KEYTAKEAWAYS

- Bitcoin Spot ETFs See Consecutive 7-Day Capital Outflows, Daily Net Outflow of $371 Million

- ETH Holders' Profit Rate Only 47.9%

- Uniswap Maintains Lead Position in DEX Trading Volume

CONTENT

Welcome to CoinRank Daily Data Report. In this column series, CoinRank will provide important daily cryptocurrency data news, allowing readers to quickly understand the latest developments in the cryptocurrency market.

BITCOIN SPOT ETFS SEE CONSECUTIVE 7-DAY CAPITAL OUTFLOWS, DAILY NET OUTFLOW OF $371 MILLION

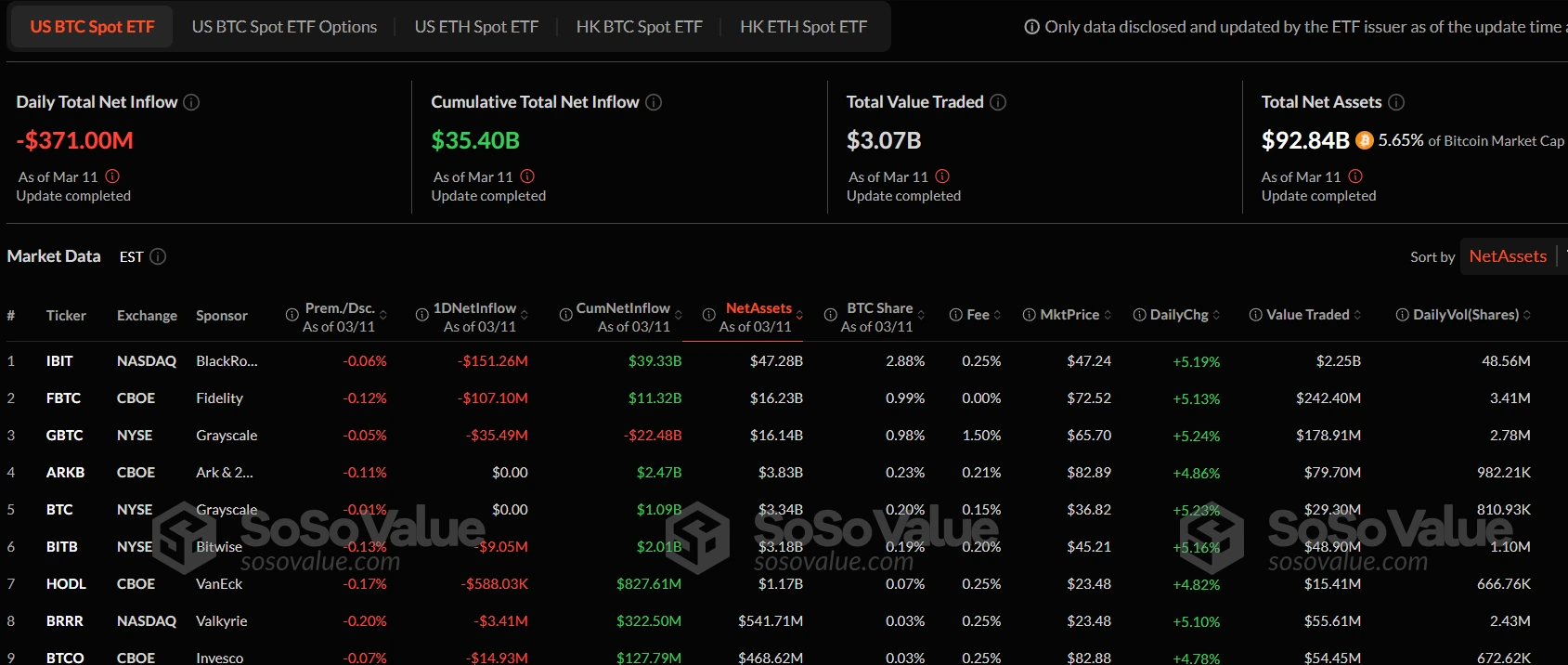

According to SoSoValue data, Bitcoin spot ETFs experienced total daily net outflows of $371 million, marking the seventh consecutive day of capital outflows. Among them, BlackRock’s Bitcoin ETF IBIT saw daily net outflows of $151 million, while Fidelity’s Bitcoin ETF FBTC had daily net outflows of $107 million.

