KEYTAKEAWAYS

- Diverse Strategies: The crypto market offers a variety of trading strategies, including spot trading, crypto savings, staking, lending, and contract trading, each with its own set of advantages and risks.

- Risk Management: It's crucial to understand the risks associated with each strategy, such as market volatility, regulatory changes, and security concerns, and to implement effective risk management techniques.

- Personal Fit: The right crypto trading strategy depends on individual preferences, goals, and risk tolerance. It's important to thoroughly research and test strategies to find the best fit for your trading style and objectives.

CONTENT

Ready to make crypto millions? Discover beginner-friendly crypto trading strategies! Buy and hold, stake your coins, or trade on the go – start earning now!

*The content of this article was updated in February 2025.

CRYPTO TRADING STRATEGIES: WHAT ARE THEY?

Cryptocurrency trading has gained a lot of traction as an attractive and profitable investment avenue in recent times. With the constant expansion and dynamics of the crypto market, an increasing number of investors are exploring diverse tactics to steer through the market efficiently and boost their earnings.

To achieve success in crypto trading, it’s crucial to have a thorough insight into the market trends, possess skills in technical analysis, implement effective risk management, and remain flexible to the market’s fluctuating nature.

>> Also read: What Is Crypto Trading? What Investors Need to Know

In this article, we’ll dive into the top crypto trading strategies that are perfect for beginners.

