KEYTAKEAWAYS

- Bitcoin surpassed previous peaks before the 2024 halving, signaling early market dynamics shifts and potential growth changes.

- Current high interest rates and evolving global economic conditions distinctly mark this halving from earlier ones.

- The introduction of Bitcoin spot ETFs enhances market accessibility and stability, reshaping investor demographics and reducing volatility.

CONTENT

Explore the unique dynamics of the 2024 Bitcoin Halving, including market highs, elevated interest rates, and the impact of new Bitcoin spot ETFs on market trends and investor behavior.

WHY IS BITCOIN HALVING A MAJOR EVENT IN THE CRYPTOCURRENCY SPHERE?

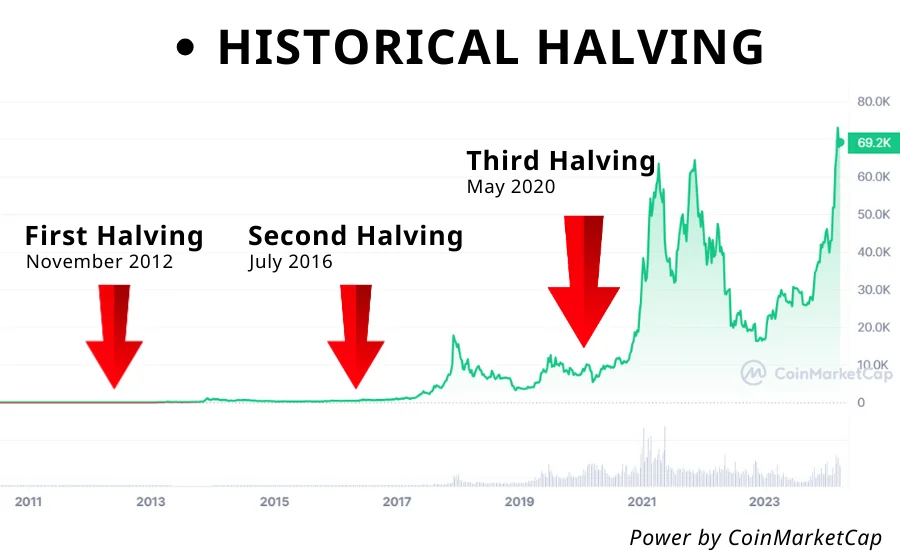

- First Bitcoin Halving: November 28, 2012, saw a maximum increase of 90 times in value over the course of one year following the halving.

- Second Bitcoin Halving: July 9, 2016, witnessed a maximum increase of 30 times in value within one year and five months after the halving.

- Third Bitcoin Halving: May 11, 2020, resulted in a maximum increase of 8 times in value over one year and six months after the halving.

- Fourth Bitcoin Halving: Approximately April 20, 2024, post-halving market performance remains to be seen.

Bitcoin was created in early 2009 and has a 15-year history with only three halving events. Each of these halvings has been followed by significant market rallies. Although history may not always repeat itself, there is an inevitable market anticipation surrounding the halving events.

Although Bitcoin halving only affects Bitcoin directly, Bitcoin’s significant position in the cryptocurrency market accounts for more than 50% of the total market value. Bitcoin is nearly synonymous with the broader cryptocurrency market index, and each major bull market is typically led by a surge in Bitcoin prices. Therefore, Bitcoin halving remains a major event in the cryptocurrency community, attracting the attention of most market participants.

What is Bitcoin Halving : Bitcoin Halving 2024 Introduction- How Can We Profit from It?

WHY DOES BITCOIN RISE AFTER A HALVING? A LOOK BACK AT PAST EVENTS

In retrospect, the substantial price surges following the past three Bitcoin halvings can be attributed to several factors:

Increasing Popularity and Acceptance: As Bitcoin becomes more well-known and widely accepted, the demand for Bitcoin increases.

Halved Block Rewards Reduce New Supply: The halving of block rewards leads to a decrease in the number of new Bitcoins mined, reducing the overall supply.

Ample Market Liquidity: The macroeconomic environment supports increased investment into Bitcoin.

Collective Market Expectations: The community’s shared anticipation of price movements often leads to self-fulfilling prophecies in the market.

History is just that—history. As investors, the focus is on the future. With the fourth halving approaching, are there any significant differences from the past three halvings?

FOURTH BITCOIN HALVING 2024 VS THIRD BITCOIN HALVING

- New Highs Before Halving: Bitcoin reached new highs before the halving event.

