KEYTAKEAWAYS

-

ZKsync suffered a $5M hack due to private key leakage, causing major token sell-off and community backlash.

-

The incident raised concerns over governance, security flaws, and centralization risks in Layer 2 networks.

-

Despite setbacks, ZKsync continues expanding with strong DeFi, traditional finance ties, and multi-chain plans.

CONTENT

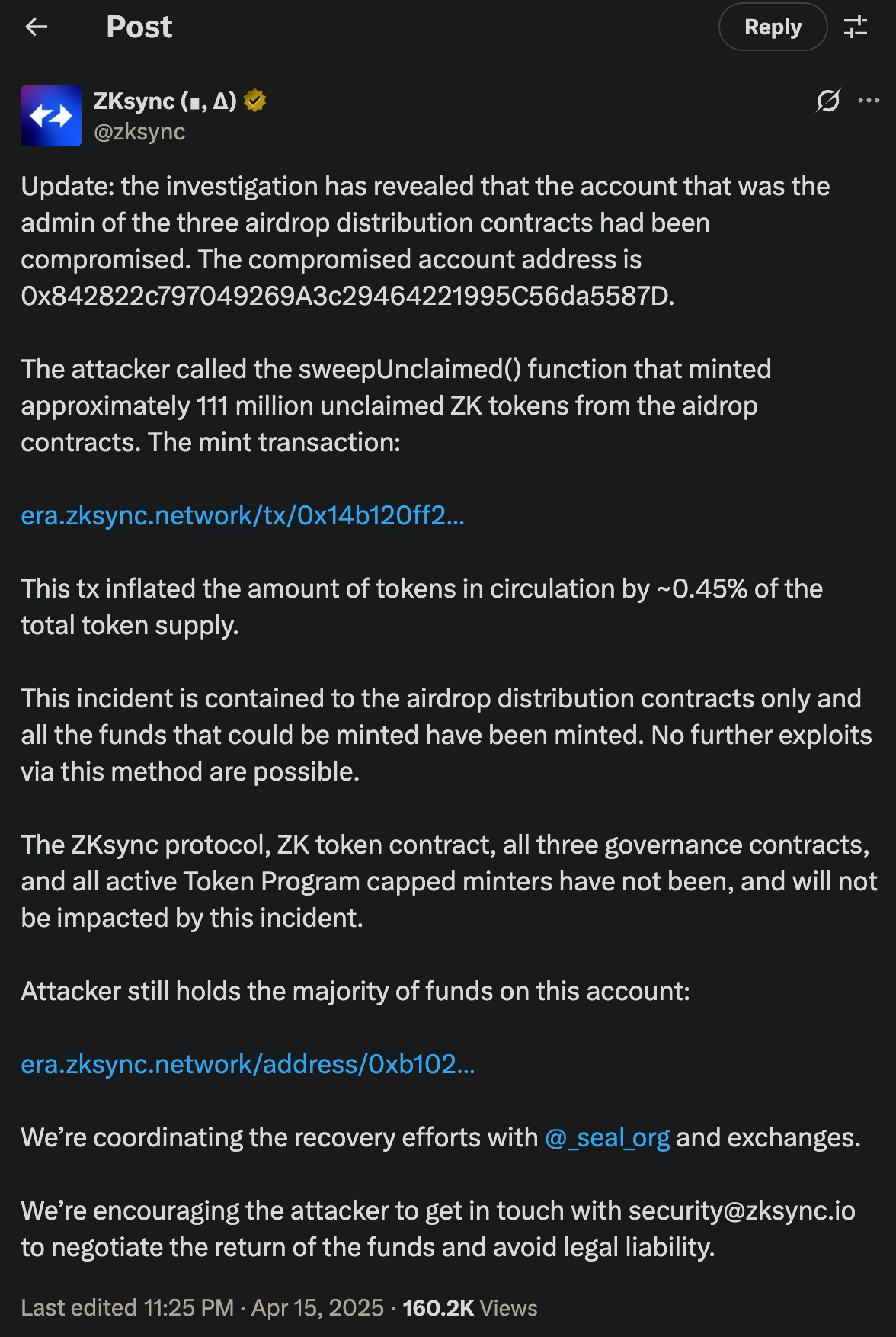

On April 15, 2025, ZKsync suffered a serious security breach that shocked the crypto world. According to an official statement, the private key of the ZKsync airdrop contract admin was leaked.