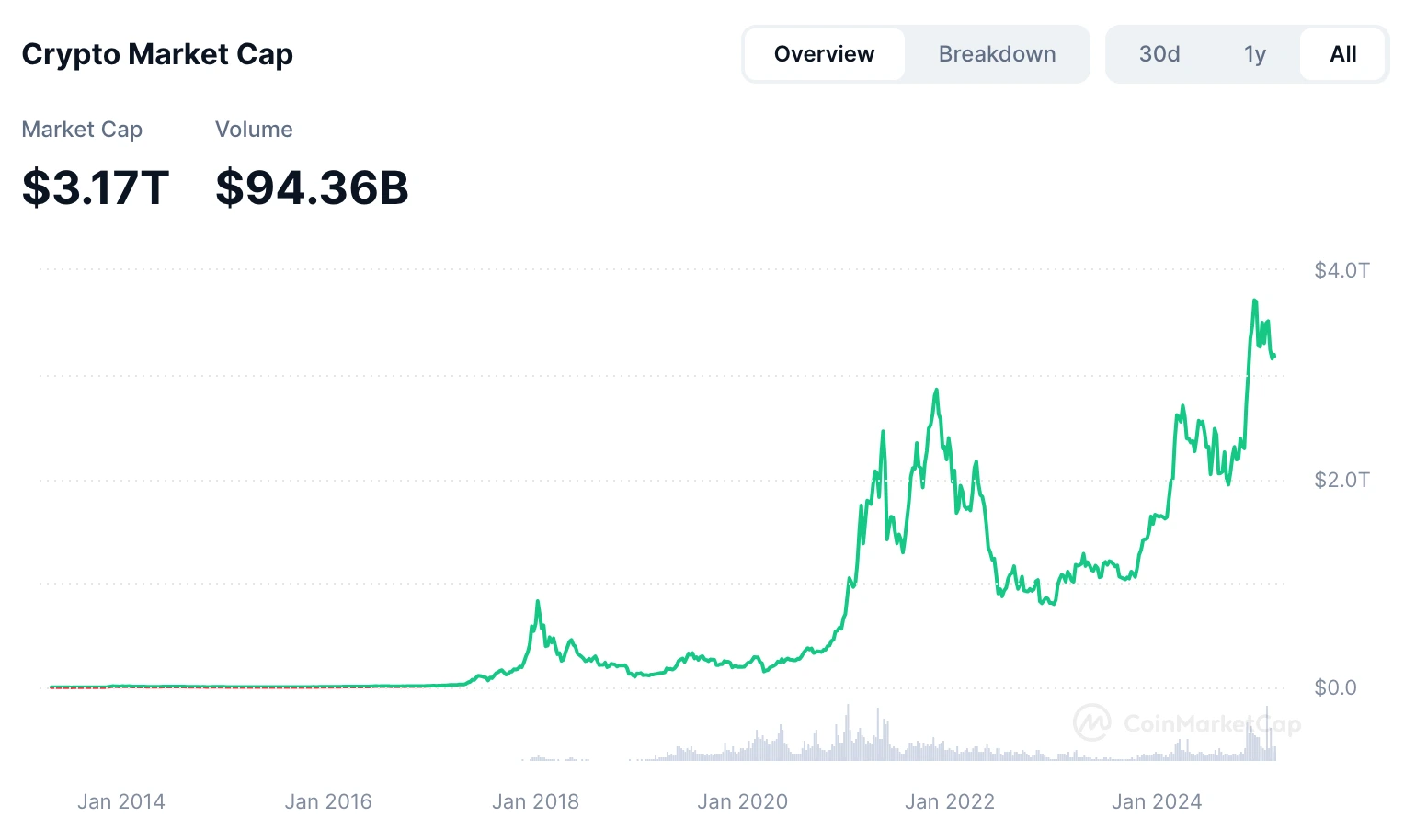

As of February 18, 2025, the global cryptocurrency market capitalization stands at $3.17 trillion.

(Source:CoinMarketCap)

CRYPTO TRADING STRATEGIES: TOP 5 COMMON TYPES

A variety of factors come into play when deciding on the most effective trading strategy for cryptocurrency, making it clear that no “one-size-fits-all” strategy exists. Furthermore, the strategy you opt for can also hinge on the duration you intend to keep a trading position active. In the sections that follow, we will introduce some beginner-friendly crypto trading strategies that are ideal for newcomers looking to enter the cryptocurrency market.

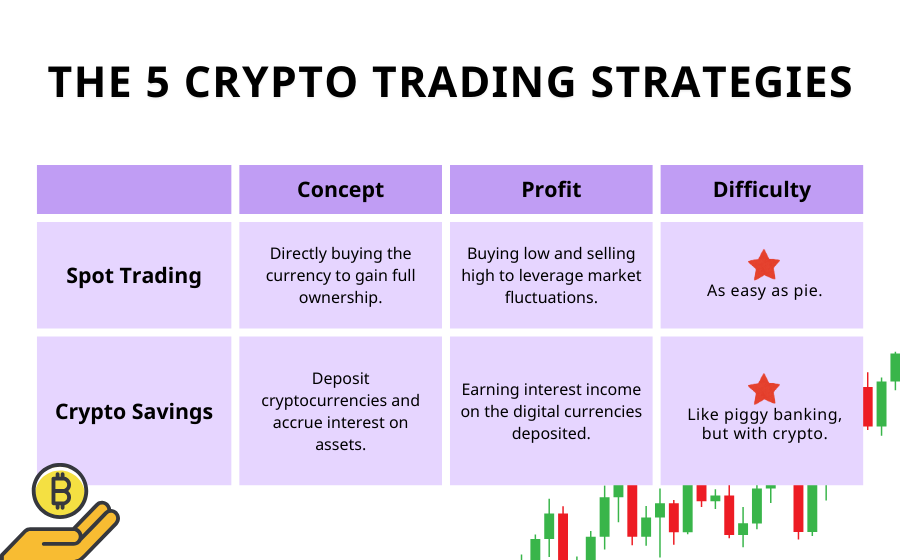

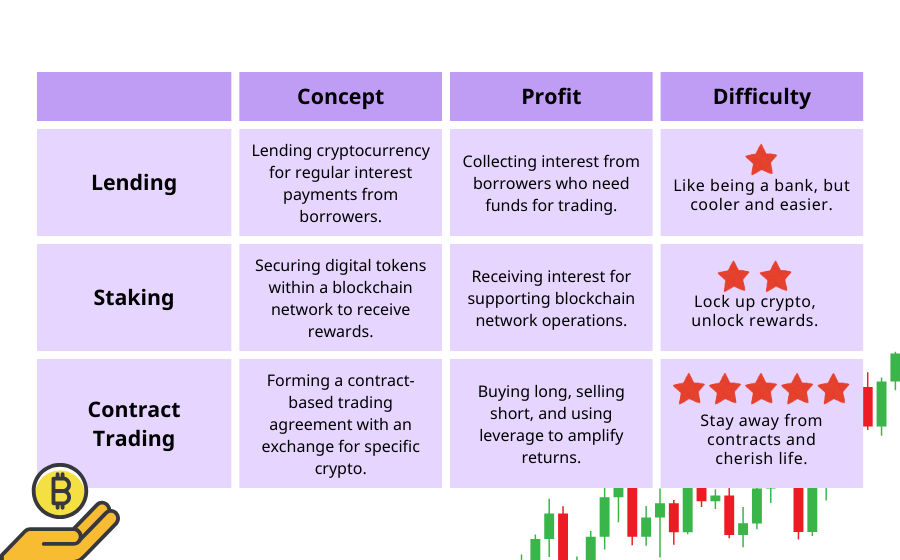

(Source: CoinRank)

(Source: CoinRank)

