KEYTAKEAWAYS

- Central banks accumulated over 1,000 tons of gold annually since 2022, driving prices to $3,357/oz while Bitcoin's correlation with tech stocks undermines its safe-haven status.

- Gold relies on physical scarcity and historical consensus for immediate protection in crises, while Bitcoin's algorithmic scarcity serves as long-term inflation hedge.

- Optimal portfolio strategy combines both assets: conservative investors should hold 60% gold/20% Bitcoin/20% cash; aggressive investors 30% gold/50% Bitcoin/20% tech stocks.

CONTENT

Gold breaks new highs while Bitcoin struggles: Analysis comparing traditional and digital safe-haven assets in 2025’s uncertain economy. Strategies for balancing both in investment portfolios amid rising geopolitical tensions.

Recently, spot gold prices have repeatedly broken historical highs, surpassing $3,357 per ounce at the time of writing, with keywords such as “gold price” and “new high” trending once again.

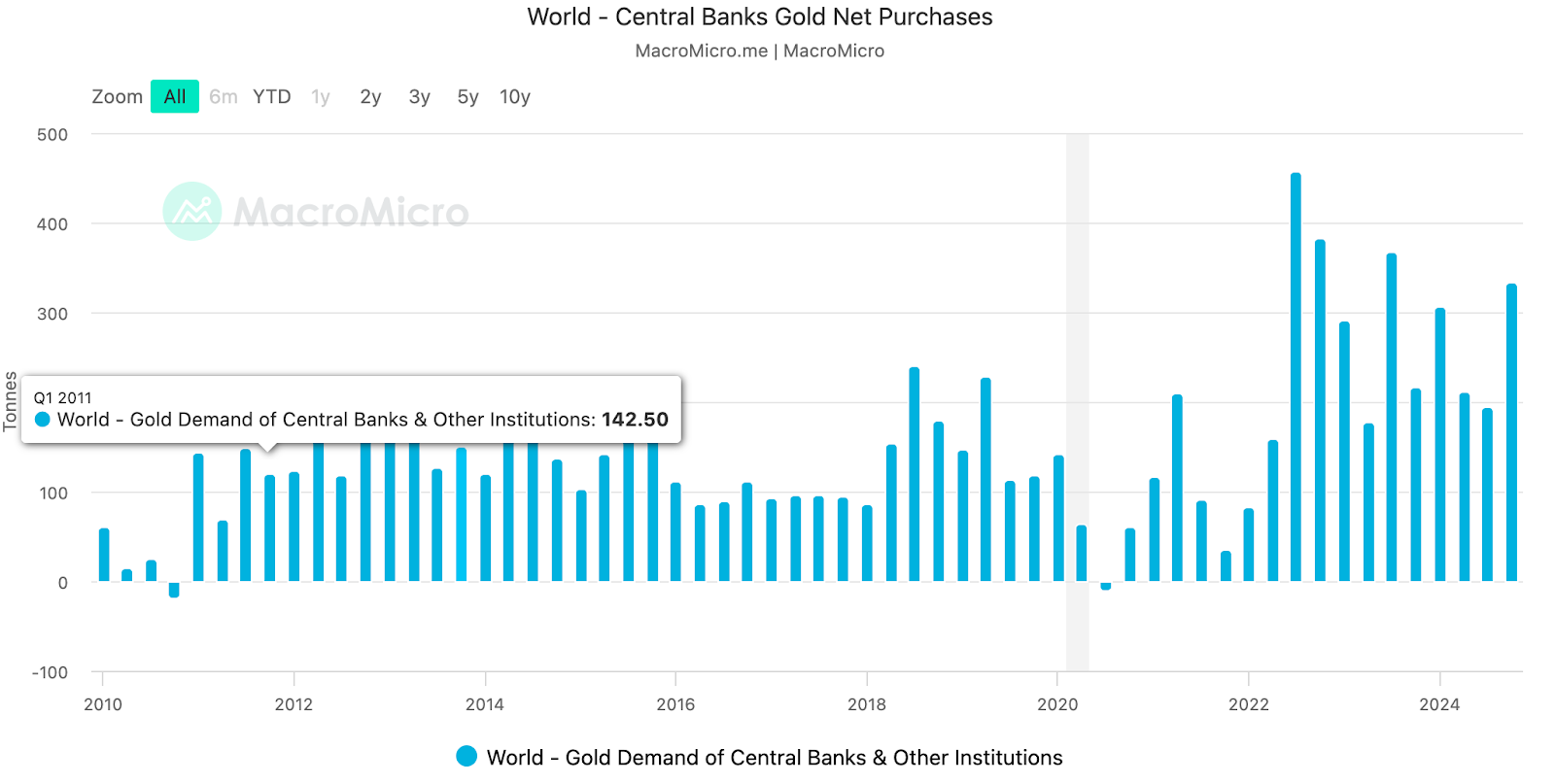

Looking at global central bank gold purchase data, in 2022, central banks worldwide made net purchases of 1,082 tons of gold, a significant increase from the previous 450 tons, setting a historical record. In 2023 and 2024, they made further net purchases of 1,037.4 tons and 1,044.6 tons respectively, accounting for nearly 20% of the total annual gold supply. The bar chart of global central bank net gold purchases below clearly illustrates the central banks’ buying frenzy in recent years.

Global Central Bank Net Gold Purchases

(Source: MacroMicro)

Behind this buying spree is the need for safe-haven assets in response to uncertainties from geopolitical tensions and other factors. With the global economy at the bottom of the Kondratieff cycle (a long-term economic wave spanning approximately 40-60 years), Trump’s tariff wars, the Federal Reserve’s high interest rates, and risks of economic recession in the US stock market have all pushed global demand for gold to a new peak. This frenzied buying is the biggest driver behind gold’s repeated breaking of historical highs.

Meanwhile, Bitcoin, known as “digital gold,” has performed quite weakly recently. After plummeting from its January peak of $109,599 (Bitget data), it has repeatedly broken new lows, reaching a minimum of $74,522. Looking at the current daily and weekly charts, although there was a rebound last week, the downward trend has not been broken. The highs of the rebounds are getting lower, and both daily and weekly Bollinger Bands show a narrowing downward trend.

