KEYTAKEAWAYS

- DeepBook Protocol uses a Central Limit Order Book (CLOB) model to deliver fast, low-slippage trading and supports high-frequency strategies on the Sui blockchain.

- It offers advanced features like perpetual contracts, lending integrations, and plans for cross-chain liquidity aggregation.

- $DEEP is the native utility and governance token, used for fees, staking, rewards, and voting—designed to grow with the ecosystem.

CONTENT

DeepBook Protocol (DEEP) is a high-speed decentralized trading platform on Sui, offering CLOB-based order matching, cross-chain liquidity access, and support for DeFi tools like lending and derivatives.

WHAT IS DEEPBOOK PROTOCOL (DEEP)?

DeepBook Protocol is a next-generation decentralized trading protocol built on the Sui blockchain. Unlike traditional AMMs, DeepBook Protocol adopts an advanced Central Limit Order Book (CLOB) model—designed to maintain consistent liquidity across trading pairs while minimizing slippage and maximizing trading efficiency.

Beyond performance, DeepBook Protocol provides a robust SDK toolkit, enabling developers to seamlessly integrate it into decentralized applications such as DEXs, crypto wallets, and more. For users, this means faster execution, lower fees, and deeper liquidity; for builders, it offers a powerful liquidity layer that’s plug-and-play ready.

➤ Official Website: deepbook.tech

Security is also a top priority for DeepBook Protocol. The protocol is routinely reviewed by both core developers and independent auditors to catch bugs and vulnerabilities early. To further reinforce its defenses, a bug bounty program is in place—rewarding researchers with over $50,000 in 2024 alone for reporting security issues.

With its high level of transparency, performance, and reliability, DeepBook Protocol has rapidly evolved into a go-to liquidity venue for DeFi protocols and pro traders within the Sui ecosystem.

📌 The Team Behind DeepBook Protocol

DeepBook Protocol is the product of collaboration among leading experts in blockchain engineering, financial systems, and decentralized infrastructure:

- Mysten Labs: As the lead developer of DeepBook Protocol, the Mysten Labs team brings deep expertise from both centralized and DeFi environments. Comprised of top-tier blockchain engineers and researchers, they laid the foundation for a high-performance protocol architecture.

- Sui Foundation: As the governing body of the Sui blockchain, the Sui Foundation plays a strategic role in the development and distribution of DeepBook Protocol, ensuring its alignment with the network’s long-term roadmap.

- Blockchain Economists and Researchers: The project is also backed by a team of financial system designers and blockchain innovation experts, ensuring DeepBook Protocol remains resilient and adaptable within the evolving DeFi landscape.

Thanks to this collaboration, DeepBook Protocol has reached its V3 iteration—introducing permissionless liquidity pools and significantly lower trading fees. DeepBook V3 is now live across all Sui networks, setting a new benchmark for decentralized liquidity infrastructure.

DeepBook v3.1 is live on @SuiNetwork

Permissionless pools. Lower fees. Deeper liquidity.

This upgrade marks a new era for onchain trading — designed for builders, traders, and everyone in between.

Let’s break it down 👇 pic.twitter.com/Ke8zpMRiWA

— DeepBook Protocol on Sui (@DeepBookonSui) April 16, 2025

>>> More to read: What is Order Book & How Does It Work?

HOW DOES DEEPBOOK PROTOCOL WORK?

DeepBook Protocol combines the best of both centralized and decentralized exchange models—delivering the efficiency of traditional trading infrastructure while maintaining the trustless nature of DeFi.

One of the key problems with centralized exchanges is their dependence on centralized market makers, which creates fragility in liquidity. DeepBook Protocol solves this by introducing a decentralized yet efficient order book mechanism that reduces slippage and improves depth.

📌 CLOB Structure: Centralized Matching, Decentralized Execution

At the core of DeepBook Protocol is a Central Limit Order Book (CLOB):

✅ All buy and sell orders are submitted to a shared order book.

✅ Orders are matched automatically based on price and volume—highest bids match with the lowest asks.

✅ Traders can place either limit orders (at specific prices) or market orders (executed at the best available price).

✅ Unfilled limit orders remain in the book, providing flexibility for traders who prefer to wait for favorable execution.

If no single large order matches, the system aggregates multiple smaller orders to fill the required trade size—this ensures liquidity even during high-volume trades.

📌 Liquidity Pools for Each Trading Pair

In DeepBook Protocol, each trading pair operates within its own isolated pool:

- Order Book: Manages all bids and asks.

- State: Logs every trade request and interaction.

- Vault: Handles asset transfers upon execution, ensuring funds are moved securely and transparently.

This modular pool structure makes the system scalable, composable, and more secure—each pair is self-contained yet fully interoperable with the broader protocol.

📌 High-Frequency Trading Ready

Thanks to Sui’s parallel transaction processing engine, DeepBook Protocol is highly optimized for high-frequency trading:

- Multiple transactions can be executed simultaneously without causing network congestion.

- This capability gives traders a near-instant execution experience even under heavy traffic conditions.

>>> More to read: Scallop: The Future of DeFi on Sui

DEEPBOOK PROTOCOL KEY FEATURES

As a pioneering Central Limit Order Book (CLOB) protocol within the Sui ecosystem, DeepBook Protocol delivers high-performance trading infrastructure designed for scalability, speed, and flexibility. Here are its three core features:

1. Lightning-Fast Token Swaps

- Leveraging the speed and scalability of the Sui blockchain, DeepBook Protocol enables token swaps to be executed in as little as 500 milliseconds.