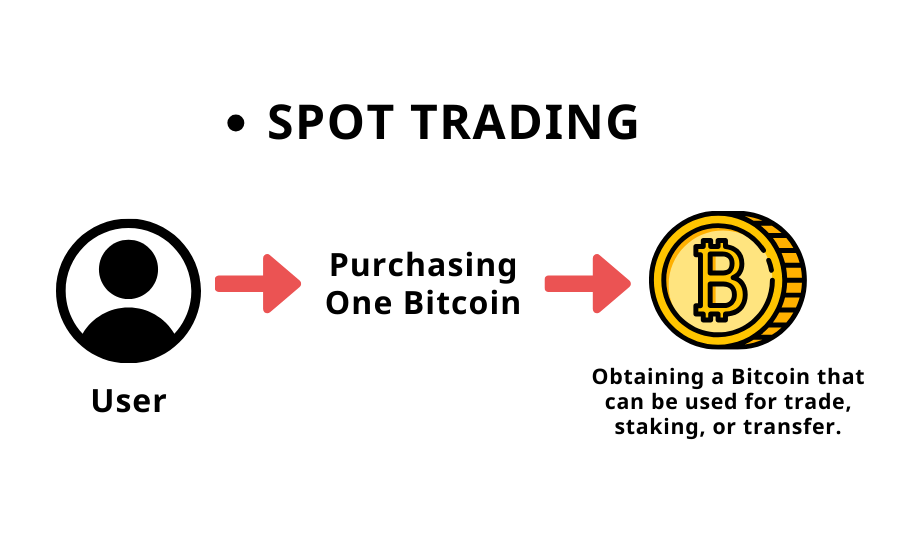

1. Spot Trading

Spot trading in cryptocurrency is the direct purchase of the currency itself, ensuring you gain full ownership. Transactions in this form are settled instantly; the moment you confirm your purchase, the asset is yours. For instance, when buying one Bitcoin (BTC) at $2,000, you pay this amount plus a nominal transaction fee. The seller receives the $2,000, less the fee, immediately. This efficiency allows for the swift transfer of the newly purchased tokens from the exchange to your personal wallet, streamlining the investment process.

Source: CoinRank

Here are some of the common strategies in spot trading:

#1. HODL (Buy-and-Hold)

HODLing, a term born from a typo of “hold,” involves purchasing cryptocurrencies and holding onto them for an extended period. This approach aims to capitalize on the asset’s long-term value increase. By adopting the HODL strategy, investors can potentially profit from the asset’s appreciation over time, avoiding the pitfalls of short-term market fluctuations and the common mistake of selling at a low price and buying at a high price.

#2. Swing Trading

Swing trading involves buying low and selling high over a short period, typically a few days to weeks. It’s a middle ground between day trading, which wraps up in a day, and long-term trading, spanning years. This strategy focuses on capitalizing on stock price movements from low to high points.

#3. Scalping

Scalping is a trading strategy where traders make quick profits by buying and selling cryptocurrencies in short time frames, often within minutes or seconds. Traders profit by executing a large number of trades that each earn a small margin.

For example, a scalper might buy a cryptocurrency at $100 and sell it at $100.50, making a $0.50 profit. Repeating this process many times throughout the day can lead to significant earnings. However, this approach requires fast decision-making, strict discipline, and careful risk management.

#4. Breakout Trading

Breakout trading targets big price changes by taking advantage when the market moves past important support or resistance levels. The idea is that once an asset’s price moves beyond its usual trading range, it will likely continue in that direction, creating an opportunity for profit.

This strategy is popular among investors looking to take advantage of market volatility for significant gains. Success in breakout trading requires the ability to identify support and resistance levels accurately and know the best times to enter the market.

#5. Arbitrage

Arbitrage trading involves making a profit from the difference in cryptocurrency prices between platforms.

Traders buy at a lower price on one exchange and sell at a higher price on another, securing profits from the disparity.

For example, if ETH/USD is priced at $20,000 on CoinW but $20,200 on Coinbase, a trader can buy 1 Ethereum (ETH) at CoinW for $20,000 and sell it on Coinbase for $20,200, securing a $200 profit.

Advantages of Spot Trading

- Instant Transactions: Crypto spot trading enables the immediate buying or selling of cryptocurrencies at existing market prices. This immediacy is crucial for leveraging short-term price fluctuations and seizing trading opportunities as they arise.

- Beginner-Friendly: Compared to more intricate crypto trading strategies like futures or options, spot trading is more straightforward, requiring less specialized knowledge to get started.

- Cost Efficiency: Generally, the fees associated with spot trading are lower than those for other types of trading, offering a more economical approach to trading cryptocurrencies.

