KEYTAKEAWAYS

- Bitcoin climbs past $65,000 as geopolitical tensions ease and anticipation grows for Hong Kong ETF approvals.

- Ether and altcoins falter despite market recovery; Bitcoin retracts after a short surge.

- Despite a sharp pullback, underlying factors suggest a bullish future for Bitcoin with the halving near.

- Market sentiment shifts bearish, potentially heralding a Bitcoin price recovery with the halving approaching.

- Bitcoin rebounds as the market stabilizes from geopolitical tensions, with focus on upcoming halving.

- KEY TAKEAWAYS

- TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

- TOP 5 CRYPTO BY MARKET CAP

- 1. BITCOIN RISES, HONG KONG ETF LAUNCH EYED

- 2. ETHER STRUGGLES AS MARKET RECOVERS BRIEFLY

- 3. BITCOIN’S RESILIENCE AMID MARKET CORRECTION

- 4. BITCOIN STABILIZES POST-STRIKE, HALVING LOOMS

- 5. BITCOIN RECOVERS TO $62K AMID GEOPOLITICAL CALM

- DISCLAIMER

- WRITER’S INTRO

CONTENT

In the Crypto Weekly Snapshot, we present to you 5 carefully selected stories from the crypto market and the latest crypto market data so you won’t miss anything important!

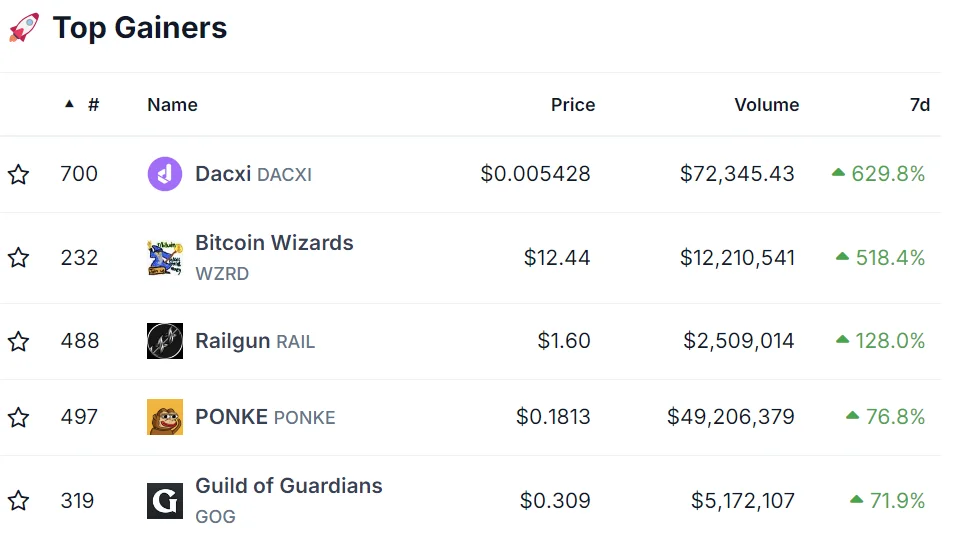

TOP 5 CRYPTO GAINERS IN LAST 7 DAYS

(Source: CoinGecko)

- DACXI +629.8%

- WZRD +518.4.%

- RAIL +128.0%

- PONKE +76.8%

- GOG +71.9%

TOP 5 CRYPTO BY MARKET CAP

(Source: CoinGecko)

- BTC $1,273,996,380,088

- ETH $372,957,920,464

- USDT $109,122,217,570

- BNB $85,776,149,495

- SOL $64,696,087,592

Apr 15, 2024

1. BITCOIN RISES, HONG KONG ETF LAUNCH EYED

Market Recovers as Tensions Subside

Bitcoin (BTC) has regained strength, climbing back over the $65,000 mark as geopolitical concerns between Iran and Israel diminish. The recent drone and missile attacks by Iran, which were largely neutralized by Israel’s air defenses, initially rocked the markets, causing Bitcoin to dip below $62,000. However, stability has returned with U.S. diplomatic efforts averting further escalation.