On the news front, US President Trump’s investigation into critical minerals has heightened market risk aversion. Escalating trade concerns have led investors to continuously withdraw from risk assets and turn to safe-haven assets. Bitcoin has shown a strong correlation with tech stocks (0.8 correlation with NASDAQ), following their ups and downs, with its safe-haven narrative currently ineffective.

So, if the broader environment does not improve for an extended period, does Bitcoin still have what it takes to compete with gold for the title of safe-haven king? In 2025, amidst global turmoil and economic weakness, can Bitcoin forge a path to attract more capital and drive industry development?

SAFE-HAVEN ASSET DEBATE: UNDERLYING LOGIC AND MARKET PERFORMANCE DIFFERENCES BETWEEN GOLD AND BITCOIN

In 2025, the global economic landscape is experiencing severe fluctuations under the resonance of trade protectionism, high inflation, and geopolitical conflicts. The debate over the safe-haven properties of gold and Bitcoin has become a focal point. Gold, as a traditional safe-haven asset, has reached a historic high (breaking through $3,357 per ounce), while Bitcoin has shown high volatility amid technical and policy dynamics (recently fluctuating between $83,000-$85,000). Though both appear to be “safe-haven assets,” the divergence in their underlying logic and market performance reveals a deeper paradigm shift in finance.

Gold Price Trend Over the Last 5 Years

(Source: TradingView)

There are fundamental differences in how their value is anchored. Gold’s safe-haven status is primarily based on physical scarcity—limited global reserves and historical consensus. Gold’s industrial uses and central bank reserve demands provide dual support.

Bitcoin, meanwhile, is based on programmatic scarcity (total supply capped at 21 million coins) and a decentralized network. Its value depends on technological consensus and institutional narratives. Although dubbed “digital gold,” its safe-haven property is more reflected in anti-inflation expectations and de-dollarization needs rather than immediate liquidity demands.

