KEYTAKEAWAYS

- Polymarket suffered its worst oracle attack, with a manipulated result in a $7M market, exposing critical flaws in UMA’s decentralized voting system.

- UMA’s optimistic oracle model failed due to token concentration, low penalties for bad actors, and no external validation, leading to an unfair outcome.

- Polymarket’s refusal to refund users triggered community outrage, raising concerns about trust, fairness, and the limits of decentralization in prediction markets.

CONTENT

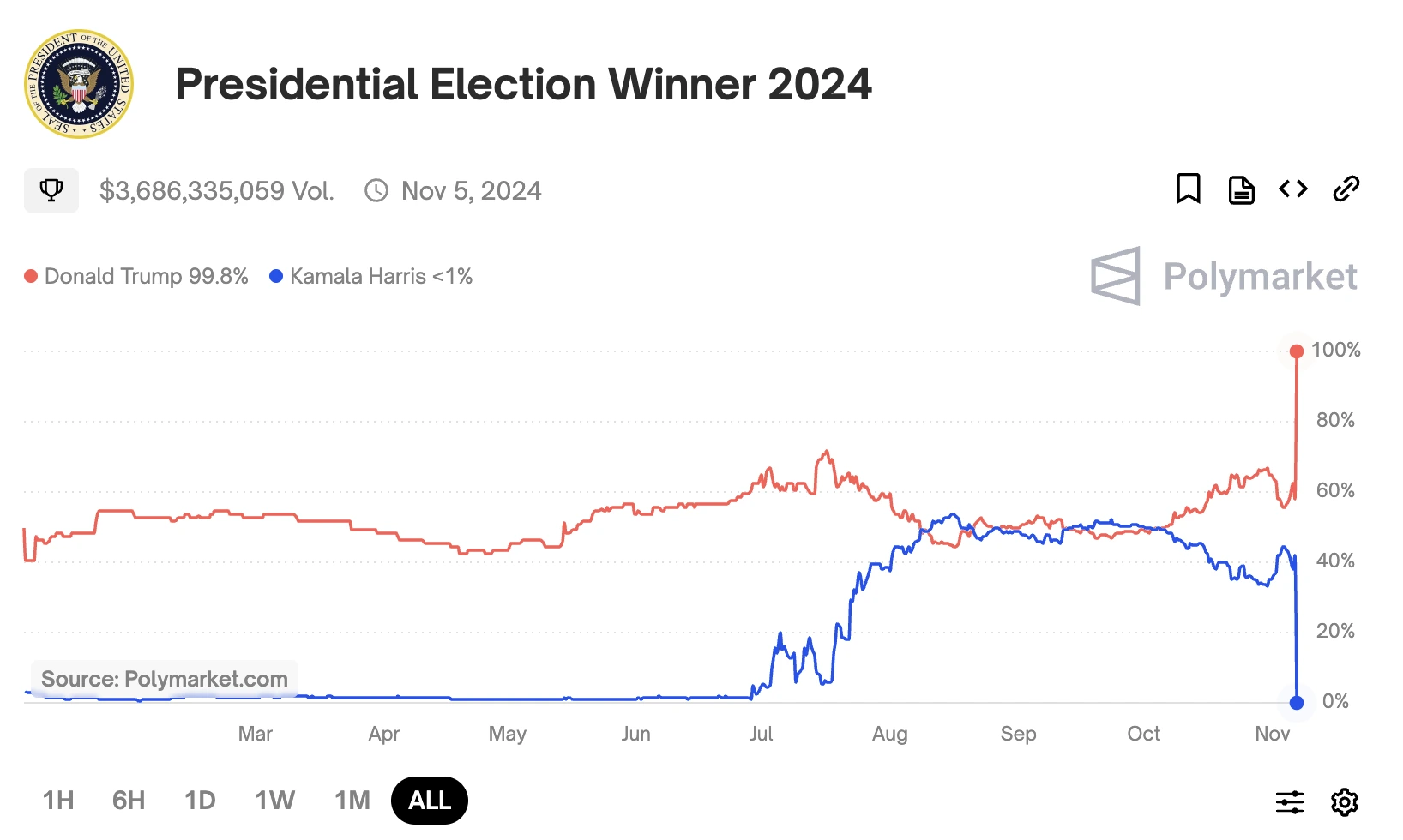

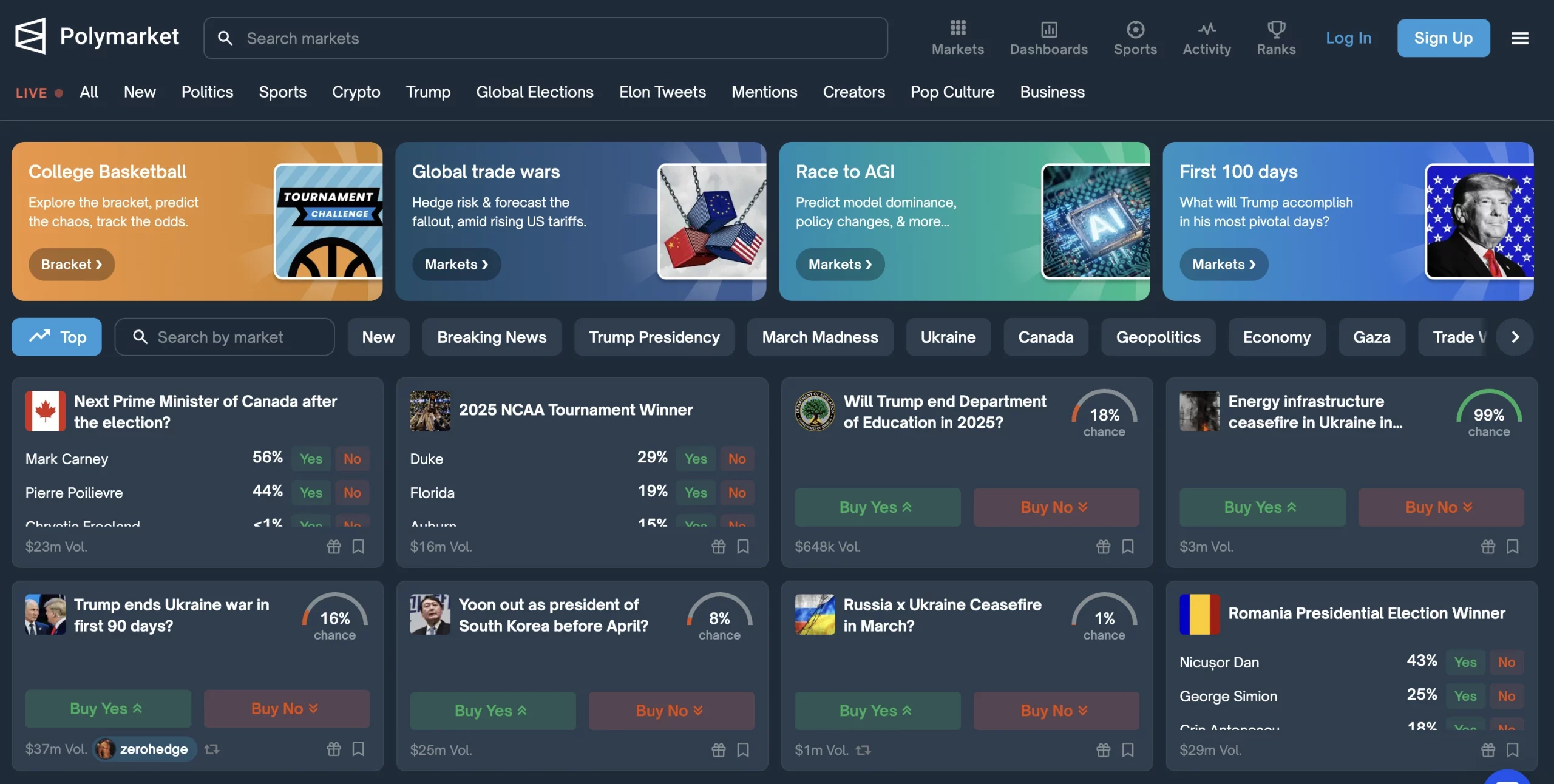

On the evening of March 25, 2025, Polymarket — a decentralized prediction market that became very popular during the 2024 U.S. election — suffered the most serious oracle attack in its history. A prediction market asking whether “Ukraine would reach a rare-earth deal with Trump before April” ended with a result that went against reality.