Geopolitical Impacts on Bitcoin

The swift recovery of Bitcoin prices follows assurances from the U.S. that it will not join any retaliatory attacks by Israel against Iran. This has significantly reduced the odds of further military conflict, with prediction markets like Polymarket now showing only a 4% likelihood of Israeli action by mid-April, a stark decrease from the 57% chance reported shortly after the attacks.

Shift to Safe-Haven Assets

During the peak of the tensions, investors turned to safer investments, exemplified by the surge in PAXG, a digital gold asset. It traded at a 20% premium compared to physical gold, highlighting the shift away from riskier assets. This flight to safety coincides with other market pressures such as the U.S. tax season and upcoming crypto halving events, which are expected to tighten dollar liquidity and potentially amplify market movements.

Anticipation of Hong Kong ETFs

The cryptocurrency market is also poised for a significant shift with the anticipated approval of Bitcoin and possibly Ether ETFs in Hong Kong. These ETFs, expected to be greenlit as early as this week, could open up to $25 billion in new market demand, according to financial experts at Matrixport. This development is particularly notable as it offers traders in China greater access to digital assets, potentially revitalizing interest and investment in the sector.

Apr 16, 2024

2. ETHER STRUGGLES AS MARKET RECOVERS BRIEFLY

Ether’s Market Fluctuations

Ether (ETH), the second-largest cryptocurrency by market value, struggled to maintain its early gains, hovering just above the $3,100 mark by Monday afternoon in the U.S. Despite rising to nearly $3,300 earlier on unconfirmed news of ETF approvals in Hong Kong, ETH ended up about 4% lower than its peak, reflecting the market’s instability.

Bitcoin’s Brief Surge

Similarly, Bitcoin witnessed a quick recovery early Monday, only to relinquish its gains, falling back to the $64,000 level. This retreat mirrored the broader market’s tentative advance, with the CoinDesk 20 Index marginally up by 0.68% over the past 24 hours, indicating ongoing volatility and investor caution.

Geopolitical Impact on Crypto

The weekend’s market turmoil followed Iran’s bombing campaign against Israel, pushing Bitcoin down to the $61,000 range and Ether below $3,000. However, historical patterns of ‘buying the dip’ during geopolitical crises seemed to hold, as the market regained some ground later in the weekend, supported by consistent buying, especially in altcoins, as noted by Ed Goh from B2C2.

Altcoins’ Diverse Outcomes

Despite the general market downturn, some altcoins demonstrated resilience with notable gains. Ondo Finance (ONDO) was up 15%, Render’s RNDR advanced by 12%, and The Graph (GRT) increased by 9%. This diverse performance underscores varying investor strategies and interests, particularly in smaller, speculative assets amid broader market uncertainty.

Apr 17, 2024

3. BITCOIN’S RESILIENCE AMID MARKET CORRECTION

Understanding the Pullback

Bitcoin has experienced a notable decline, dropping more than 15% from its all-time high of over $73,000, with key altcoins like Solana and Pepe Coin seeing reductions of 40%-50%. This correction, though sharp, is characteristic of the volatility inherent in bull markets. Market strategist Joel Kruger emphasizes that such corrections are typical and often misinterpreted by those unfamiliar with the crypto market’s dynamics.

Halving and ETF Influences

The upcoming Bitcoin halving, set to occur later this week, traditionally marks a pivotal moment for BTC’s value. This event, which halves the reward for mining Bitcoin, has historically preceded significant price increases. This halving could be particularly influential due to the increased visibility of Bitcoin through U.S. spot ETFs from financial giants like BlackRock and Fidelity. These developments may introduce Bitcoin to a broader investor base, potentially catalyzing a new rally.

Market Resilience Amid Macro Challenges

Recent market downturns align with broader macroeconomic uncertainties, including fears of military escalations and shifts in U.S. economic policies. Despite these challenges, the fundamental narratives around Bitcoin—such as its role as a store of value and a hedge against currency devaluation—continue to attract investment. Macro analyst Noelle Acheson suggests that any crypto declines linked to stock market drops would likely be temporary, bolstered by ongoing positive developments in the crypto space.