- High Interest Rates: Interest rates are at elevated levels.

- Top Ten Global Asset: Bitcoin is now among the top ten assets globally.

- Impact of Bitcoin Spot ETFs: The influence of Bitcoin spot exchange-traded funds on the market.

New Highs Before Halving

In the past three halvings, each occurred around the midpoint of the bull market, indicating that the bull market had already started before the halving and that the halving simply extended its duration.

This time, Bitcoin began its ascent from a low point of around $15,000 in November 2022, and it has been rising for over a year. If history repeats, and the halving occurs mid-bull market, there’s a chance this bull market could continue into the second half of 2025.

However, in the past, Bitcoin only broke its historical high after halving. This time is different! The previous bull market’s peak of $69,000 was surpassed in March 2024, marking the first time Bitcoin has broken its historical high before halving.

This might indicate that the market dynamics around this halving are different. Reaching new highs earlier suggests that the halving effect started sooner, and the continuation might not last as long. These are only possibilities, as the future is hard to predict, but clear signs indicate a departure from the past. We can’t simply copy previous strategies; we must consider additional factors this time.

High Interest Rates

During the previous three Bitcoin halvings, U.S. benchmark interest rates were near 0%, never exceeding 0.5%, indicating an overall low-interest rate environment in the financial markets. However, this time is different. The current U.S. benchmark interest rate is as high as 5.33%, and there is no clear indication of a rate cut in the near future. Additionally, Japan has ended its decade-long negative interest rate policy and has begun to raise rates.

Therefore, compared to the past three halvings, the macroeconomic environment of the financial markets this time around has changed significantly.

Top Ten Global Assets

(source: CompaniesMarketCap)

In 2012, Bitcoin was relatively obscure, known only within a small circle of enthusiasts. By the second halving in 2016, the cryptocurrency was still not widely recognized, even though the ICO craze that significantly expanded the cryptocurrency ecosystem erupted in 2017. At that time, the price of Bitcoin was still under $10,000, and its overall prominence was low, with many still considering it a potential scam likely to be shut down by governments. By the third halving, Bitcoin had gained substantial recognition. Today, Bitcoin is ranked as the world’s ninth largest financial asset, positioned between silver and Meta (formerly Facebook).

Since its inception fifteen years ago, Bitcoin has appreciated by seventy million times. First, as growth inevitably faces limits, the potential for further appreciation diminishes. Second, the larger the market capitalization becomes, the more difficult it is for the asset to rise, as it requires increasingly significant amounts of capital to drive its value higher.

Compared to the past, the difficulty of Bitcoin experiencing another explosive growth surge will continue to increase, necessitating greater momentum.

Impact of Bitcoin Spot ETFs

The U.S. approval of Bitcoin spot ETFs, a crucial market for cryptocurrencies, marks a significant milestone with a profound impact. In just three months post-approval, the total value of these ETFs neared $60 billion, with daily trading volumes frequently in the billions and single-day volumes sometimes exceeding $10 billion. The net inflow of funds has reached $12 billion, indicating robust investor interest.

Spot ETFs have transformed the Bitcoin market by increasing accessibility for the general public and attracting more traditional investment funds. This has resulted in a major shift in the demographic of market participants, diversifying the investor base and decreasing Bitcoin’s volatility. Market corrections have become milder, signaling a shift in market dynamics.

Currently, exchanges hold about 1.74 million Bitcoins, whereas the top five spot ETFs collectively hold over 800,000 Bitcoins. This redistribution of Bitcoin holdings underscores the ongoing decrease in Bitcoin reserves on exchanges due to significant purchases by ETFs.

Although the spot ETFs were introduced only three months ago, their long-term impact requires further observation to gauge how they might disrupt market inertia and continue to influence Bitcoin’s price and market structure.

CONCLUSION

History doesn’t repeat itself, but it often rhymes. Past performance is not indicative of future results. Despite many differences, similarities exist, such as the market’s anticipation of the halving event. Interest rate cuts are expected in the latter half of this year or the first half of the next. Even if its impact has diminished, the halving will still clearly reduce the supply of new Bitcoins, and the market has shown signs of warming up before the event.

The future may not mirror the past, but what we can do is use historical insights to plan our investments for the future.

Looking for the latest scoop and cool insights from CoinRank? Hit up our Twitter and stay in the loop with all our fresh stories!