KEYTAKEAWAYS

- Ripple CEO predicts the cryptocurrency market will double to $5 trillion by the end of 2024.

- Analysts highlight stablecoin growth as a crucial indicator of a crypto bull market.

- VanEck CEO emphasizes the significance of transaction fees over Bitcoin and Ethereum ETFs.

- Bitcoin's price recovers to $70,000, showing resilience amid rising U.S. inflation.

- The SEC's legal action against Uniswap signals an intensified regulatory scrutiny on the DeFi sector.

- KEY TAKEAWAYS

- TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

- TOP 5 CRYPTO BY MARKET CAP

- 1. RIPPLE CEO FORECASTS CRYPTO MARKET TO REACH $5 TRILLION

- 2. STABLECOIN SURGE SIGNALS STRENGTHENING CRYPTO MARKET

- 3. GAS FEES ECLIPSE ETFS AS CRYPTO’S CRITICAL CONCERN

- 4. BITCOIN DEFIES INFLATION CONCERNS, REBOUNDS TO $70K

- 5. SEC’S UNISWAP LAWSUIT SIGNALS DEFI REGULATORY CRACKDOWN

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In the Crypto Weekly Snapshot, we present to you 5 carefully selected stories from the crypto market and the latest crypto market data so you won’t miss anything important!

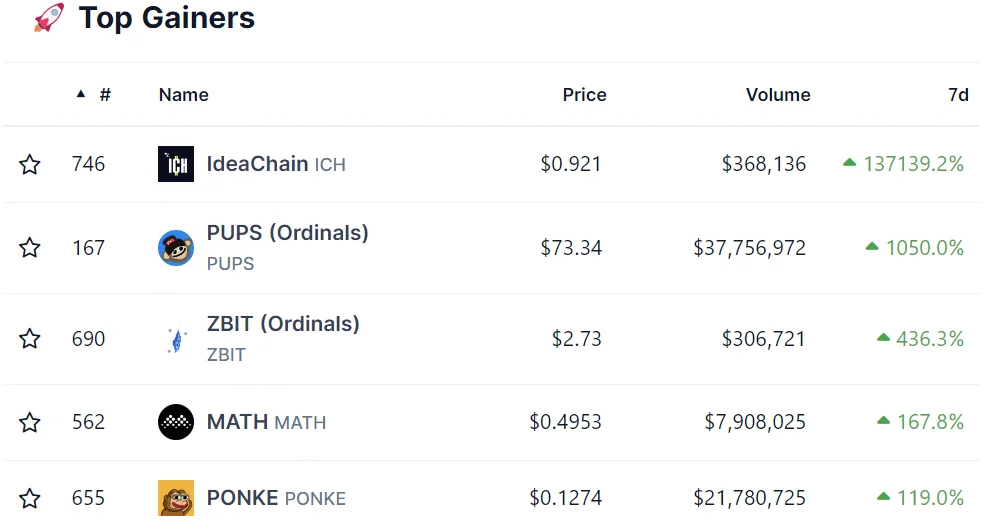

TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

(Source: CoinGecko)