The total net asset value of Bitcoin spot ETFs stands at $92.838 billion, with the ETF net asset ratio (market value proportion) reaching 5.65%, and historical cumulative net inflows of $35.402 billion.

Analysis:

The recent continuous outflows from Bitcoin spot ETFs may be related to increased market volatility and rising investor risk aversion sentiment. Although BlackRock and Fidelity ETFs showed significant daily net outflows, their historical net inflows remain high, indicating that long-term capital’s confidence in the cryptocurrency market has not diminished.

ETH HOLDERS’ PROFIT RATE ONLY 47.9%

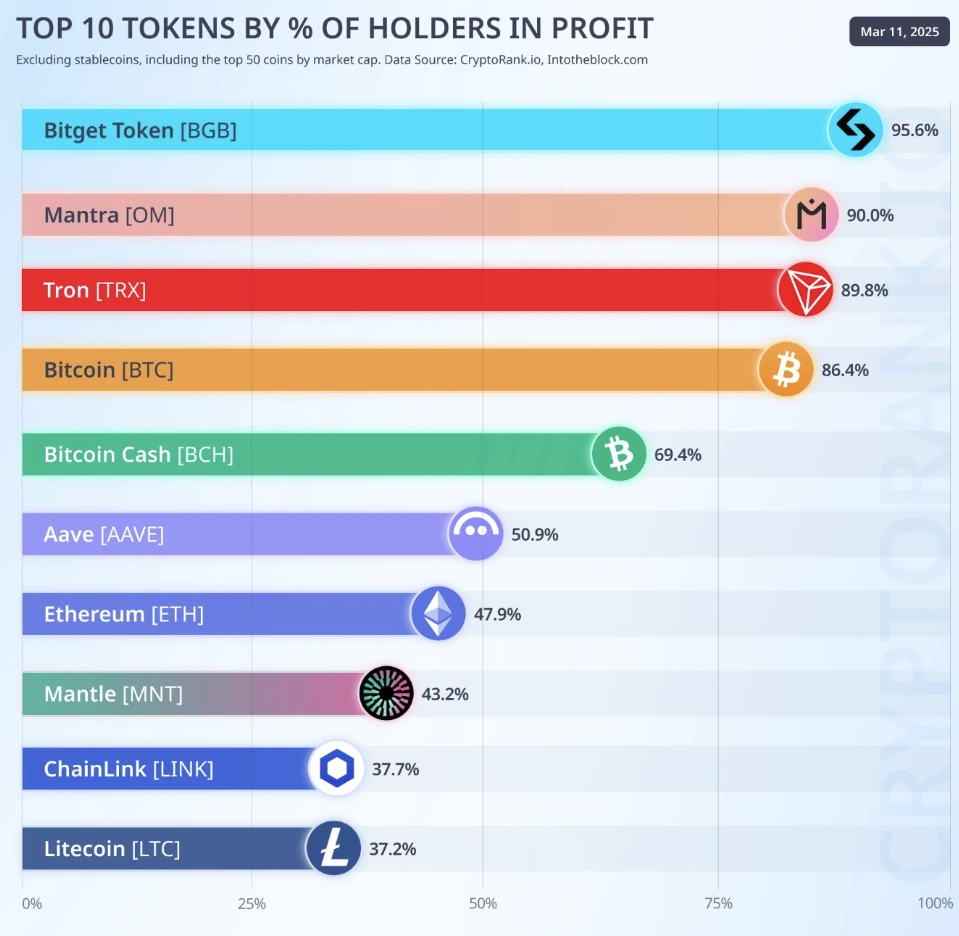

According to the latest data from CryptoRank, as of March 11, 2025, among the top 50 cryptocurrencies by market cap, Bitget Token (BGB) has the highest percentage of holders in profit at 95.6%. This is closely followed by Mantra (OM) at 90%, Tron (TRX) at 89.8%, and Bitcoin (BTC) at 86.4%.