Hackers used this to exploit a vulnerability in the sweepUnclaimed() function and minted about 111 million unclaimed ZK tokens, worth around $5 million. Of these, 66 million tokens were already sold on the open market.

As a result, the price of ZK tokens dropped by over 17% within hours—from $0.0478 to $0.0396. Trading volume jumped by 96% to $71 million, showing the market’s strong reaction.

ZKsync’s team acted quickly to block the attack path and started an investigation with Security Alliance (SEAL). They stated that core protocols and user funds were safe.

However, the crypto community raised tough questions about the project’s internal controls and the risks of high-privilege accounts. Some even speculated that the hack might be an inside job, comparing it to past incidents like the Mantra (OM) crash.

This event not only hurt ZKsync’s reputation but also highlighted broader risks in the Layer 2 ecosystem.

PROJECT BACKGROUND: A LEADER IN LAYER 2

ZKsync is a Layer 2 scaling solution for Ethereum, built by Matter Labs. It uses zero-knowledge proofs (zkRollups) to reduce fees and increase transaction speed, while keeping Ethereum’s security and decentralization.

Launched in June 2020, ZKsync 1.0 focused on fast and cheap payments, handling about 300 transactions per second (TPS). In 2022, ZKsync Era (version 2.0) was released. It became the first zkEVM to support smart contracts, allowing developers to build decentralized apps (dApps) using familiar Ethereum tools.

By 2025, ZKsync has processed over 1 billion transactions. Its ecosystem includes over 200 active dApps in DeFi, NFTs (like zkMarkets), and gaming (like Treasure). It has also raised over $200 million from top investors like Andreessen Horowitz.

CORE TECHNOLOGY: WHAT MAKES ZKSYNC DIFFERENT

ZKsync uses zkRollup technology, which processes many transactions off-chain and submits only compressed data and a cryptographic proof to Ethereum. This reduces gas fees and increases speed.

Key features include:

- Off-chain computation and storage: Saves cost by moving most data and processing off the Ethereum mainnet.

- zkEVM compatibility: Supports Solidity and Vyper, so Ethereum dApps can be used with little change.

-

High scalability: With zkPorter (a mix of zkRollup and sharding), ZKsync aims for over 20,000 TPS—much higher than Ethereum’s 15–30 TPS.

