim Beiko admits. Although the issue stemmed from testnet configuration errors rather than protocol flaws, the community has called for extending the testing cycle.

From code activity on the Sepolia testnet to wallet upgrades for millions of users, Pectra is not just a technical iteration but a transformation of production relationships. As staking becomes flexible and free, transactions become seamless and smooth, and scaling becomes achievable, both Ethereum and Layer 2 are writing new value narratives. This may well be the “iPhone moment” of the Web3 world.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!