In terms of market structure and liquidity, the gold market is mature with extremely high liquidity, with daily trading volumes exceeding $200 billion, and participants ranging from central banks to institutions and retail investors. The Bitcoin market, on the other hand, exhibits “institutional whale grouping,” with over 60% of circulating BTC locked in custody addresses, leading to depleted exchange liquidity and increased volatility.

Currently, with Federal Reserve interest rates consistently high at 4.25-4.5%, capital flows are increasingly divergent. Gold, on one hand, is suppressed by the Federal Reserve maintaining high interest rates, while on the other hand, debt monetization risks (US debt exceeding $36 trillion) and stagflation expectations support long-term demand.

Bitcoin faces an institutional adoption paradox. Despite high interest rates, Bitcoin ETFs continue to attract capital, with institutions viewing it as a “digital treasury bond,” but retail participation continues to decline, showing a clear exodus of smaller investors.

Bitcoin ETF Section

(Source: CoinGlass)

In the face of black swan events, such as geopolitical conflicts, gold’s performance is more direct. For example, Middle East tensions in April 2025 pushed gold prices beyond $3,050 due to its immediate delivery and global recognition. Bitcoin, because of its cross-border payment attributes, partially substitutes for gold but is limited by regulatory uncertainties, making its substitutability very limited.

Looking at historical patterns, gold and Bitcoin have a lagged correlation, with BTC typically following within 100-150 days after gold reaches new highs. However, in 2025, the correlation between the two has weakened. Gold shows a negative correlation with US stocks, while Bitcoin’s correlation with the NASDAQ index has risen to 0.8, exhibiting dual “risk-safe haven” properties.

In the long run, gold’s “de-dollarization” mission will gradually strengthen, with central banks in countries like China and Russia increasing gold purchases, contributing to gold’s position as the “ultimate reserve” asset. Bridgewater Associates, the world’s largest hedge fund, predicts that if US dollar hegemony collapses, gold could become the anchor of a multipolar monetary system.

However, Bitcoin is still in the stage of “regulatory breakthrough.” The US crypto strategic reserve plan attempts to incorporate BTC into the “new Bretton Woods system,” but technical risks and legal conflicts pose challenges. In the long term, BTC may diverge into two poles: “national reserve” and “decentralized asset.”

Currently, gold has an annualized volatility of 15% with strong resistance to drawdowns; Bitcoin’s volatility is considerably higher, with single-day drops potentially reaching $10,000. Technical vulnerabilities and regulatory black swan threats are significant. Bitcoin needs to break through regulatory shackles and reduce volatility to below 30% to potentially transition from a risk asset to “digital gold.”

The debate over the safe-haven properties of gold and Bitcoin is essentially a value reassessment of the traditional financial order versus the digital revolution. In 2025, amid stagflation and protectionism, the two are not a zero-sum game but together form the “dual anchors” of a new economic paradigm. Investors need to transcend either-or thinking and capture diverse hedging opportunities amid policy and technological shifts. As Bridgewater founder Ray Dalio said, “The purest store of wealth is gold, but the most disruptive value carrier is Bitcoin.”

GOLD AND BITCOIN: BALANCING GROWTH AND PROTECTION IN 2025 INVESTMENT PORTFOLIOS

As mentioned above, although gold currently has stronger safe-haven properties and is more welcomed by major capital, gold and Bitcoin are not simply substitutes for each other. Instead, they can build a unique “offensive-defensive balance” in investment portfolios through functional positioning complementarity.

Looking at the long term, the symbiotic relationship between the two is stronger, a view shared by many macro investors and crypto researchers: In the long run, gold and Bitcoin may jointly play the role of “non-sovereign assets,” complementing rather than replacing each other across different investor structures and scenarios.

They share common enemies: currency devaluation and credit risk. Both gold and Bitcoin counter currency oversupply and inflation. Gold is a “thousand-year-old value storage tool,” while Bitcoin is a “new generation digital value carrier.” Both represent assets outside traditional government monetary control (non-sovereign assets), one traditional, one modern. During macroeconomic instability, both attract capital seeking safe havens.

