KEYTAKEAWAYS

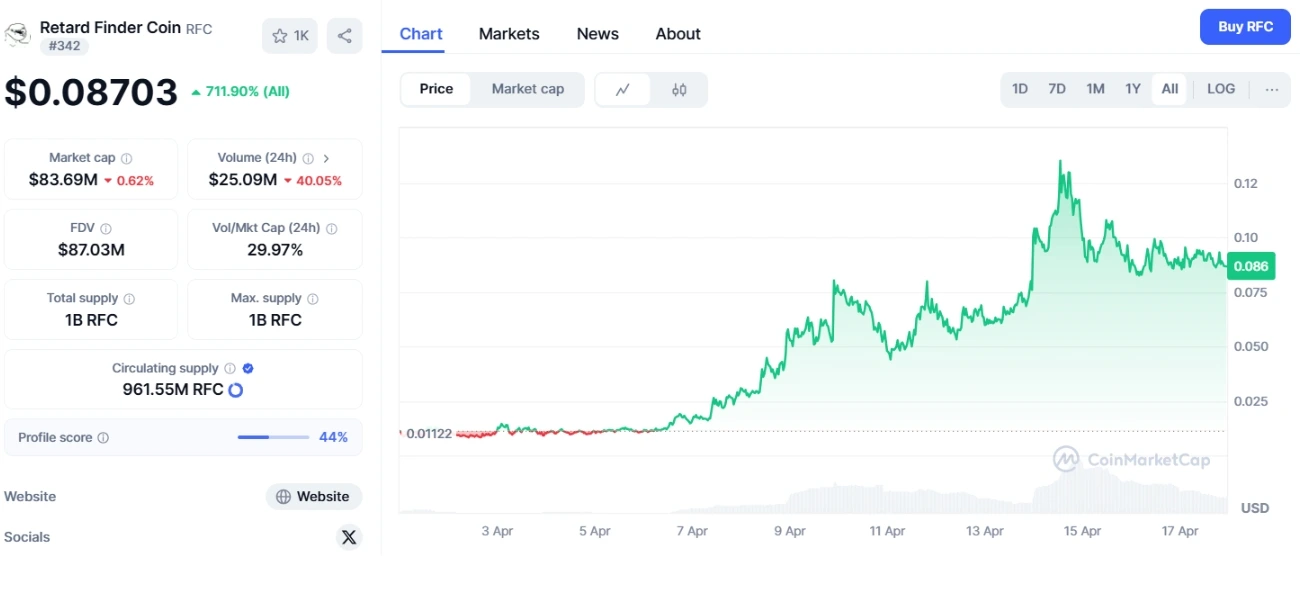

- RFC is priced at $0.08703, with a market cap of $83.69M, representing a total historical gain of 711%

- When Musk first liked the “Retard Finder” social account, RFC began its manic upward trend

- The top 500 addresses control 36.46% of RFC’s supply, with the green cluster single address group accounting for 29.61%

CONTENT

PHENOMENAL SURGE: FROM FRINGE MEME TO 100X LEGEND

As of April 17, RFC is priced at $0.08703, with a market cap of $83.69M, representing a total historical gain of 711%.

Late on April 13, 2025, Solana chain monitoring alerts suddenly triggered—a Meme token called RFC (Retard Finder Coin) saw its price skyrocket 200% within 15 minutes, with market capitalization breaking through $100 million, and price peaking at $0.199. The climax of this frenzy was ignited by a massive buy order worth $1.2 million.

While the market was still speculating whether this was collective retail madness, on-chain data revealed a more complex capital game: a sophisticated network woven by at least 3 related address groups, 5 market makers, and $180 million in speculative funds pushing this “community celebration” toward an unpredictable abyss.

Since March 29 when Musk first liked the “Retard Finder” social account, RFC began its manic upward trend. From $0.003 on April 1 to a historical high of $0.2 on April 13, its price curve exhibited typical “ladder-style control” characteristics: every breakthrough of integer thresholds was accompanied by massive buy orders, with pullbacks consistently controlled within 15%. This abnormal stability is rare in Meme coins known for high volatility.

In the early hours of April 14, on-chain detective @CaNoe disclosed key evidence: a whale address beginning with 0x3d… purchased $1.2 million worth of RFC through four transactions, driving market cap past $100 million.

But this was just the tip of the iceberg—this address split funds through 14 related wallets over 3 days, with actual purchases exceeding $8 million, accounting for 23% of total trading volume.

Even more shocking was the fund flow path:

- Upstream fund pool: $100 million USDC came from a TRUMP market maker address, routed through Gg5yX…

- Relay network: 8hsoX… address group completed 10 cross-chain conversions involving ETH, SOL, and BASE blockchains

- Terminal operations: Finally completed RFC acquisitions through 5 newly created addresses on SOL chain

This three-level jump-style fund transfer exposes the operator’s sophisticated techniques to evade monitoring. As crypto analyst Ember stated: “This isn’t spontaneous speculation, but capital deployment premeditated for months.”

CROSS-ECOSYSTEM OPERATOR’S CAPITAL MAP

By tracing the historical behavior of the 0x3d address, we discovered its deep connection with the 2024 election concept token TRUMP. This address has only interacted with three coins: TRUMP, VIRTUAL, and LIBRA. Particularly with TRUMP, it conducted nearly 50 frequent interactions, buying a total of $7.3 million and selling $11.2 million – a pattern that essentially confirms this as a market maker’s address.

Meanwhile, this address has also been active with LIBRA and VIRTUAL, both widely recognized as super manipulated coins. This typical market maker behavior pattern was perfectly replicated in the RFC campaign. Notably, this address group suddenly cleared all TRUMP holdings on March 15, precisely coupling with the timing of RFC’s upward movement initiation.

Digging deeper into fund flows, we’ve mapped out a more extensive relationship network. These projects collectively outline the operator’s strategic preferences: selecting tokens with strong narratives, low circulation, and celebrity endorsements, then creating an illusion of liquidity through high-frequency trading. RFC perfectly meets all conditions—Musk interactions, Solana ecosystem support, fixed supply, and other characteristics make it an ideal manipulation target.

ECOLOGICAL RESONANCE: SOLANA’S WEALTH-CREATION MACHINE AND RISK HOTBED

RFC’s explosion is no coincidence. On March 7, when Musk replied to the “Retard Finder” account’s statement about “cryptocurrency needing more rebellious spirit” on Twitter, astute capital already sensed an opportunity.

This three-phase marketing of “celebrity interaction-code hints-community propagation” precisely hit the narrative hunger in the crypto market. Even though Musk never publicly acknowledged any relationship with RFC, enough “coincidences” have driven speculators into collective madness.

M7 Research’s on-chain report reveals a more dangerous reality: the top 500 addresses control 36.46% of RFC’s supply, with the green cluster single address group accounting for 29.61%.

This concentration even exceeds SHIB in 2021 (when the top 10 addresses accounted for 27%), giving whales absolute market control.

Solana ecosystem’s deep involvement injected additional momentum into RFC’s surge. This intertwined support, both visible and invisible, has elevated RFC beyond ordinary Meme coins, making it a “model project” showcasing Solana ecosystem’s capabilities.

RFC’s surge is not simply “community consensus,” but a capital game jointly directed by whales, market makers, speculative funds, and celebrity effects. In the crypto market, narrative equals wealth, but the power to distribute wealth remains in the hands of a few.

For ordinary investors, this feast may have just begun, or it could end abruptly at any moment. The only certainty is—when the music stops, the last person holding the baton will pay a painful price.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!