KEYTAKEAWAYS

- Grayscale Simplifies Crypto Investment: Grayscale offers trust funds like GBTC, enabling investors to access cryptocurrencies through traditional securities without blockchain complexities.

- GBTC's Potential as a Spot Bitcoin ETF: Following a legal victory, there's a strong prospect of GBTC converting into a spot Bitcoin ETF, potentially aligning its value closer to Bitcoin.

- Considerations for Investing in GBTC: While convenient, GBTC may have volatile premiums/discounts and higher management fees (2%) compared to typical ETFs, affecting investment returns.

CONTENT

INTRODUCTION OF GRAYSCALE

Grayscale is a company focusing on providing cryptocurrency investment products. Established in 2013, the company’s primary goal is to enable investors to participate in the cryptocurrency market in both simple and traditional manners. Grayscale is renowned for its innovative investment trust funds, which allow investors to gain exposure to this emerging asset class without the need to own and manage cryptocurrencies directly.

The company’s investment products primarily include Grayscale Bitcoin Trust (GBTC) and other funds designed to track the price performance of corresponding cryptocurrencies. Through these funds, investors can access the cryptocurrency market via traditional securities trading methods, such as brokerage accounts. While Grayscale’s product structure differs from conventional Exchange-Traded Funds (ETFs), its investment choices allow investors to engage in the cryptocurrency market without delving into the complexities of blockchain technology and cryptocurrency exchanges.

WHAT’S NEW FOR GRAYSCALE?

GBTC becomes the potential spot Bitcoin ETF after undergoing recent SEC scrutiny

Since 2020, Grayscale has been planning to convert GBTC into a spot Bitcoin ETF, but it has consistently faced rejection from the U.S. Securities and Exchange Commission (SEC).; Grayscale subsequently took the matter to court. In August of this year, the U.S. Federal Appeals Court ruled that the SEC’s denial of Grayscale’s investment application proposal was improper and instructed the SEC to review it again. Surprisingly, the SEC decided not to pursue further appeals. This move is widely seen as an indication that the SEC is likely to approve Grayscale’s application.