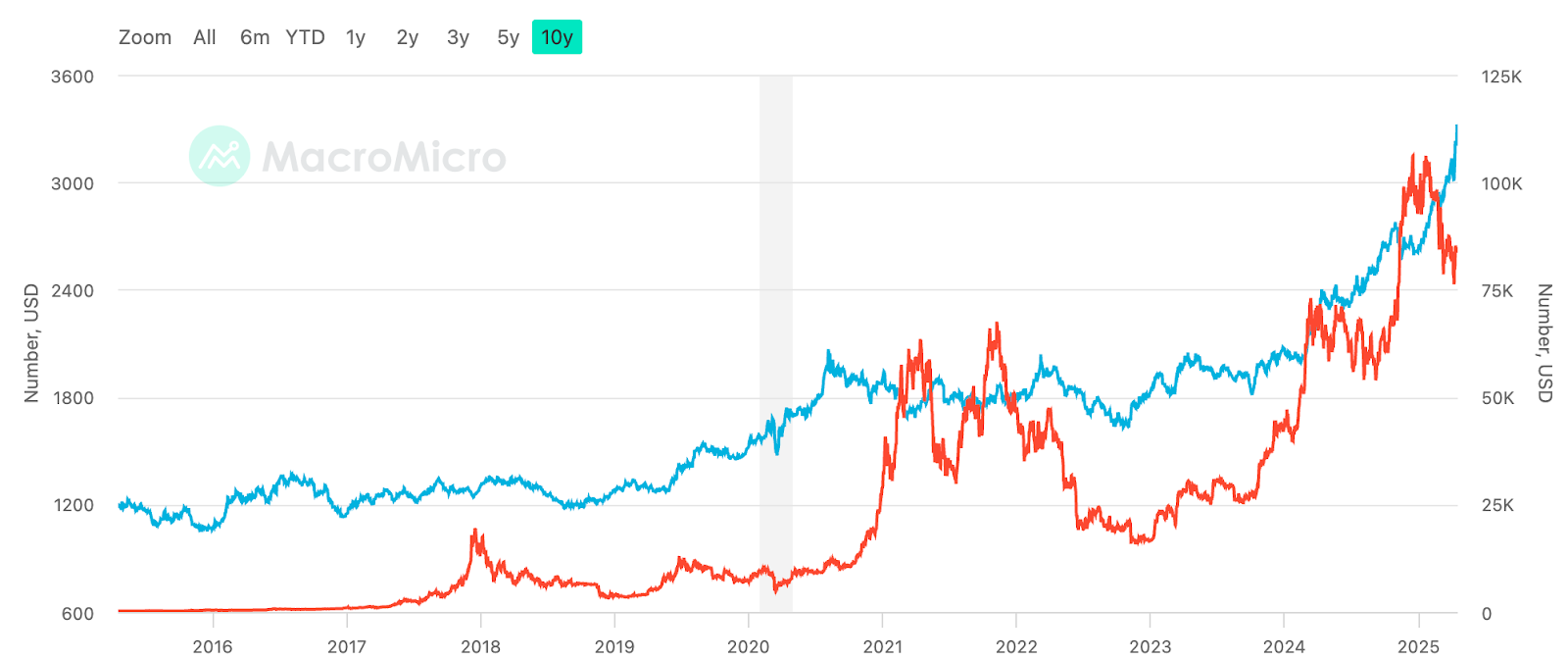

Bitcoin and Gold Price Chart Over the Last 10 Years

(Source: MacroMicro)

Although they attract different investors, there is overlap. Gold appeals to traditional financial investors, central banks, sovereign funds, and hedge institutions; Bitcoin mainly attracts crypto-native users, emerging market young investors, and risk-preferring funds. But they form complementary proportions in non-sovereign asset allocation, together constituting a “diversified alternative asset basket.” Gold is stable offline, while BTC is flexible online, each dominating value systems in traditional and digital worlds respectively.