- Market Liquidity: The spot market for cryptocurrencies is usually characterized by high liquidity, with a vast number of participants ready to buy or sell, facilitating swift and smooth transactions.

Disadvantages of Spot Trading

- Market Volatility: One of the significant risks of spot trading is the extreme volatility of the cryptocurrency market. Prices can swing wildly in short periods, posing a challenge to predict and manage.

- Strategy Limitations: With spot trading, you’re primarily limited to purchasing or selling at the market’s current rates. This limitation can restrict the diversity of crypto trading strategies you might employ, compared to other trading forms offering more strategic flexibility.

Not sure where to start with spot trading? This easy step-by-step guide has you covered.

>> Also read: Crypto Spot Trading vs. Future Trading: Which is Best for You?

2. Crypto Savings

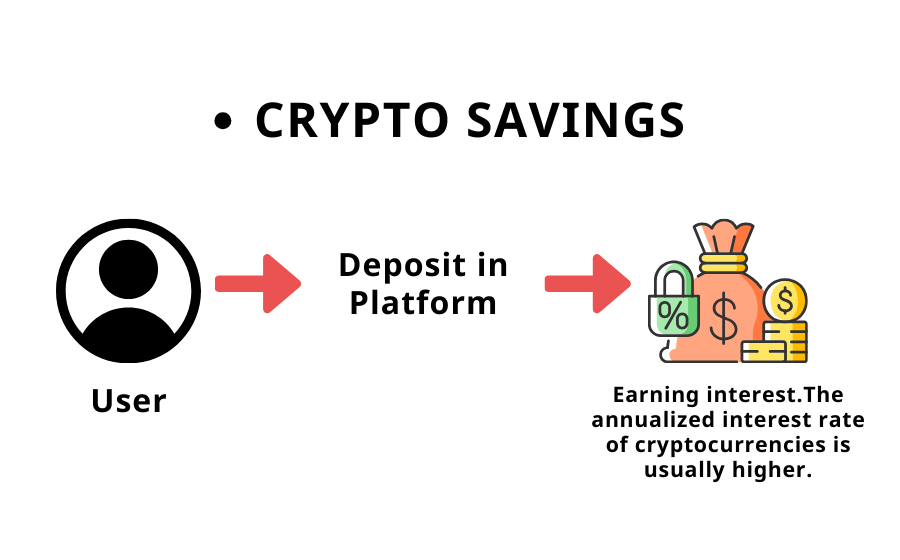

Crypto savings accounts, one of the easiest crypto trading strategies for beginners, present an enticing option to amplify your investments with minimal effort. These accounts stand out for offering significantly higher interest rates than traditional savings accounts, with potential returns of 10% to 15% or more simply by parking your digital assets in one. Adopting a well-informed strategy for crypto savings can pave the way for substantial growth of your digital assets, combining the pursuit of lucrative returns with the practical management of investment risks.

(Source: CoinRank)

>> Also read: Crypto Savings: How to Profit from Crypto Investment

Types of Crypto Savings Accounts:

Crypto savings accounts come in several forms. Each type offers unique features and benefits when it comes to withdrawal terms, fees, and yields. Here’s a quick look at the most common types of crypto savings accounts:

- Flexible accounts: Flexible accounts offer high liquidity, allowing for easy deposits and withdrawals. Interest is calculated daily and paid frequently, but rates are usually lower due to this flexibility. Some platforms may charge fees for withdrawals beyond a certain limit.

- Fixed accounts: Similar to certificates of deposit, fixed accounts lock funds for a set period, like 90 days, offering higher interest rates. After the term, funds and interest can be redeemed or reinvested.

- Tiered interest accounts: In a tiered interest account, interest rates vary with the deposit amount, with larger deposits earning higher rates. This benefits anyone making a larger investment, offering higher returns for more significant deposits.

- Token-specific accounts: Tailored for specific cryptocurrencies, token-specific accounts provide customized services and rates for particular digital assets. They offer more favorable terms for those specific tokens.

That said, the volatile nature of cryptocurrencies means the value of your savings can fluctuate widely, impacting the final amount you might withdraw. Moreover, the importance of choosing a reputable platform cannot be overstated, as the crypto industry has seen its share of platforms, such as Celsius and Voyager, facing issues that jeopardize user funds.

Advantages of Crypto Savings

- Portfolio Diversification: Crypto savings accounts provide an avenue for diversifying your investment portfolio. Incorporating digital assets can lessen the dependence on traditional investments and act as a counterbalance to market shifts, as cryptocurrencies typically have a low correlation with stocks and bonds.