Significance of Market Corrections

Massive liquidations in the crypto derivatives market, which recently wiped out over $1.5 billion in bullish bets, may signal a cleansing of market exuberance, setting a healthier stage for future growth. Historical patterns in Bitcoin’s bull cycles, including the 2016-2017 and 2020-2021 phases, show that pullbacks of 20%-30% are common and typically precede substantial price recoveries. This context suggests that the current market conditions might be a normal consolidation phase before the next uptrend.

Apr 18, 2024

4. BITCOIN STABILIZES POST-STRIKE, HALVING LOOMS

Shift in Crowd Sentiment

Recent analysis from Santiment indicates a noticeable shift in social media sentiment towards Bitcoin, with increasing bearishness among traders and enthusiasts. This sentiment trend is often a contrarian indicator; as Charles Bukowski famously remarked, wisdom might lie in doing the opposite of the crowd. According to Santiment, this growing bearish sentiment typically precedes a price recovery, suggesting that the current sell-off in Bitcoin could be nearing its end.

Social Media Trends and Market Impact

Santiment’s data reveals a significant drop in mentions of “bull market” and an increase in “bear market” discussions across platforms like Telegram, Reddit, X, and 4Chan since late March. This change in dialogue correlates with a 16% decrease in Bitcoin’s market value from its all-time high in mid-March. The decrease in optimistic terms like “buy the dip” further supports the view that the market might be bottoming out, historically a precursor to market reversals.

External Market Pressures

The recent downturn in Bitcoin’s price is also attributed to broader economic factors, including diminishing prospects for U.S. Federal Reserve rate cuts, increased geopolitical tensions, and the timing of tax payments in the U.S. These factors contributed to Bitcoin dipping below $60,000 recently, although it has slightly recovered to around $61,200. Despite these challenges, the cryptocurrency market, represented by the CoinDesk 20 Index, has seen a significant overall decline this month, dropping by 24%.

Upcoming Halving and Analyst Perspectives

The upcoming Bitcoin halving, expected to occur by the end of this week, will reduce the mining reward by half to 3.125 BTC per block. This event has historically led to increased price volatility and has been both anticipated and feared by the market. While some analysts, including those from JPMorgan, caution about potential short-term price declines post-halving, the general consensus remains bullish over the long term. This upcoming halving will be closely watched, as it could catalyze significant market movements based on historical patterns and current investor sentiment.

Apr 19, 2024

5. BITCOIN RECOVERS TO $62K AMID GEOPOLITICAL CALM

Market Response to Geopolitical Events

Bitcoin’s price surged back above $62,000 following initial declines caused by an Israeli strike on Iranian military targets. Reports of limited damage and minimal escalation have helped stabilize the market. Coverage from ABC News and CNN highlighted the nature of the strikes, which included missile attacks on military bases and airfields, while Al Jazeera reported Iranian authorities played down the attack, describing it as a limited drone strike.

Cryptocurrency and Commodity Movements

In addition to Bitcoin’s recovery, Ether also saw a slight uptick, though it remained below the $3,000 mark. Interestingly, PAXG, a tokenized gold asset, rose nearly 3%, reflecting investors’ inclination towards safe-haven assets amid the initial scare. This shift underscores the interconnectedness of geopolitical events and cryptocurrency market dynamics, where traditional and digital asset classes often react in tandem to global incidents.

Broader Market Impacts

The geopolitical tension also impacted major stock indices across Asia, with significant drops observed in the Hang Seng, Nikkei 225, and TAIEX. U.S. stock futures saw declines while crude oil prices experienced an uptick, indicating a classic flight-to-quality pattern often observed during times of international uncertainty. These movements highlight the global nature of financial markets and the rapid effects geopolitical events can have on different asset classes, including cryptocurrencies.

Outlook and Halving Anticipation

As the market absorbs the impact of the Israeli strike, attention is turning back to the cryptocurrency sector’s fundamentals, notably the upcoming Bitcoin halving. Market analysts like Semir Gabeljic of Pythagoras Investments note the typical ‘sell the news’ behavior likely already priced into Bitcoin’s recent fluctuations. He emphasizes that while historical halving events have led to price drawdowns, the current macroeconomic uncertainty could introduce additional volatility. Despite these challenges, the sector shows signs of resilience, evidenced by the slight uptick in the CoinDesk 20 Index, signaling cautious optimism among investors as the halving approaches.