In the long term, they together form alternative value carriers for the “post-dollar era.” As de-dollarization accelerates, gold is being heavily increased by national central banks, while Bitcoin becomes a means for individuals and private capital to hedge against systemic risks. They play a common role in monetary multipolarization and financial disintermediation trends.

Gold is the defensive anchor of traditional finance, Bitcoin is the digital anchor of the future. Both represent the concept of global asset independence from government control, not conflicting but mutually enhancing each other’s legitimacy and potential. Gold serves as the “defensive shield,” Bitcoin as the “growth engine,” with the two achieving complementarity through different risk exposure profiles.

Gold and Bitcoin will form convergence trends in future narratives, “de-dollarization,” and technology. Bitcoin’s mainstream narrative will strengthen. In 2025, Bitcoin will attract more institutional capital, mainly due to ETF scaling. Since the approval of spot ETFs, total assets under management have reached $100 billion in less than half a year, far exceeding the historical pace of gold ETFs.

Gold’s “de-dollarization” mission has also been accelerating since this year. Central bank gold purchases and the weakening of US dollar credit by other countries have made gold an anchor for a multipolar currency system.

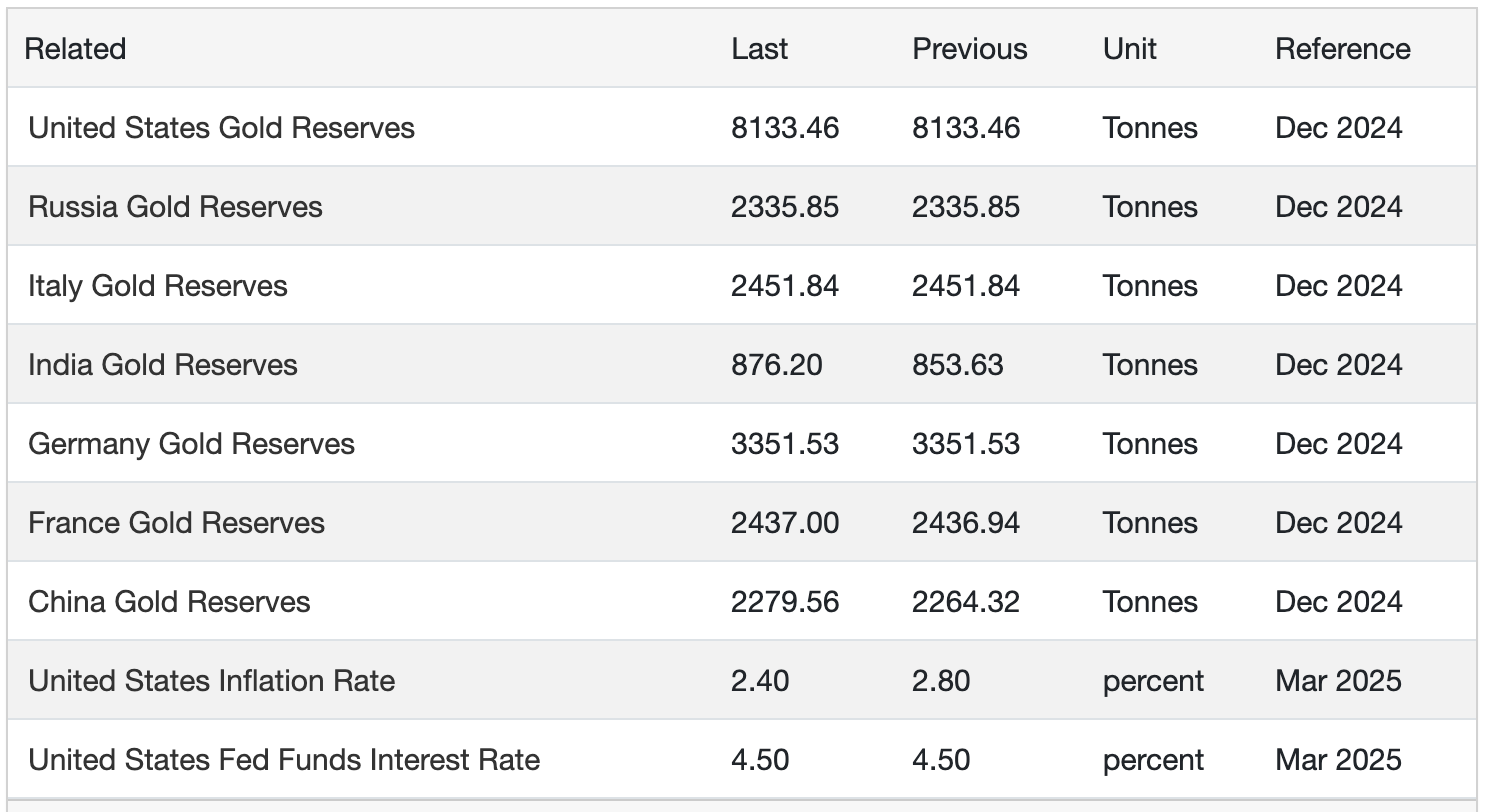

Gold Reserves Across Countries

(Source: Trading Economics)

The integration between the two will deepen, such as in technological integration, with blockchain technology empowering gold trading (like tokenized gold ETFs), enhancing liquidity; and policy coordination, exploring the interoperability of central bank digital currencies and Bitcoin to build a hybrid reserve system.

So, how should one allocate between the two to achieve balance between growth potential and downside protection? First, optimize risk-reward ratios: gold has an annualized volatility of 2.2% with maximum drawdowns below 15%, suitable as a portfolio stabilizer; Bitcoin has an annualized volatility of 9.9% but historical returns (11,873% over the past 5 years) far exceed gold, offering excess return potential.