- ICH +137139.2%

- PUPS +1050.0%

- ZBIT +436.3%

- MATH +167.8%

- PONKE +119.0%

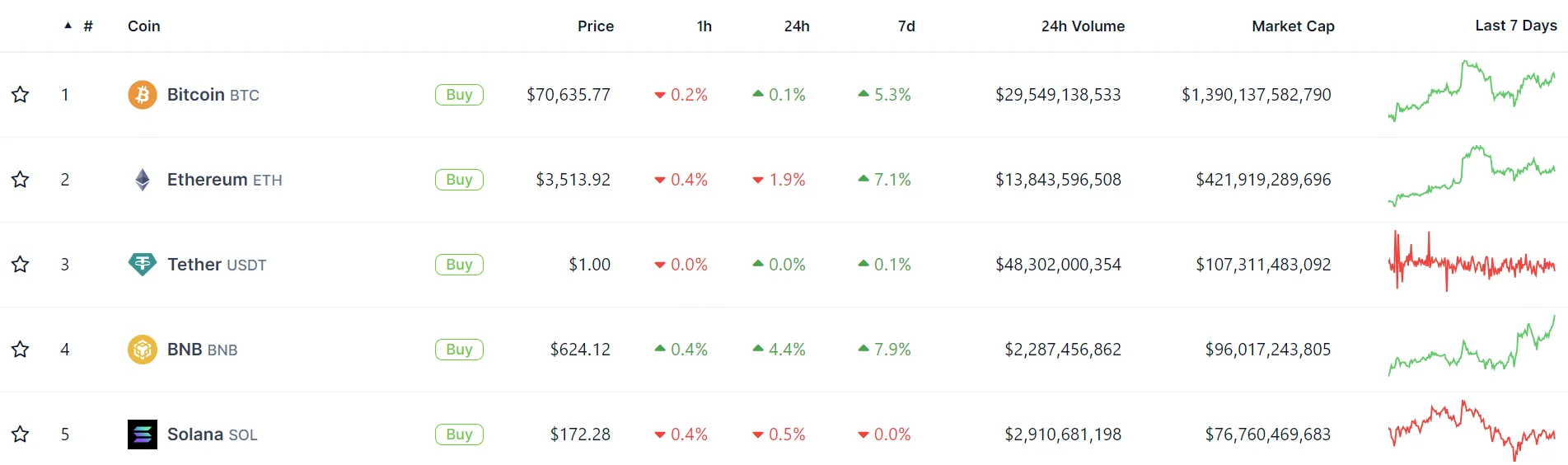

TOP 5 CRYPTO BY MARKET CAP

(Source: CoinGecko)

- BTC $1,390,137,582,790

- ETH $421,919,289,696

- USDT $107,311,483,092

- BNB $96,017,243,805

- SOL $76,760,469,683

Apr 8, 2024

1. RIPPLE CEO FORECASTS CRYPTO MARKET TO REACH $5 TRILLION

Market Growth Expectations

Brad Garlinghouse, CEO of Ripple, believes the cryptocurrency market’s total value will surpass $5 trillion this year. Factors contributing to this growth include the introduction of the first U.S. spot bitcoin exchange-traded funds (ETFs) and the anticipated bitcoin “halving” event. Garlinghouse sees these macro trends driving significant institutional investment into the market.

Regulatory Developments

Positive regulatory momentum in the United States is another factor that could boost the crypto market. With 2024 being an election year, there is optimism that the new administration will adopt more crypto-friendly policies. The SEC’s aggressive stance on crypto companies, including a lawsuit against Ripple, has been a challenge. However, Garlinghouse expects more clarity in U.S. crypto regulations, potentially making the market more attractive.

Bitcoin’s Leading Role

Bitcoin has been a major driver of the broader crypto market’s gains, accounting for about 49% of the total market capitalization. It has seen a significant increase of more than 140% over the past 12 months. Despite recent fluctuations, the overall trend remains positive, with bitcoin’s market cap reaching $1.3 trillion as of April 1.

Industry Optimism

Other industry experts share Garlinghouse’s bullish outlook. Marshall Beard, COO of U.S. crypto exchange Gemini, predicts that the bitcoin price could soar to $150,000 later this year. Factors such as increased adoption, new regulations, and the upcoming halving event are expected to contribute to this growth.

Apr 9, 2024

2. STABLECOIN SURGE SIGNALS STRENGTHENING CRYPTO MARKET

Stablecoins’ Rising Influence

The past month has seen a remarkable $10 billion increase in the supply of leading stablecoins USDT and USDC, outpacing the inflows to bitcoin ETFs during the same period. This growth is twice that of bitcoin ETFs, suggesting a significant shift in the crypto market dynamics. Stablecoins, primarily pegged to the U.S. dollar, serve as a bridge between traditional and digital assets, offering liquidity for trading.

A New Market Barometer

According to 10x Research, the expansion of stablecoin supply might be a more accurate indicator of crypto demand than bitcoin ETF inflows. The rapid growth of stablecoins implies an increase in prices, as it indicates that fiat money is being moved into crypto at an accelerated pace. Markus Thielen, founder of 10x Research, advises paying less attention to bitcoin ETF flows, stating that “Stablecoin issuers are the new sheriff in town, driving this market higher.”

Supply Expansion and Market Health

The supply of Tether’s USDT and Circle’s USDC has expanded by nearly $10 billion combined over the past 30 days. This expansion provides a vital clue about the health of the crypto market, as it reflects the creation of stablecoins by depositing fiat money. Additionally, the supply of other major stablecoins like MakerDAO’s DAI and First Digital’s FDUSD has also grown by 5%-10% in this period.

The Role of ETFs and Futures

While U.S.-based spot bitcoin ETFs attracted $5 billion of net inflows in the past 30 days, the impact of these inflows might be different from that of stablecoin minting. ETF inflows could be influenced by savvy market participants exploiting arbitrage opportunities through the carry trade, which involves buying spot BTC or ETF shares and selling an equal size of BTC futures to maintain a neutral position while pocketing the price difference as a yield.

Apr 10, 2024

3. GAS FEES ECLIPSE ETFS AS CRYPTO’S CRITICAL CONCERN

Shifting Focus in Crypto

Jan van Eck, CEO of global investment firm VanEck, believes the cryptocurrency industry should prioritize addressing transaction fees rather than concentrating solely on Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs). He highlighted the unpredictable nature of transaction fees on the Bitcoin and Ethereum blockchains, which poses challenges for developing applications in those ecosystems.