In contrast, only 47.9% of Ethereum (ETH) holders are in a profitable position. The profit percentages for other major tokens are: Aave (AAVE) 50.9%, Mantle (MNT) 43.2%, Chainlink (LINK) 37.7%, and Litecoin (LTC) 37.2%.

Analysis:

The relatively low percentage of Ethereum holders in profit may be related to recent market volatility, intensified Layer 2 competition, and ETH’s relatively weak price performance. Bitcoin, as the market leader, shows its “digital gold” safe-haven characteristics with its high profit percentage.

UNISWAP MAINTAINS LEAD POSITION IN DEX TRADING VOLUME

According to the latest data, the daily trading volume rankings for decentralized exchanges (DEXs) are as follows:

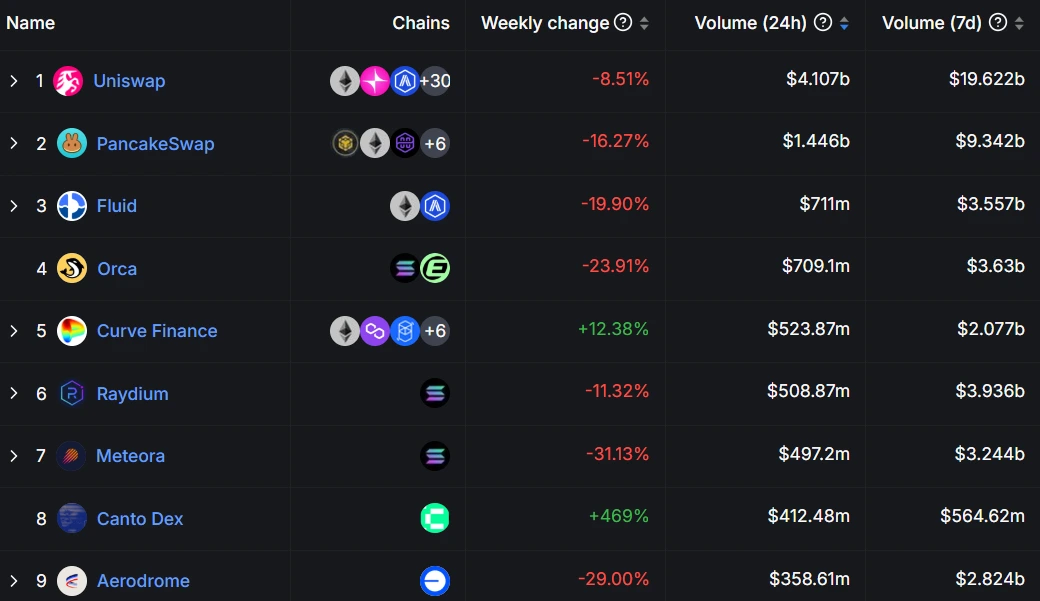

Uniswap holds the top position with an absolute advantage of $4.107 billion, while PancakeSwap ranks second with $1.446 billion. Fluid and Orca follow closely behind in fierce competition. Curve Finance and Raydium have secured positions in the top six with trading volumes of $523.87 million and $508.87 million respectively.

Analysis:

Uniswap continues to lead the DEX market thanks to its massive user base and extensive multi-chain support. PancakeSwap’s trading volume largely depends on the activity of the BNB Chain ecosystem. Competition in the DEX market will become increasingly intense, with user experience and liquidity becoming the key factors determining success.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!