- Gas fees remain low and predictable, ensuring a smooth and cost-effective user experience.

- With parallel transaction processing, trading pairs can be handled independently—reducing latency and improving overall efficiency, even under high-volume conditions.

2. Support for Perpetual Contracts and Derivatives

- DeepBook Protocol extends beyond spot trading by supporting perpetual contracts and other derivative products, enabling developers to build more sophisticated financial instruments.

- A prime example is Kriya, a DeFi project on Sui that integrates DeepBook Protocol’s liquidity pools with its own margin engine to deliver CEX-like performance with DEX-level transparency.

- This hybrid approach empowers users with high-speed execution while preserving the decentralized and open nature of DeFi.

3. Decentralized Lending Integration

- DeepBook Protocol facilitates lending markets by enabling DeFi protocols to aggregate lenders’ assets into shared liquidity pools.

- Borrowers can draw funds from these pools, and repayment—including interest—is handled via smart contracts, ensuring trustless and secure operations.

- Users from the same or different DeFi protocols can borrow or lend seamlessly, with dynamic interest rates based on market conditions.

In summary, DeepBook Protocol is redefining the boundaries of decentralized trading. From ultra-fast swaps to advanced derivatives and integrated lending, it serves as a high-performance engine at the heart of Sui’s DeFi landscape—offering both developers and users a powerful, future-ready foundation.

>>> More to read: Suiswap | Leading Token Swap Platform on SUI Blockchain

WHAT IS THE DEEP TOKEN?

DEEP is the native cryptocurrency of DeepBook Protocol, officially launched in October 2024 and listed on major exchanges. As the utility and governance token of the protocol, DEEP plays a critical role in supporting the platform’s ecosystem, covering everything from transaction fees to staking rewards and protocol governance.

✅ Key Use Cases of DEEP

- Transaction Fee Payments: Traders can use DEEP to pay for trading fees and pool commissions on the DeepBook Protocol DEX.

- Liquidity Incentives: Liquidity providers and market makers receive fee discounts when using DEEP, encouraging greater participation and deeper liquidity.

- Staking Rewards: Users can stake DEEP to earn protocol-based rewards, helping enhance network security and liquidity provisioning.

- Governance Participation: DEEP holders can vote on key parameters such as staking requirements and fee structures. The governance model is designed to ensure even smaller holders have meaningful influence through a weighted voting mechanism.

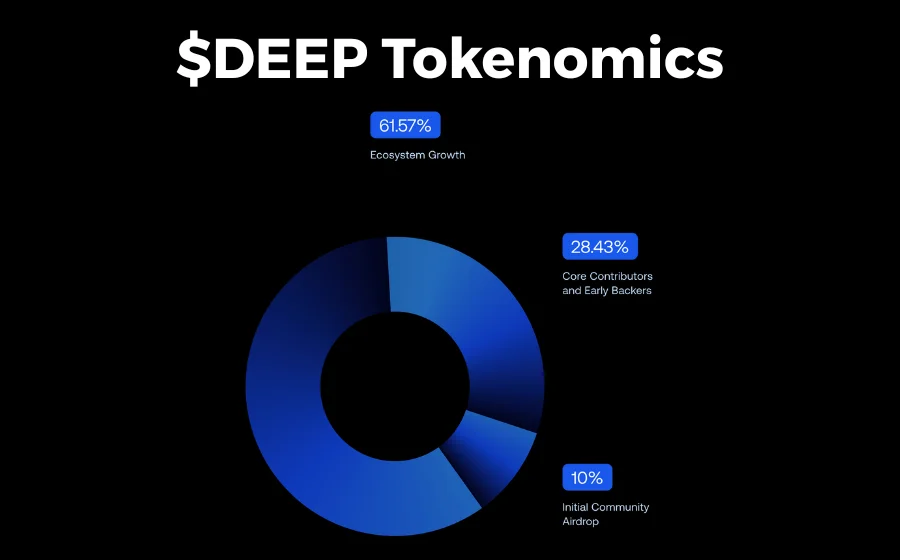

📌 DEEP Tokenomics

The total supply of DEEP is capped at 10 billion tokens, with an initial circulating supply of 2.5 billion. Token distribution is structured to support long-term ecosystem growth and fairness, with a 7-year vesting and unlock schedule.

🔍 Token Allocation Breakdown

- 61.57% allocated to ecosystem development (e.g., liquidity mining, grants, partnerships).

- 28.43% reserved for rewarding core contributors and early backers.

- 10% designated for an initial airdrop campaign aimed at community expansion and protocol decentralization.

As of the latest data, approximately 3.05 billion DEEP tokens are in circulation, with gradual increases based on the vesting plan.

>>> More to read: SUI Takes the Spotlight in 2025’s Crypto Comeback

DEEPBOOK PROTOCOL (DEEP) CONCLUSION

DeepBook Protocol has evolved beyond its initial role as Sui’s liquidity layer, now aiming to integrate advanced features like Sui Bridge for seamless cross-chain asset transfers and external liquidity access. Future plans include cross-chain liquidity aggregation, allowing users to tap into multi-chain liquidity pools without moving tokens—enhancing yield opportunities and trading flexibility.

With DEEP now listed on major centralized exchanges, market momentum is strong. DeepBook Protocol is setting a new standard for decentralized trading by focusing on liquidity, performance, security, and ecosystem integration.

For anyone interested in the future of DeFi, DeepBook Protocol is a project worth watching closely.