- Operational Flexibility: These accounts often offer greater flexibility in terms of deposits and withdrawals compared to their traditional counterparts. This adaptability is invaluable in the dynamic cryptocurrency markets, ensuring quick access to funds for strategic moves or trades.

- Attractive Interest Rates: A standout feature of crypto savings accounts is their ability to offer significantly higher interest rates than standard savings accounts. This aspect presents an appealing option for generating passive income from your cryptocurrency holdings.

- Platform Benefits: Many platforms providing crypto savings accounts also extend additional perks such as signup bonuses, referral programs, and sophisticated trading tools, all aimed at enhancing your investment journey and boosting your earnings.

- Additional Earning Mechanisms: Beyond traditional interest earnings, these accounts may enable further financial gains through activities like staking or yield farming within the DeFi ecosystem, offering diversified income sources from your investments.

Disadvantages of Crypto Savings

- Absence of Federal Deposit Insurance Corporation (FDIC) Insurance: Unlike bank accounts that are typically insured by the FDIC to protect deposits up to $250,000, crypto savings accounts lack this safeguard. In the event of platform failure, there is no guaranteed recovery of funds.

- Withdrawal Restrictions: Some platforms may impose withdrawal limits or fees, potentially restricting access to your funds when needed. It’s advisable to consider accounts with flexible withdrawal policies to ensure liquidity.

- Risk of Loan Defaults: As your deposited cryptocurrency may be lent to borrowers, there’s a risk of losing your assets if borrowers default on their loans. Opting for platforms with a solid track record of managing loan defaults is crucial for mitigating this risk.

3. Staking

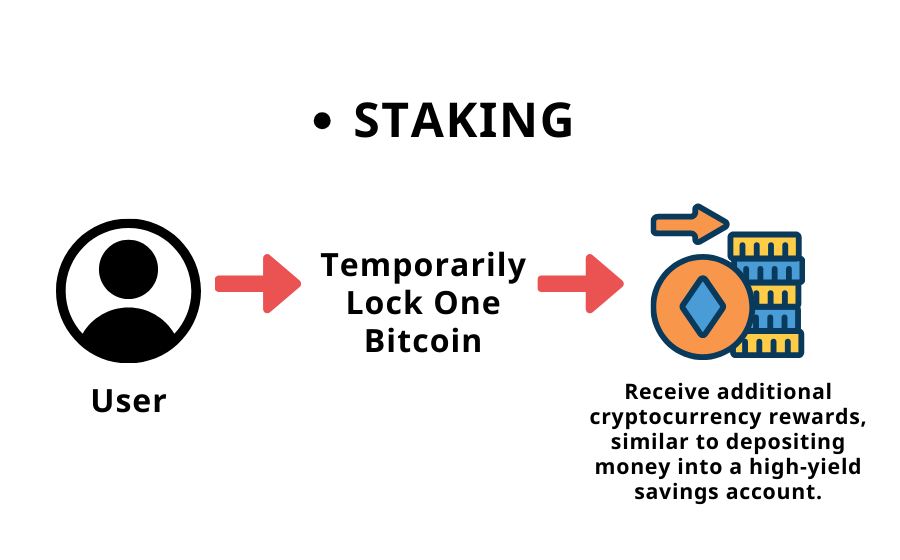

Staking cryptocurrencies involves locking up your digital assets to support a blockchain network and validate transactions. It’s a feature of cryptocurrencies that operate on a proof-of-stake (PoS) model, which is an energy-saving alternative to the traditional proof-of-work (PoW) model that relies on mining devices and significant computing power.

Staking offers a way to earn passive income from your crypto holdings, with some cryptocurrencies providing attractive interest rates for staking.

(Source: CoinRank)

In essence, staking allows participants to earn rewards, or staking yields, on their cryptocurrency. This concept of yield is familiar in traditional finance, such as earning interest from a bank savings account, receiving regular payments from bonds, dividends from stocks, or rental income from property. In traditional banking, banks pay interest by lending out depositor’s funds. In contrast, crypto staking locks up cryptocurrency to help run and secure the blockchain network.

Ways to Stake Cryptocurrency:

- Become a validator: This option requires a significant amount of cryptocurrency, along with the necessary hardware, software, time, and expertise.

- Join a staking pool: Validators often run staking pools that allow multiple users to combine their smaller stakes, known as ‘liquid staking.’ This involves a liquidity token representing the staked coin and its generated rewards. Validators handle the validation tasks and distribute rewards, minus their fees.

- Lock-up tokens with exchanges: Many cryptocurrency exchanges offer staking services by pooling users’ tokens. The amount and type of cryptocurrency you lock up will determine your share of the rewards.