Even though no deal had been made, the market ruled “Yes,” which caused people who bet on the correct answer to lose all their money, while those who bet incorrectly took the prize.

This incident exposed deep flaws in Polymarket’s oracle system, UMA, and brought attention to a key problem in decentralized prediction markets: how to keep results fair while removing the need for trust.

FROM SUCCESS TO CRISIS: POLYMARKET’S RISE AND ITS DARK SIDE

Since its launch, Polymarket grew quickly thanks to its easy-to-use interface, low fees, and accurate predictions about real-world events. It became especially popular during the 2024 U.S. election, attracting millions of dollars. By using blockchain and oracles, Polymarket turned people’s opinions on future events into tradeable assets.

But behind the success was a weakness — the reliability of oracles.

This latest event was much larger than earlier manipulation attempts (like falsely declaring Edmundo González as Venezuela’s president or claiming Trump audited Fort Knox). The $7 million prediction pool drew huge attention, but UMA’s vote-based system failed. The result was manipulated.

Polymarket admitted there was an issue and promised improvements — but said it wasn’t a “system failure,” so they refused to refund users. That decision triggered a strong backlash from the community, raising doubts about Polymarket’s trustworthiness and governance.

ORACLE FAILURE: A BROKEN MECHANISM

Polymarket uses UMA as its oracle. UMA works as an “optimistic oracle,” meaning anyone can report a result, and then there’s a period where people can challenge it. If there’s disagreement, UMA token holders vote on the final result.

This system seemed solid, but in this case, it clearly broke down:

•Too much power in too few hands: At first, more voters were saying, “It’s too early to tell.” But suddenly, a large number of UMA tokens were used to vote “Yes,” reversing the result. This shows that a small group (or a coordinated group) can control outcomes, especially since UMA tokens are unevenly distributed.

•Low penalty for cheating: The cost of voting wrongly is just 0.05%. With $7 million at stake, this small punishment is meaningless. Attackers only need to hold enough tokens to vote, and they can easily make big profits. UMA’s token price jumping 24% on March 22 might also suggest someone planned this in advance.

•No external checks: Polymarket only uses UMA’s internal vote and doesn’t use outside data or arbitration. So when voters care more about money than facts, the system’s “optimism” fails.

POLYMARKET’S RESPONSE: A CRISIS OF TRUST, NOT JUST TECHNOLOGY

After the result, Polymarket posted in its Discord, admitting the outcome didn’t match reality, but still claimed the system worked as designed. They refused to refund users, saying they couldn’t interfere with decentralized processes. However, this upset many users — especially small investors who trusted the platform. Even though Polymarket has the money to compensate, it chose not to.

Worse, this wasn’t the first time. There were earlier small manipulation cases, but Polymarket didn’t fix the system in time. Now, they say they’ll work with UMA to improve things — like better monitoring, clearer rules, and faster explanations — but no clear plan has been shared yet, and many users doubt these promises.

A CROSSROADS FOR DECENTRALIZED PREDICTION MARKETS

This crisis shows a key problem in decentralized prediction markets: the balance between decentralization and trustworthiness. In traditional markets, fairness comes from trusted organizations and rules. But decentralized systems try to replace that with token-based voting and incentives. When that system is abused, the fairness of results collapses.

It also shows the limits of current oracle designs. Oracles connect blockchain to the real world, but they’re still the weakest part of DeFi. UMA’s system is cheap but not very secure. Chainlink uses multiple data sources and is more reliable, but also more expensive — and still not 100% safe.

To move forward, Polymarket may need a hybrid model — combining on-chain voting with off-chain data checks, and adding stronger punishments for dishonest actions.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!