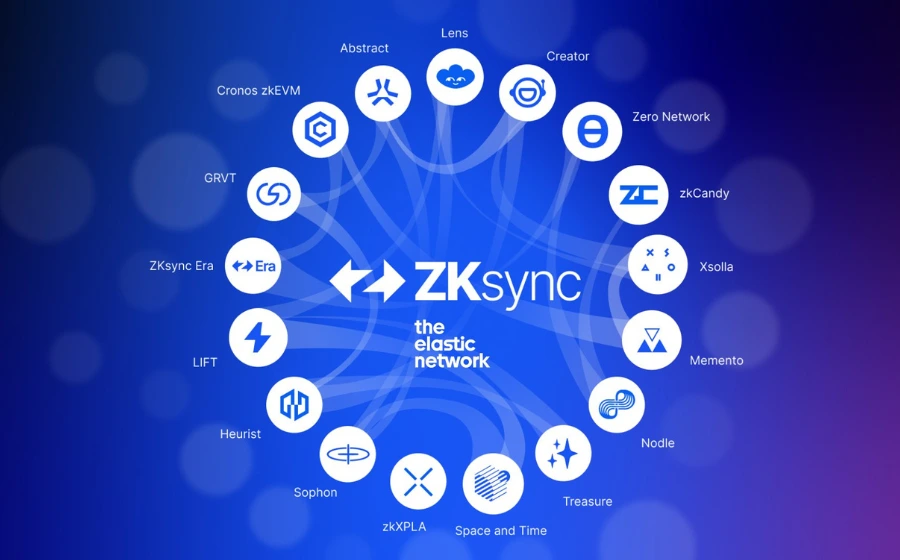

In June 2024, version 3.0 launched with the Elastic Chain architecture, turning ZKsync into a multi-chain network. With its ZK Stack toolkit, developers can build custom chains (for games, DeFi, etc.) that work together, putting it in competition with Polygon’s AggLayer.

GROWTH TIMELINE: FROM PAYMENTS TO MULTI-CHAIN ECOSYSTEM

-

Startup Phase (2020–2021):

ZKsync 1.0 focused on low-cost token transfers. During this time, it processed over 1 million transactions and partnered with wallets and dApps.

-

Expansion Phase (2022–2023):

With ZKsync Era, the project moved beyond payments. Major DeFi protocols like Uniswap and Aave began testing on it. The team launched tools like ZK Stack and the Ignite program to attract developers and grow liquidity.

-

Transformation Phase (2024–2025):

In 2024, Elastic Chain made ZKsync a multi-chain platform. Projects like Lens Protocol and Cronos zkEVM joined. Traditional finance also took notice:- UBS tested a gold investment product (Key4 Gold) using ZKsync Validium.

-

Deutsche Bank explored asset tokenization with ZKsync in a project called Dama 2.

However, airdrop-related controversies emerged. Critics said that token distribution was unfair—49.1% went to the ecosystem, 17.2% to investors, and 16.1% to the Matter Labs team. This raised concerns about trust, which the recent hack made worse.

CURRENT STATUS: OPPORTUNITIES AND RISKS

1.Ecosystem & Market Performance

As of April 2025, over 20 new chains are expected to launch on ZKsync this year. The ecosystem covers areas like gaming and social finance (SocialFi). Total Value Locked (TVL) is around $1.2 billion, making ZKsync a top Layer 2, though still behind Arbitrum ($3 billion). ZK’s market cap is about $800 million, with 35% of its 21 billion total supply in circulation.

2.Traditional Finance Integration

UBS and Deutsche Bank are bringing real-world use cases to ZKsync. This improves the project’s image and shows its potential in regulated markets.

3.Security & Governance Issues

The hack revealed problems in risk control. A single private key controlled too much power. The community is now calling for changes—like using multi-signature wallets or MPC (multi-party computation) for admin control. Also, the high liquidity of airdrop tokens gave attackers an easy way to cash out.

4.Competition and Market Positioning

ZKsync faces strong competition from other Layer 2s like Arbitrum, Optimism, and StarkNet. Arbitrum leads in TVL and DeFi adoption, while StarkNet competes with ZKsync in ZK tech. ZKsync’s strength lies in its Elastic Chain design and real-world finance ties, but it must improve user experience and grow its ecosystem.

LOOKING AHEAD: THE PATH FORWARD FOR LAYER 2

This hack was a serious setback for ZKsync but also a wake-up call. To move forward, ZKsync should focus on:

- Security upgrades: Use multi-sig wallets, on-chain governance, and regular audits for safer key and contract management.

- Ecosystem growth: Attract more dApps, especially in sectors like GameFi and SocialFi, using programs like Ignite and tools like ZK Stack.

- Traditional finance partnerships: Build on relationships with UBS, Deutsche Bank, and others to explore more tokenized assets.

- Rebuilding trust: Improve transparency, rework token distribution, and include the community more in governance.

The ZKsync hack is not just a setback for one project—it’s a lesson for the entire Layer 2 space. As a leader in zero-knowledge tech, ZKsync has shown great promise. But this event shows that even the most advanced systems must prioritize security and governance. Whether ZKsync can recover and continue to lead depends on how well it learns from this crisis and adapts.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!