Advantages of Staking

- Earn Passive Income: One of the primary benefits of staking is the ability to earn passive income. By staking your crypto in a network’s wallet, you receive rewards in the form of additional tokens. These rewards depend on the specific network and how much you stake, offering a steady income stream without needing to engage in active trading.

- Contribute to Network Stability: Staking your tokens contributes to the governance and security of a blockchain network. This helps maintain the network’s integrity, processes transactions, and secures the blockchain, offering financial and ideological rewards by supporting the network’s success.

- Potentially Higher Returns: Compared to traditional financial tools like savings accounts or bonds, staking can offer higher returns. Annual rewards can vary widely based on the network and market conditions, making staking an appealing option for growing your crypto holdings among other crypto trading strategies for beginners.

- Maintain Control with Liquidity: Staking provides control over your assets while allowing some liquidity. While tokens are staked, they are not entirely inaccessible and can often be unstaked after a waiting period, offering flexibility in emergencies or when choosing to leave a staking program.

Disadvantages of Staking

- Volatility and Risk of Loss: Despite its potential for profit, staking carries risks, notably due to the cryptocurrency market’s volatility. A significant drop in your staked tokens’ value could result in a net loss compared to your original investment.

- Lock-Up Periods: Many staking programs require your tokens to be locked up for set periods, which can vary greatly. This can be a disadvantage if you need quick access to your funds, as these periods can last from a few weeks to several months.

- Need for Technical Expertise: Staking can require a level of technical knowledge, including setting up a compatible wallet, understanding the staking process, and monitoring rewards. This learning curve may deter beginners from participating.

>> Also read: What Is Crypto Staking?: Overview, How It Works, & Future

4. Lending

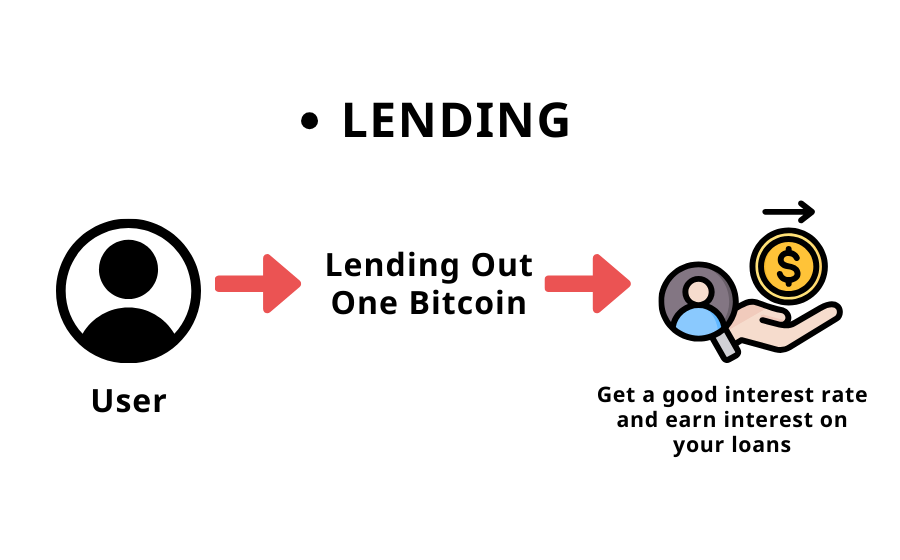

When it comes to lending, many immediately think of traditional banking practices where individuals deposit funds into banks, which in turn lend those funds to others or businesses, earning interest. This mechanism is a primary revenue source for banks. But in the world of cryptocurrency, lending operates in a unique way.

Source: CoinRank

So, let’s take a look at how it works:

- Choosing a Lending Platform: Your first step is to find a trustworthy lending platform, such as Compound or Aave.

- Depositing Cryptocurrency: You then deposit your cryptocurrency into the selected platform.

- Collecting Interest: Over time, you will start to collect interest. This interest fluctuates based on market demand.

For example, Mike has 5 Bitcoins but doesn’t plan to sell them right now. He discovers that the Compound platform offers an annual interest rate of 8%. Therefore, he deposits his Bitcoins into the platform, and after one year, in addition to the original 5 Bitcoins, he earns an interest of 0.4 Bitcoin!

Why would someone be interested in borrowing cryptocurrency? Typically, there are two main scenarios:

- Trading Leverage: Investors may seek to use leverage to increase their trading capacity, hence the need to borrow cryptocurrency.

- Starting a Business: Companies may require cryptocurrency for startup costs or ongoing operational expenses.