Conservative investors should consider a portfolio with 60% allocated to gold, 20% to Bitcoin, and 20% to cash or bonds, using gold to hedge geopolitical risks. Aggressive investors might prefer 30% gold, 50% Bitcoin, and 20% tech stocks, leveraging BTC’s high correlation with tech stocks to amplify returns.

The competition between gold and Bitcoin is essentially a value reassessment of traditional order versus digital revolution. Amidst stagflation and protectionism in 2025, they together form a “dual-anchor defense system”: gold guards the stability of wealth, Bitcoin expands the growth potential.

CONCLUSION

Gold’s safe-haven logic is rooted in physical scarcity and historical consensus, providing “immediate shelter” in geopolitical conflicts and liquidity crises; Bitcoin’s safe-haven narrative depends on algorithmic scarcity and digital faith, serving as a “long-term hedging tool” in currency oversupply and dollar trust crises. Together, they form a multi-timeframe protection strategy: gold addresses short-term shocks, Bitcoin hedges against long-term inflation. Investors need to dynamically adjust weights based on risk windows. Gold guards the present, Bitcoin bets on the future, the two forming complementary protective roles across different time horizons.

Gold reacts to policy changes after they occur, while Bitcoin anticipates and amplifies expected policy shifts. Combined, they can navigate through entire interest rate cycles, jointly hedging against the decline of US dollar hegemony and forming the “physical-digital” binary foundation of a new monetary system.

The interplay between gold and Bitcoin is not a zero-sum game but a core strategy for investors to build what Nassim Taleb calls “anti-fragility” – the ability to not just withstand stress but actually benefit from volatility and disorder. As the Federal Reserve’s monetary policy toolkit gradually loses effectiveness and geopolitical conflicts become the norm, only by incorporating gold’s stability and Bitcoin’s growth potential into the same framework can one navigate through cyclical uncertainty.

Soros’s theory of reflexivity confirms: “Markets forever cycle between overreaction and correction”—meaning investor perceptions and market fundamentals create feedback loops that drive cycles of growth and decline. The rotation between gold and Bitcoin is the ultimate interpretation of this rule.

▶ Buy Crypto at Bitget

CoinRank x Bitget – Sign up & Trade to get $20!