Affordable Alternatives Emerge

Van Eck pointed out that affordable transaction costs are now available through Solana and so-called layer 2 solutions, which offer a more stable and economical environment for building applications. He compared the high gas fees on Ethereum to fluctuating fuel prices, emphasizing the need for predictable costs to encourage development.

Layer 1 and Layer 2 Solutions

Solana, often dubbed an Ethereum killer, is a layer 1 protocol that provides cheaper and faster transaction speeds than Ethereum. Layer 2 solutions, built on top of layer 1 chains like Ethereum, aim to alleviate scaling and data bottlenecks. Examples include Ethereum rollups and the Lightning network on Bitcoin. With these new solutions, developers can create more useful applications due to lower and more predictable transaction fees.

Future Developments and ETF Prospects

Van Eck predicts that the next few years will see significant advancements in crypto, with scalable databases enabling the creation of practical applications. However, he expressed skepticism about the approval of ether ETFs by their May deadline, citing a lack of responsiveness from the U.S. Securities and Exchange Commission.

Apr 11, 2024

4. BITCOIN DEFIES INFLATION CONCERNS, REBOUNDS TO $70K

Bitcoin’s Resilient Rebound

Despite a brief dip following the release of hotter-than-expected U.S. inflation data for March, Bitcoin (BTC) has climbed back to the $70,000 mark. The dip, which saw BTC fall nearly 4% to $67,500, was a reaction to the Consumer Price Index (CPI) indicating a faster rise in prices than analysts anticipated. This prompted investors to adjust their expectations for rate cuts this year. However, Bitcoin managed to erase its losses, outperforming U.S. equities and gold, which both ended the day with significant declines.

Market Reaction and Altcoin Performance

The initial dip in Bitcoin’s price echoed through various asset classes, but BTC’s recovery was not mirrored by most cryptocurrencies. The broad-market CoinDesk 20 Index was down 0.6%, with major altcoins such as Polkadot (DOT), Bitcoin Cash (BCH), Near (NEAR), and Aptos (APT) experiencing declines of 5%-7%. Uniswap’s governance token (UNI) saw a notable drop of over 10% following an enforcement notice from the U.S. Securities and Exchange Commission, hinting at potential regulatory actions against the platform.

Analyst Perspectives and Long-Term Outlook

Digital asset hedge fund QCP Capital highlighted the rebound as indicative of underlying demand for Bitcoin, with investors viewing dips as buying opportunities. This sentiment is reflected in the strong demand for long-dated BTC calls, signaling deep structural bullishness in Bitcoin. Reflexivity Research’s co-founder Will Clemente emphasized the significance of increasing U.S. debt levels in the broader economic context. He suggested that policymakers might allow inflation to exceed the 2% target to help manage the debt, positioning Bitcoin as insurance against this scenario.

Apr 12, 2024

5. SEC’S UNISWAP LAWSUIT SIGNALS DEFI REGULATORY CRACKDOWN

Uniswap’s SEC Challenge and Industry Implications

Uniswap Labs, the main developer of the Uniswap protocol, has received a Wells Notice from the U.S. Securities and Exchange Commission (SEC), suggesting an imminent lawsuit. This marks a significant escalation in the SEC’s ongoing conflict with the crypto industry, following lawsuits against centralized exchanges like Coinbase and Kraken. The legal action against Uniswap, a decentralized protocol, highlights a new frontier in regulatory enforcement and raises concerns about the future of decentralized finance (DeFi).

The SEC’s Expanding Legal Front

Uniswap’s response to the Wells Notice indicates a perception of the SEC’s actions as politically motivated efforts targeting compliant blockchain entities. The SEC’s previous focus on centralized institutions, such as Coinbase, Kraken, and Ripple, contrasts with this move into decentralized protocols. The case against LBRY and the ongoing international cases against Tornado Cash developers offer some insight into the potential legal challenges Uniswap might face.

Potential Legal Concerns and User Reassurance

Legal concerns for Uniswap Labs include its operation of the primary portal to the Uniswap protocol and the launch of the UNI governance token, which could be construed as a securities offering. However, legal experts believe that Uniswap token holders and users are unlikely to face legal action from the SEC. This reassurance is crucial for maintaining user confidence amid regulatory uncertainties.

A Pivotal Moment for DeFi Regulation

The lawsuit against Uniswap could represent a critical moment for the DeFi industry, signaling a broader regulatory crackdown. The SEC’s approach of targeting different categories within the crypto space suggests a methodical strategy. The outcome of this legal battle will likely have significant implications for DeFi’s regulatory landscape and its ability to innovate and grow.