Crypto lending means lending your cryptocurrency to someone else or a platform and then earning interest from it. In other words, you make money from your cryptocurrency without needing to sell it. While lending cryptocurrency can yield earnings, it also carries risks, such as platform security or market fluctuations. Therefore, before proceeding with lending, ensure you have fully understood the risks and details.

Advantages of Lending

- Elevated Earnings Potential: Crypto lending stands out for its capacity to generate significantly high returns. With many platforms providing annual percentage yields (APYs) over 10%, the earning potential far exceeds that of conventional savings accounts.

- Portfolio Diversification: Engaging in crypto lending can broaden your investment landscape, offering a strategic approach to risk reduction across your portfolio.

- Greater Operational Flexibility: Unlike traditional banking, crypto lending platforms excel in adaptability, presenting options like short-duration loans, possibilities for early withdrawal, and tailorable loan agreements to suit various needs.

Disadvantages of Lending

- Market Fluctuations: The notable fluctuation in cryptocurrency values can affect your investment’s worth, posing a risk of diminishing returns or potential financial setbacks.

- Borrower Default Risk: There’s an inherent risk in crypto lending that borrowers may fail to fulfill their repayment obligations, which could result in a loss of your lent assets.

- Platform Security Concerns: Despite the advancements in security, crypto lending platforms remain vulnerable to cyber threats and hacking incidents, potentially jeopardizing your invested capital.

You’re probably wondering how crypto savings, staking, and lending differ, here’s a simple breakdown:

The main differences lie in their operation, roles, and potential rewards. Crypto savings accounts allow you to passively earn interest on deposited cryptocurrency, typically offering safer and lower returns. Staking involves locking up your cryptocurrency to support a blockchain network, with the potential to become a validator for higher returns, but it carries the risk of value fluctuations. In contrast, crypto lending actively involves lending your cryptocurrency to borrowers, often yielding higher interest rates with loans secured by collateral, but it also comes with higher risks compared to savings.

5. Contract Trading

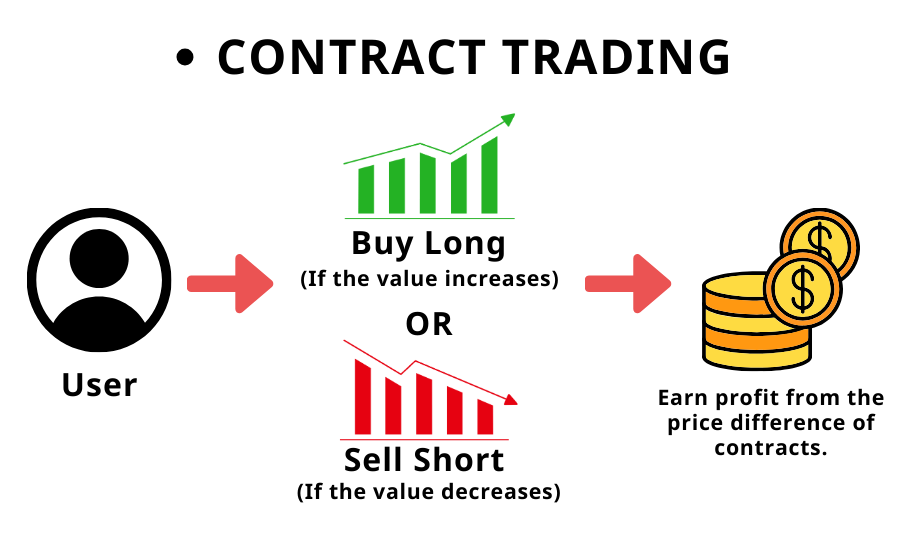

Unlike spot trading, contract trading does not involve the buying and selling of the cryptocurrency itself; you do not actually acquire the cryptocurrency. Contract trading involves financial tools called derivatives, including futures and perpetual contracts. These contracts specify the future exchange of a set amount of currency for a predetermined sum of money.

In contract trading, both parties are trading contracts, not directly trading cryptocurrency. The concept is somewhat akin to betting, with the exchange acting as the house. The settlement of these contracts is handled by the exchange, and the contracts cannot be taken outside of the exchange. Contract trading allows for both long (betting on a price increase) and short (betting on a price decrease) positions.

Source: CoinRank

Below are 2 common approaches in contract trading:

#1. Long Position and Short Position

Long Position: Taking a long position in cryptocurrency, or “going long,” is a fundamental investment strategy where traders buy a cryptocurrency with the expectation that its value will rise. This bullish approach reflects confidence in the market’s future. Traders aim to profit by buying cryptocurrency at a lower price and selling it later at a higher price.