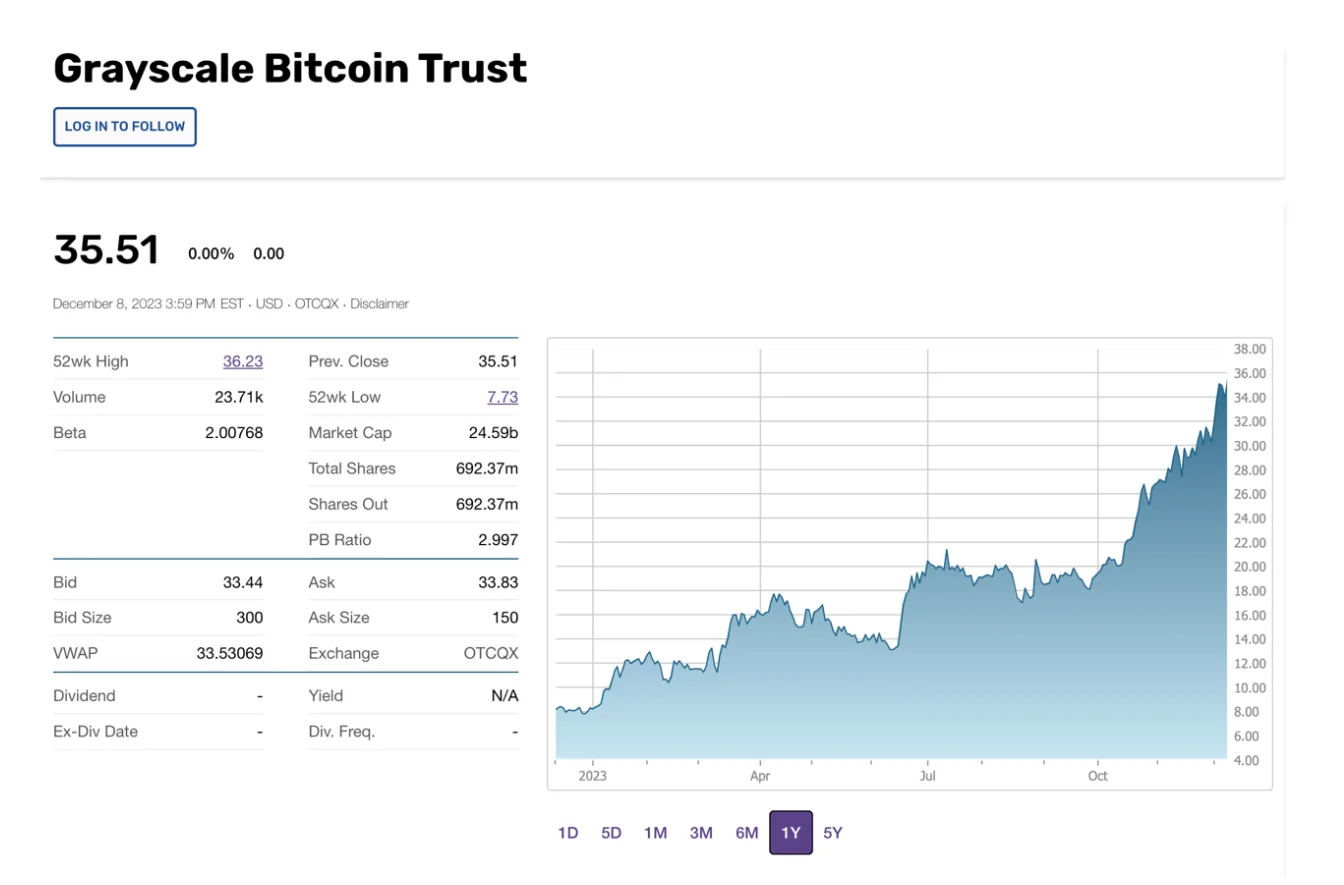

(Source: TradingView)

Due to this progress t, the market is currently optimistic about the outlook for GBTC. The chart shows that since the U.S. Federal Appeals Court ruled against the SEC in October this year, GBTC has risen by approximately 70%, indicating a significant upward trend.

GBTC INTRODUCTION

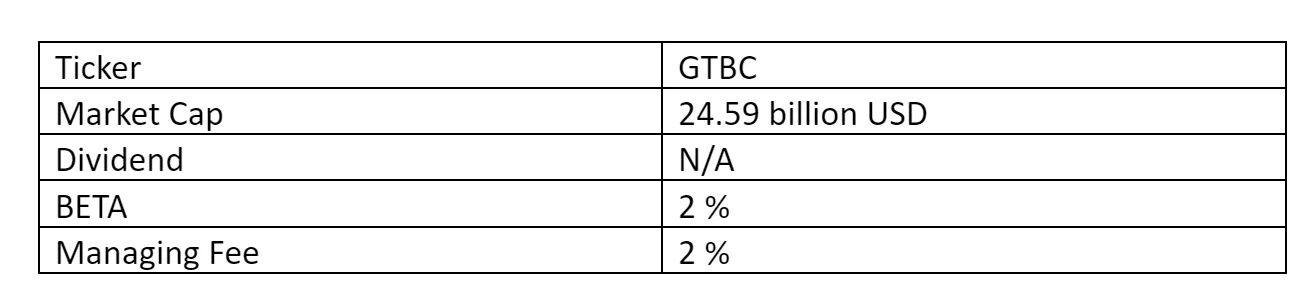

(Source: https://www.thestreet.com/quote/GBTC)

GBTC is one of the earliest stocks focusing on Bitcoin. Through stocks, investors can passively invest in cryptocurrencies, avoiding many complexities associated with cryptocurrency investment. Its market cap is approximately $2.459 billion, with no dividend distribution.

The Beta value* of GBTC is around 2%, and its management fee is also 2%. As GBTC primarily tracks the price of Bitcoin and is not a traditional physical entity providing products, conventional stock indicators like P/E ratio and profit margin are not suitable for assessing GBTC.

*The Beta Value

The beta (β) coefficient measures the relative volatility of a stock’s price compared to the overall market. The market itself has a beta of 1. For example, when a stock has a beta of 1.5, it means that for a 1% change in the market index (such as the Hang Seng Index), the stock is expected to change by 1.5%. Therefore, if the market index, like the Hang Seng, increases by 1%, the stock is anticipated to rise by 1.5%. Conversely, if the market index decreases by 1%, the stock is expected to decline by 1.5%.

INVEST IN GTBC: PROS

- Convenient and Rapid Investment in Cryptocurrencies

Grayscale’s trusts, like GBTC, are structured as traditional investment tools and can be traded through brokerage accounts. This structure enables investors to engage in stock trading like traditional securities.

- High Level of Security

Grayscale emphasizes the security measures of its products. The assets held in trusts are protected according to industry standards, reducing the risks associated with storing cryptocurrencies on exchanges or wallets.

- Potential for Becoming a Spot Bitcoin ETF with Significant Upside

Due to Grayscale’s legal victory against the SEC, there is widespread belief that GTBC will convert into a legalized Bitcoin spot ETF in the short term. Once the application is approved, the discount between GTBC and BTC assets is expected to disappear, providing holders with more tremendous profit potential.

INVEST IN GTBC: CONS

- BroaderPremium and Discount Volatility

A significant drawback of investing in GTBC is that shares of Grayscale’s trusts, including GBTC, may trade at a premium or discount compared to the underlying assets’ Net Asset Value (NAV), which can impact the actual return on investment.

- High Management Fees

Grayscale charges management fees for its products, with investors in GBTC incurring an annual fee of 2%. In comparison, typical ETFs have management fees below 1% or around 1%, making a 2% fee relatively expensive. Such high fees can erode investment returns, especially in unfavorable market conditions where investors may experience lower returns.

CONCLUSION

Grayscale charges management fees for its products, with investors in GBTC incurring an annual fee of 2%. In comparison, typical ETFs have management fees below 1% or around 1%, making a 2% fee relatively expensive. Such high fees can erode investment returns, especially in unfavorable market conditions where investors may experience lower returns.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!