Short Position: Going short is a strategy for profiting from a falling cryptocurrency market. Traders borrow a cryptocurrency and sell it at the current price, aiming to buy it back later at a lower price. If successful, they return the borrowed cryptocurrency and keep the price difference as profit.

Spot trading in cryptocurrencies does not allow for going short; you can only buy or sell assets you already own. In contract trading, placing a buy order signifies going long, and a sell order signifies going short.

#2. Leverage

Leverage trading is a method investors use to increase their potential gains from an asset by controlling a larger position than their original investment allows. This technique is common not just in the crypto world but also in traditional markets, including commodities, stocks, and other financial assets. With leverage in crypto trading, participants can potentially increase their profits or losses beyond the amount of their actual investment.

Let’s illustrate how leverage works with long/short positions through an example.

Long Position Scenario:

Alice starts with $1,000 and enters a long position with 10x leverage, controlling a $10,000 position in Bitcoin.

If the price of Bitcoin increases to $40,100 (a $100 increase):

Alice’s profit = $1,000.

Alice has her initial $1,000 + $1,000 profit = $2,000 in her account.

If the price of Bitcoin decreases to $39,900 (a $100 decrease):

Alice’s loss = $1,000.

Alice has her initial $1,000 – $1,000 loss = $0 in her account.

Short Position Scenario:

Alice starts with $1,000 and enters a short position with 10x leverage, controlling a $10,000 position in Bitcoin.

If the price of Bitcoin decreases to $39,900 (a $100 decrease):

Alice’s profit = $1,000.

Alice has her initial $1,000 + $1,000 profit = $2,000 in her account.

If the price of Bitcoin increases to $40,100 (a $100 increase):

Alice’s loss = $1,000.

Alice has her initial $1,000 – $1,000 loss = $0 in her account.

Advantages of Contract Trading

- Opportunities for Leveraged Trading: Traders have the chance to trade with more funds than are available in their accounts, which can amplify both potential profits and the risk of losses.

- Eliminates the Need for Crypto Ownership: It allows for speculation on price directions without the hassle of buying, holding, or securing cryptocurrencies, reducing the risks related to digital asset security.

- Versatile Trading Conditions: Traders enjoy flexibility in terms of trade sizes, position management, and the availability of contracts that do not expire.

- Access to High Leverage: Some platforms offer the chance to trade with high leverage, significantly increasing the amount of capital at play.

Disadvantages of Contract Trading

- Risks Associated with Leverage: While leveraging in cryptocurrency trading can amplify possible returns, it also significantly increases the risk of major losses. A wrong move in market prediction might lead to financial consequences greater than the initial stake.

- Trading Costs: The expenses associated with executing trades, especially those involving leverage, can eat into profits substantially. These fees are variable and might exceed initial calculations.

- Complex Regulations of Trading Platforms: Each platform for cryptocurrency trading, including contract trading sites, comes with its unique set of rules and requirements. Misunderstanding or failing to adhere to these rules can lead to unfavorable trading outcomes.

- Intensity of Contract Trading: The world of contract trading in cryptocurrencies is notably fast-moving and demands quick, decisive actions from traders, which can contribute to a high-stress environment.

PICKING THE RIGHT CRYPTO TRADING STRATEGIES

Before adopting any crypto trading strategies, thoroughly explore and ensure it fits your style. After evaluating its compatibility and backtesting it against chosen assets and trends, trial it in a demo setting. Positive results there might mean it’s ready for real trading.

Finding the right crypto trading strategies is deeply personal, influenced by your available trading time, experience, and goals, among other factors. Beginners should experiment with various strategies to discover what works best for them, while more seasoned traders often refine and customize their approach to better match their individual preferences.

FAQ

- What Are Crypto Trading Strategies?

Crypto trading strategies are approaches to buying, holding, or selling cryptocurrencies to achieve desired financial outcomes or manage risks.

- What Are Some Simple Crypto Trading Strategies?

Crypto trading strategies include spot trading, crypto savings, staking, lending, and contract trading, each offering different risk and return profiles.

- Is Investing in Crypto Good for the Long Run?

Cryptocurrencies can offer long-term gains with careful risk management, diversification, and responsible investing.

- Which Cryptocurrencies Are Good to Buy Today?

Bitcoin’s $1.3 trillion market cap and 13,996% growth since May 2016, or stablecoins that mirror real-world asset values, are both promising investment options.

- Is It Better to Invest in Cryptocurrencies or Stocks?

Each offers distinct opportunities. Seasoned investors often diversify with both for a balanced portfolio, considering risk tolerance and goals.

More articles about the crypto trading: